Thread by Joe Consorti ⚡

- Tweet

- Oct 11, 2022

- #Finance #CentralBank

Thread

Global financial instability is emerging from plummeting bond prices and the precipitous rise in rates we've seen since the end of last year.

But... central banks will ease one by one to stave off calamity.

A financial instability 🧵

But... central banks will ease one by one to stave off calamity.

A financial instability 🧵

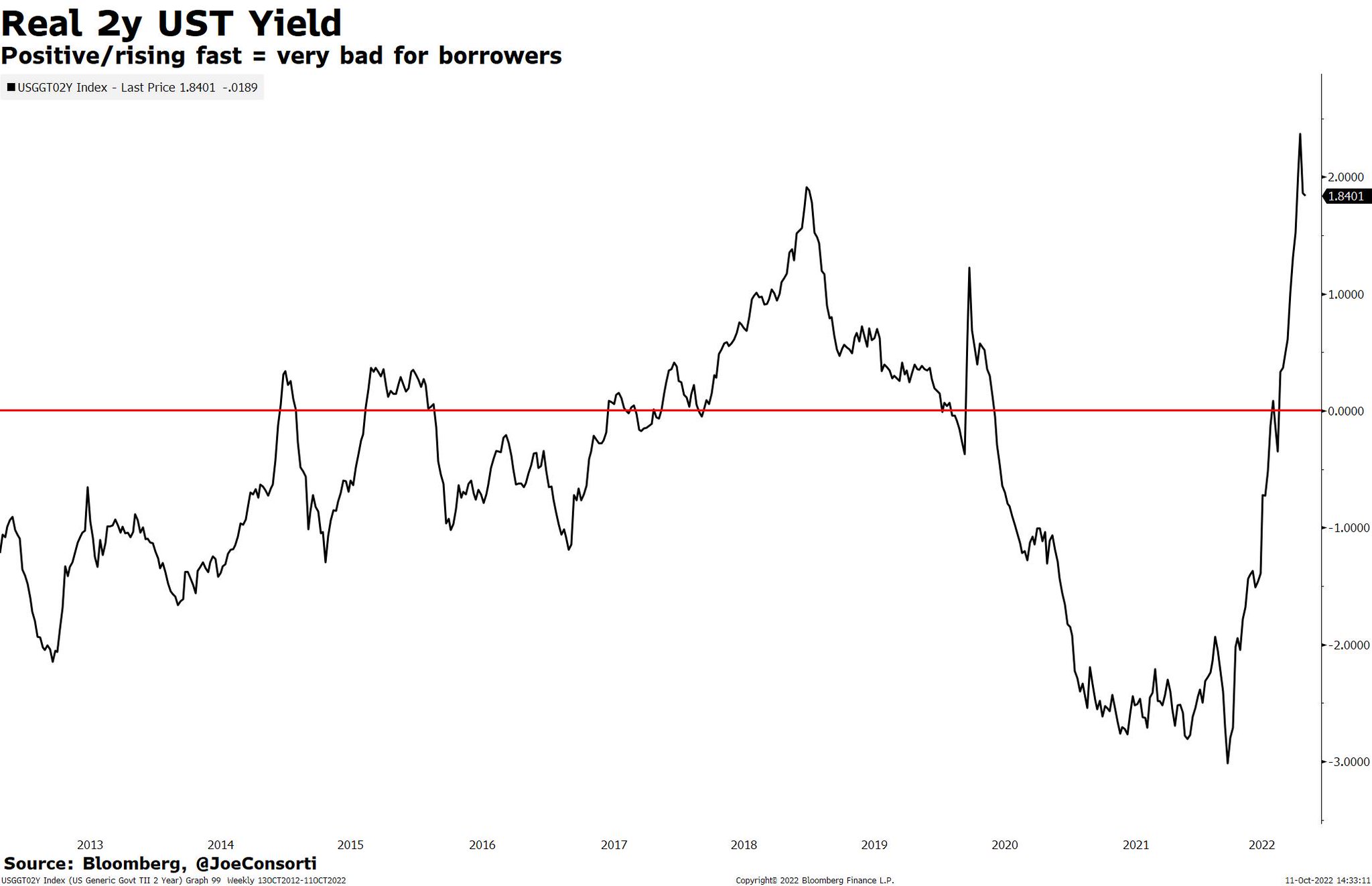

We all know that interest rates have been at or near the zero lower bound for upwards of 14 years now.

Apart from a window in 2018/19, people, corporates, and sovereigns have been able to borrow cheaply.

Often, with a negative real rate; an interest rate lower than inflation.

Apart from a window in 2018/19, people, corporates, and sovereigns have been able to borrow cheaply.

Often, with a negative real rate; an interest rate lower than inflation.

This negative required return on investment, or cost of capital, has led to the misallocation of debt financing.

People borrow for the sake of borrowing, rather than using the debt in the hopes of generating positive economic value.

This is bad.

People borrow for the sake of borrowing, rather than using the debt in the hopes of generating positive economic value.

This is bad.

Artificially skewing the equilibrium rate down floods the system with cheaply-financed debt. This increases fragility.

In times of a negative real cost of capital, everything's fine.

As rates climb, it gets rough.

In times of a negative real cost of capital, everything's fine.

As rates climb, it gets rough.

Positive real interest rates are horrendous for borrowers.

Extreme credit stress is placed on the system as discount rates are adjusted upwards.

This discourages borrowing which helps the Fed in its mission to fight inflation, and raises default risk. Let's explore the latter.

Extreme credit stress is placed on the system as discount rates are adjusted upwards.

This discourages borrowing which helps the Fed in its mission to fight inflation, and raises default risk. Let's explore the latter.

When rates rise, creditworthy borrowers often have no trouble paying the higher premium.

Lots of times they pay it off early in anticipation of rates rising further. The two parties settle up, the IOU dissolves, all is well that ends well.

Lots of times they pay it off early in anticipation of rates rising further. The two parties settle up, the IOU dissolves, all is well that ends well.

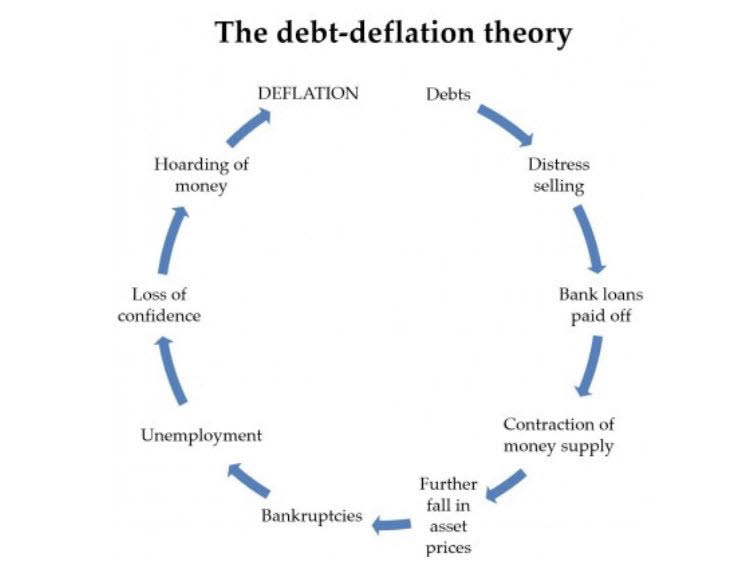

For those who can't stomach the higher premiums, a default may occur.

When a debtor cannot repay its debt obligation, the value of the creditor's assets falls, they may not be able to repay their own debt obligations, & more forced selling ensues.

This is a liquidation cascade:

When a debtor cannot repay its debt obligation, the value of the creditor's assets falls, they may not be able to repay their own debt obligations, & more forced selling ensues.

This is a liquidation cascade:

Falling debt value pushes selling ➡️

Rates rise ➡️

Loans paid off by some borrowers ➡️

Money supply contracts ➡️

Debt value continues falling ➡️

Rates rise ➡️

Default cascade; where debtors default on creditors and creditors default on their own obligations, rinse and repeat.

Rates rise ➡️

Loans paid off by some borrowers ➡️

Money supply contracts ➡️

Debt value continues falling ➡️

Rates rise ➡️

Default cascade; where debtors default on creditors and creditors default on their own obligations, rinse and repeat.

We're not quite at this stage yet.

There is rising FRAGILITY in markets, but no risk of an imminent sovereign bond asset firesale. There is strong structural demand for Treasury securities globally.

However, we are starting to see the first murmurs of wider financial stress.

There is rising FRAGILITY in markets, but no risk of an imminent sovereign bond asset firesale. There is strong structural demand for Treasury securities globally.

However, we are starting to see the first murmurs of wider financial stress.

Notably, what we witnessed in UK pension funds that held normally stable long-dated gilts (bonds) as collateral.

As the gilt selloff persisted, margin calls were threatened which would have tempted a default cascade. The Bank of England intervened with a bond-buying facility.

As the gilt selloff persisted, margin calls were threatened which would have tempted a default cascade. The Bank of England intervened with a bond-buying facility.

Other central banks will be faced with a similar issue.

As the value of sovereign debt held as collateral drops, the choice is between allowing your financial plumbing to explode or becoming the buyer of last resort to backstop the price and pin yields.

Not much of a choice.

As the value of sovereign debt held as collateral drops, the choice is between allowing your financial plumbing to explode or becoming the buyer of last resort to backstop the price and pin yields.

Not much of a choice.

In sum, explicit default is not a huge concern for sovereigns.

Central banks can generally be counted on backstop their government in a pinch.

Collateral markdowns for sovereign bondholders is the pressing matter.

Central banks can generally be counted on backstop their government in a pinch.

Collateral markdowns for sovereign bondholders is the pressing matter.

So: asset/collateral markdowns are the near-term concern with sovereign debt.

Reference rates rising as these bonds selloff poses a more medium-term concern.

Reference rates rising as these bonds selloff poses a more medium-term concern.

Reference rates are an interest rate benchmark used to set other interest rates.

The most widely-used reference rates are from US Treasuries.

Your mortgage, car loan, commercial real estate loans; all are written at a premium to a corresponding Fed Funds-linked borrowing rate.

The most widely-used reference rates are from US Treasuries.

Your mortgage, car loan, commercial real estate loans; all are written at a premium to a corresponding Fed Funds-linked borrowing rate.

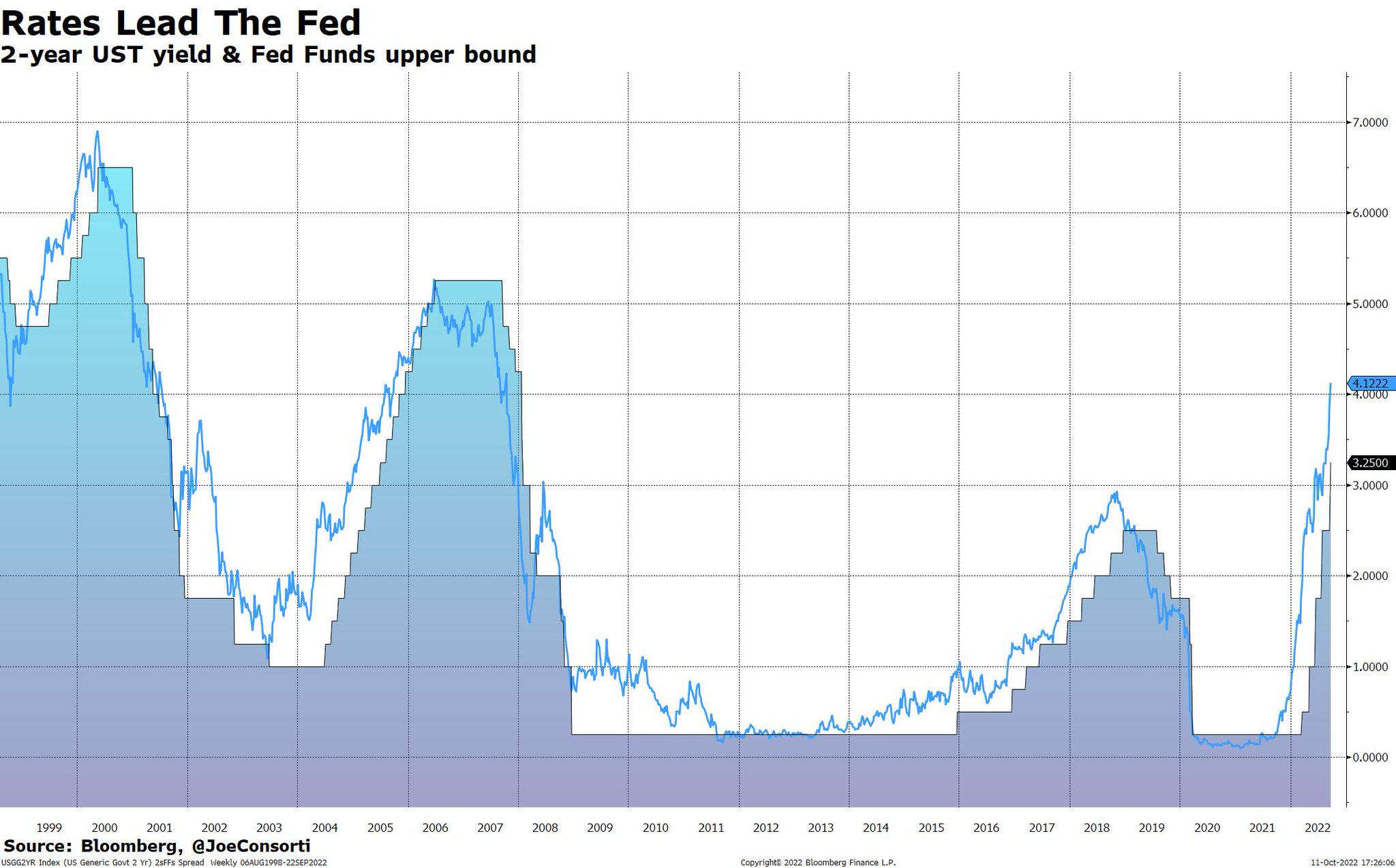

When the Fed sets the Fed Funds rate, short-dated Treasury yields usually rise and fall in tandem with it.

As the Fed hikes and cuts, the 2-year yield prices in its movement ahead of time:

As the Fed hikes and cuts, the 2-year yield prices in its movement ahead of time:

Rising Treasury yields lift all other rates that are written at a premium to them.

This sometimes includes other sovereign bonds, as other central banks are forced to tighten

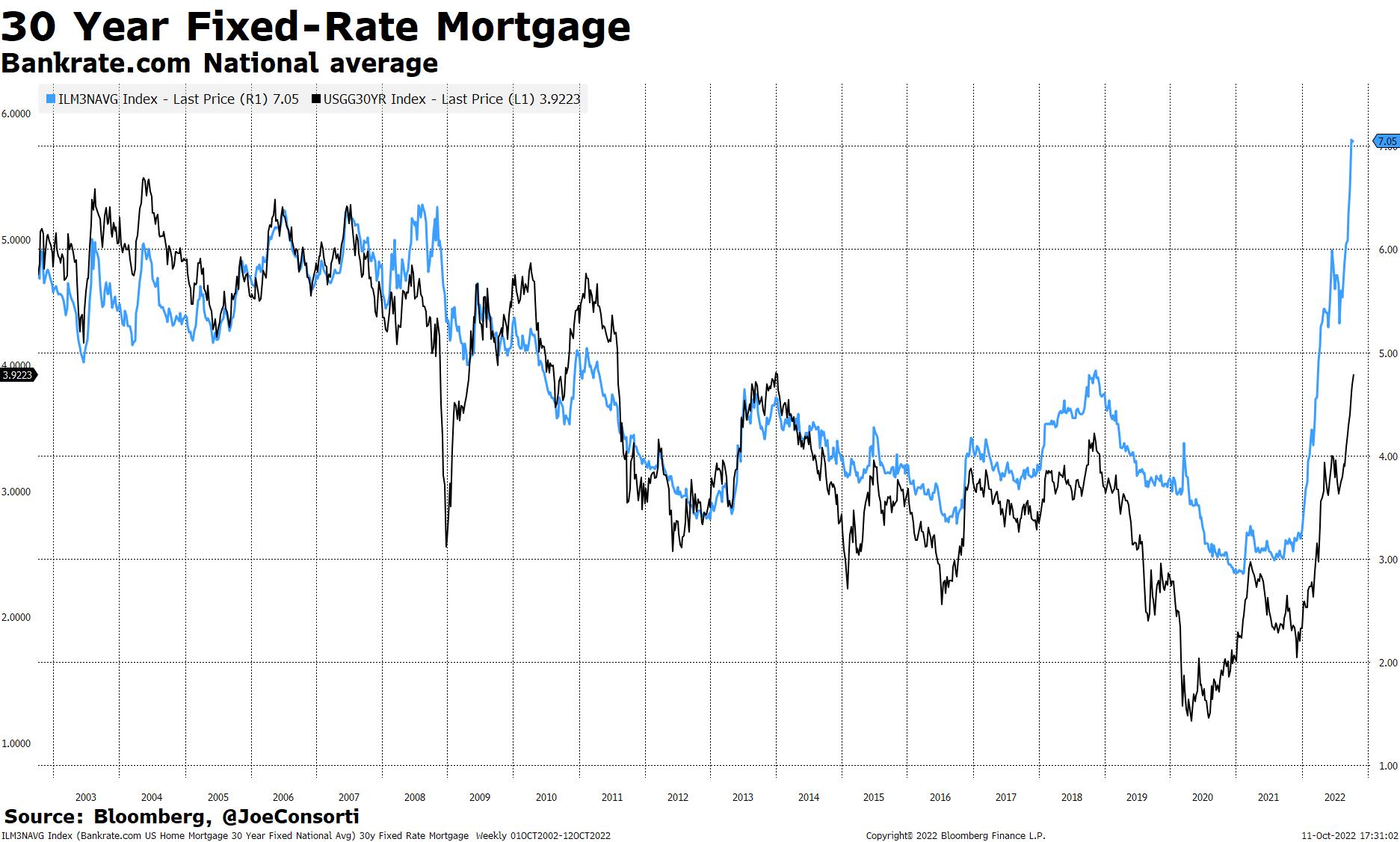

Look at the staggering rise in the 30y Fixed-Rate Mortgage, mapped with the 30y TSY yield:

This sometimes includes other sovereign bonds, as other central banks are forced to tighten

Look at the staggering rise in the 30y Fixed-Rate Mortgage, mapped with the 30y TSY yield:

The Fed's hiking has been matched by other central banks in their fight against inflation.

They must maintain hiking pace with the Fed so as to not import the US inflation.

You see a commensurate rise in sovereign bond yields and thus borrowing costs globally.

They must maintain hiking pace with the Fed so as to not import the US inflation.

You see a commensurate rise in sovereign bond yields and thus borrowing costs globally.

As a function of the sovereign bond selloff and yields soaring, financial instability has begun setting in.

There are several estimates for the "neutral rate" here in the US, and we're about to blow past all of them.

Here's where global financial instability is emerging:

There are several estimates for the "neutral rate" here in the US, and we're about to blow past all of them.

Here's where global financial instability is emerging:

BOE governor gives "three more days" to pension funds to unwind their unfavorable gilt positions before the bond-buying support ends.

Bailey, are you sure?

Seems like a bad idea to take the bottle (continuous liquidity injections) away from the baby (UK gilts):

Bailey, are you sure?

Seems like a bad idea to take the bottle (continuous liquidity injections) away from the baby (UK gilts):

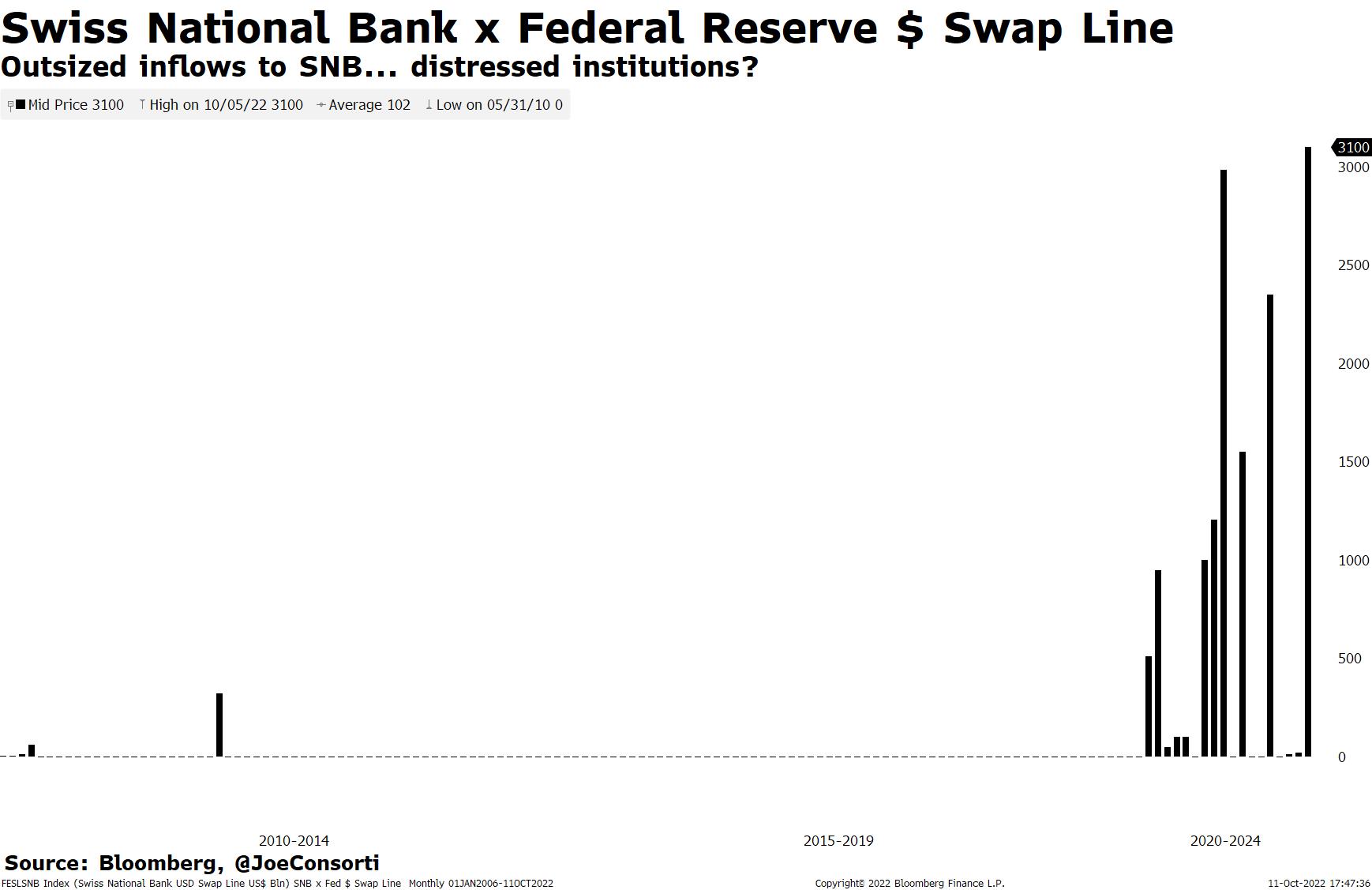

Federal Reserve quietly extending Switzerland more US dollars over its swap line than ever before.

Wat mean?

Fragility amongst Swiss financial entities.

Dollars go to the Swiss National Bank, then disbursed to distressed institutions. Credit Suisse, perhaps? We'll see:

Wat mean?

Fragility amongst Swiss financial entities.

Dollars go to the Swiss National Bank, then disbursed to distressed institutions. Credit Suisse, perhaps? We'll see:

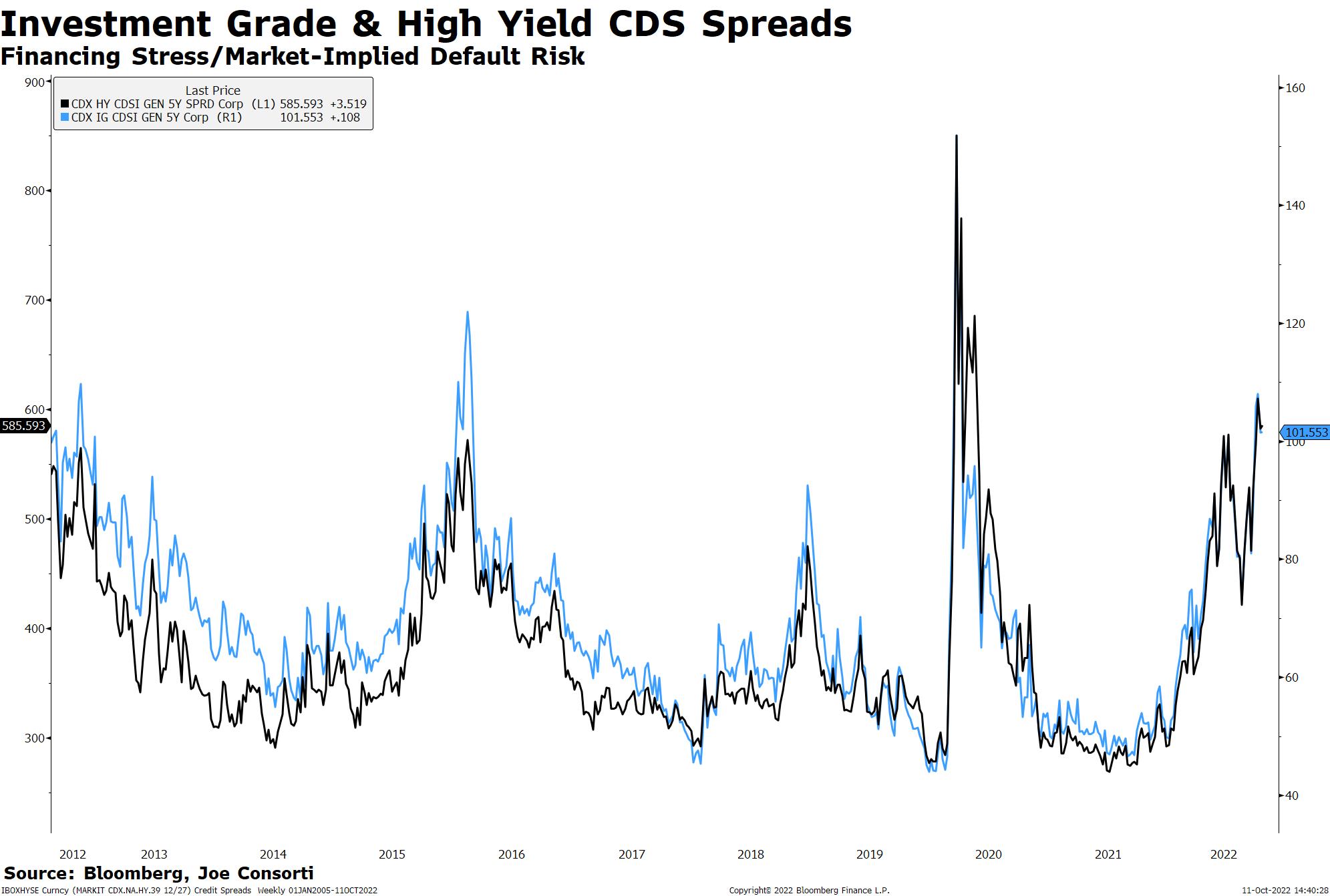

Heightened credit stress from investment-grade (AAA-BBB) all the way down to high-yield borrowers.

Domestic credit markets are under great stress:

Domestic credit markets are under great stress:

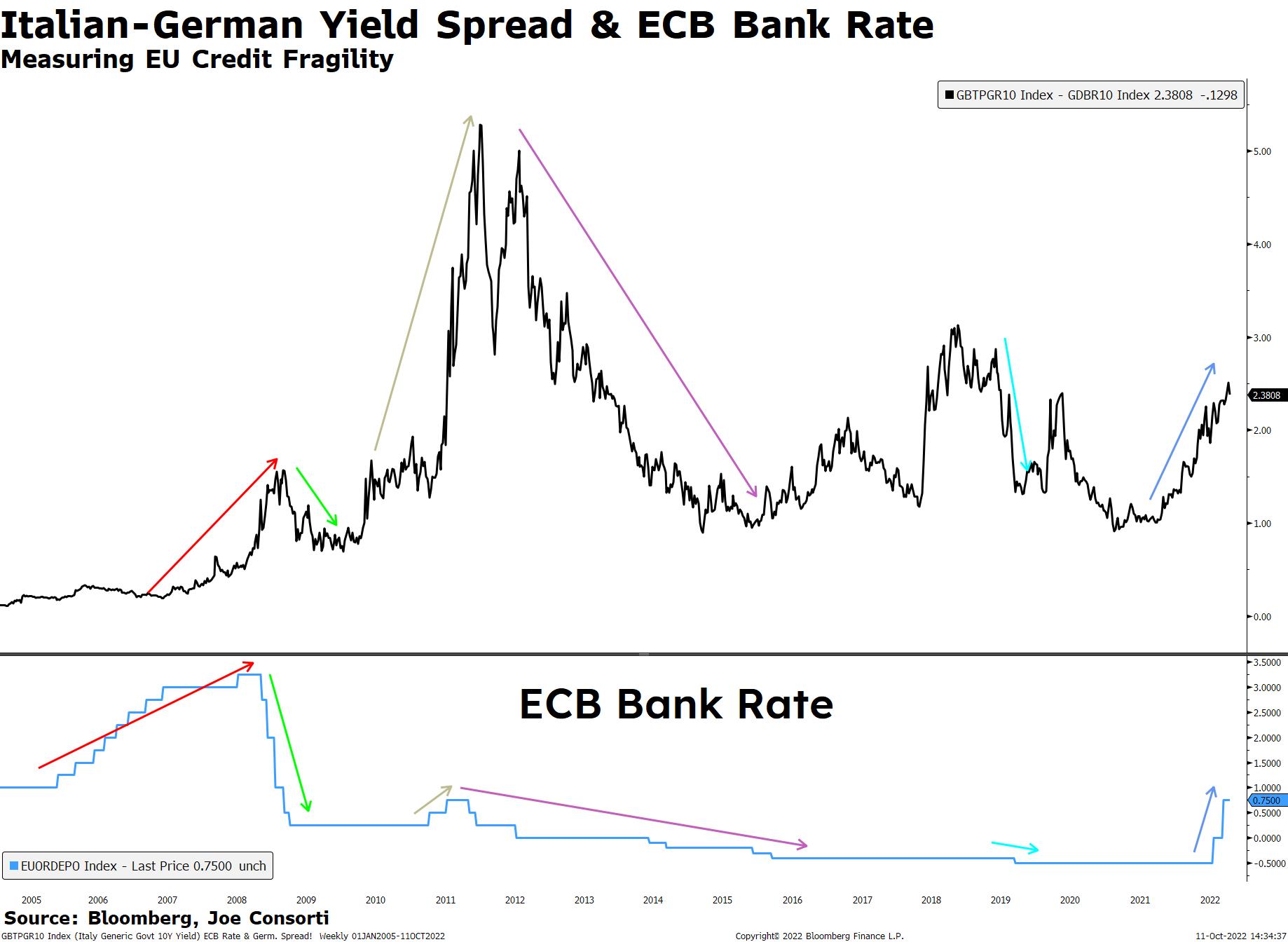

It's worse for nations that had 'loose for longer' rate regimes.

Take Europe. Look at spreads on Italian bonds & the ECB bank rate. The meteoric rise in rates is untenable for fragile borrowers like Italy.

A fragile foreign borrower like this will be the next shoe to drop:

Take Europe. Look at spreads on Italian bonds & the ECB bank rate. The meteoric rise in rates is untenable for fragile borrowers like Italy.

A fragile foreign borrower like this will be the next shoe to drop:

Monetary policy works with a lag. The effect of tightening is unobservable presently and justifies successive large hikes in the Fed's mind.

This will give them the slowed economy they so desire... just like slamming on the brakes while driving at 100 mph will slow down the car.

This will give them the slowed economy they so desire... just like slamming on the brakes while driving at 100 mph will slow down the car.

From 14 years of cheap money to a sudden 3%+ increase in the borrowing rate for even the most creditworthy.

The velocity of money is screeching to a halt quicker than we've ever been alive to witness.

All Eyez On Europe and other fragile borrowers at home and abroad.

/end

The velocity of money is screeching to a halt quicker than we've ever been alive to witness.

All Eyez On Europe and other fragile borrowers at home and abroad.

/end

Mentions

See All

Lawrence Lepard @LawrenceLepard

·

Oct 30, 2022

Important thread 👇