Thread by Max Anderson

- Tweet

- Nov 3, 2022

- #CentralBank #Inflation

Thread

The Fed just gave *big* guidance

They plan to take rates to 5%+

And hold them there for most of next year, until they've "defeated" inflation

Here's why this won't work

(according to basic math) 👇

They plan to take rates to 5%+

And hold them there for most of next year, until they've "defeated" inflation

Here's why this won't work

(according to basic math) 👇

In 2019, pre-pandemic, debt service accounted for 13% of our federal budget

#4 biggest line item

2019 Budget:

🏥 Healthcare: $1,240bn

🧓🏼 Pensions: $1,100bn

🪖 Defense: $940bn

❌ Debt Service: $580bn ⚠️

👪 Welfare: $370bn

📚 Education: $150bn

🚀 NASA: $22bn

#4 biggest line item

2019 Budget:

🏥 Healthcare: $1,240bn

🧓🏼 Pensions: $1,100bn

🪖 Defense: $940bn

❌ Debt Service: $580bn ⚠️

👪 Welfare: $370bn

📚 Education: $150bn

🚀 NASA: $22bn

This was up from 10% in the prior decade

Previously #5 biggest line item

2009 Budget, for comparison:

🪖 Defense: $790bn

🏥 Healthcare: $760bn

🧓🏼 Pensions: $730bn

👪 Welfare: $420bn

❌ Debt Service: $350bn ⚠️

📚 Education: $90bn

🚀 NASA: $18bn

Previously #5 biggest line item

2009 Budget, for comparison:

🪖 Defense: $790bn

🏥 Healthcare: $760bn

🧓🏼 Pensions: $730bn

👪 Welfare: $420bn

❌ Debt Service: $350bn ⚠️

📚 Education: $90bn

🚀 NASA: $18bn

That increase in debt service costs wasn't great

It meant fewer and fewer of our tax dollars could go towards the things that are actually supposed to add value to our lives

But it was at least manageable

And for the most part, we learned to live with it

It meant fewer and fewer of our tax dollars could go towards the things that are actually supposed to add value to our lives

But it was at least manageable

And for the most part, we learned to live with it

But then 2020 happened

We had a crisis

And went a lil' spend-crazy

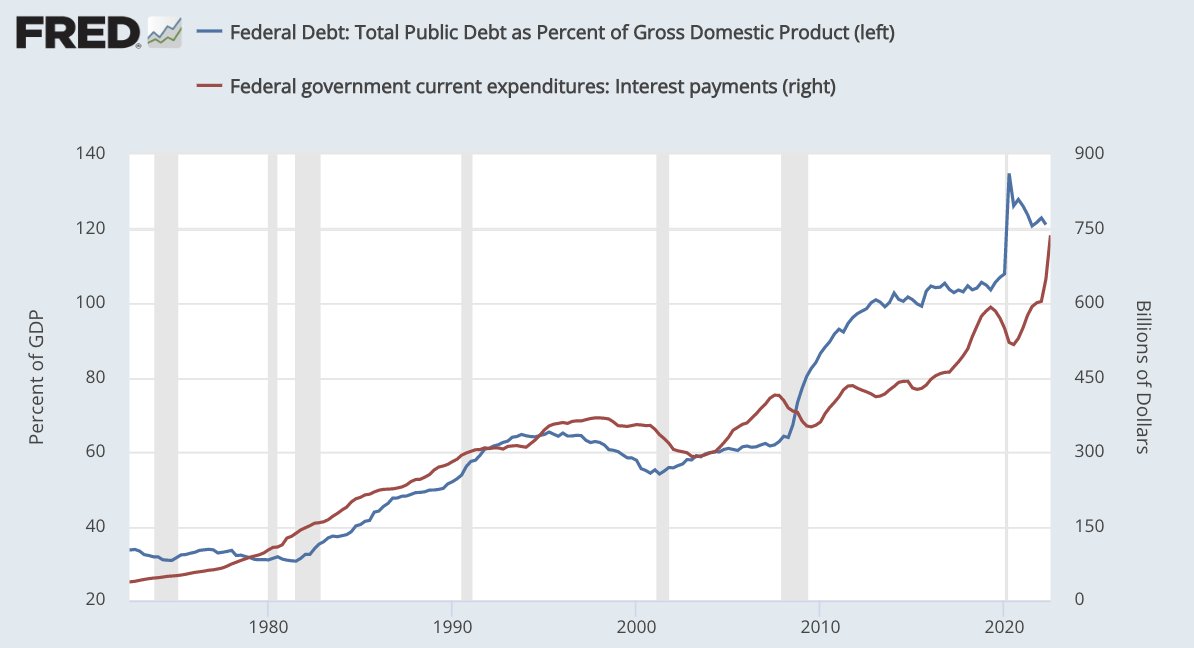

We may or may not have maxed out our credit card, to the tune of a whopping 135% debt / GDP 🔵

It was giga fun while it lasted

But 2 years later, that bill is finally coming due 🔴

We had a crisis

And went a lil' spend-crazy

We may or may not have maxed out our credit card, to the tune of a whopping 135% debt / GDP 🔵

It was giga fun while it lasted

But 2 years later, that bill is finally coming due 🔴

Don't get me wrong, zero interest rates were a god damn good time

It felt amazing. Downright orgasmic 💦

But, sadly, nothing good lasts forever

0% turned into 4%

On its way to 5%

Really, really f*cking quick

It felt amazing. Downright orgasmic 💦

But, sadly, nothing good lasts forever

0% turned into 4%

On its way to 5%

Really, really f*cking quick

Now let's fast forward to today, and take a look at the planned 2023 federal budget

And assume we have to pay for this budget at these new higher interest rates

That $31 trillion of debt we racked up might start to get a lil' spicy🌶️

This should be fun

And assume we have to pay for this budget at these new higher interest rates

That $31 trillion of debt we racked up might start to get a lil' spicy🌶️

This should be fun

At 4% interest, our debt svc cost grows to 22% of the planned federal budget

#3 biggest line item

2023 Budget (@ 4%):

🏥 Healthcare: $1,640bn

🧓🏼 Pensions: $1,370bn

❌ Debt Service: $1,250bn ⚠️

🪖 Defense: $1,170bn

👪 Welfare: $510bn

📚 Education: $240bn

🚀 NASA: $26bn

#3 biggest line item

2023 Budget (@ 4%):

🏥 Healthcare: $1,640bn

🧓🏼 Pensions: $1,370bn

❌ Debt Service: $1,250bn ⚠️

🪖 Defense: $1,170bn

👪 Welfare: $510bn

📚 Education: $240bn

🚀 NASA: $26bn

Spicy indeed

But arguably, still manageable

But arguably, still manageable

Worth noting tho:

w/ 22% of fed budget consumed by debt svc, to get the same level of services the government provided you pre-pandemic, your taxes have to go up by ~12%

(unless of course the gov wants to pay for it with even more debt, making the problem worse in future years)

w/ 22% of fed budget consumed by debt svc, to get the same level of services the government provided you pre-pandemic, your taxes have to go up by ~12%

(unless of course the gov wants to pay for it with even more debt, making the problem worse in future years)

Now let's try 5% 😈

Debt service grows to 27% of the planned federal budget

#2 biggest line item

2023 Budget (@ 5%):

🏥 Healthcare: $1,640bn

❌ Debt Service: $1,560bn 🔥

🧓🏼 Pensions: $1,370bn

🪖 Defense: $1,170bn

👪 Welfare: $510bn

📚 Education: $240bn

🚀 NASA: $26bn

Debt service grows to 27% of the planned federal budget

#2 biggest line item

2023 Budget (@ 5%):

🏥 Healthcare: $1,640bn

❌ Debt Service: $1,560bn 🔥

🧓🏼 Pensions: $1,370bn

🪖 Defense: $1,170bn

👪 Welfare: $510bn

📚 Education: $240bn

🚀 NASA: $26bn

Extra spicy 🌶️🌶️

If you want the same services (and your government to remain solvent), your taxes go up by ~19%

Ouch.

If you want the same services (and your government to remain solvent), your taxes go up by ~19%

Ouch.

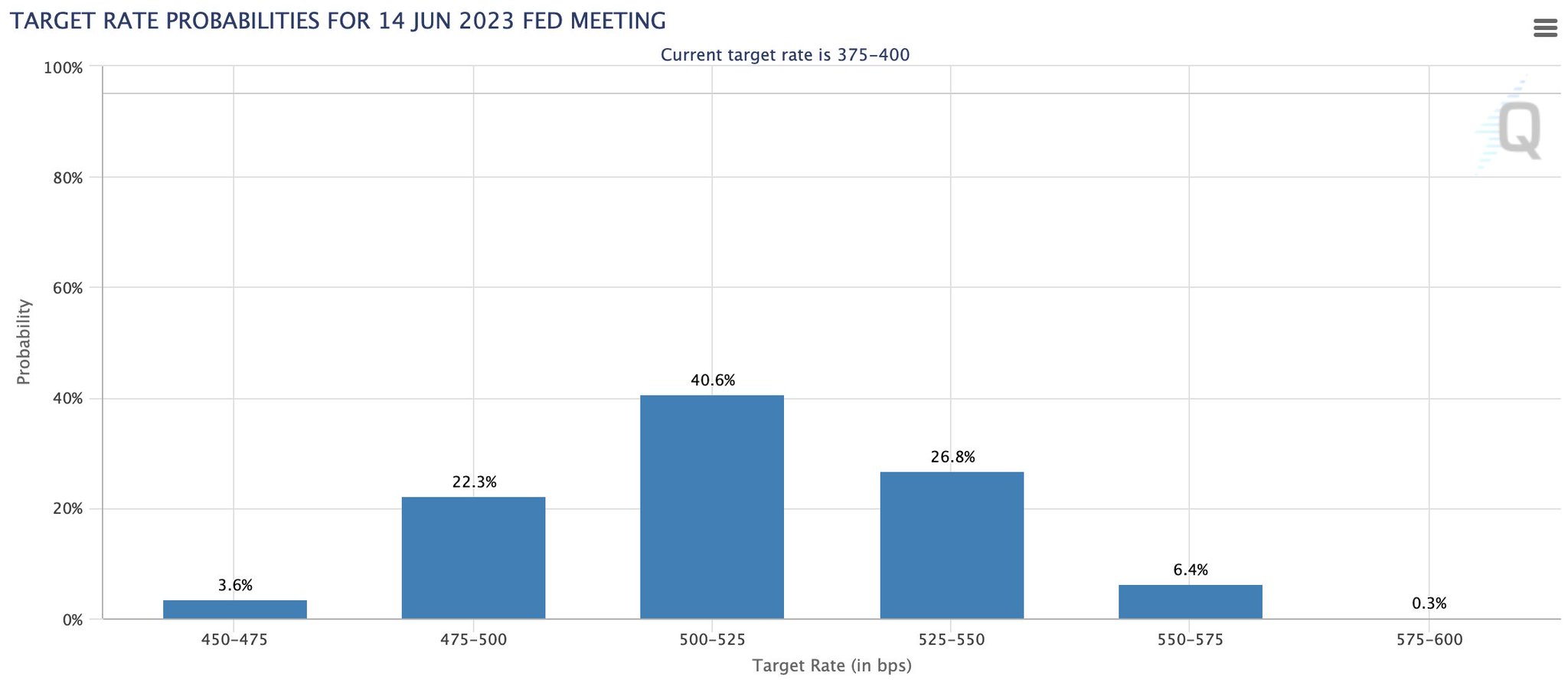

Now let's do 5.5%, since the futures market is pricing in a small chance the Fed tries to take us there by middle of next year:

At 5.5%, debt service grows to 30% of the planned federal budget

Line item numero uno 🥇

2023 Budget (@ 5.5%):

❌ Debt Service: $1,720bn 🔥🔥

🏥 Healthcare: $1,640bn

🧓🏼 Pensions: $1,370bn

🪖 Defense: $1,170bn

👪 Welfare: $510bn

📚 Education: $240bn

🚀 NASA: $26bn

Line item numero uno 🥇

2023 Budget (@ 5.5%):

❌ Debt Service: $1,720bn 🔥🔥

🏥 Healthcare: $1,640bn

🧓🏼 Pensions: $1,370bn

🪖 Defense: $1,170bn

👪 Welfare: $510bn

📚 Education: $240bn

🚀 NASA: $26bn

$1.7 trillion, just to pay the interest on our debt, for a single year

Fun stuff

Your taxes go up by 24%

Fun stuff

Your taxes go up by 24%

By now, it's probably becoming clear how difficult it would be for the Fed to hold rates much higher than ~5% for any significant period of time

Go much above there, and stay for long, things break badly

Now, let's move on to the part about the Fed's plan to defeat inflation

Go much above there, and stay for long, things break badly

Now, let's move on to the part about the Fed's plan to defeat inflation

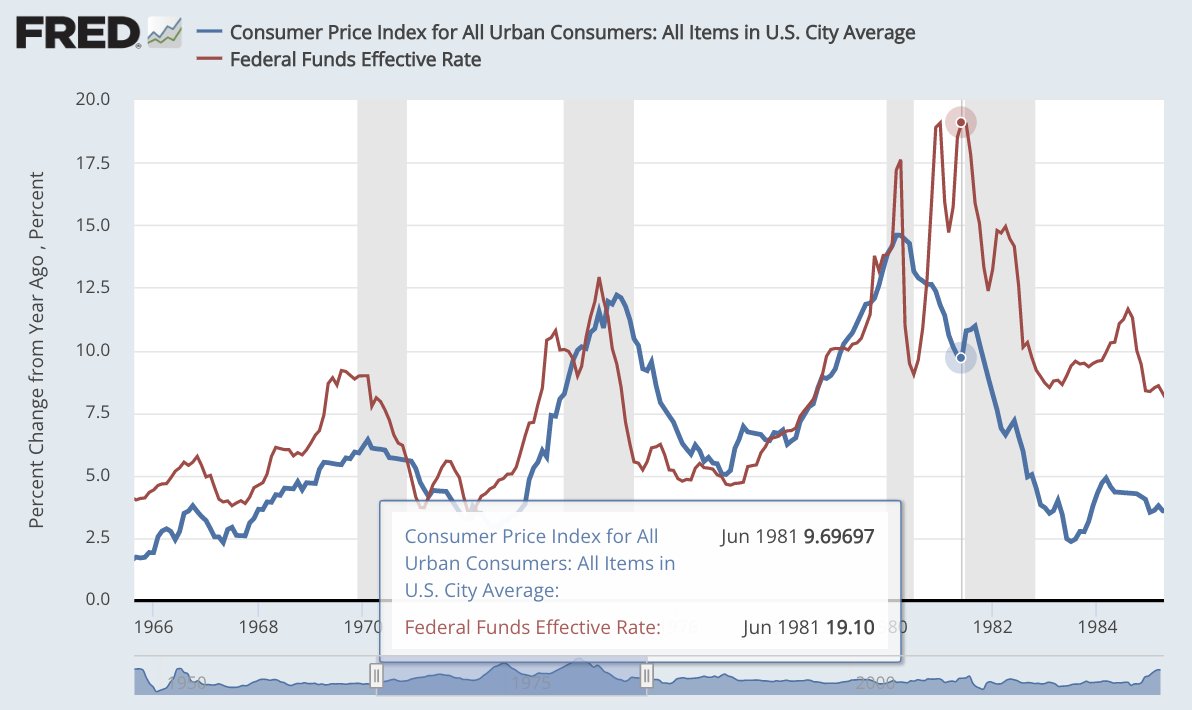

You already know the Volcker Fed had to go to great lengths to defeat our last major inflationary episode in the 70's to early 80's

But let me remind just how far they went

Each time inflation spiked up, they had to raise rates well *above* prevailing CPI @ the time to beat it

But let me remind just how far they went

Each time inflation spiked up, they had to raise rates well *above* prevailing CPI @ the time to beat it

In fact, in Jun 1981, to finally kill the 70's inflation for good, Volcker had to raise Fed Funds to a peak of 19.1%

Nineteen-point-one percent

Roughly *double* the 9.7% CPI at the time

Nineteen-point-one percent

Roughly *double* the 9.7% CPI at the time

Now, just for fun, let's see what Fed Funds at ~double the current CPI would do to our future federal budget

CPI has been hovering around 8%, so we'll use 16% as our inflation-annihilating Fed Funds Rate for this example

CPI has been hovering around 8%, so we'll use 16% as our inflation-annihilating Fed Funds Rate for this example

At 16% interest, debt service would become 86% of the planned federal budget

2023 Budget (w/ 16% Treasury yields):

❌ Debt Service: $5,000bn 💀

🏥 Healthcare: $1,640bn

🧓🏼 Pensions: $1,370bn

🪖 Defense: $1,170bn

👪 Welfare: $510bn

📚 Education: $240bn

🚀 NASA: $26bn

2023 Budget (w/ 16% Treasury yields):

❌ Debt Service: $5,000bn 💀

🏥 Healthcare: $1,640bn

🧓🏼 Pensions: $1,370bn

🪖 Defense: $1,170bn

👪 Welfare: $510bn

📚 Education: $240bn

🚀 NASA: $26bn

And just for some comic relief

If you want to get the same services from your government, your taxes *sextuple*

The avg American, earning the median household income of $78,000, would need to pay $116,000 per year in taxes

If you want to get the same services from your government, your taxes *sextuple*

The avg American, earning the median household income of $78,000, would need to pay $116,000 per year in taxes

I'm no expert in math, but I think that might not work

Unless, of course, we're using alternate-universe Federal Reserve math, in which case it makes total sense

Unless, of course, we're using alternate-universe Federal Reserve math, in which case it makes total sense

Of course I've made many over-simplifications here

Much of the gov's debt is locked in on longer durations, and doesn't immediately need to be rolled over at these higher rates

But the principles discussed still hold

Much of the gov's debt is locked in on longer durations, and doesn't immediately need to be rolled over at these higher rates

But the principles discussed still hold

With $31 trillion in outstanding debt, there's a fundamental ceiling on how high rates can go before everything breaks

At > 100% debt / GDP, that ceiling isn't very high, and we're already close to it now

So yeah - in short, JPow's job is shittier than yours

At > 100% debt / GDP, that ceiling isn't very high, and we're already close to it now

So yeah - in short, JPow's job is shittier than yours

❤️ or RT if you're now as jaded as me 🥲

Want to know the Fed’s *actual* goal around inflation?

Here you go 👇

Here you go 👇

Mentions

See All

Greg Foss @FossGregfoss

·

Nov 3, 2022

Problem is we don’t consider the law of diminishing returns in this excellent analysis. As tax rates rise, tax revenues can actually DECLINE as more of the economy moves underground. Some would argue we are already at max tax rates before diminishing returns sets in. #btc