Thread

How did we arrive at 0%/Optional fees so quickly within Solana NFTs?

Let's take a look back.

🧵

Let's take a look back.

🧵

I believe when the comparisons started it was getting into Magic Edens head.

My personal view, Optional/0% fee marketplaces/AMMs should not be directly compared to those who don't allow users to waiver creator royalties/any other fees.

But the comparisons kept coming regardless.

Again.

I actually found the blur quite amusing because technically ME shouldn't have been in this comparison anyway.

Again.

Again.

This is what I believe broke the camels back

And again.

Then this came.

I don't know all the ins and out and respect Frank's decision. If he believes they was ready to make this move that's their choice.

Although I do think this was motivated by zero fee marketplaces.

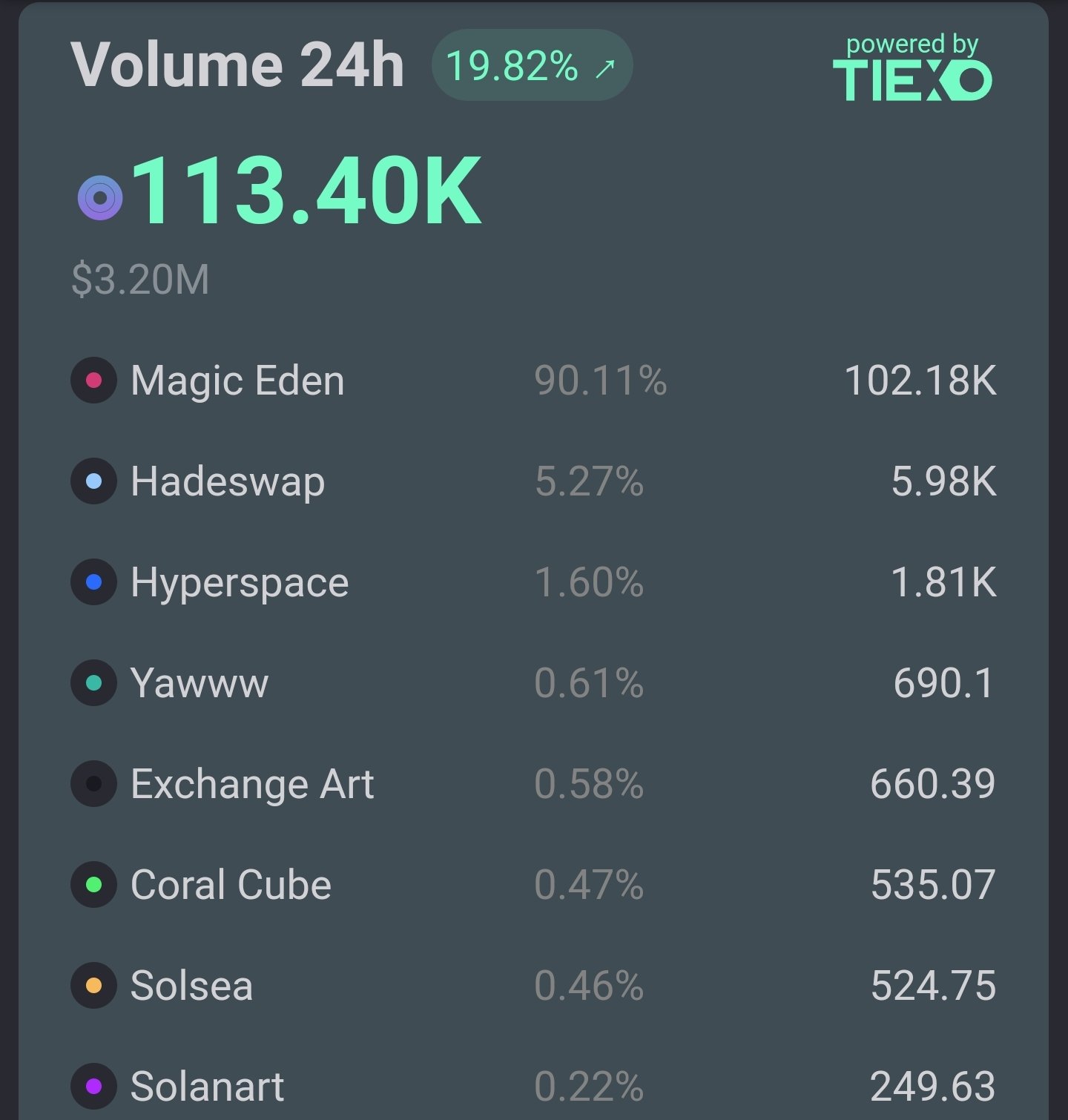

What's interesting is the volume actually dropped off the day before @MagicEden made their announcement. Solanart and Hadeswap spiked then settled back down again. Although I think ME already made their decision before this stage out of panic.

To everyone surprise (lol).

Magic Eden announced they acquired @coralcubenft.

At this point I think everyone assumed where this was going.

P4P, headshot, dead. As @Leon_edwardsmma would say.

This instantly sent shockwaves throughout the Solana NFT space, effectively killed Solanart and Yawww primarily, also damaging the AMMs volume with the same blow.

Nearly one week one from this, what damage has it created so far?

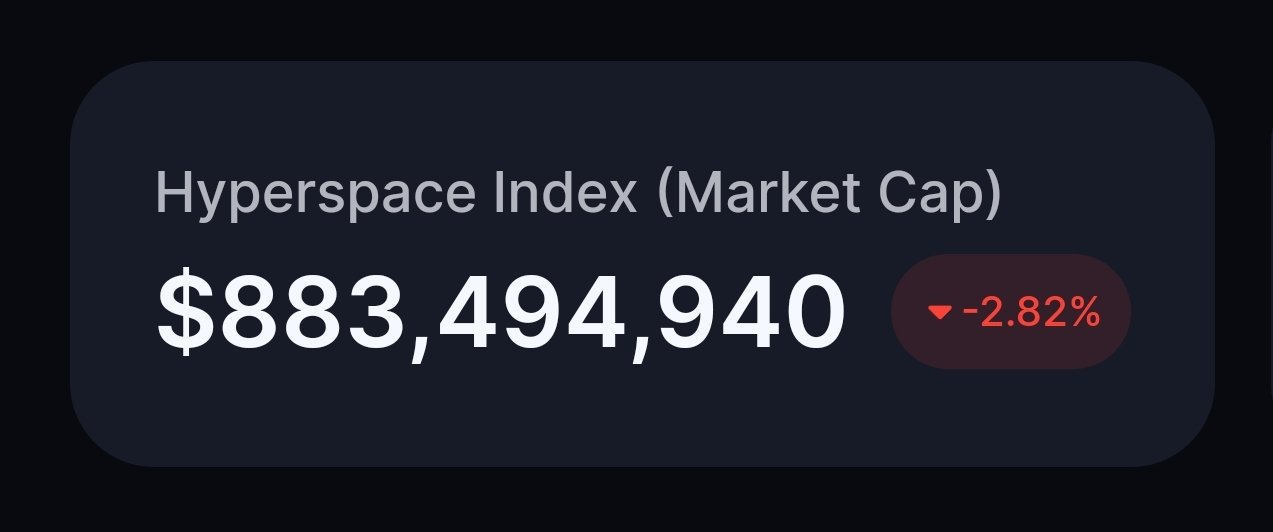

This screenshot was taken before the Magic Eden announcement, the figure was slightly higher but I didn't record a screenshot before DeGods switched to 0%.

This screenshot was taken before the Magic Eden announcement, the figure was slightly higher but I didn't record a screenshot before DeGods switched to 0%.

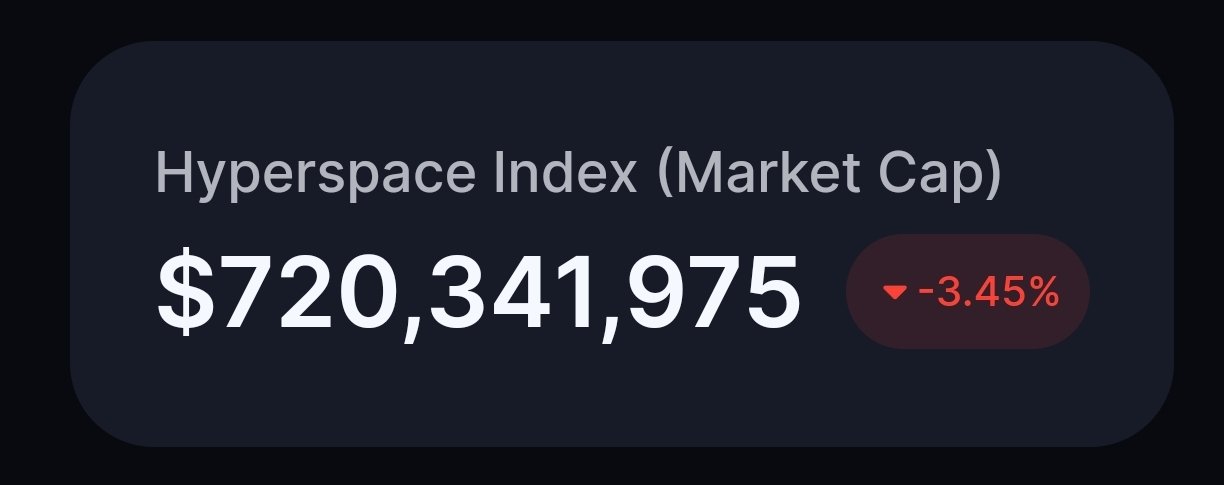

Then here's the aftermath.

I make that a 20% drop in total marketcap so far.

This is within the space of a week.

I make that a 20% drop in total marketcap so far.

This is within the space of a week.

How has this impacted some of the top projects?

Take a look.

Can we all agree that volume should not be the common denominator for success?

This has increased MEs volume, but not in a positive way.

160M+ has already exited the ecosystem.

This has increased MEs volume, but not in a positive way.

160M+ has already exited the ecosystem.

Not all volume is good volume.

The demand is already low during a bear period, why move the incentive from buyers to the seller? This techincally encourages sellers and dissuades buyers. Therefore the supply side becomes heavier.

In my opinion, the only volume which matters is what creates revenue for NFT projects and marketplaces allowing them to continue building long term.

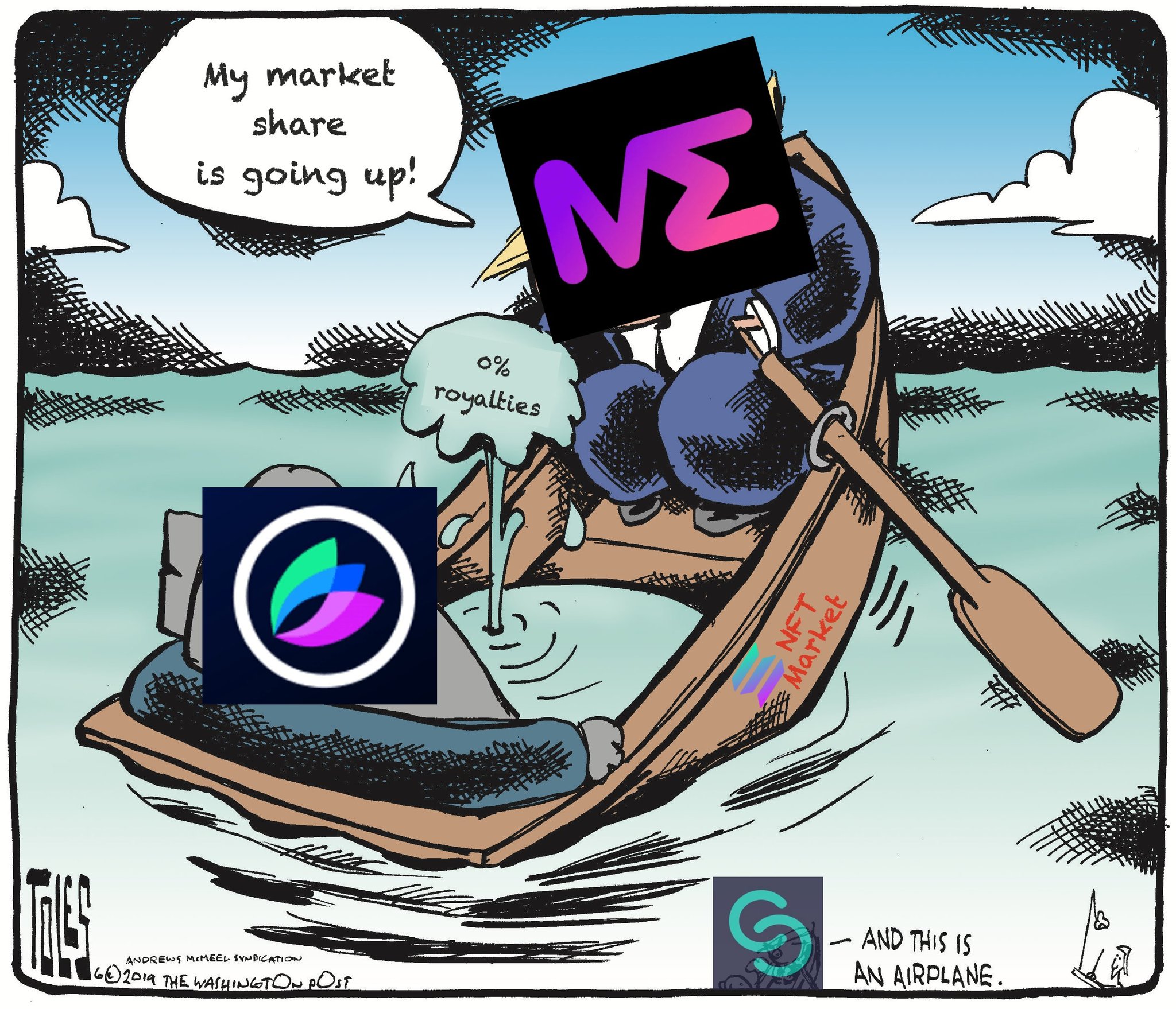

To summarise, ME has ultimately buried their competitors in the sand, but they're sinking.

NFTs collections are also sinking, they're not even receiving revenue anymore while the floor tanks in most cases.

ME isn't gaining fees because they've cut their marketplace fees to 0

NFTs collections are also sinking, they're not even receiving revenue anymore while the floor tanks in most cases.

ME isn't gaining fees because they've cut their marketplace fees to 0

Was this really all worth it? Just so they wouldn't get dunked on by other marketplaces via a 24 hour wash trade volume metric?

Do I think 10-12% fully loaded fees is too much? Totally.

Flipping that completely on its head to 0% is also horrible though.

I'm hoping beyond all this a middleground is found and the ecosystem can recover and thrive in the future.

Support creators ✅️