Thread

Lots of hot takes right now on where early stage startups and VCs are at on funding, valuations, and more.

Well, here's first party data from @AngelList + @SVB_Financial based on thousands of early stage startups in Q3 + my own takes. Here we go 🔥😨

1/n

Well, here's first party data from @AngelList + @SVB_Financial based on thousands of early stage startups in Q3 + my own takes. Here we go 🔥😨

1/n

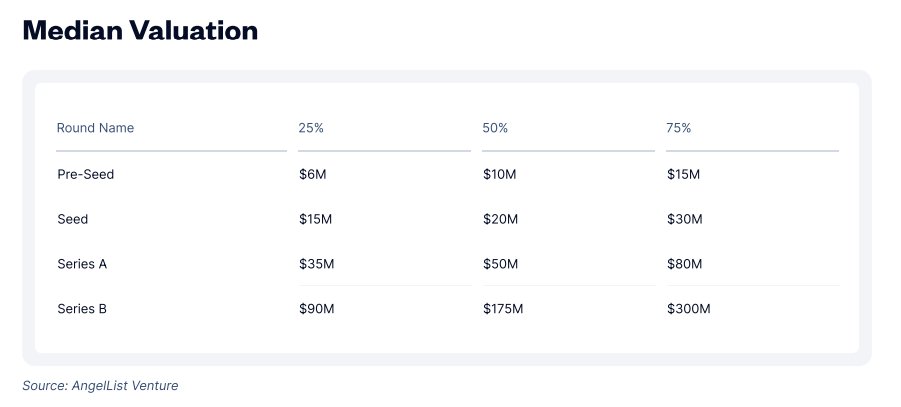

Early-Stage Valuations. Kinda steady? Perhaps higher than expected? Pre-money, median valuations below.

My take: less deals are being done, but the best deals are still being done, with lots of dry powder rich investors taking their more limited shots to support them.

My take: less deals are being done, but the best deals are still being done, with lots of dry powder rich investors taking their more limited shots to support them.

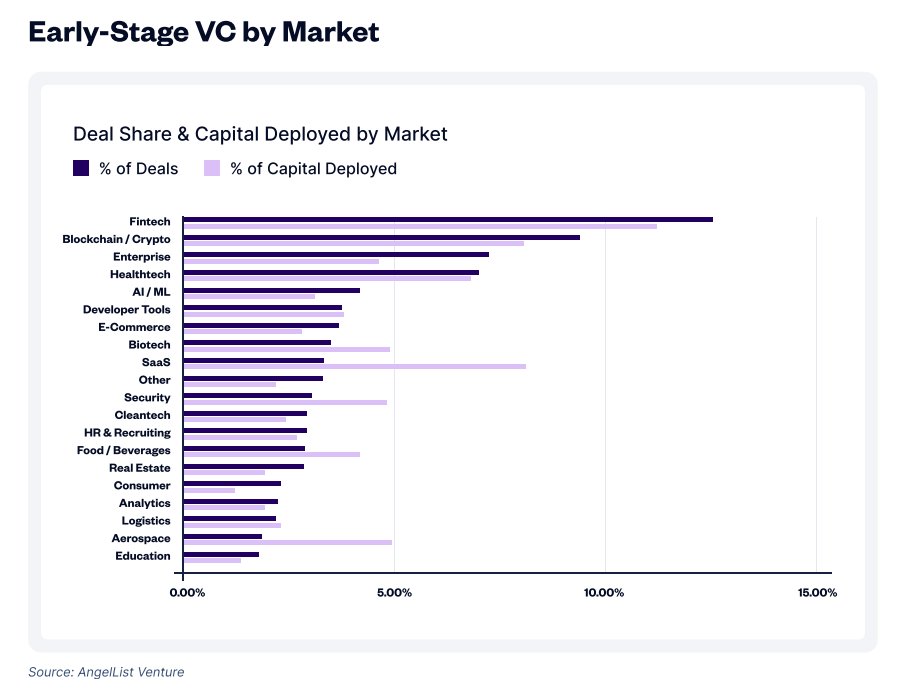

Ok so where's that funding actually going?

-Web3 fell from #1 for the 1st time since Q4 2021.

-Fintech and healthcare holding strong, though multiples for fintech have come down considerably at later stages.

-AI/ML? No longer acronyms on the deck (5 yrs ago). Very real now.

-Web3 fell from #1 for the 1st time since Q4 2021.

-Fintech and healthcare holding strong, though multiples for fintech have come down considerably at later stages.

-AI/ML? No longer acronyms on the deck (5 yrs ago). Very real now.

Seed deals absolutely dominate the deal count. Why have they gone up QoQ as a piece of the pie? Likely due to multi-stage firms converging on the seed-stage as later stage deals face pressure.

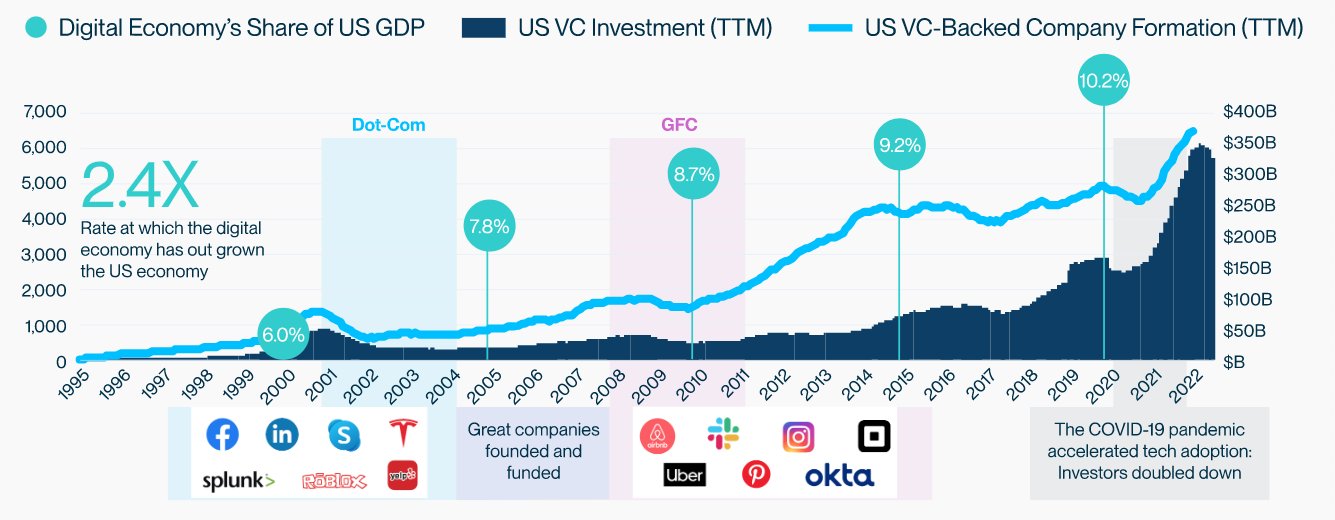

And lastly, from another @SVB_Financial report (www.svb.com/trends-insights/reports/state-of-the-markets-report) and since I'm glass half full, I'll continue to remind folks during rocky times that some of the all time best tech companies were born out of adversity. Stay positive. 🙏

For more info and the full report, check out @AngelList's recap here:

www.angellist.com/blog/the-state-of-us-early-stage-venture-startups-3q22

www.angellist.com/blog/the-state-of-us-early-stage-venture-startups-3q22

And a huge shout out to my teammates @Liz_Cahill and @ijakemendel for their hard work on this one. You rock.

Finally, I'd be remiss if I didn't say that it's a super difficult time, and we're here to help guide founders through it.

If you're an existing client/want to become one, DMs open. If you want to learn more about how we support our early stage founders: www.svb.com/startup-banking

If you're an existing client/want to become one, DMs open. If you want to learn more about how we support our early stage founders: www.svb.com/startup-banking