Thread

Japan has been a big part of the global bond market for quite some time – both unhedged investors (the government, mostly) and hedged investors (the banks, the lifers ).

And Japan’s financial system report is still the best guide to really understanding the associated risks

1/

And Japan’s financial system report is still the best guide to really understanding the associated risks

1/

The financial system report is the most authoritative source laying out how Japan’s banks, life insurers, postal savings bank, credit cooperatives and pensions have managed the foreign exchange risk on their large dollar loan and securities book.

2/

www.boj.or.jp/en/research/brp/fsr/fsr221021.htm/

2/

www.boj.or.jp/en/research/brp/fsr/fsr221021.htm/

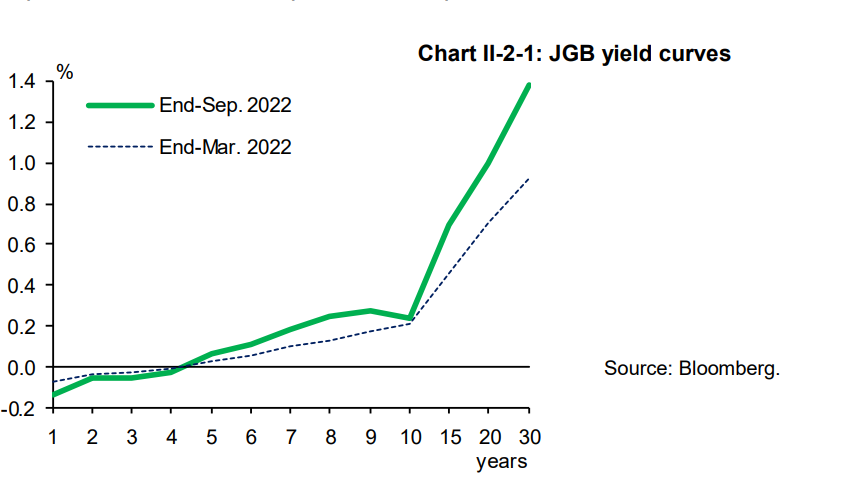

The most recent report explicitly focuses on the external risks facing Japan’s financial system from a flat to inverted U.S. yield curve. Its conclusion: “The functioning of financial intermediation could be impaired for some financial institutions” in a stress scenario.

3/

3/

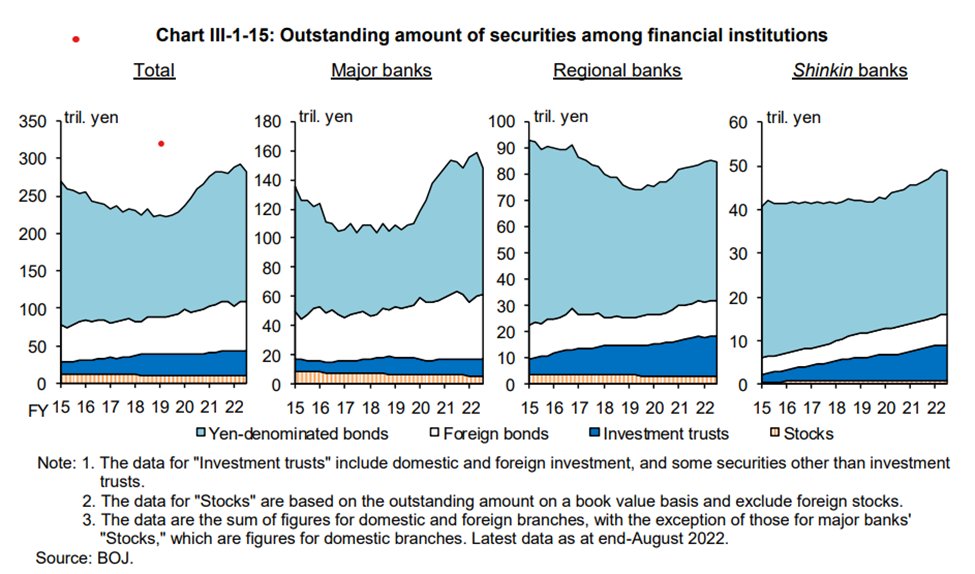

It is hard to overstate the extent to which Japanese banks have become dollar based intermediaries – their foreign loan portfolio (mostly) in dollars is now close to a trillion dollars, and they also have a roughly $500b portfolio of foreign securities.

4/

4/

As @M_C_Klein has emphasized, there is a macro reason for this – the domestic yield curve has been flat for a long time (bad for a classic bank) and Japanese firms have massive cash balances/ a limited borrowing need, so the banks had trouble making money in yen/ at home.

5/

5/

The Bank of Japan has long been concerned with the fx funding risk as well as credit risk.

The bulk of the loan portfolio is now funded with dollar liabilities that are considered (relatively) stable – either fx deposits, fx bonds, or longer-term currency swaps.

6/

The bulk of the loan portfolio is now funded with dollar liabilities that are considered (relatively) stable – either fx deposits, fx bonds, or longer-term currency swaps.

6/

The banks typically fund their foreign securities portfolio via repo as much as through cross currency swaps. The Bank of Japan’s latest report shows a deep underlying concern that the banks would have to absorb the “flow” costs of an inverted U.S. yield curve.

7/

7/

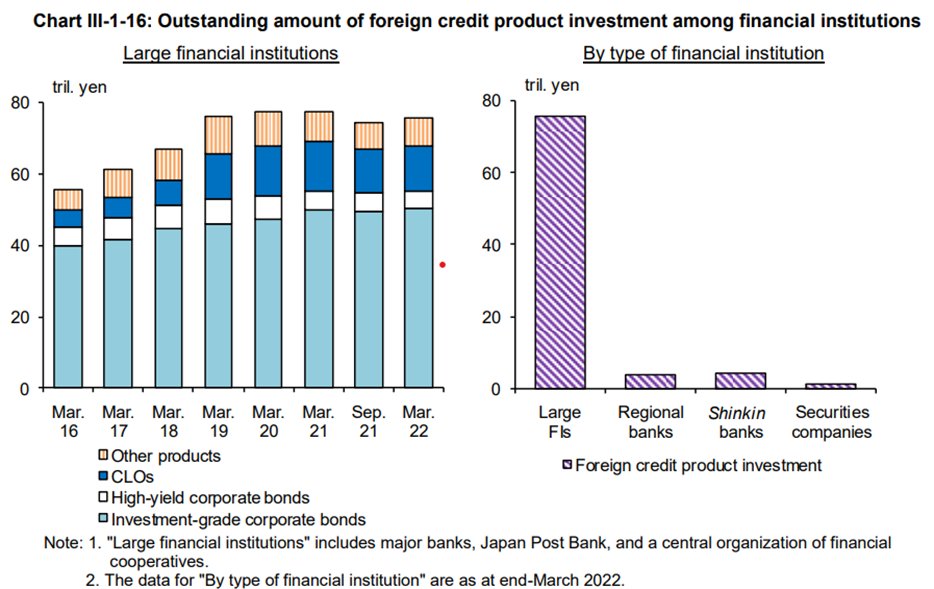

The smaller banks and credit cooperatives have reached for yield through their holdings of investment trusts (mutual funds that invest in foreign bonds).

8/

8/

One of the surprises (to me) of the latest report was the clear suggestion that these trusts didn’t fully hedge (hence the fx profits that offset a portion of their bond market losses this year)

9/

9/

And there are now obvious incentives to reach for yield by taking on credit risk, as an fx hedged Treasury portfolio loses money.

The banks have also taken on more Japanese interest rate risk – with rising exposure to ultralong JGBs.

(relevant for the risks linked to YCC)

10/

The banks have also taken on more Japanese interest rate risk – with rising exposure to ultralong JGBs.

(relevant for the risks linked to YCC)

10/

I have written extensively about the risks in Asia’s lifers in the past – and Japan’s insurers continue to have a massive foreign bond portfolio.

The financial system report tells us that 60% of their securities portfolio is still currency hedged.

12/

The financial system report tells us that 60% of their securities portfolio is still currency hedged.

12/

And there is clear concern that the insurers now are pushed to reach for yield.

"life insurance companies have sold some of their U.S. Treasuries and shifted their investment to higher yield products such as U.S. corporate bonds and European government bonds"

13/

"life insurance companies have sold some of their U.S. Treasuries and shifted their investment to higher yield products such as U.S. corporate bonds and European government bonds"

13/

I need to learn more about insurance regulations, but my guess is that many of the lifers -- like the banks -- are also stuck holding negative carry positions on their hedged book. Selling hedged positions can mean realizing losses.

14/

14/

Why does all of this matter –

Well, the flat US yield curve and bond market losses are a stress test for investors who hold close $3 trillion in foreign bonds, and at least $1.2 trillion in USD bonds (even setting aside the MoF)

15/

Well, the flat US yield curve and bond market losses are a stress test for investors who hold close $3 trillion in foreign bonds, and at least $1.2 trillion in USD bonds (even setting aside the MoF)

15/

Japan’s economy is far smaller than China’s economy, but Japan’s foreign bond holdings, counting Japan’s reserves, now are bigger than those of China …

Thus it is hard to understand bond market risks without understanding the risk of a shock to big Japanese institutions.

16/

Thus it is hard to understand bond market risks without understanding the risk of a shock to big Japanese institutions.

16/

So even if there is a bit less attention to stress scenarios around the Treasury market and the yen now than two weeks ago, the financial systems report is essential, if somewhat wonky, reading.

17/17

www.boj.or.jp/en/research/brp/fsr/data/fsr221021a.pdf

17/17

www.boj.or.jp/en/research/brp/fsr/data/fsr221021a.pdf

p.s. -- a hat tip to @AitkenAdvisors for highlighting the latest installment of the report. It really is the best of the major financial stability reports. Kudos to the BoJ for not hiding obvious risks.

one last note, the BoJ isn't too worried about derivative exposure among pensions.

"Japan's pension funds primarily follow simple investment strategies consistent with the policy asset mix or the basic portfolio allocation, instead of those that make use of leverage ... "

"Japan's pension funds primarily follow simple investment strategies consistent with the policy asset mix or the basic portfolio allocation, instead of those that make use of leverage ... "