Thread

1/ Last week's events in crypto have led me to self-reflection. I've spent the past four years tracking and analyzing capital allocation to this sector. Understanding the regulatory hammer is coming, now, more than ever, is the time to speak out about all the issues I've seen.

2/ In 2017/18, ICOs were the main driver of capital allocation as opposed to VC. ICOs were riddled with scams & terrible ideas, but the Public ICO model was more democratic than what we have today. Sure, VCs were investing, but it could be on the same terms as your average joe.

3/ It is no coincidence that most of the most alluring trends also were democratic & had not been value captured by VC: Anyone could participate in an ICO. Anyone could farm YFI (DeFi). Anyone could mint a Crypto Punk or a Bored Ape (NFTs).

4/ We should be asking ourselves, "How did we get here? Why is it that in 2022 our systems are significantly more gated than in 2017? @jack angered many people when he said, "You don't own Web3, The VCs and their LPs do. Was he wrong?

5/ Many point out the iniquities of 1 ecosystem (High FDV Solana projects) but ignore that the upside in their ecosystem has also been captured. ANYONE could have bought Ethereum. As for its future (L2s)? That's reserved for the likes of SoftBank, Sequoia, & Tiger Global

6/ I'm sure many token projects would've preferred the distribution of their tokens to be more democratic. It's why we see airdrops to power users. Lack of regulatory clarity and concerns about raising money from retail is the primary reason we're here.

7/ It may be the case that public sales are mostly a thing of the past and the VC model is the only way forward due to regulations. Regardless, it's time to demand transparency on these token raises. For an industry that broadcasts transparency, it is completely lacking here

8/ Projects want to act like a typical startup (selling equity + token warrant) but are then a decentralized protocol when it's convenient for them. The way we are demanding proof-of-reserves from exchanges, we should be demanding full transparency on any token they list.

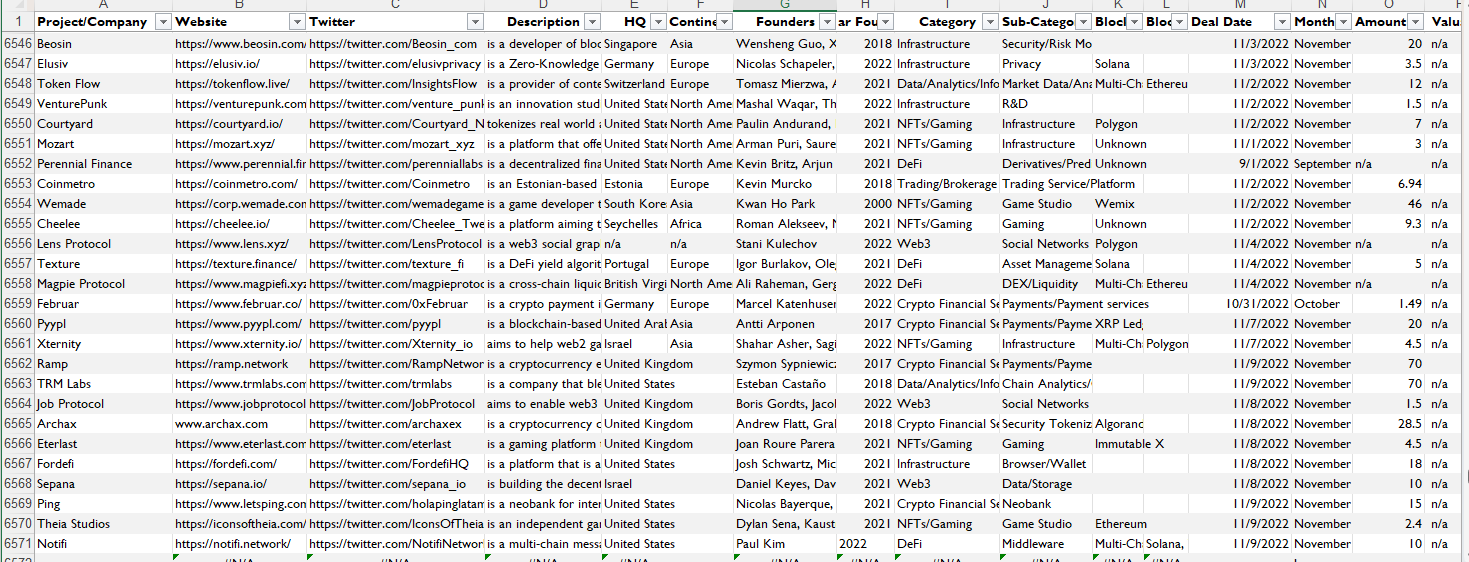

9/ We've created a system where we have pubicly-listed tokens that any retail user can purchase, yet its creators are not required to disclose how much money they've raised, how many times they've raised, when they raised it, who bought it, and at what price did they purchase it

10/ There is way too much irony with the fact that we're trying to create open systems while many of the creators of these systems themselves aren't open about critical information that is imperative for ordinary users and investors

11/ Angel Investing: In my opinion, the current funding landscape isn't called out as it should because many have graduated to the special privilege of being an angel investor. Many have forgotten their beginnings. Why call out something that is advantageous to yourself?

12/ Angel Investing II: The openness to financially participate at the ground level still exists, but only if you have graduated to that angel level. Unlike any other industry I've seen, Cap Tables in crypto sometimes look like novels with a plethora of individuals

13/ Potential conflicts of Interest: Who gets the most access to deal flow outside the most renowned VCs in the space? Cryptocurrency exchanges and Market Makers. The ELI5 is that projects like having them on their cap table in the expectancies of being listed & market making

14/ I have no doubt that for some exchanges like Coinbase, Kraken, etc., the venture arm is fully separate from their Exchange business. However, can we confidently believe that for the many exchanges that operate in the shadows? The Alameda/FTX fallout exemplifies this concern

15/ Should exchanges have direct exposure to many of the tokens that they are listing on their platforms? That is a question we should be asking

16/ Imagine a world where the most active investors in traditional finance are Nasdaq Ventures and the NYSE, and the financial information on those listed securities is opaque. That is our reality in the crypto sector. This is what we have created

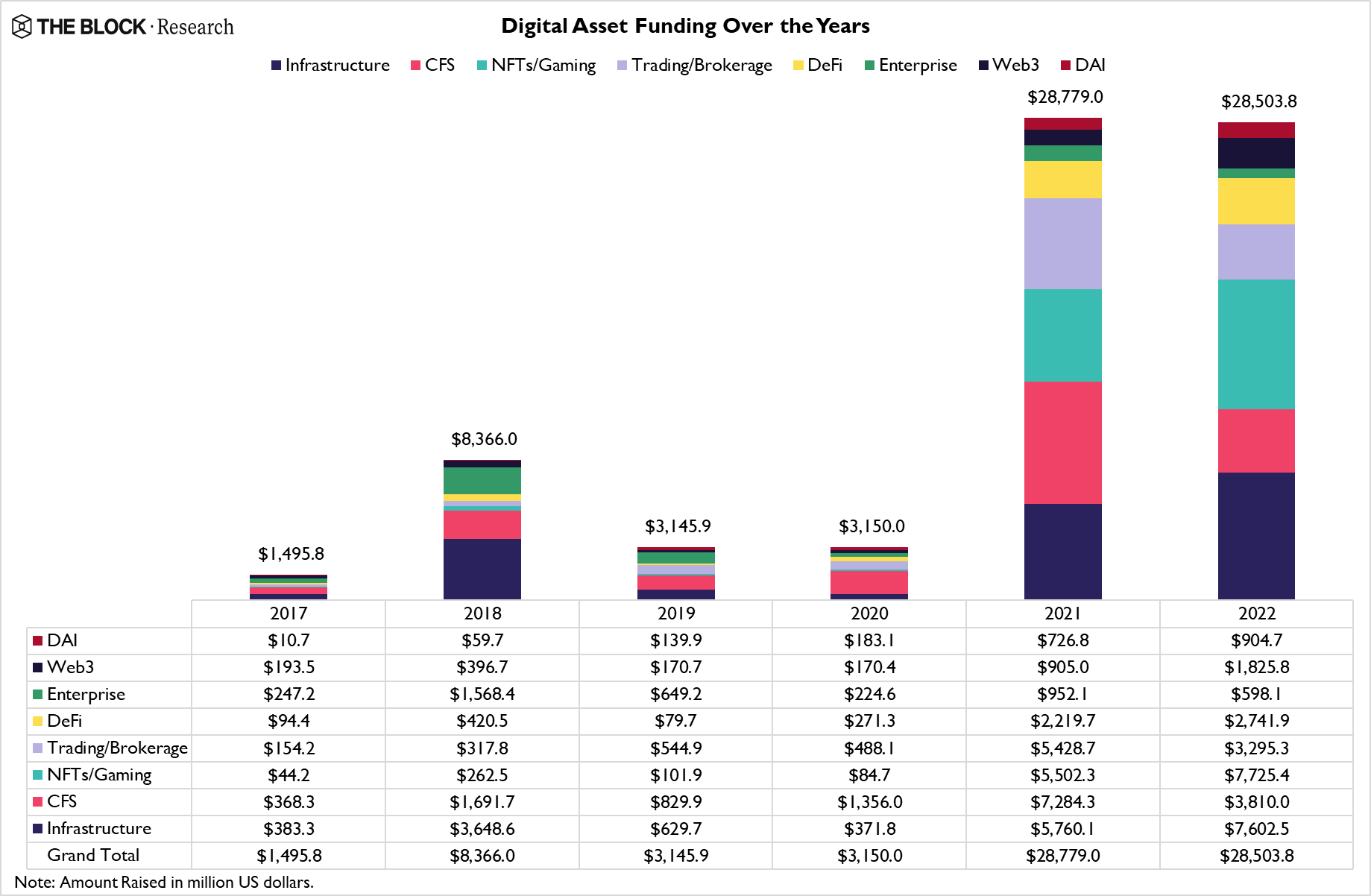

17/ What's to come? This year alone, billions have been raised by crypto-related VCs. The concern? Many of these funds raise so much capital because they are Rolling Funds. After recent events, no doubt a lot of LPs will look to cut exposure and call back their capital

18/ This also does not include many funds that announced a new fund but were based on pre-commitments. Ex) Fund X raises $75 million for a new crypto venture, but in reality, it only had, say, $25 million committed. A lot of the $ announced was soft-committed and won't be there.

19/ What about all of the capital that has already been allocated? Year to date, nearly $30 billion has been deployed into crypto businesses. In theory, businesses should have years of runway with this abundance of capital. But what if a lot of this money was already spent?

20/ The upcoming months will show what companies were prepared for an extended winter and which were as wreckless as a crypto degen trader fantasizing of an "Up only" environment. Oct already was the lowest funding month since Feb 21, and this was before all the recent turmoil

21/ What should be taken from this? It's time to cut the bullshit. It's time, to be honest. It's time to improve. It's time to self-reflect. It's time to self-regulate. It's time to be transparent. It's time for projects raising $ to stop hiding under the veil of decentralization