Thread

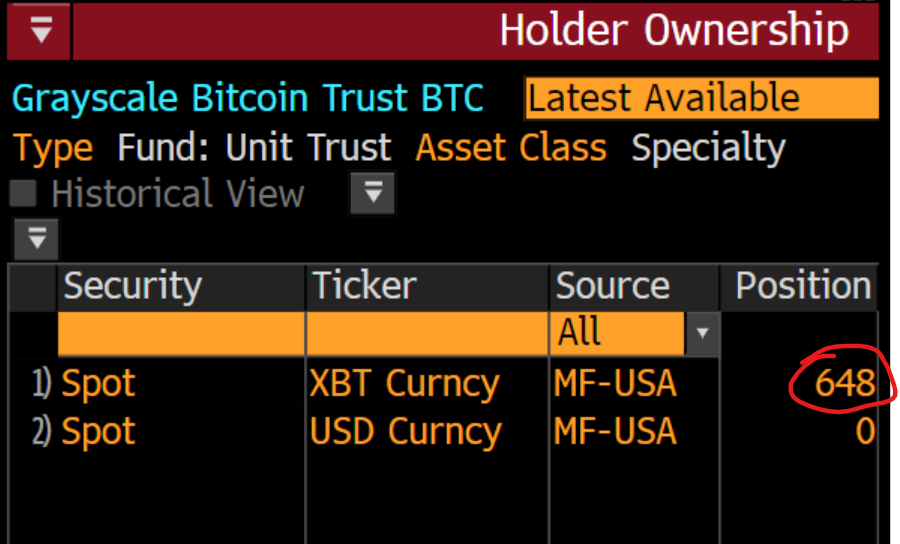

As GBTC has been dumped by institutions all year long - parent company Digital Currency Group (DCG) has chosen to pick up the bag.

3AC dumped 100% of its bags.

BlockFi dumped 100% of its bags.

DCG is the largest holder of its subsidiary's bitcoin trust.

3AC dumped 100% of its bags.

BlockFi dumped 100% of its bags.

DCG is the largest holder of its subsidiary's bitcoin trust.

Their purchases of GBTC are to mitigate the impact of the institutional-level selling pressure and prop up the fund's net asset value (NAV).

Almost like a stock buyback.

Still, that intervention hasn't stopped the discount to NAV of the fund widen out to -42.7%

Almost like a stock buyback.

Still, that intervention hasn't stopped the discount to NAV of the fund widen out to -42.7%

ALL of this GBTC intervention as it blew $140m to help its subsidiary, Genesis.

Now DCG is requesting a $1 billion emergency loan. Good luck finding a lender after this last week.

They may have to drop some of their GBTC holdings to shore up cash, widening the discount further.

Now DCG is requesting a $1 billion emergency loan. Good luck finding a lender after this last week.

They may have to drop some of their GBTC holdings to shore up cash, widening the discount further.

GBTC holds ~648,000 bitcoin

(Is this number correct? Please DM)

Obviously, GBTC dissolving and selling $10.5 billion worth of bitcoin would send the price down.

But the more pertinent setback would be the timeline for a spot ETF coming to fruition.

(Is this number correct? Please DM)

Obviously, GBTC dissolving and selling $10.5 billion worth of bitcoin would send the price down.

But the more pertinent setback would be the timeline for a spot ETF coming to fruition.

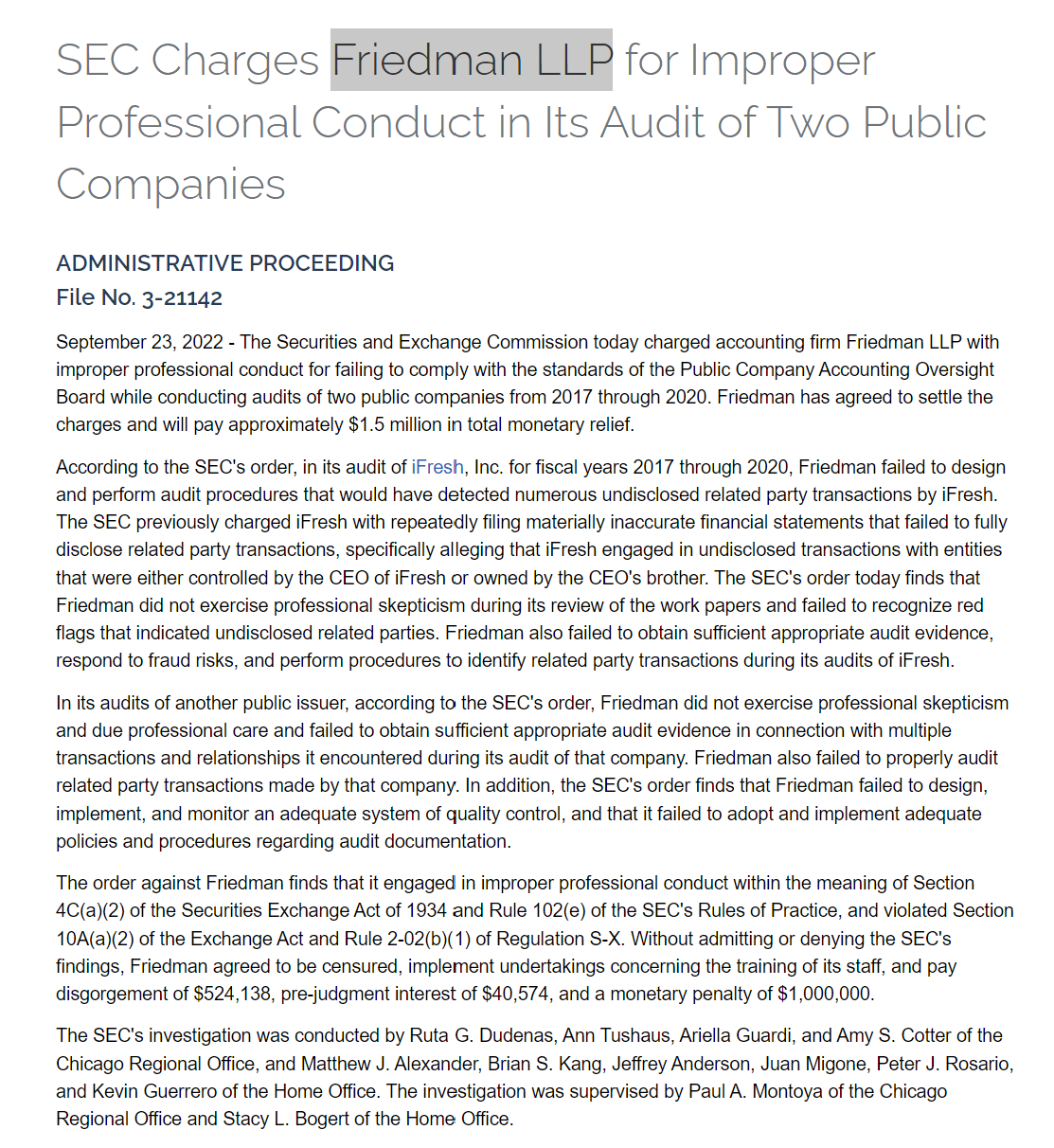

GBTC's public filings are unaudited.

But its accounting firm, Friedman LLP, was busted by the SEC this year for "improper professional conduct" in audits of other firms since 2017.

Friedman LLP's audits failed to report "materially inaccurate financial statements" & fraud.

🤔

But its accounting firm, Friedman LLP, was busted by the SEC this year for "improper professional conduct" in audits of other firms since 2017.

Friedman LLP's audits failed to report "materially inaccurate financial statements" & fraud.

🤔

@stewartnoyce No FUD.

Scenarios:

1 - Collect mgmt fees until ETF conversion

or DCG distress leads to:

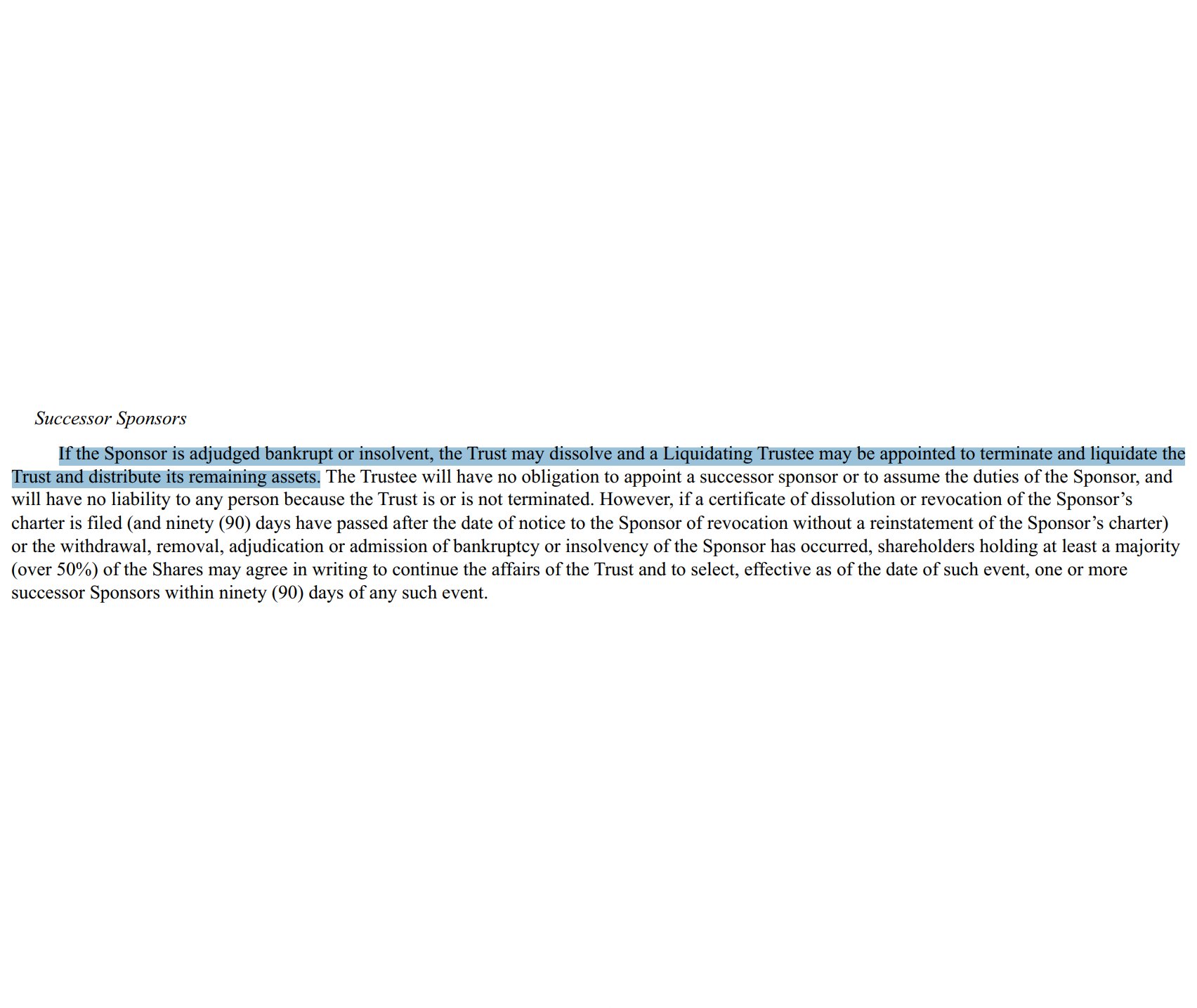

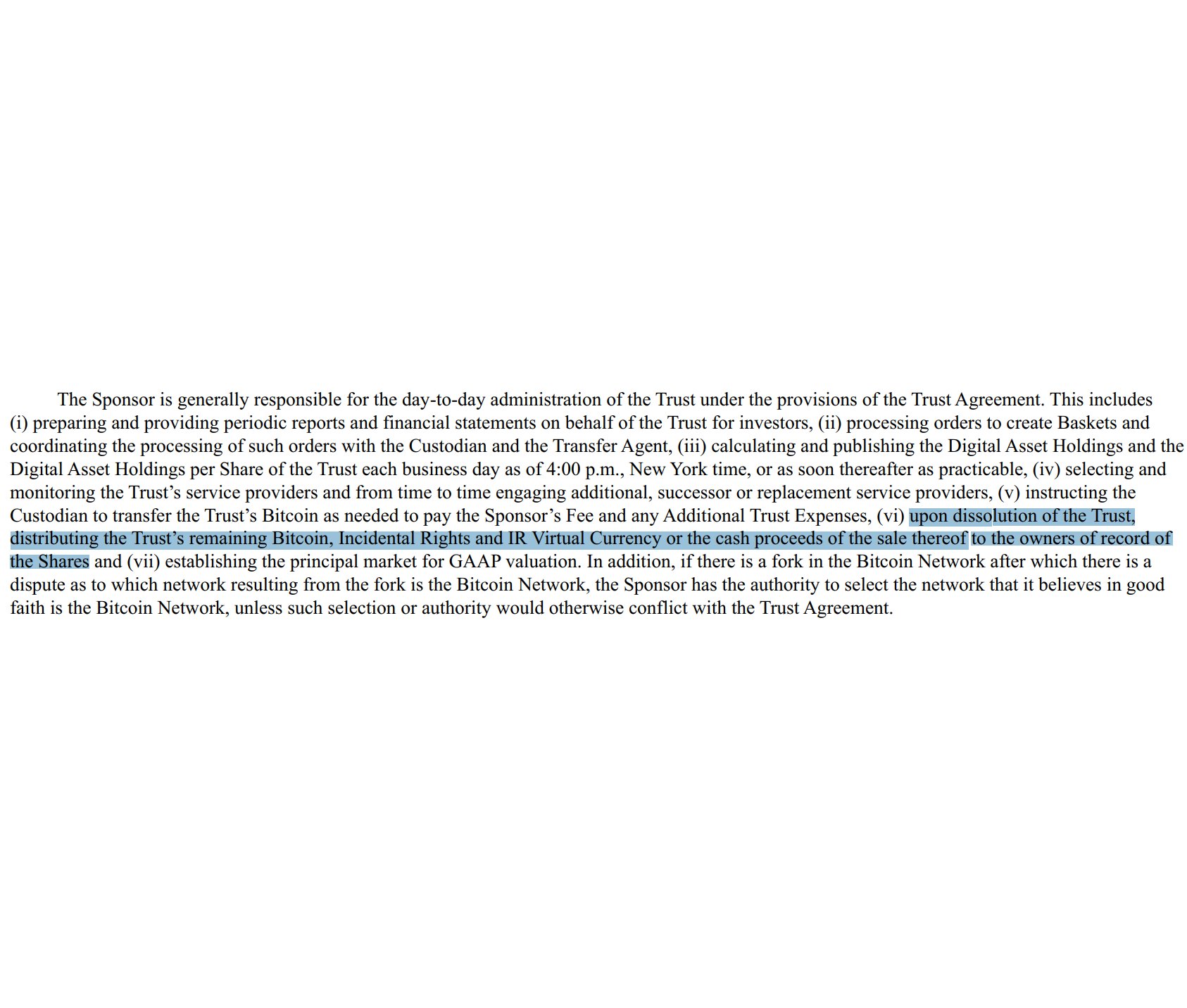

2 - Dissolution of the trust

3 - Buyout from JPM, Fidelity, etc.

#1 = Occam's razor unless DCG distress isn't resolved.

Then it's 2 or 3. Either way, clients get $-equivalent to their GBTC:

Scenarios:

1 - Collect mgmt fees until ETF conversion

or DCG distress leads to:

2 - Dissolution of the trust

3 - Buyout from JPM, Fidelity, etc.

#1 = Occam's razor unless DCG distress isn't resolved.

Then it's 2 or 3. Either way, clients get $-equivalent to their GBTC:

@stewartnoyce Shot 🥃

Genesis is the sole broker-dealer for GBTC - it sets the index price and converts BTC 🔁 USD and vice versa.

Chaser 🥤

GBTC gets dissolved if an event prevents it from setting index price or converting BTC 🔁 USD - an event like... Genesis/DCG facing solvency issues.

Genesis is the sole broker-dealer for GBTC - it sets the index price and converts BTC 🔁 USD and vice versa.

Chaser 🥤

GBTC gets dissolved if an event prevents it from setting index price or converting BTC 🔁 USD - an event like... Genesis/DCG facing solvency issues.

Gemini may issue a notice of default on Genesis, which likely forces them into Ch. 11 bankruptcy.

Genesis made $575m in callable loans to DCG, its bankruptcy would call those loans in, forcing DCG to liquidate assets...

Like its 66,972,899 shares of GBTC

Genesis made $575m in callable loans to DCG, its bankruptcy would call those loans in, forcing DCG to liquidate assets...

Like its 66,972,899 shares of GBTC

The Winklevoss twins are all that stand in the way of DCG's 10% share of $GBTC getting partly or fully liquidated, depending on if loan repayment to Genesis poses solvency issues for them.

Could drive GBTC discount down past -50% even further into the ravine.

Big week, indeed.

Could drive GBTC discount down past -50% even further into the ravine.

Big week, indeed.

Mentions

See All

Preston Pysh @PrestonPysh

·

Nov 19, 2022

The best thread I’ve found on GBTC.