Thread by James McAvity

- Tweet

- Nov 3, 2022

- #BitcoinMining #EnergyPolicy

Thread

Its hard to overstate the tremendous benefit that will accrue to West Texas from the coincidence of the three below events:

Renewable energy tax credit

BTC Genesis Block

Ukraine war/NG forward curve re-pricing

Renewable energy tax credit

BTC Genesis Block

Ukraine war/NG forward curve re-pricing

The Production Tax Credit (PTC) gives you $27/MWH for every Megawatt hour of renewable energy generation. The Investment Tax Credit (ITC) is a 30% one time tax credit based off the cost of the project.

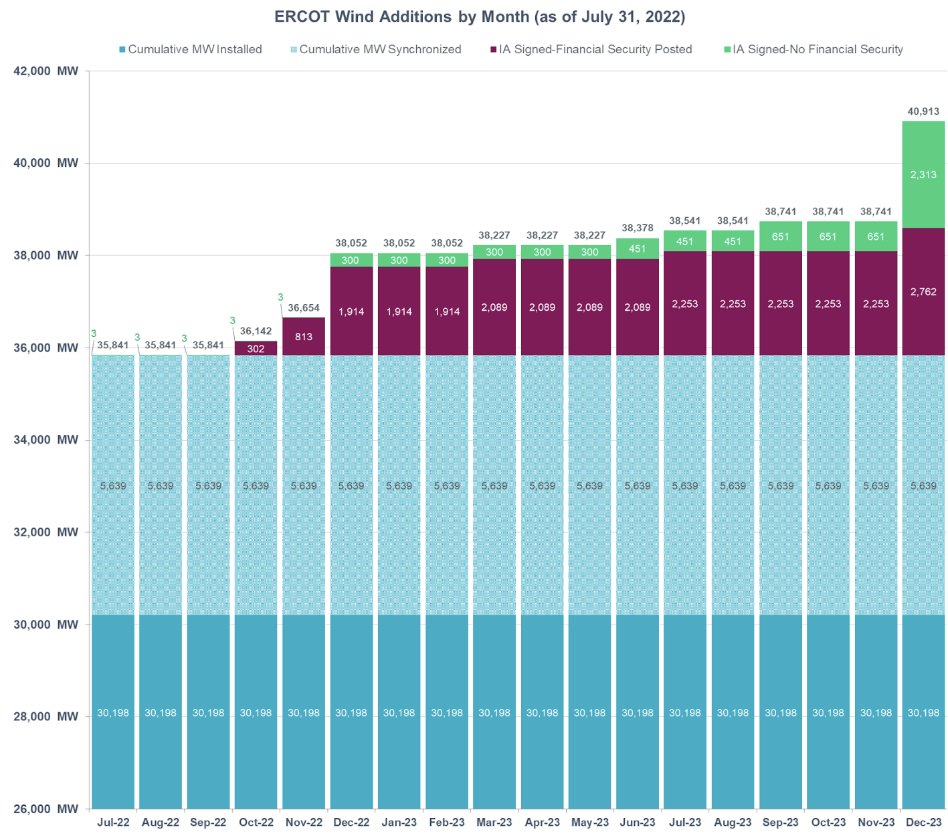

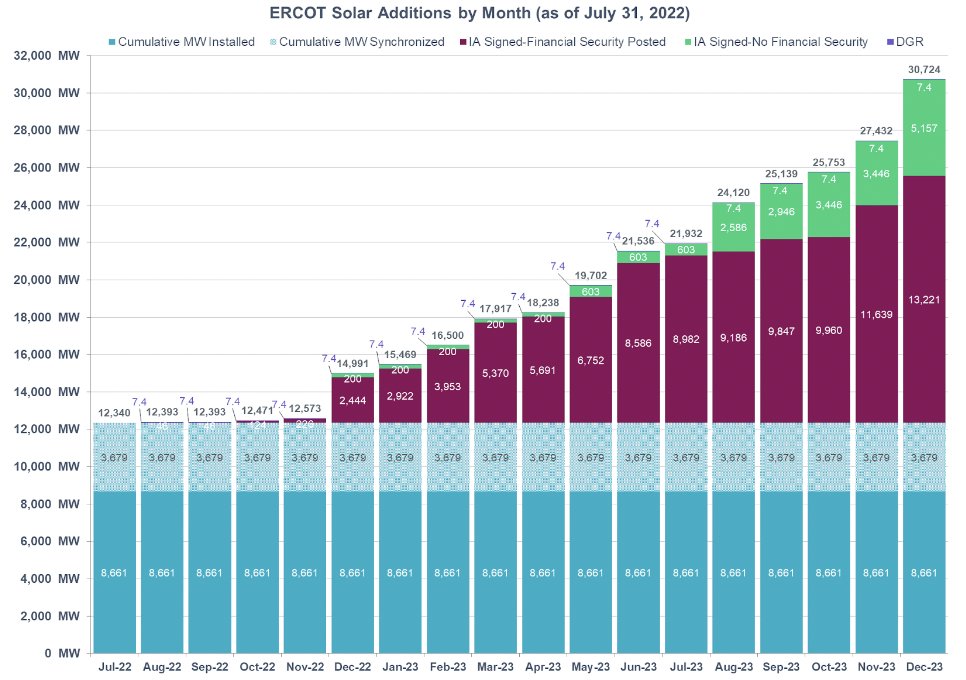

In the mid 2000s, the PTC for wind and solar sparked a renewable generation boom in Texas, specifically north and West Texas. 35 GW of wind(going to 41) and 12 GW of solar(going to 31!)

@POTUS 2022 inflation reduction act renewed the wind PTC and gave the same full PTC to solar (previously ITC only which is worth less $). The above screenshots were for projects planned prior to IRA + Ukraine driven energy spikes.. a lot more power is coming to West Texas.

The BTC genesis block + subsequent growth of industrial mining means you now have a multibillion $ industry effectively competing to find the coincidence of lowest cost of wholesale electricity and highest price volatility within the most free/deregulated electricity markets.

Miners consume 24/7 and can curtail instantly. A miner with a PPA is long power, long power offtake and inherently long upside power vol. This vol position is worth money if power prices are free to float. In ERCOT it’s worth about – $100-200k per MW/yr depending on strike price

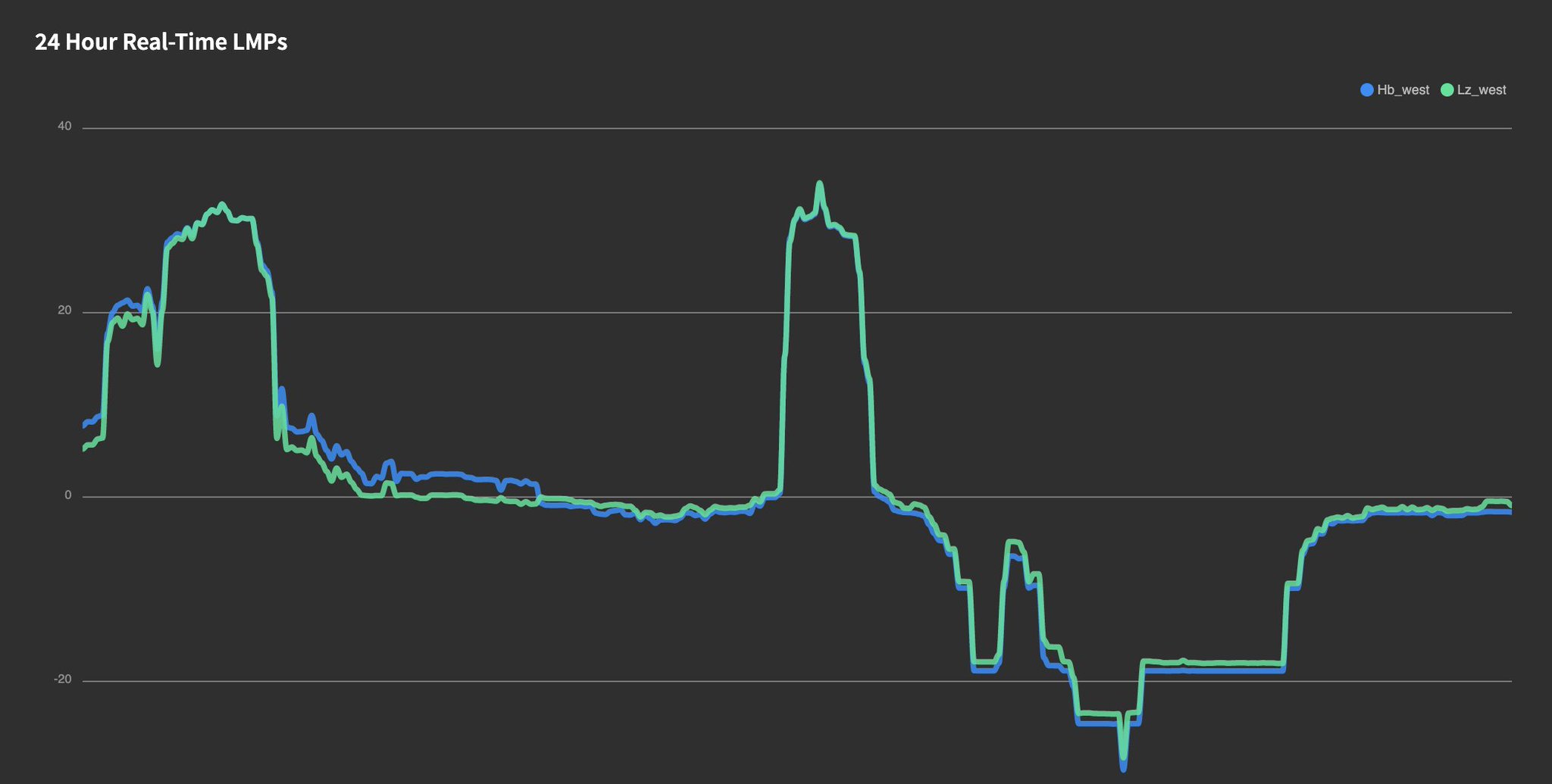

West Texas is the best place in the world to put on this position. Miners here can still profitably invest while the broader global mining industry contracts. Prices are often negative(like last night) leading to low baseline prices and high vol driven by intermittent renewables.

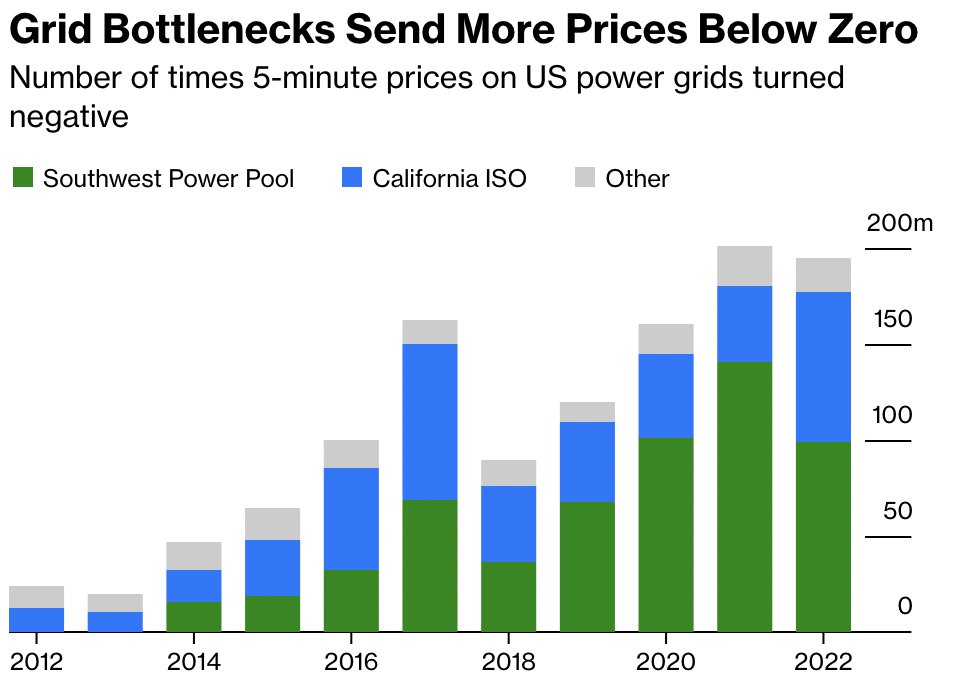

The negative pricing is caused by a transmission constraint for exporting power to East Texas. The tax credit means that renewable gen investment still makes sense in West and North Texas, even if the power cant be exported.

Transmission upgrades will come but it takes time to plan and build vs renewable development which is much faster. Without the tax credit, renewable developers would be more sensitive to price but that's not the case as we can see : www.bloomberg.com/news/articles/2022-08-30/trapped-renewable-energy-sends-us-power-prices-below-zero?...

Agenda-driven critics like Alex Devries of

@DigiEconomist don't present the full picture of renewables + bitcoin mining when overlayed with human electricity consumption behavior.

@DigiEconomist don't present the full picture of renewables + bitcoin mining when overlayed with human electricity consumption behavior.

“Bitcoin miners are helping to create an electricity shortage,” says De Vries, the specialist in Bitcoin’s environmental impact. “And then they get paid a ridiculous amount of money to help solve the shortage that they helped to create in the first place.”

www.bloomberg.com/news/articles/2022-10-14/bitcoin-still-guzzles-power-but-can-be-greener-crypto-irl

www.bloomberg.com/news/articles/2022-10-14/bitcoin-still-guzzles-power-but-can-be-greener-crypto-irl

High electricity prices coinciding with negative prices don't imply a shortage, they imply a chronological mismatch of supply and demand that is driven by wind power intermittency + tax credits. How can you see this picture and say there is an electricity shortage?

Adding base load demand that is flexible is the perfect solution. It sends the appropriate signal to build more base load generation and helps alleviate the distorted price signal from tax-credit subsidized renewables.

More recently, the Ukraine war drove higher energy prices in the forward curve which means more renewables will get greenlit due to massively in the money forward hedges priced off the gas curve + tax credits. Great thread by @DoombergT :

The foundation has been laid for a taxpayer subsidized boomtown to emerge with generation, consumption, job creation and innovation. @LynAldenContact will tell you what comes next - an economic and productivity boom! www.lynalden.com/energy-problems/

In addition to the cheap energy and favorable business climate, you now have an environment in which the bright minds of renewable energy intersect with the most efficient Bitcoin miners who survive this industry contraction.

It wouldn't surprise me to see breakthrough innovations emerge from this region in: Battery Storage, Renewable generation, Data center cooling/utilization, Grid stabilization software and potentially other ancillary industries. Green shoots of this are happening already.

Existing gas production in West Texas also gives a home to off-grid pioneers like @CrusoeEnergy taking the equivalent of 170k cars off the road. Legends.

www.businesswire.com/news/home/20221012005190/en/Crusoe-Energy-Systems-Acquires-Great-American-Mining...

www.businesswire.com/news/home/20221012005190/en/Crusoe-Energy-Systems-Acquires-Great-American-Mining...

The freedom of West Texas is the jurisdictional equivalent to the freedom of the internet native crypto-economy. Build what is needed/viable, minimal red tape, open space for development.

This attracts ambitious free-thinking builders who are looking for a friendly home.

This attracts ambitious free-thinking builders who are looking for a friendly home.

We'll also get a preview of the potential grid of the future here which is very difficult to manage - Too many intermittent renewables and not enough base load = problems. The ESG folks are already starting to see the promise of Nuclear - we need this to continue.

Nuclear generation is currently the most ESG friendly form of generation that is complimentary with the behavioral patterns of human electricity consumption. Solar is OK, wind is not a good form of generation for our species.

Climate hysteria must eventually meet with reason. Energy efficiency and truth seeking pioneers have arrived, done the work and are now offering solutions and answers. Climate activists should seek to galvanize investment that doesn't require the decline of human prosperity.

I find that I'm frustrated by a lack of call to action in what I read so here are my recommendations:

1. Give nuclear the same PTC as Wind

2. Subsidize nuclear waste disposal at a federal level

3. Expedite permitting for new nuclear

4. Increase grants for small scale fission R+D

1. Give nuclear the same PTC as Wind

2. Subsidize nuclear waste disposal at a federal level

3. Expedite permitting for new nuclear

4. Increase grants for small scale fission R+D

If you want to learn more, read the links above and check out Vaclav Simil's book "How the world really works" www.youtube.com/watch?v=XEQuMuHsJn4&t=1s

Mentions

See All

Mags Gronowska @Crypto_Mags

·

Nov 3, 2022

Excellent thread James, thanks!