Thread

In my appearance on Odd Lots w/ @TheStalwart @tracyalloway, I touched on a few themes that are, in my opinion, crucial to understanding the international political economy of oil. Thread: www.bloomberg.com/news/articles/2022-11-14/guyana-is-the-most-exciting-story-in-the-world-oil-market?...

1) The Resource Curse

Refers to a form of econ dev affecting nations dependent on commodity exports to supply state revenues, cover trade deficits, and maintain currency value.

Guyana's emergence as a potential new "petro-state" has brought the concept back into the discourse.

Refers to a form of econ dev affecting nations dependent on commodity exports to supply state revenues, cover trade deficits, and maintain currency value.

Guyana's emergence as a potential new "petro-state" has brought the concept back into the discourse.

Lit on the resource curse suggests oil extraction, by producing rents or transfers from private companies to the state in the form of taxes/royalties, creates environment hostile to democracy and amenable to corruption.

Petro-states often (but not always) have governance issues.

Petro-states often (but not always) have governance issues.

This is because the state can rely on rents rather than taxation, severing the link between state and society. The rents, which often exceed investment requirements, encourage waste. The oil industry develops as an enclave, with few backward or forward linkages.

Guyana appears to be following a well-trod path. Governance issues have already appeared. The country explosive GDP growth (40%) has yet to impact areas outside the oil industry. But this ties to a second theme... www.reuters.com/business/energy/africa/oil-money-is-flooding-into-guyana-who-will-benefit-2022-08-25/...

2) International capital

As I mentioned to Joe and Tracy, in nearly all instances, a nation's oil industry (esp. when one geared toward exports) is developed by foreign capital. In earlier periods, this was because major oil companies possessed the technical know-how....

As I mentioned to Joe and Tracy, in nearly all instances, a nation's oil industry (esp. when one geared toward exports) is developed by foreign capital. In earlier periods, this was because major oil companies possessed the technical know-how....

...but more recently, it's because private capital is willing to invest capital and take on risk to develop new fields which local govts. cannot develop through their own resources.

Role of private capital is crucial to understanding the resource curse. corporate.exxonmobil.com/locations/guyana/news-releases/exxonmobil-announces-significant-oil-discover...

Role of private capital is crucial to understanding the resource curse. corporate.exxonmobil.com/locations/guyana/news-releases/exxonmobil-announces-significant-oil-discover...

Private capital is not interested in local development, except where it supports or secures existing or planned future development. Company lit notwithstanding, ExxonMobil has no interest in developing the broader economy of Guyana. Extraction and producing ROI is what matters.

In earlier cases (Venezuela, Iran, Iraq, Mexico to some extent), private capital produced the ingredients for the resource curse before succumbing to nationalization (which is bound to occur in Guyana, at some point, as I told Joe and Tracy).

Producing linkages is left to the state. But altering infrastructure geared around exports can be immensely difficult, as well as expensive. Guyana faces many challenges. www.bloomberg.com/news/articles/2022-07-25/world-s-fastest-growing-economy-seeks-to-diversify-away-fr...

3) Guyana as Swing Producer?

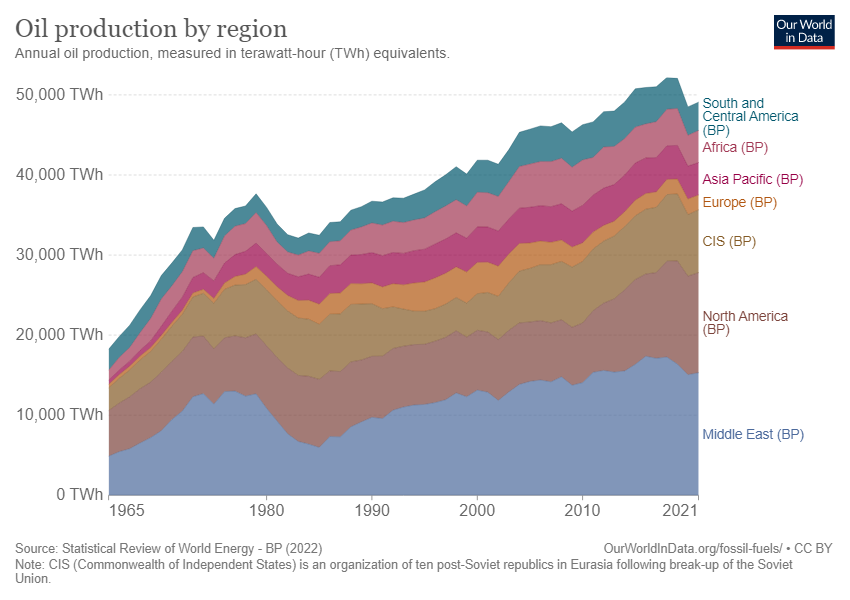

As mentioned in the discussion, since 2015 1/3 of all discovered oil reserves have been located in Guyana. Much of the "new" oil coming online is either from countries like Guyana or the US.

As mentioned in the discussion, since 2015 1/3 of all discovered oil reserves have been located in Guyana. Much of the "new" oil coming online is either from countries like Guyana or the US.

As OPEC struggles to meet its quotas, more of the world's oil is outside of management agreements. As I mentioned to Joe and Tracy, this is somewhat unusual: in oil's history, price can stabilize when investment cycles are tamed through pro-rationing. www.dallasfed.org/research/economics/2022/0419

But OPEC rules (or the old rules of the TRC) don't apply to US shale, nor to Guyana, where the local govt hopes to increase production as quickly as possible. That sounds good when supply is tight, but that won't last forever--at some point, prices will fall as supply catches up.

4) Future Shocks

Which brings us back to the resource curse. The reason it is a "curse:" without measures of control, bust follows boom. Rents from oil extraction fall alongside global prices. For vulnerable producers, the results can be devastating. www.cfr.org/backgrounder/venezuela-crisis

Which brings us back to the resource curse. The reason it is a "curse:" without measures of control, bust follows boom. Rents from oil extraction fall alongside global prices. For vulnerable producers, the results can be devastating. www.cfr.org/backgrounder/venezuela-crisis

Which is why I suggested to Tracy and Joe that Guyana, once it has taken over its oil industry, is likely to join OPEC, at some point in the future. The organization's purpose is to preserve oil's value, and in so doing mitigate the destructive effects of the boom-bust cycle.

Very few of the group's members have escaped dependence on crude. In most cases, as with Guyana, this is the result of private capital's early involvement in developing national oil industries. But it continues to be a problem, long after the major companies are gone. End/