Thread

Massive Fed meeting, and huge market reaction.

A thread that breaks down what happened, step by step.

1/

A thread that breaks down what happened, step by step.

1/

The press release seemed to be dovish

''In determining the pace of future (rate) increases, the FOMC will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity & inflation, and...financial developments''

2/

''In determining the pace of future (rate) increases, the FOMC will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity & inflation, and...financial developments''

2/

Stocks rose, the USD weakened, the yield curve steepened = bullish price action.

But as soon as the press conference started, things dramatically changed.

Powell came out with 3 bombs that slowly but surely hit markets across asset classes.

Let's go through them.

3/

But as soon as the press conference started, things dramatically changed.

Powell came out with 3 bombs that slowly but surely hit markets across asset classes.

Let's go through them.

3/

1. ''The incoming data since our last meeting suggest the terminal rate of Fed Funds will be HIGHER than previously expected (4.63%), and we will stay the course until the job is done''.

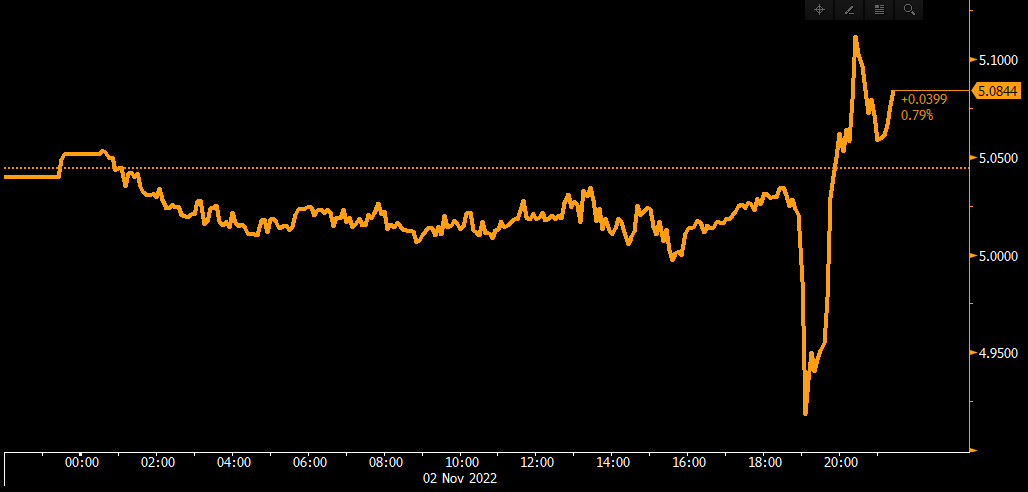

The intraday chart of the US terminal rate says it all: immediate repricing...

4/

The intraday chart of the US terminal rate says it all: immediate repricing...

4/

...back above 5%: the Fed won't lower their bar for the terminal rate.

Forget about a pause for now.

Well, perhaps they will reach 5% and then be much more open to cutting rates later on?

You know, that kind of ''pivot''?

Here comes the second bomb.

5/

Forget about a pause for now.

Well, perhaps they will reach 5% and then be much more open to cutting rates later on?

You know, that kind of ''pivot''?

Here comes the second bomb.

5/

''What's far more important now is for how long rates will remain high, and we will stay the course until the job is done''

In other words, with Core PCE >5% and Fed Funds still way below that Powell will keep at it

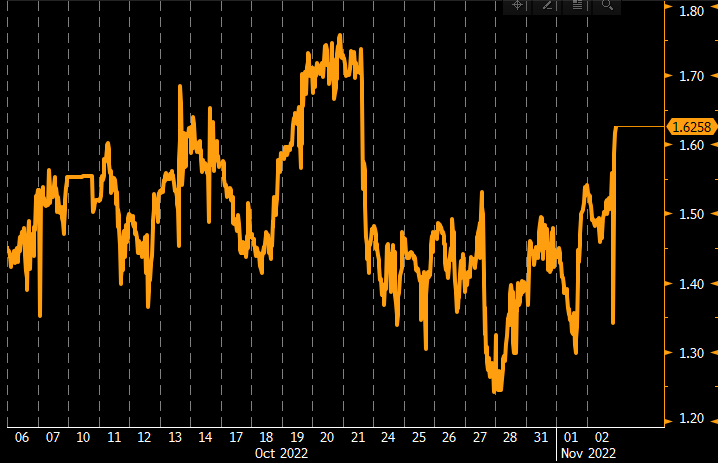

The Powell Credibility Indicator is an index that tracks..

6/

In other words, with Core PCE >5% and Fed Funds still way below that Powell will keep at it

The Powell Credibility Indicator is an index that tracks..

6/

...market-implied real Fed Funds in 1y from now

Powell wants the market to believe he'll set Fed Funds well above inflation and keep them there for a good period of time to tame inflation

If this indicator stays north of 1.0-1.5%, markets are assigning credibility to Powell

7/

Powell wants the market to believe he'll set Fed Funds well above inflation and keep them there for a good period of time to tame inflation

If this indicator stays north of 1.0-1.5%, markets are assigning credibility to Powell

7/

Job done there, as we are trying to test new highs in 1y1y real Fed Funds and anyway way above +1%.

But now comes the third bomb: are you ready?

8/

But now comes the third bomb: are you ready?

8/

''Risk management is key here: if we were to overtighten, we could use our tools to support the economy later on; but if we failed to tighten enough, inflation would become entrenched and that would be a much bigger problem''.

Wow - the risk is not to tighten enough.

9/

Wow - the risk is not to tighten enough.

9/

This was the KO punch for markets, which fully understood the renewed hawkish stance

If there was one pivot, it was from hawkish to more hawkish

Investors had become very complacent to a Fed pause or pivot at this meeting, which compounds negative price action in equities

10/

If there was one pivot, it was from hawkish to more hawkish

Investors had become very complacent to a Fed pause or pivot at this meeting, which compounds negative price action in equities

10/

Tech hammered hard on a repricing higher in real rates, but 3m and 6m skew in equities keeps suggesting people are more willing to pay up for calls (!) than for puts here against historical standards.

Sum up the net liquidity drain ahead of us with:

11/

Sum up the net liquidity drain ahead of us with:

11/

- Fed balance sheet down $95bn/month (net negative)

- TGA going up towards year-end (net negative)

- Reverse Repo balances unlikely to shrink much

And the risk of investors taking away deposits (and hence reserves) from the banking sector to allocate into bonds and MMF...

12/

- TGA going up towards year-end (net negative)

- Reverse Repo balances unlikely to shrink much

And the risk of investors taking away deposits (and hence reserves) from the banking sector to allocate into bonds and MMF...

12/

...and you are looking into a potentially nasty combination of renewed hawkish Fed stance, weakening fundamentals and net liquidity drains.

There was much more into this Fed meeting and market implications, and hence...

13/

There was much more into this Fed meeting and market implications, and hence...

13/

...I'll be covering the FOMC and its implications in much more details in a piece I'll release early tomorrow on my newsletter TheMacroCompass.substack.com.

Consider subscribing so you'll receive it directly in your inbox - it's free!

I also reply to all comments there.

14/14

Consider subscribing so you'll receive it directly in your inbox - it's free!

I also reply to all comments there.

14/14

Mentions

See All

Jeff Ross @VailshireCap

·

Nov 2, 2022

Nice summary thread, Alf. 🤝