Thread

Ethereum's Layer-2 Bull Cycle has begun. And with the supply side boost from the Merge in the rearview, the market should hone in on the demand dynamics, which are beginning to drive significant network effects. Ethereum on-chain fundamentals update 🧵

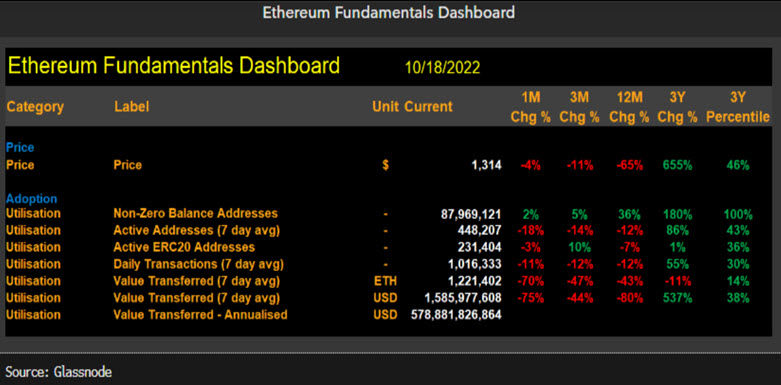

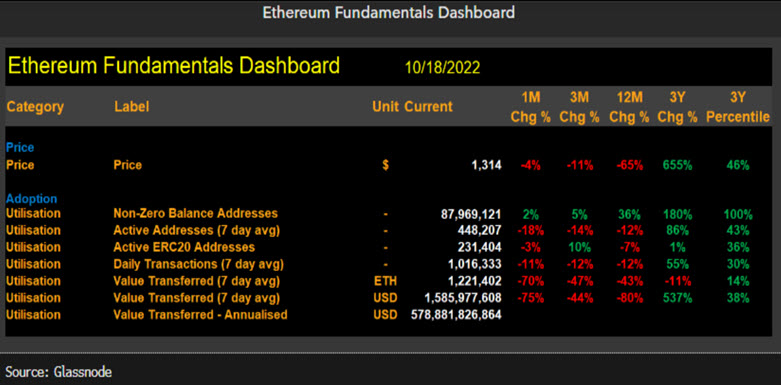

Given the severity of the global monetary tightening, Ethereum, over the last 12-months, has performed commendably across some of the network adoption metrics we analyze in our fundamentals dashboard.

Remember, these core fundamental metrics; active addresses, transactions, transferred values and non-zero balance addresses, are tracked because of their strong correlation with the price since inception.

Over the past 12-mths, only one metric, transferred value (USD), failed to outperform the price (which declined by -65%) -- to see this many outperforming is pretty much what the bulls want to see in a severe bear market.

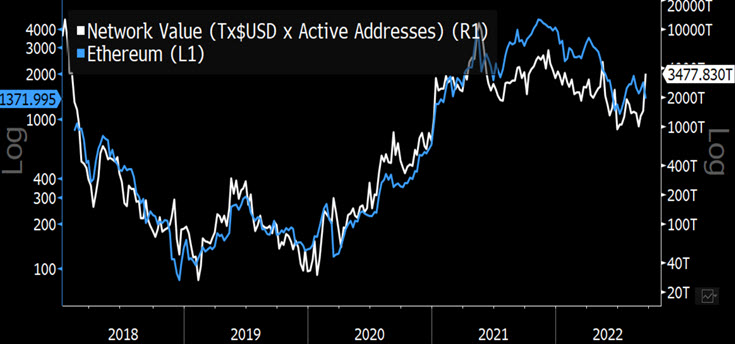

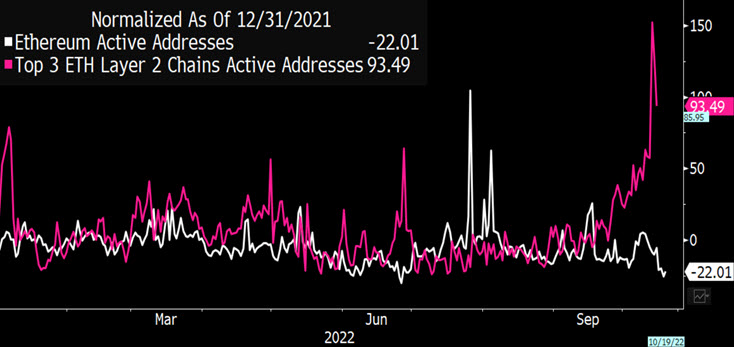

The current state of activity on the network could be interpreted in multiple ways depending on one's perspective. On the one hand, active addresses are down 47% from the 2021 bull market high (vs. -74% in 2018)....

Longer-term time horizon investors might pay to look through the current activity recession and appreciate the trough-to-trough expansion from 180,000 to min 400,000 addresses this cycle

That additional 220,000 addresses reflects an expanding price-insensitive community of developers, users and stakers committed to the ecosystem, building the next generation of Web3, DeFi and gaming Dapps on the network.

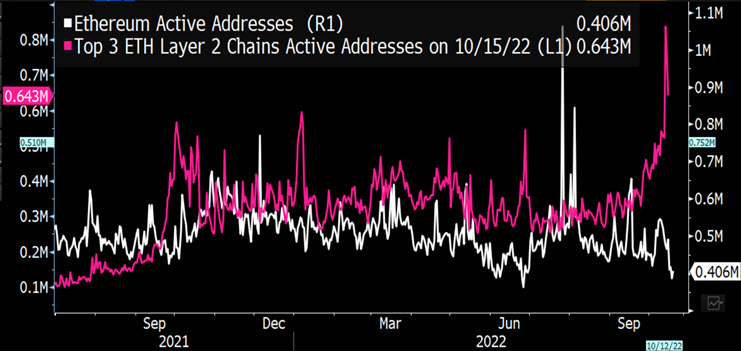

But the role of Layer-2s also cannot be understated...

But the role of Layer-2s also cannot be understated...

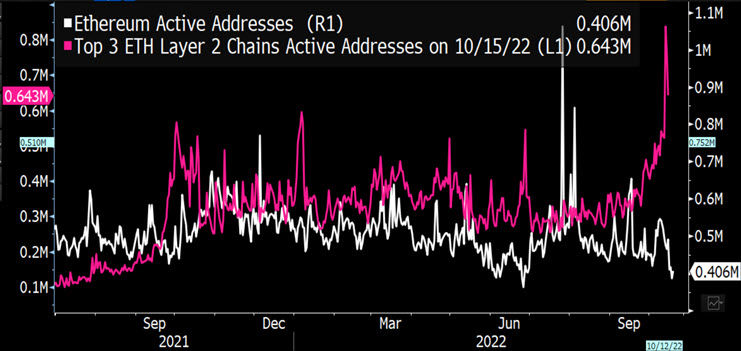

Ethereum's rollup-centric scalability roadmap is starting to pay off as active users on the top L2 solutions surpass that on the base chain. Over the past month active addresses on the three top layer-2 chains; Polygon, Arbitrium and Optimism increased by 85%. @Artemis__xyz

@Artemis__xyz The largest L2, Polygon, boasts over 500,000 active addresses (more than Ethereum), an increase of 50% since the start of the year. Polygon's multi-layered success has been a lightning rod for DeFi, Web3 and Gaming developers. @Artemis__xyz

@Artemis__xyz But L2s could be subduing base chain active address growth. Whilst, onboarding the next wave of users via a much improved, lower friction experience, L2s dramatically increase the network effect, a lower fee footprint impacts the valuation of the base asset, Ether.

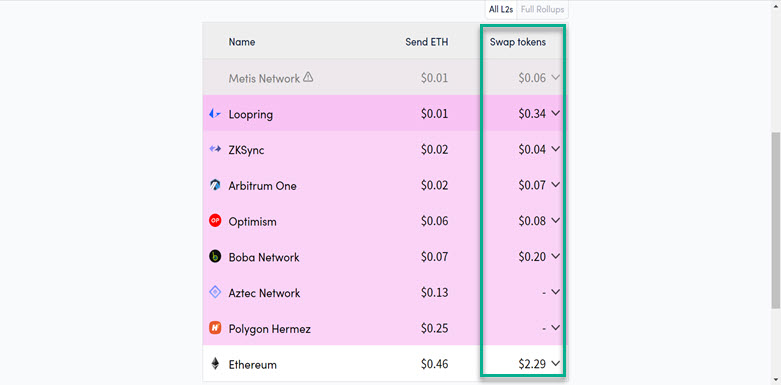

@Artemis__xyz According to l2fees.info, asset swaps are 90-98% cheaper on L2. More activity esp high frequency, lower value tx's (lower security assurance) will migrate - but how much of the high-value tx's will remain on the base chain? The answer will impact Ether valuation.

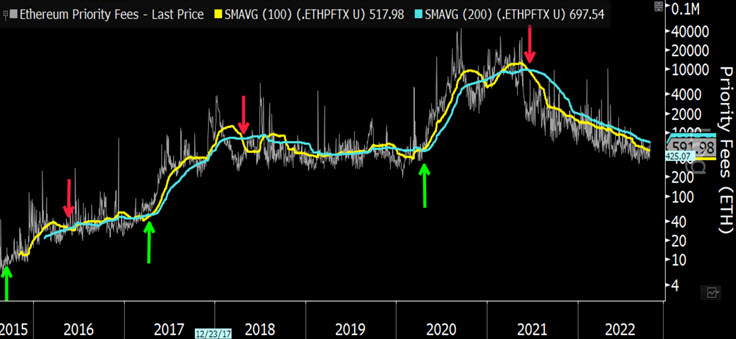

@Artemis__xyz Prior bull markets had a common feature - Priority Fee uptrend. Currently, in a downtrend. The clear relationship will be hard to shake even if total Txs ⬆️

Higher Priority Fees = higher staking return = more stakers = less ETH in circulation (net of liquid ETH e.g. stETH)

Higher Priority Fees = higher staking return = more stakers = less ETH in circulation (net of liquid ETH e.g. stETH)

@Artemis__xyz Except for a CB pivot, a primary catalyst for a new bull cycle will be a recovery in Priority Fees. Given impressive L2 adoption, this will require a factor ⬆️ in L2 volumes/$value and/or an increase in the base chain tx's

@Artemis__xyz On some valuation metrics, like Mkt Cap to Active Addresses, Ethereum has not reached the same washed-out levels seen in the 2018/2019 bear market. June low was -75% vs -89% in 2018.

@Artemis__xyz But Ethereum, this cycle, is different. Users migrating to L2s are subduing base chain active addresses while at the same time scaling the network, in essence amplifying network effects.

@Artemis__xyz 1) Adoption cannot be disentangled from macro but overall fundamentals outperformed the price (positive)

2) L2s are exploding & the network is growing (positive)

3) L2 migration hitting total Network Fees; volume needs to increase substantially to arrest the fee downtrend (Neg)

2) L2s are exploding & the network is growing (positive)

3) L2 migration hitting total Network Fees; volume needs to increase substantially to arrest the fee downtrend (Neg)

Mentions

See All

Raoul Pal @RaoulPal

·

Oct 25, 2022

Excellent thread again