Thread

My cofounder @homsiT and I are increasingly being asked for advice on how to build a *sustainable* consumer saas business.

Let me share some thoughts on the single most important concept we wish we knew before starting @readwise.

It's called 📈 CARRYING CAPACITY 📈

Let me share some thoughts on the single most important concept we wish we knew before starting @readwise.

It's called 📈 CARRYING CAPACITY 📈

(Why listen to us?)

(We're still early in our journey, but we have been working on @readwise for 5 years now, and we have created a sustainable business, so I like to think we’ve learned some lessons along the way.)

(We're still early in our journey, but we have been working on @readwise for 5 years now, and we have created a sustainable business, so I like to think we’ve learned some lessons along the way.)

(Also, modeling saas companies is like underwriting cash flow businesses, which happens to be my pre-@readwise expertise coming from a 10+ year career in real estate private equity.)

(Excel is the *one* domain where I'm not a wordcel 😛)

(Excel is the *one* domain where I'm not a wordcel 😛)

We first learned of *carrying capacity* from our advisor @rahulvohra (CEO of @superhuman).

In a series of LinkedIn posts from 2015, he defined it as:

"The number of users where the rate at which we lose users equals the rate at which we gain users."

www.linkedin.com/pulse/20121002124206-18876785-how-to-model-viral-growth-the-hybrid-model/

In a series of LinkedIn posts from 2015, he defined it as:

"The number of users where the rate at which we lose users equals the rate at which we gain users."

www.linkedin.com/pulse/20121002124206-18876785-how-to-model-viral-growth-the-hybrid-model/

Carrying capacity is particularly important in consumer saas because you have true churn 😥

This is in stark contrast to enterprise where the best companies not only don't lose customers, but those customers grow in size over time.

(This is referred to as "negative net churn")

This is in stark contrast to enterprise where the best companies not only don't lose customers, but those customers grow in size over time.

(This is referred to as "negative net churn")

An enterprise biz like @superhuman might first land 2 users inside a company and then gradually expand throughout the org, increasing revenue from that account.

Sure, they lose some accounts, but the expansions more than offset the losses.

Negative net churn is actually growth.

Sure, they lose some accounts, but the expansions more than offset the losses.

Negative net churn is actually growth.

In consumer, there is no land & expand, corporate inertia, true network effects, or even switching costs.

You *will* lose subscribers. Period.

It's especially pronounced in consumer productivity (versus, say, entertainment):

You *will* lose subscribers. Period.

It's especially pronounced in consumer productivity (versus, say, entertainment):

Churn is best thought of as: "What percentage of my subscriber base will cancel their subscription each month?"

As your customer base scales, you'll notice the number of subscribers cancelling each month steadily increases even though the percentage churn remains ~fixed.

As your customer base scales, you'll notice the number of subscribers cancelling each month steadily increases even though the percentage churn remains ~fixed.

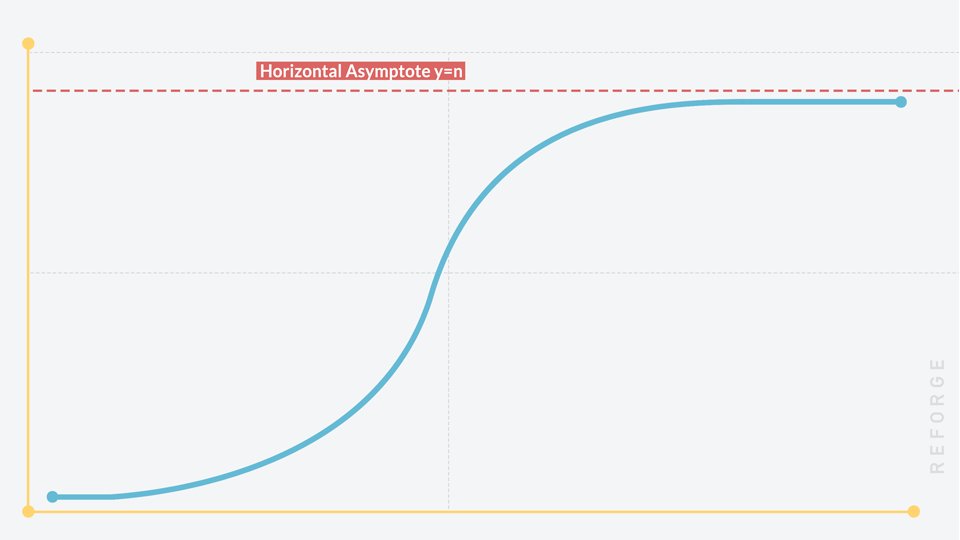

Eventually, the number of existing customers cancelling each month will equal the number of new customers subscribing.

👆 This is carrying capacity.

It’s an asymptote. You're done growing.

👆 This is carrying capacity.

It’s an asymptote. You're done growing.

Unlike @eugenewei's *invisible asymptotes* sneaking up on a business as complex as Amazon, you can see the carrying capacity of a simple saas business coming a mile away.

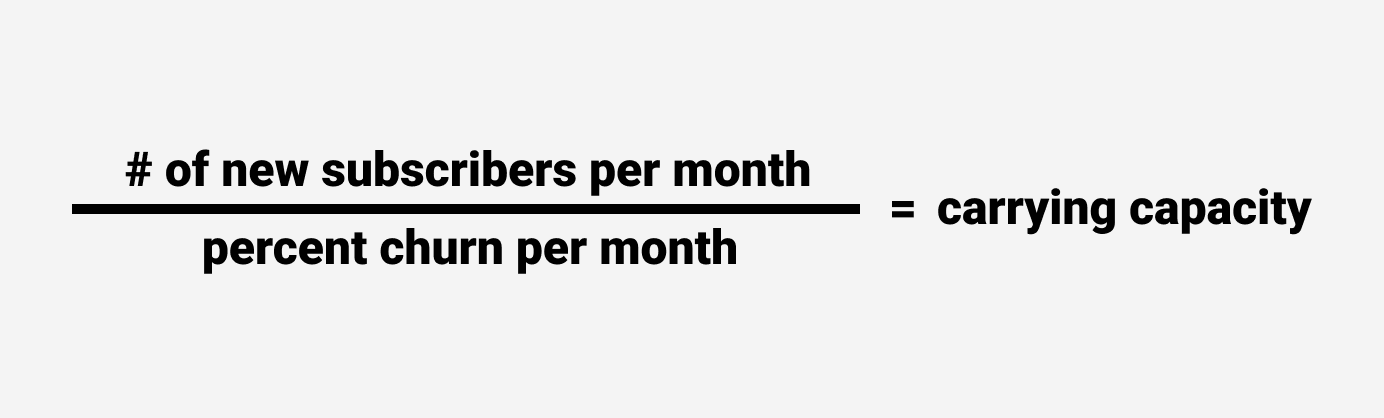

You can even calculate it as (a) average new subscribers per month divided by (b) monthly churn.

You can even calculate it as (a) average new subscribers per month divided by (b) monthly churn.

If you're adding ~1,000 subscribers/mo with a monthly churn of 10%, your carrying capacity is 10,000 subscribers.

At capacity, each month you're losing 1,000 subs (10,000 x 10%) while replacing them with 1,000 new subs.

The limit, sadly, does exist.

At capacity, each month you're losing 1,000 subs (10,000 x 10%) while replacing them with 1,000 new subs.

The limit, sadly, does exist.

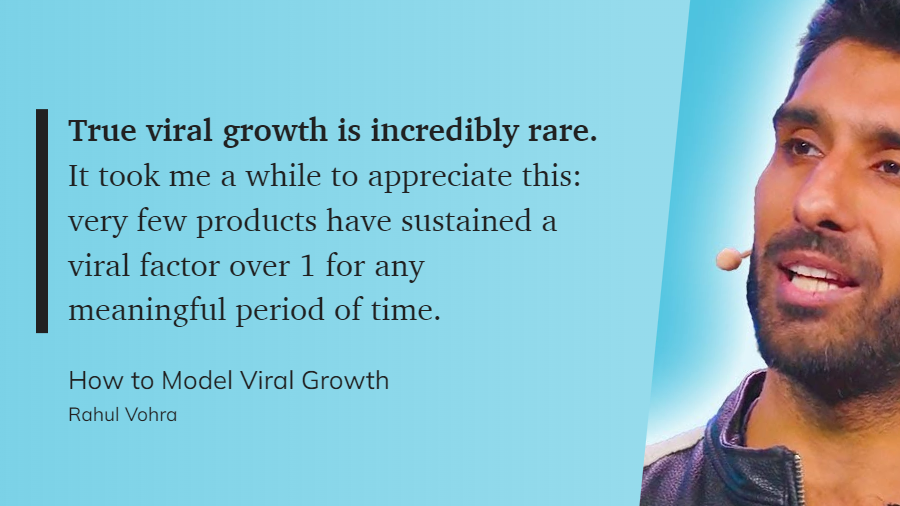

"But you've assumed growth is linear! Isn't growth viral?"

I had a hard time believing this too, but @rahulvohra (as always) was right.

I had a hard time believing this too, but @rahulvohra (as always) was right.

What you'll discover is your consumer saas growth is surprisingly constant and linear.

There will be spikes here & there, but the trend is predominantly linear due to a mix of app stores, WOM, paid advertising, integrations, SEO/SEM, influencers, hustling, referrals, etc.

There will be spikes here & there, but the trend is predominantly linear due to a mix of app stores, WOM, paid advertising, integrations, SEO/SEM, influencers, hustling, referrals, etc.

The subscriber growth shared by @substack influencers such as our friend @packym hammer this home.

This is exactly what the growth chart of a (successful) consumer saas product looks like in the 2022 era.

This is exactly what the growth chart of a (successful) consumer saas product looks like in the 2022 era.

We've now covered the basics.

Let's apply them to a fictional but typical consumer productivity saas biz.

I'm basing "typical" on a half decade of talking to other founders in the space, reading everything I can (thanks @readwise), and, of course, my own experience.

Let's apply them to a fictional but typical consumer productivity saas biz.

I'm basing "typical" on a half decade of talking to other founders in the space, reading everything I can (thanks @readwise), and, of course, my own experience.

Assume you spend your first ~2 years building a really good product that people will actually pay for.

During this free beta period, you accumulate 100,000 active users.

(For the record, this would be world class hustle & retention for a first-time founder.)

During this free beta period, you accumulate 100,000 active users.

(For the record, this would be world class hustle & retention for a first-time founder.)

For reference, we launched the @readwise MVP in May 2017.

After 1 year, we had 3K users. (lol, yes)

After 2 years, 10K.

After 3 years, 30K.

These are onboarded users. Not active users. Not paying customers.

0 to 100K in 2 years would be a feat, but let's go with it anyways.

After 1 year, we had 3K users. (lol, yes)

After 2 years, 10K.

After 3 years, 30K.

These are onboarded users. Not active users. Not paying customers.

0 to 100K in 2 years would be a feat, but let's go with it anyways.

Before charging, you have to decide between free trial or freemium.

Freemium will offer greater top of funnel growth, but lesser conversion. Free trial the opposite.

Assume you choose freemium to maintain growth and not alienate your beloved beta users.

Freemium will offer greater top of funnel growth, but lesser conversion. Free trial the opposite.

Assume you choose freemium to maintain growth and not alienate your beloved beta users.

Now you have to decide on pricing.

Pricing is an unbelievably hard decision, well beyond the scope of this thread.

For our purposes, let's just assume you paywall a subset of premium features for $8.33/mo ($100/yr) comparable to other productivity tools.

Pricing is an unbelievably hard decision, well beyond the scope of this thread.

For our purposes, let's just assume you paywall a subset of premium features for $8.33/mo ($100/yr) comparable to other productivity tools.

You're ready to announce your premium plan and officially start charging.

How many of your existing 100,000 active users will convert to premium?

Rule of thumb conversion rates on freemium are ~2% to 5%.

hbr.org/2014/05/making-freemium-work

How many of your existing 100,000 active users will convert to premium?

Rule of thumb conversion rates on freemium are ~2% to 5%.

hbr.org/2014/05/making-freemium-work

You can assume your earliest users will convert the best because these are the users who love you the most.

So let’s use the upper end of the range (5%) for the initial paywall event.

100,000 x 5% = 5,000 subscribers paying $100/yr = $500K ARR

So let’s use the upper end of the range (5%) for the initial paywall event.

100,000 x 5% = 5,000 subscribers paying $100/yr = $500K ARR

How will you grow from here?

You can look at your historical website traffic and signup rates to make an educated guess, baking in new growth initiatives.

For our example, let's assume you’ll add 50,000 new signups per month (to be clear, this would be ~INSANELY GOOD~ 🤯).

You can look at your historical website traffic and signup rates to make an educated guess, baking in new growth initiatives.

For our example, let's assume you’ll add 50,000 new signups per month (to be clear, this would be ~INSANELY GOOD~ 🤯).

How many signups convert to paid?

Let's return to benchmark of ~2% to 5%.

Assume it drops to 3.5% as you're spreading to less core users.

50,000 x 3.5% = 1,750 new subscribers per month

This is ~60/day, which any consumer saas founder will tell you is a huge day.

Let's return to benchmark of ~2% to 5%.

Assume it drops to 3.5% as you're spreading to less core users.

50,000 x 3.5% = 1,750 new subscribers per month

This is ~60/day, which any consumer saas founder will tell you is a huge day.

Now we have a starting subscriber base (5,000), ARPU ($100/yr) and monthly growth (1,750/mo).

The final number we need is churn.

We can look to @lennysan who's compiled the best benchmarks around.

The final number we need is churn.

We can look to @lennysan who's compiled the best benchmarks around.

One caveat is that his GREAT numbers are for generational consumer cos like @spotify and @netflix.

A more down-to-earth assumption for your biz might be something like @duolingo which retains ~20% after 1 year.

Let's use the GOOD churn midpoint: 4%/mo.

A more down-to-earth assumption for your biz might be something like @duolingo which retains ~20% after 1 year.

Let's use the GOOD churn midpoint: 4%/mo.

Now we can calc carrying capacity.

1,750 subs/mo divided by 4% churn/mo = 43,750 subs

At $100 ARPU, that's $4.4M ARR.

This is as big as this consumer product will get.

1,750 subs/mo divided by 4% churn/mo = 43,750 subs

At $100 ARPU, that's $4.4M ARR.

This is as big as this consumer product will get.

We can also plot what the long slow saas ramp of death will look like for this co.

Building for 2 years, converting 5,000 initial subs, adding 1,750/mo thereafter, and churning 4%/mo results in a 5- to 6-year journey to asymptotic growth.

Building for 2 years, converting 5,000 initial subs, adding 1,750/mo thereafter, and churning 4%/mo results in a 5- to 6-year journey to asymptotic growth.

Sidenote: The term "long slow saas ramp of death" comes from a talk given by @Gail_Goodman about her journey building Constant Contact. Highly recommended.

This thread is really just a redux of that talk and @rahulvohra's articles on carrying capacity.

www.youtube.com/watch?v=FJu0LKsirO4

This thread is really just a redux of that talk and @rahulvohra's articles on carrying capacity.

www.youtube.com/watch?v=FJu0LKsirO4

This is truly what a *successful* consumer saas business looks like.

You can play with ARPU, steady state growth, and churn, but they'll only stretch so much.

e.g., it's hard to charge more than $20/mo (in consumer) or drive churn below 2%.

You can play with ARPU, steady state growth, and churn, but they'll only stretch so much.

e.g., it's hard to charge more than $20/mo (in consumer) or drive churn below 2%.

As an entrepreneur, the assumption you'll push back on is growth: both the magnitude and the linearity.

Trust me. I get it.

But I would advise you not to expect to outperform the base rates unless you're deep in the idea maze with a validated breakthrough. Growth is HARD.

Trust me. I get it.

But I would advise you not to expect to outperform the base rates unless you're deep in the idea maze with a validated breakthrough. Growth is HARD.

Generally the way you grow your company from here is to go multi-product (eg @basecamp), but this is easier said than done.

In many ways, it's like starting over.

(I now speak from experience thanks to @ReadwiseReader.)

In many ways, it's like starting over.

(I now speak from experience thanks to @ReadwiseReader.)

If you’re lucky, maybe you find a way to pivot to bottoms up enterprise (moving out of consumer) or find some kind of network effects / growth loop.

But these transformations are rare.

If you this is the outcome you seek, you should just avoid consumer saas from the get-go.

But these transformations are rare.

If you this is the outcome you seek, you should just avoid consumer saas from the get-go.

I know the idea of spending 5+ years to build a ~$3.5M ARR biz is a tough pill to swallow.

If you had explained all this to me before @readwise, I wouldn't have believed you.

Even a few years in, I wouldn't have because churn takes so long to notice! But this is how it goes.

If you had explained all this to me before @readwise, I wouldn't have believed you.

Even a few years in, I wouldn't have because churn takes so long to notice! But this is how it goes.

Returning to the original question around sustainability:

If you have a consumer software product you want to work on, we advise you to plan to operate within the limits of this carrying capacity math.

Hopefully you outperform, but hope is not a strategy.

If you have a consumer software product you want to work on, we advise you to plan to operate within the limits of this carrying capacity math.

Hopefully you outperform, but hope is not a strategy.

It should also be obvious now why VC is unsustainable for this type of business.

Why raise $10M to spend 5 grueling years on a startup that's barely worth your liquidation preference?

If you want to go VC-scale, just go enterprise or consumer social.

Those are the ways.

Why raise $10M to spend 5 grueling years on a startup that's barely worth your liquidation preference?

If you want to go VC-scale, just go enterprise or consumer social.

Those are the ways.

I wish I had understood carrying capacity before starting my consumer saas journey.

I hope this thread helps you in yours.

I hope this thread helps you in yours.