Thread by Adam Ozimek

- Tweet

- Oct 13, 2022

- #RealEstate #Inflation

Thread

Want to do a quick thread on rental inflation. There's a whole lot to unpack here, and sadly my main takeaway is we urgently need more data... 🧵

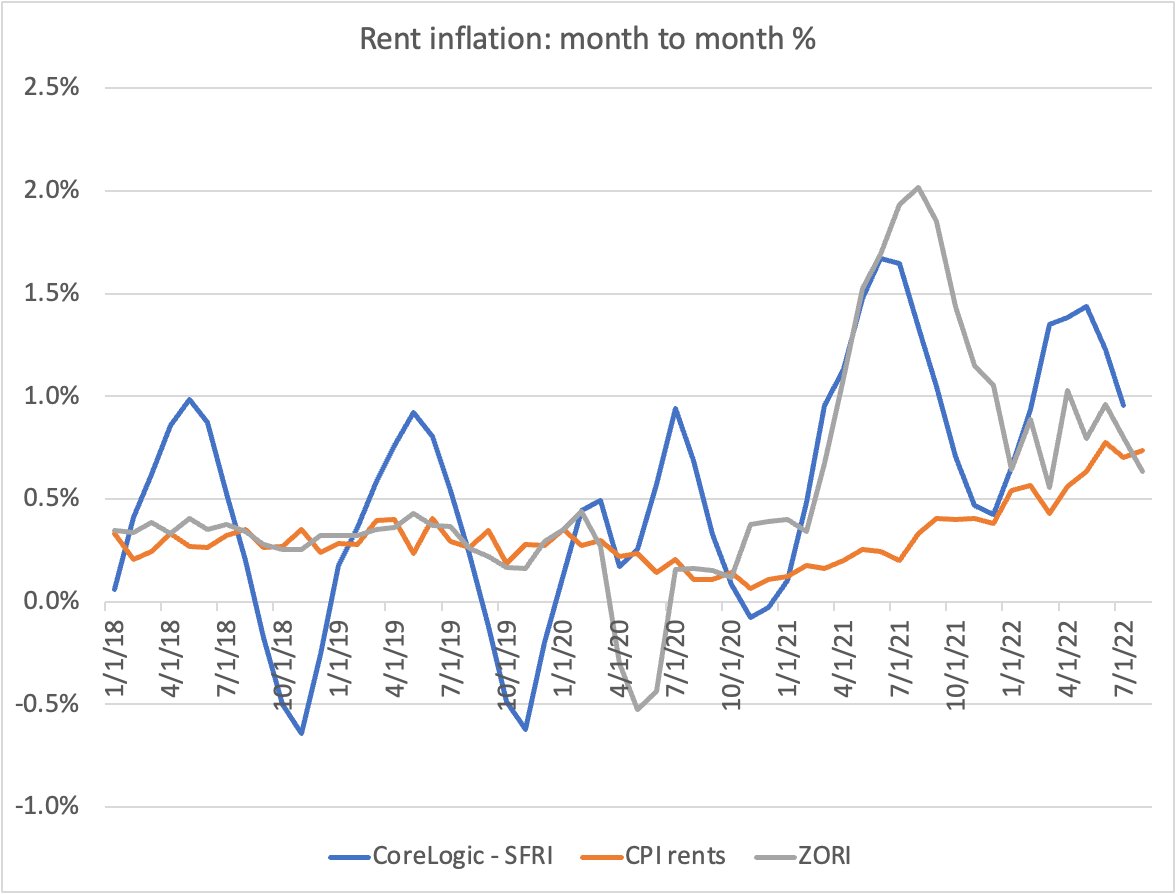

There are two categories of rental prices out there: market rents (based on new tenants) and the CPI rents (based on all tenants). This has been much discussed, but I think the discussion is missing a lot.

First, while its true that market rents and CPI rents are converging in levels, this does not by itself tell us that CPI rents are going to be declining soon.

In a very simple model, I showed in my 2013 dissertation on this topic, that the CPI is not a biased measure of market rents, meaning that they will converge over time. www.proquest.com/openview/172251dfc89cfb1872e67cb4a9bc9e3c/1?pq-origsite=gscholar&cbl=18750&diss=y

This implies, however, that we should expect the CPI in rents to converge in levels to the other price indexes. This is extremely worrying. While growth is converging (shown above), the market indexes remain around 14% higher than the CPI for rents.

This is a massive gap to close. Housing is about 31% of the CPI, meaning that we have 31% x 14% = 4.3% in headline CPI to absorb from housing alone. www.bls.gov/cpi/tables/relative-importance/2020.htm

However, I also think there are major methodological concerns. First, both Apartment List and Zillow's widely used rental index measures include zero geographical controls. This means that index weights are based on the places seeing the greatest rent volume.

If transaction volume is correlated with demand increases at any level (building, neighborhood, metro area), then these indexes will be biased up relative to wider inflation.

The corelogic index does not include within metro geographic weights, but it does include price tier and between metro weights which should help. On the other hand, it is entirely single-family rentals...

It's important to understand that these biases can be huge problems now even if they normally don't cause huge bias problems. And the close relationship between these measures over time does suggest they normally work. Why might now be different?

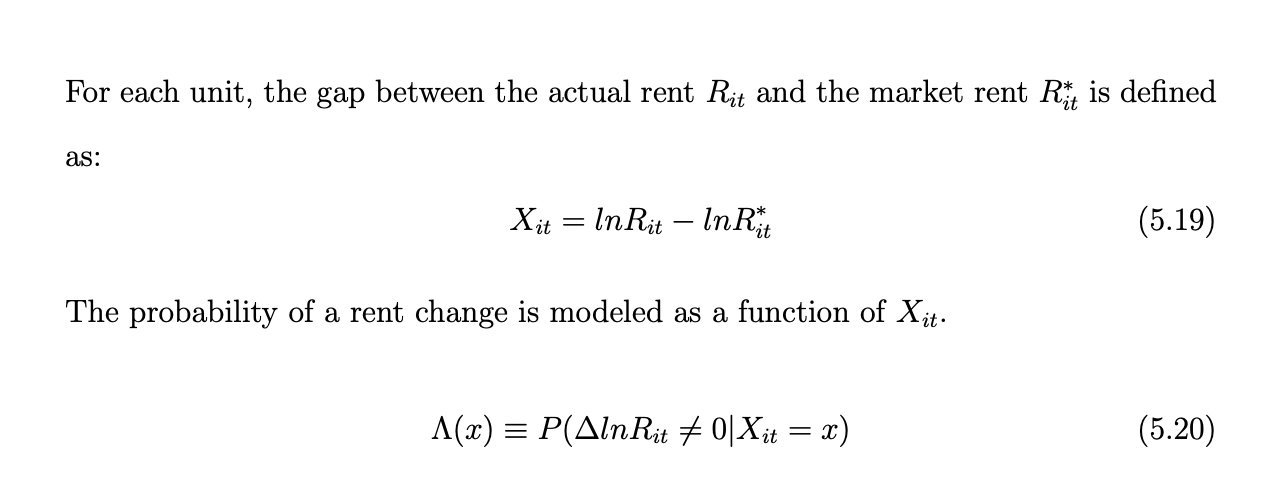

For the geographic weighting bias, landlords have more pressure to find new tenants when the gap between market rents and lease rents grows. Shown in a simple model here

Normally this relationship is not that important as past work on rent rigidity has shown that the probability of rent changes stays relatively constant. But again, we are in strange times, might p(rent change) become increasingly endogenous to the rapid rent changes?

I would be extremely nervous about assuming that transaction volume is NOT related to demand right now, as one does when assuming apartment list and zillow index levels are accurate measures of overall market rents.

The Core Logic index has better geographic weights, however still missing at the sub MSA level. And we know from a variety of "donut hole" papers that there have been huge within MSA changes in housing demand.

Another issue is that the relative demand for single-family rents relative to apartments seems plausibly higher today. Stanton and Tiwari show that remote work has caused in increase demand for housing space, which SFR has more than apartments. www.hbs.edu/ris/Publication%20Files/StantonTiwari_RemoteWorkHousing_NBER_f425ab5a-53f3-4372-8e1a-b8af...

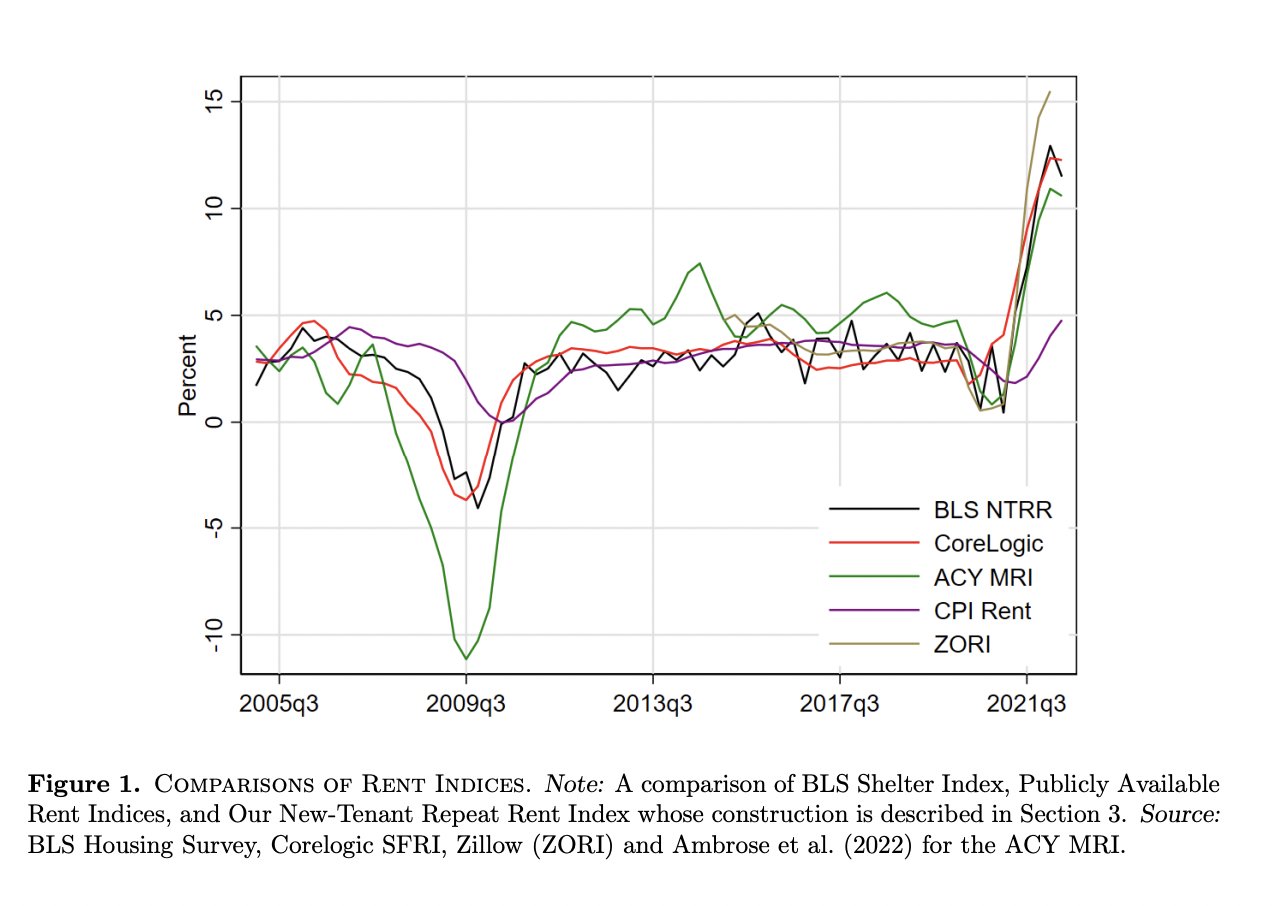

Now the BLS could help resolve this issue by computing market rents using their data with careful geographic weights. And the good news is they did this in this paper! www.bls.gov/osmr/research-papers/2022/pdf/ec220100.pdf

We can see that market rent growth in CPI data (BLS NTRR) has indeed been high, but how much of a level gap is there?

The paper is focused on what NORMALLY happens between these series, but what matters is what has happened now, how big is the gap. The authors do not report this even though this is the most important information in their paper.

Worryingly, the report that the rent indexes are cointegrated which implies in levels we should expect them to converge! Thus that scary 14pp growth coming down the pike.

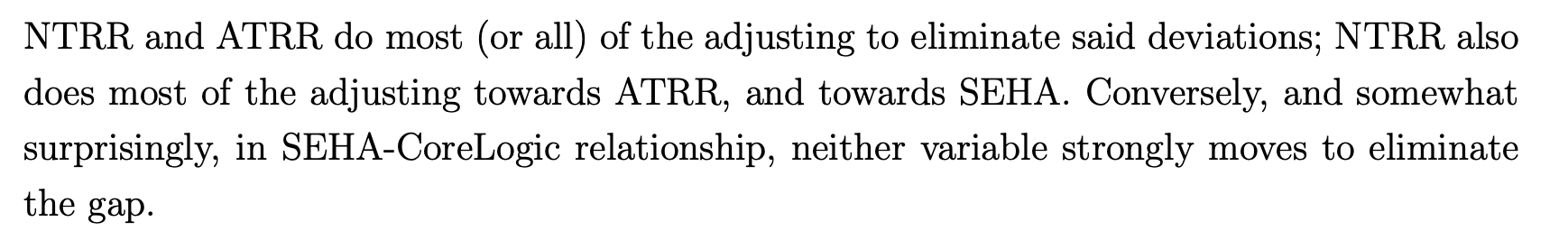

However, when comparing the CPI to the corelogic index specifically, they find that the levels gap is not predictive, instead they find that SHOCKS are predictive. Meaning we could potentially not worry about the 14 pp gap

They also find that the BLS marginal rental index tends to adjust to the CPI rents, not vice versa! However, this index is volatile, and this effect on average over the past does not give me comfort about what could be (we don't know) a large levels gap today

Where does this leave us? A few important things. First, we really need to see the BLS levels index to see how large the levels gap is. Is it 14 pp? That's very worrying. The authors of that paper absolutely should release this info ASAP.

Second, the lack of sufficiently precise geographic weights, or in some cases geographic weights at all, makes other market indexes very risky to take literally right now.

Third, we need to know what has happened to average turnover. If it has gone up, CPI has farther to go than if it has gone down.

Fourth, we need to know whether turnover has become more endogenous to the gap between market rents and leased rents. This could be biasing up ALL market rental indexes relative to the CPI, and mean a lot less pain going forward.

Fifth the convergence in growth rates I keep seeing on here is REALLY not sufficient. If there is a levels gap after controlling for the various measurement probs I discussed, we need market rents to FALL not just grow slower, to help close some of this gap so CPI doesn't have to