Thread

Chapter 2: The hidden dirty secrets of fiat-currencies: Why sound money fixes (almost) everything.

Key takeaways of this Chapter, small thread 🧵 (1/14)

#Bitcoin #ESG #energy

endorsen.medium.com/chapter-2-the-hidden-dirty-secrets-of-fiat-currencies-ba9a59df37eb

Key takeaways of this Chapter, small thread 🧵 (1/14)

#Bitcoin #ESG #energy

endorsen.medium.com/chapter-2-the-hidden-dirty-secrets-of-fiat-currencies-ba9a59df37eb

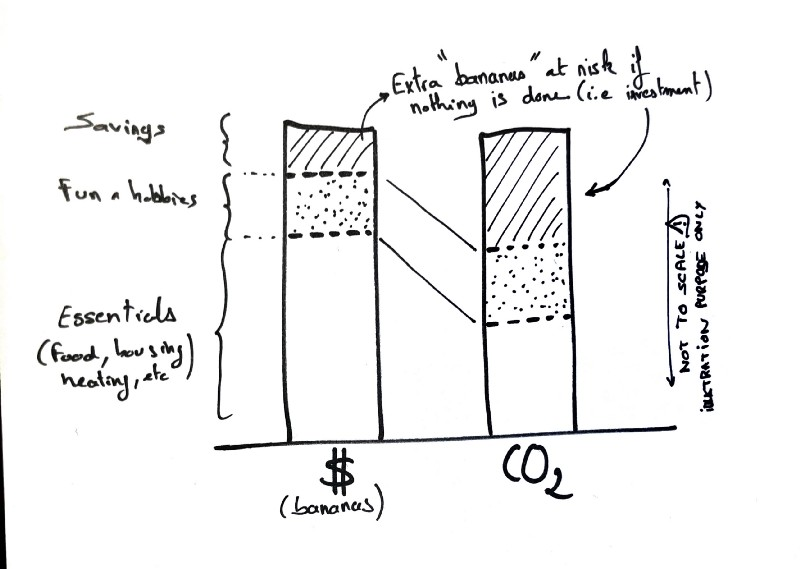

(2/14) Incomes received for work can essentially be allocated in 3 buckets with relative environemental impacts.

#1 Essential spending (food, housing, etc)

#2 Discretionary spending

#3 Savings/investments

#1 Essential spending (food, housing, etc)

#2 Discretionary spending

#3 Savings/investments

(3/14) In Chapter 1, we discussed why people were green-shamed, and why it was so counter-productive, espercially for the poorest percentiles of the population.

The incentive generates the expected outcome.

medium.com/@endorsen/green-shaming-no-more-5a8687e6427e

The incentive generates the expected outcome.

medium.com/@endorsen/green-shaming-no-more-5a8687e6427e

(4/14) #1 is basically food and housing. Poor people already minimize their footprint by obligations.

#2, discretionary expenses and #3 savings/investments, are mostly responsible for the resources depletion and excessive footprints on the environment.

www.theguardian.com/commentisfree/2020/jan/17/the-guardian-view-on-flight-shaming-face-it-life-must-c...

#2, discretionary expenses and #3 savings/investments, are mostly responsible for the resources depletion and excessive footprints on the environment.

www.theguardian.com/commentisfree/2020/jan/17/the-guardian-view-on-flight-shaming-face-it-life-must-c...

(5/14) Sound money enables two very distincts options for each individuals:

1) Transport wealth across time and risk free.

2) Grow wealth by investing with the least amount of interference.

What a foreign concept in 2022 !

1) Transport wealth across time and risk free.

2) Grow wealth by investing with the least amount of interference.

What a foreign concept in 2022 !

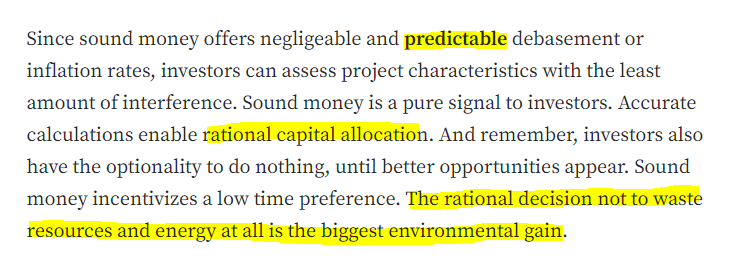

(6/14) In a manipulated fiat system, investors are not capable of nuanced arbitrages, because economic calculation are unreliable because unpredictable.

(7/14) And Worst: Under a compounded debasement rate of nearly 7%, investors are not offered the privilege to wait and do nothing, in contrast with a sound moneteray system.

(8/14) Innovation is deflationary, and that’s where yields comes from: Do the same (or more) with less.

A perfect incentive, so to speak, for limiting environmental impacts.

The incentive is to chase inefficiencies in the system, and reward those who fix it.

A perfect incentive, so to speak, for limiting environmental impacts.

The incentive is to chase inefficiencies in the system, and reward those who fix it.

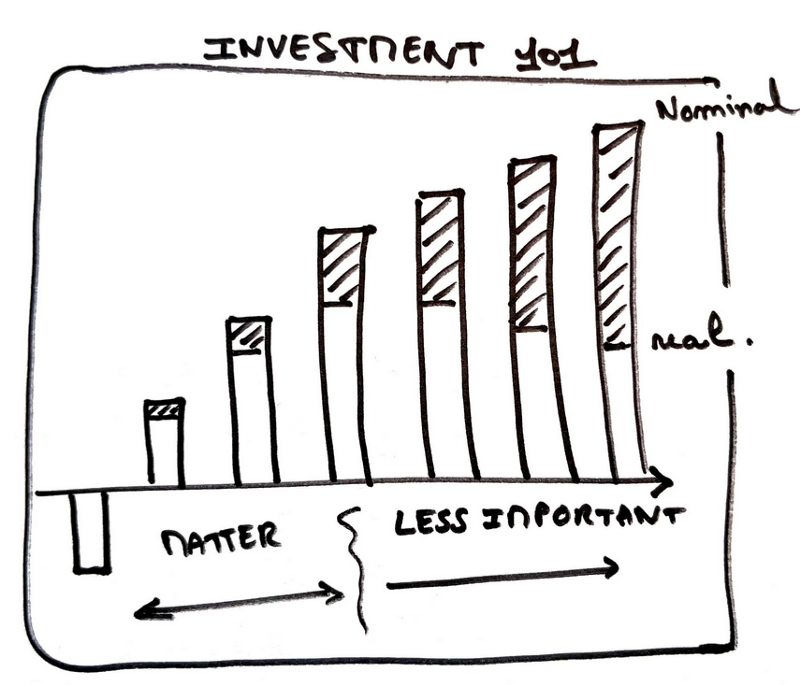

(9/14) If innovation creates yields through greater efficiency, then it’s an opposing force to the fiat system.

Central banks will need to offset the innovation effect via debasement. And debasement, as we saw earlier, is a terrible incentive for limiting environmental impacts

Central banks will need to offset the innovation effect via debasement. And debasement, as we saw earlier, is a terrible incentive for limiting environmental impacts

(10/14) ESG policies won't save it.

The fact nearly EVERYTHING is ESG should switch on a few 🚨🚨.

The incentive structure underneath the ESG mandates makes it doomed to failure.

The fact nearly EVERYTHING is ESG should switch on a few 🚨🚨.

The incentive structure underneath the ESG mandates makes it doomed to failure.

(11/14) Fiat-currencies also oppose long-term thinking and therefore sustainable development.

Think about it: one of the first “project finance” fundamentals you may learn is how to discount future cash flows.

People learn how to discount the Future with a capital F !

Think about it: one of the first “project finance” fundamentals you may learn is how to discount future cash flows.

People learn how to discount the Future with a capital F !

(12/14) Fiat-currencies also oppose decentralization and by design, waste the brain power of millions of people, which is so precious for innovation and "local-fit" of those innovations.

(13/14) In conclusion, I do not think sound money will fix everything

But it gives us all a much greater shot for a sustainable development path than staying on a fiat currency standard.

In particular, via better capital allocation, lower time preference, and local innovation

But it gives us all a much greater shot for a sustainable development path than staying on a fiat currency standard.

In particular, via better capital allocation, lower time preference, and local innovation

Mentions

See All

Preston Pysh @PrestonPysh

·

Nov 4, 2022

Great thread to read this morning.