Solvency Constraints - Fed Guy

- Article

- Oct 10, 2022

- #CentralBank #BondMarket

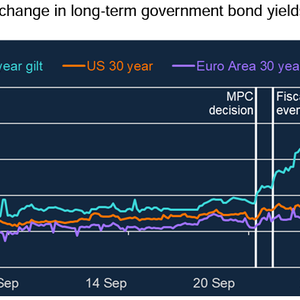

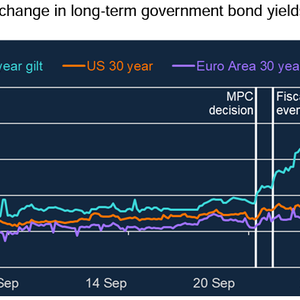

Financial stability requires a central bank put on the bond market. The Fed will likely be the last to cave, so dollar strength will continue.

Financial stability requires a central bank put on the bond market. The Fed will likely be the last to cave, so dollar strength will continue.