Thread by Jaran Mellerud

- Tweet

- Nov 4, 2022

- #Bitcoin #BitcoinMining

Thread

Many have questions about Core Scientific right now:

- How did they get into this mess?

- Who do they owe money to?

- What could be the outcomes of this situation?

- How could a bankruptcy affect the mining ecosystem?

In this thread, I try to answer these questions 🧵

- How did they get into this mess?

- Who do they owe money to?

- What could be the outcomes of this situation?

- How could a bankruptcy affect the mining ecosystem?

In this thread, I try to answer these questions 🧵

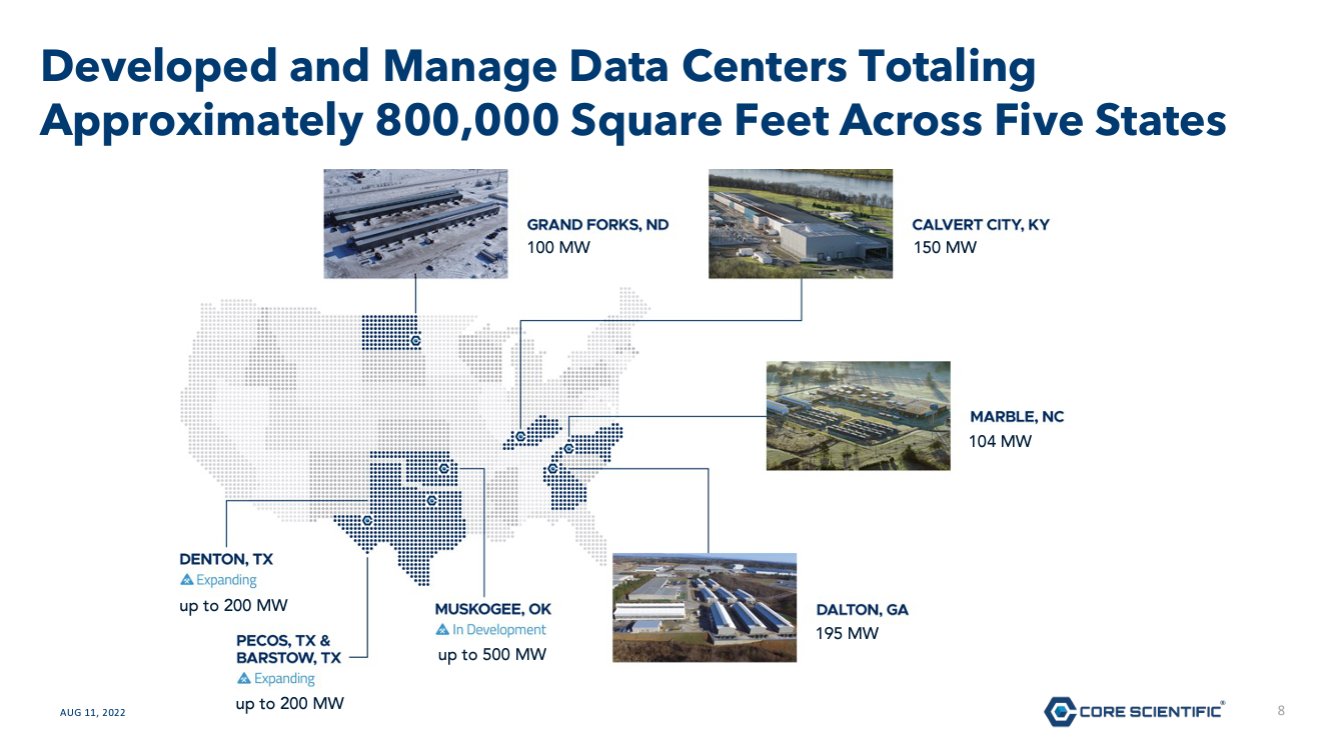

Core Scientific rapidly expanded operations during 2021 and 2022, primarily funding the expansion with debt.

In April 2022, before the bear market took off, Core Scientific had much higher levels of debt than other public miners.

In April 2022, before the bear market took off, Core Scientific had much higher levels of debt than other public miners.

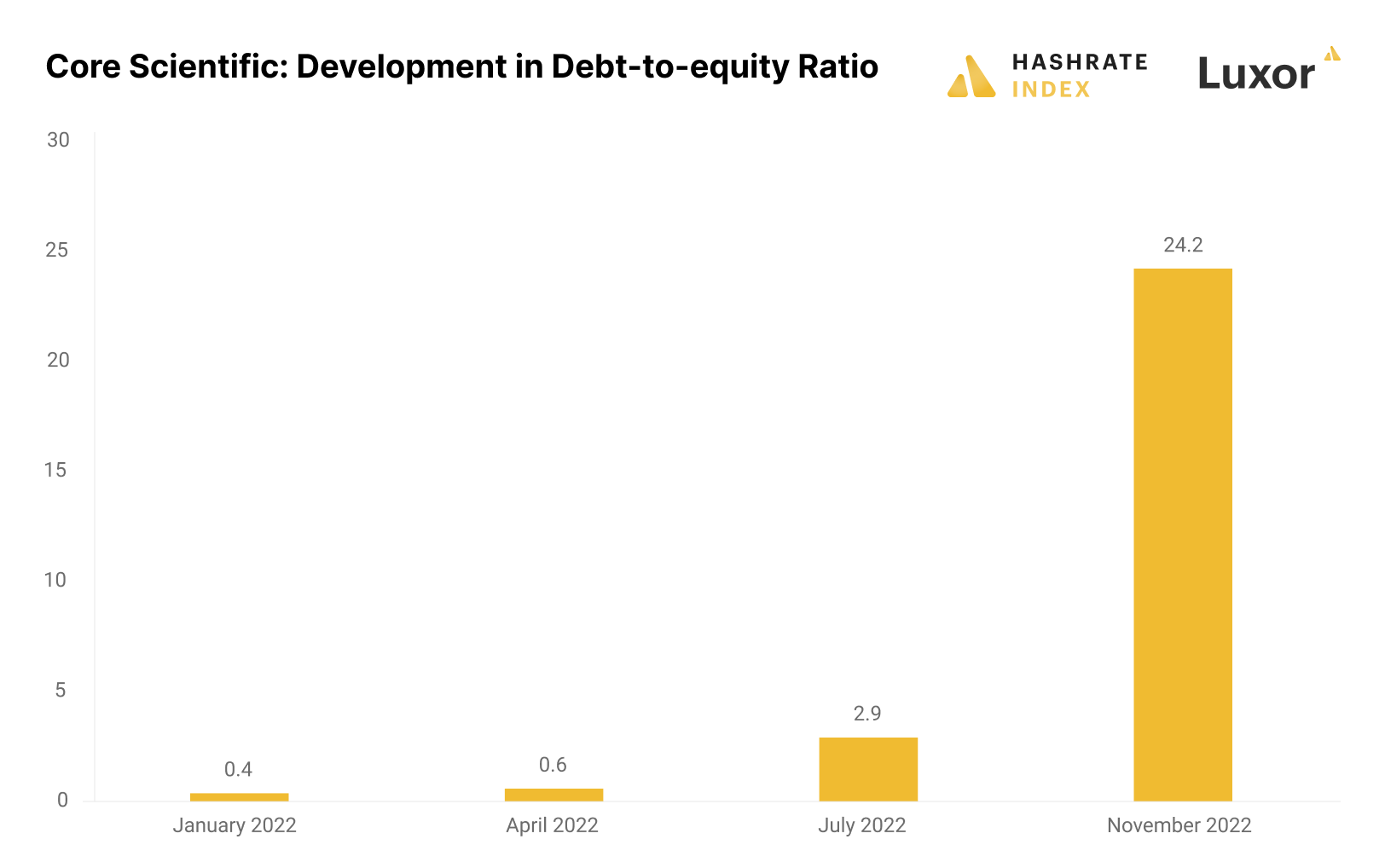

Core Scientific’s April 2022 debt-to-equity ratio of 0.58 is normal in most industries. The problem is that bitcoin mining is not a normal industry. Bitcoin mining is an exceptionally volatile industry, and the bear cycles will destroy those with too much debt.

As the bear market unfolded this summer, Core Scientific’s debt-to-equity ratio skyrocketed due to its plummeting equity value.

In July 2022, the company’s debt-to-equity ratio was already 2.9, a high figure even in less volatile industries.

In July 2022, the company’s debt-to-equity ratio was already 2.9, a high figure even in less volatile industries.

Due to its high debt-to-equity ratio, the company couldn’t take on any additional debt and would severely dilute its shareholders if it raised equity. The company’s financial situation suddenly started looking very grim.

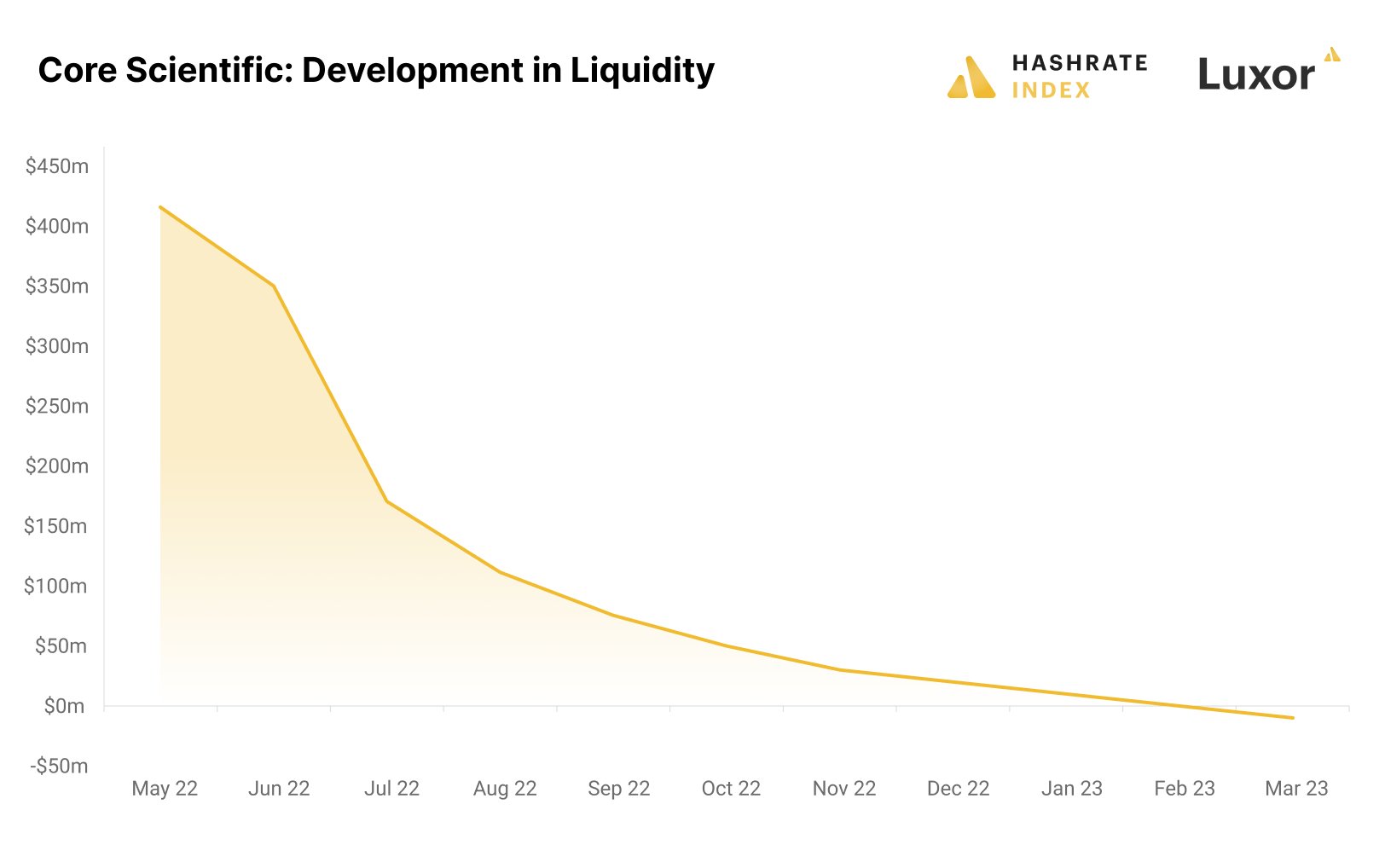

The company had a relatively liquid balance sheet in early May, holding 9,618 bitcoin worth $40k each then. In addition, it held $50 million in cash. Its total liquidity was $415 million, which on paper looked solid and should have been enough to cover future debt payments.

The problem was that nearly 90% of this liquidity consisted of bitcoin, and we all know what happened to the bitcoin price in May. One month later, in June, the bitcoin price was suddenly $20k, and the company appears to have realized it was in danger.

It suddenly started diverging from its previous “hodl-at-any-cost” strategy, dumping 2,698 bitcoin in May and 7,205 in June at fire sale prices. The company has since kept selling and now only has 24 bitcoin left.

The company now only has $27 million of liquidity. It produces about 1,200 bitcoin per month, equivalent to $25 million. I estimate their gross margin is only 30% due to the company being hit hard by energy price inflation.

This gross margin gives the company a monthly cash flow of $7 million. Meanwhile, it has $17 million in monthly debt payments, $10 million more than its cash flow from operations. Its $27 million cash balance will get wiped out by February 2023.

The company is in a hopeless position both from a solidity and liquidity perspective. It is therefore forced to either restructure or declare bankruptcy. Now I will discuss the battle for the company’s assets in the event of bankruptcy.

Core Scientific’s capital holders are now battling to save what is left of their investments. Equity holders are clinging to their last hopes that the company will not bankrupt, while debt holders are forced to play the game of musical chairs for who gets their money out first.

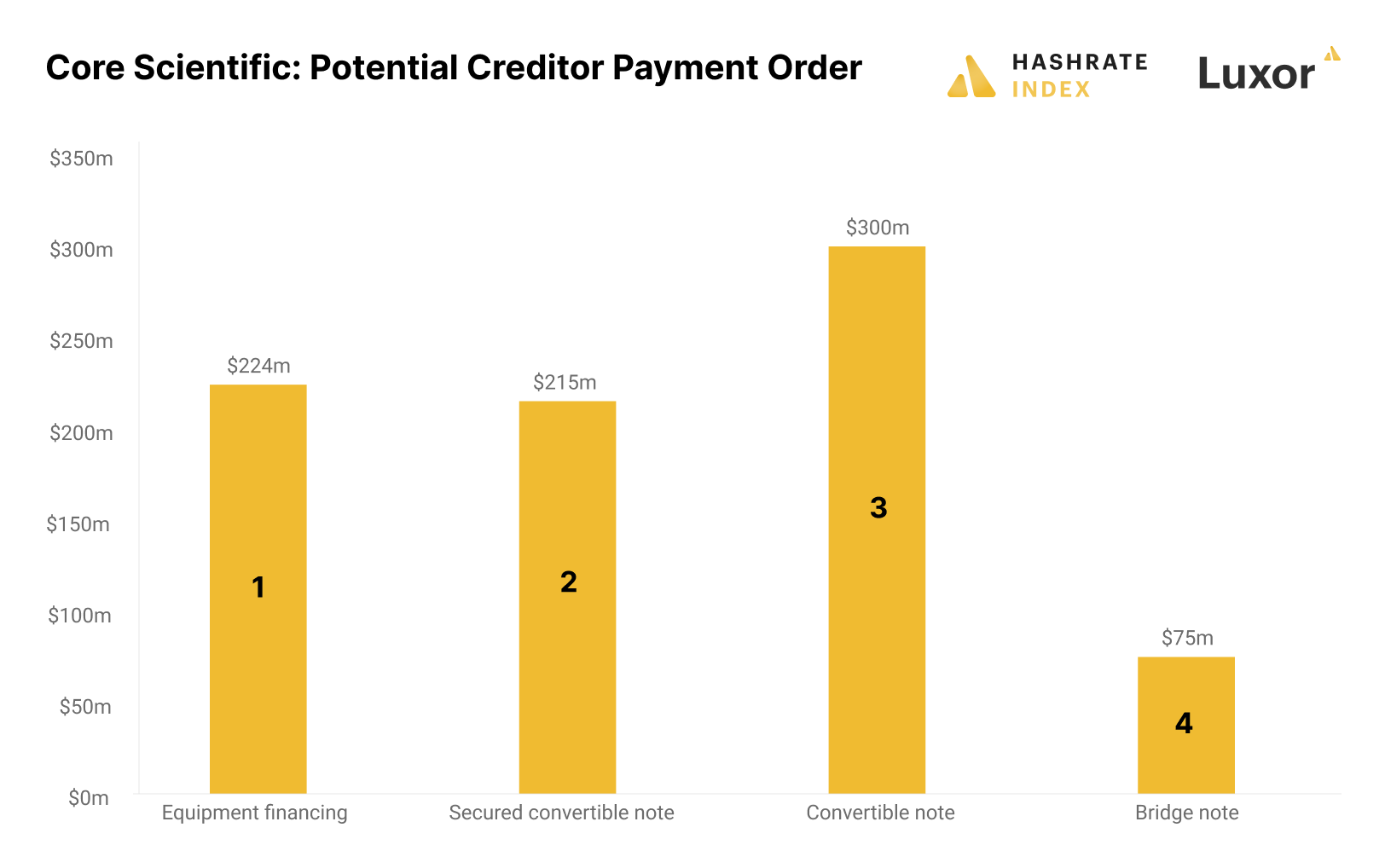

Core Scientific’s $836 million debt consists of $224 million of secured convertible notes, $300 million in convertible notes, $225 million in equipment financing, and $75 million in bridge notes.

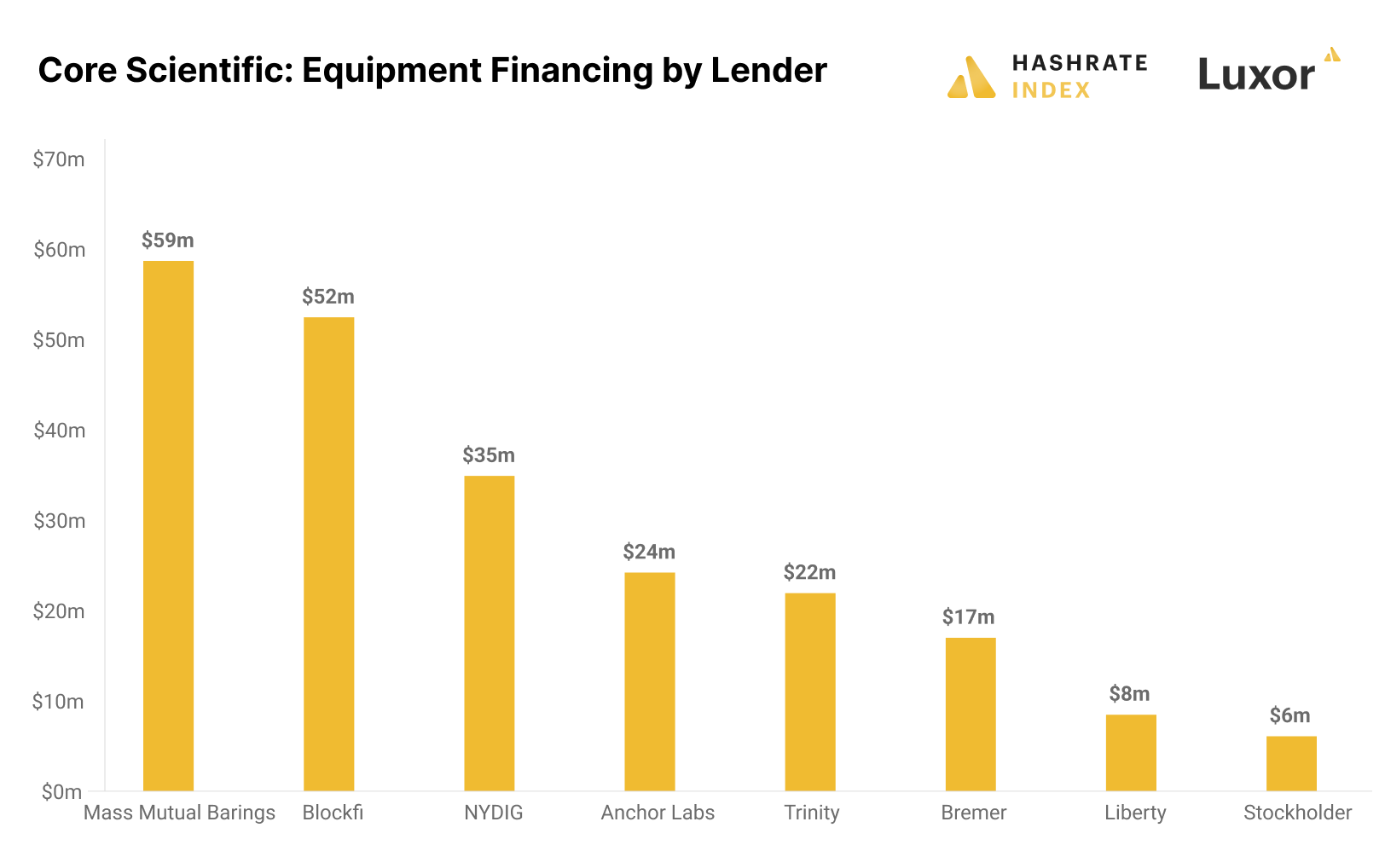

The equipment financing is backed directly by the machines. These lenders are first in the creditor payment order as they could take direct control of the machines. Let’s take a closer look at who these equipment financers are.

I estimate the value of Core's ASIC fleet to be $255 million, which is higher than the $225 equipment financing balance. These lenders should be able to get their money back.

The secured convertible notes are likely the next in line for getting paid. These notes are secured by assets unencumbered by equipment financing. These assets primarily consist of mining facilities, electrical infrastructure, and equity.

Estimating the value of Core Scientific’s mining facilities is complex, but I still give it a try. I estimate the value to be $320 million.

The convertible notes outstanding are $515 million, meaning that they will likely book a major loss, and the bridge notes will not get paid

The convertible notes outstanding are $515 million, meaning that they will likely book a major loss, and the bridge notes will not get paid

Core Scientific’s finances look grim. The company will soon run out of cash and default on its massive loans. The financiers providing these loans want to protect their investments, but there is not much value left in the company.

The company cannot exist in its current form and will have to go through a restructuring. Such a restructuring involves two main pathways: exchanging its existing debt for equity or going bankrupt.

Turning debt into equity involves massive equity dilution, which the stock market currently is pricing in. In bankruptcy, the equity owners will lose it all, and the debt holders will scramble to get what is left of the company’s assets.

The most likely scenario is that the debt will be converted into equity. Convertible note holders will likely lose a significant portion of their investments if the company goes bankrupt and are therefore incentivized to convert their debt to equity.

Turning debt to equity is also the least bad outcome for the company’s shareholders. This hypothesis is further strengthened by Bloomberg reporting that the convertible note holders are working with restructuring attorneys.

Another possible scenario is that Core Scientific gets acquired by another bitcoin mining company. I believe the most likely acquirer is Marathon.

Marathon has a very liquid balance sheet that it could use to acquire and restructure Core Scientific. At the same time, Marathon has several EH/s of capacity sitting idle. With problems at their primary hosting provider Compute North, they could use some extra machine space.

I hope Core avoids bankruptcy since it could lead to a sell-off of other mining equities, particularly the ones with high net debt.

This could render them unable to raise capital and thus result in a domino effect of public miners suffering the same bankruptcy fate as Core

This could render them unable to raise capital and thus result in a domino effect of public miners suffering the same bankruptcy fate as Core

Read the full article here to learn even more about Core Scientific's current situation:

hashrateindex.com/blog/under-a-mountain-of-debt-analyzing-core-scientifics-current-situation/

hashrateindex.com/blog/under-a-mountain-of-debt-analyzing-core-scientifics-current-situation/