Thread

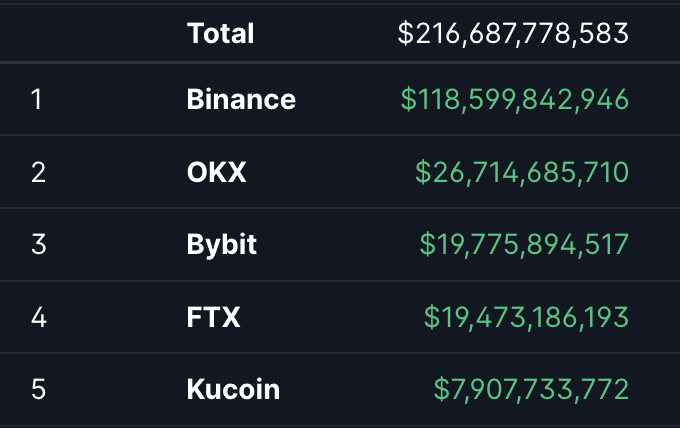

FTX was the world's 3rd largest crypto exchange.

Today it's said to be insolvent and in the midst of an acquisition by Binance.

Here's everything you need to know about Alameda Research and the collapse of FTX:

👇

Today it's said to be insolvent and in the midst of an acquisition by Binance.

Here's everything you need to know about Alameda Research and the collapse of FTX:

👇

Troubled crypto exchange @FTX_Official has faced severe liquidity issues in the past few days and has now agreed to terms its primary competitor and investor, @binance.

It's hard to understate how big a deal this is.

It's hard to understate how big a deal this is.

Less than a week ago, on November 2nd, CoinDesk broke a story claiming to have acquired Alameda Research's balance sheet.

It showed a damning view of the relationship between Alameda, a hedge fund, and FTX, an exchange.

www.coindesk.com/business/2022/11/02/divisions-in-sam-bankman-frieds-crypto-empire-blur-on-his-tradin...

It showed a damning view of the relationship between Alameda, a hedge fund, and FTX, an exchange.

www.coindesk.com/business/2022/11/02/divisions-in-sam-bankman-frieds-crypto-empire-blur-on-his-tradin...

The balance sheet's accuracy was subsequently confirmed by Alameda's CEO, Caroline Ellison.

So why was this a big deal and how did it result in one billionaire acquiring another billionaire's company and the entire crypto market going into free-fall?

So why was this a big deal and how did it result in one billionaire acquiring another billionaire's company and the entire crypto market going into free-fall?

Alameda is FTX founder and billionaire Sam Bankman-Fried's first venture, a wildly successful crypto hedge fund he founded after getting his start arbitraging the Japanese Bitcoin premium:

www.forbes.com/advisor/investing/cryptocurrency/who-is-sam-bankman-fried/

www.forbes.com/advisor/investing/cryptocurrency/who-is-sam-bankman-fried/

Alameda pivoted to becoming a market maker after arbitrage opportunities dried up, making massive sums employing quantitative trading strategies.

It earned a reputation for exceptional returns and a less sterling reputation for quietly dumping on retail:

It earned a reputation for exceptional returns and a less sterling reputation for quietly dumping on retail:

FTX was in fact founded *after* Alameda, as a platform "for traders, by traders."

By its own measures FTX is the 3rd or 4th biggest exchange in the world.

And since its inception, there has been wild speculation on the relationship between the entities.

By its own measures FTX is the 3rd or 4th biggest exchange in the world.

And since its inception, there has been wild speculation on the relationship between the entities.

It doesn't help that in its early days, Alameda was the first market maker for FTX, giving the exchange the liquidity it needed to get off the ground.

The crux of this current crisis is a narrative violation surrounding that relationship.

The crux of this current crisis is a narrative violation surrounding that relationship.

The prevailing narrative of FTX-Alameda had been one of brazen corruption:

FTX gives Alameda priority orderflow, allowing its sister hedge fund to front-run other traders.

Taking a few privileged basis points on the 3rd largest exchange would be a perpetual money machine.

FTX gives Alameda priority orderflow, allowing its sister hedge fund to front-run other traders.

Taking a few privileged basis points on the 3rd largest exchange would be a perpetual money machine.

But FTX isn't Alameda's data source.

FTX is Alameda's piggy bank.

Sam uses a highly profitable exchange as a source of capital for a wildly profitable trading operation.

FTX is Alameda's piggy bank.

Sam uses a highly profitable exchange as a source of capital for a wildly profitable trading operation.

In a moment of foreshadowing, Sam tells David Rubenstein about Alameda's early days:

"We were cobbling together credit agreements."

It must be wildly frustrating to have a winning strategy but no capital to deploy.

FTX was invented to solve that issue.

www.youtube.com/watch?v=VF6nFT0_clA&ab_channel=DavidRubenstein

"We were cobbling together credit agreements."

It must be wildly frustrating to have a winning strategy but no capital to deploy.

FTX was invented to solve that issue.

www.youtube.com/watch?v=VF6nFT0_clA&ab_channel=DavidRubenstein

Let's return to Alameda's balance sheet:

The incriminating revelation from Coindesk was that a plurality of Alameda's assets ($5.8 billion of the $14.6 billion reported) were in FTX's own exchange token, $FTT.

A large majority of the rest were in Solana ecosystem tokens.

The incriminating revelation from Coindesk was that a plurality of Alameda's assets ($5.8 billion of the $14.6 billion reported) were in FTX's own exchange token, $FTT.

A large majority of the rest were in Solana ecosystem tokens.

As with other exchange tokens, owning and staking $FTT offers certain benefits to traders on FTX's exchange:

- discounted trading fees

- access to airdrops

- free withdrawals

And "VIP access."

ftx.com/ftt

- discounted trading fees

- access to airdrops

- free withdrawals

And "VIP access."

ftx.com/ftt

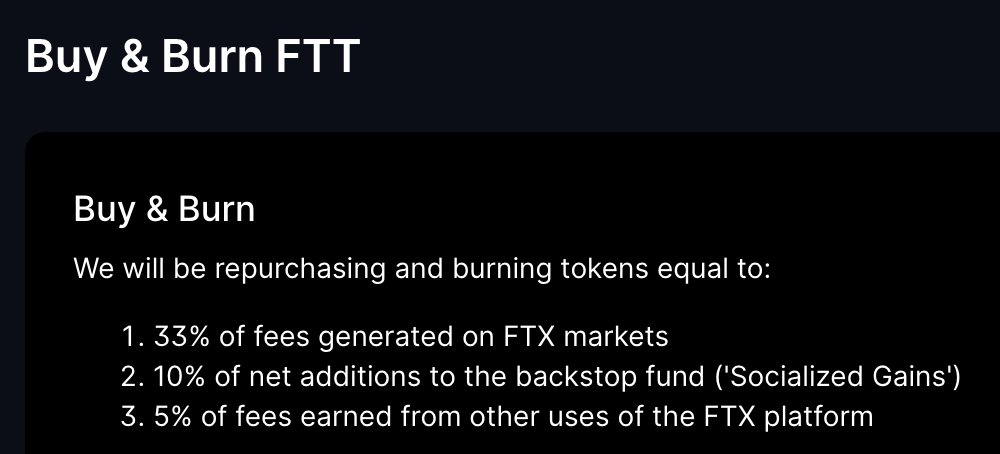

Another key to $FTT's design?

1/3 of FTX's own trading revenue was used to purchase and burn $FTT supply (the equivalent of retiring shares).

Sam himself promoted the weekly $FTT buy from his personal account:

1/3 of FTX's own trading revenue was used to purchase and burn $FTT supply (the equivalent of retiring shares).

Sam himself promoted the weekly $FTT buy from his personal account:

At the same time, $FTT had remarkably low circulating liquidity relative to Alameda and FTX's holdings.

In other words: even if Alameda wanted to sell the $5.8B of $FTT it had, there wouldn't be enough buyers:

Alameda's holdings represented 2-3x $FTT's circulating supply!

In other words: even if Alameda wanted to sell the $5.8B of $FTT it had, there wouldn't be enough buyers:

Alameda's holdings represented 2-3x $FTT's circulating supply!

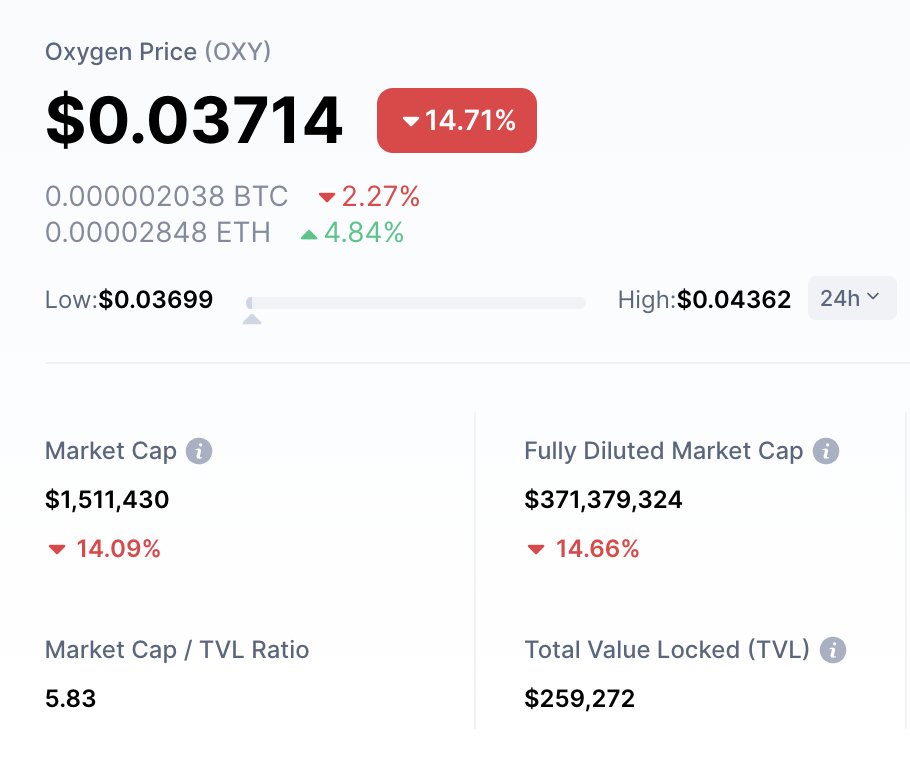

This "low float, high FDV" strategy is worth touching on, because it applies to other tokens on Alameda's balance sheet, most in the Solana ecosystem ($SRM, $OXY, $MAPS).

$MAPS for instance has a circulating cap of $5m to $1.1 BILLION fully diluted:

$MAPS for instance has a circulating cap of $5m to $1.1 BILLION fully diluted:

Sam actually cynically describes this exact token dynamic to @matt_levine on an Odd Lots episode hosted by @TheStalwart!

It's like he's showing us his gameplan, not only for farming and dumping crypto yield, but executing FTX's strategy:

youtu.be/KZYqL79GDXU?t=1276

It's like he's showing us his gameplan, not only for farming and dumping crypto yield, but executing FTX's strategy:

youtu.be/KZYqL79GDXU?t=1276

Now the pieces are in place for FTX and Alameda to collude while retaining a legal and legitimate-seeming arms-length relationship, all using $FTT as the lynchpin:

Here's how it works:

- FTX creates $FTT

- Alameda buys or premines $FTT at super low price

- FTX pumps $FTT

- Alameda posts $FTT back to FTX as collateral, borrowing "real" assets from FTX's customer deposits

- FTX creates $FTT

- Alameda buys or premines $FTT at super low price

- FTX pumps $FTT

- Alameda posts $FTT back to FTX as collateral, borrowing "real" assets from FTX's customer deposits

Both entities get to show auditors they have legitimate credit agreements and claim a genuine arms-length relationship.

That's how the circular piggy bank facilitates the transfer of customer funds out of FTX and into Alameda's prop trading business.

All while looking legit.

That's how the circular piggy bank facilitates the transfer of customer funds out of FTX and into Alameda's prop trading business.

All while looking legit.

So how does this all break?

Well, the low float and constant buy pressure from FTX means the only thing that could make $FTT go down is if there were some huge, exogenous $FTT sale.

And this is where CZ comes in.

Well, the low float and constant buy pressure from FTX means the only thing that could make $FTT go down is if there were some huge, exogenous $FTT sale.

And this is where CZ comes in.

Two days ago, Changpeng Zhao, CEO of Binance, announced he was selling all of Binance's $FTT holdings, worth $500+ million.

I'll let the rampant speculation fly as to why, and what he knew, but he did it, citing "recent revelations."

I'll let the rampant speculation fly as to why, and what he knew, but he did it, citing "recent revelations."

Caroline from Alameda then offered to purchase the FTT OTC for $22 to reduce price impact.

A strange move to telegraph a price level, given she could have bought at any price lower.

A strange move to telegraph a price level, given she could have bought at any price lower.

To which CZ politely declined.

Again a strange move, given he could have sold $FTT higher.

Occam's razor would say the goal was therefore to sink $FTT's price. And sink it did.

Again a strange move, given he could have sold $FTT higher.

Occam's razor would say the goal was therefore to sink $FTT's price. And sink it did.

Sell pressure against FTT pushed against the stated $22 level,

and defense of the FTT "peg" at $22 fell around 8pm EST on November 7th.

By morning on the 8th, FTX had paused all withdrawals of user funds.

and defense of the FTT "peg" at $22 fell around 8pm EST on November 7th.

By morning on the 8th, FTX had paused all withdrawals of user funds.

Before the end, Alameda and friendly-to-FTX entities scrambled to facilitate customer withdrawals and preserve confidence.

@FTX_Official tweeted memes.

SBF stepped in to assert FTX's solvency:

@FTX_Official tweeted memes.

SBF stepped in to assert FTX's solvency:

The fear that Alameda's shoddy balance sheet was commingled with FTX's led to a liquidity crisis and ultimately to today's offer by CZ to acquire the exchange.

So, that's it, right?

So, that's it, right?

But then--why defend the $22 number?

Because Alameda was clearly a debtor to entities other than FTX.

If it's just an agreement between kissing cousins, who cares?

But Alameda was also a counterparty to failed crypto banks Voyager and Blockfi:

Because Alameda was clearly a debtor to entities other than FTX.

If it's just an agreement between kissing cousins, who cares?

But Alameda was also a counterparty to failed crypto banks Voyager and Blockfi:

It's perhaps clear now why Sam was so intent on bailing out failed crypto lenders over the summer:

They needed to defend the solvency of their own banks. And at the time, FTX had more than enough liquidity to do so.

They needed to defend the solvency of their own banks. And at the time, FTX had more than enough liquidity to do so.

Now there's a seeming multi-billion dollar hole at FTX, and Sam, the previous lender of last resort, has had to turn to CZ for help.

There is a new king in crypto.

There is a new king in crypto.

In a year of turmoil the last 24 hours have been the worst thing that has happened for the crypto space, by orders.

It underscores the need again for transparent, overcollateralized systems that can deleverage in an orderly manner.

It ironically underscores the need for crypto.

It underscores the need again for transparent, overcollateralized systems that can deleverage in an orderly manner.

It ironically underscores the need for crypto.

tl;dr

- CZ dumps $FTT

- Alameda faces external margin calls, looks to FTX for liquidity

- FTX depositors have withdrawn; piggy bank is broken

- FTX's assets are loans Alameda can't repay, against real customer liabilities

- FTX in the hole for billions

- CZ buys FTX

- CZ dumps $FTT

- Alameda faces external margin calls, looks to FTX for liquidity

- FTX depositors have withdrawn; piggy bank is broken

- FTX's assets are loans Alameda can't repay, against real customer liabilities

- FTX in the hole for billions

- CZ buys FTX

Mentions

See All

4762 = 4762 @BrianDColwell

·

Nov 9, 2022

Great thread on FTX!

Trung Phan @TrungTPhan

·

Nov 9, 2022

good thread here