Thread

1/ A funny thing occurred in the gold market in March of 2020. If you happened to be in New York and in possession of four 100-ounce gold bars, you could have traded them for one 400-ounce gold bar plus a handsome premium – some say as much as $100 an ounce.

2/ That ~6% divergence in price was highly unusual and arose from the nature of contract settlement in New York versus London. COMEX contracts were settled with 100-ounce gold bars, whereas LBMA contracts used the 400-ounce variety.

3/ In normal times, gold is flown around the world in various forms to facilitate such settlements and the difference in price per ounce between bar weights is minimal. Of course, March 2020 was anything but a normal time.

4/ With Covid and the associated lockdowns taking hold across the globe, planes were generally not flying, and certain gold refineries were forced to close. The just-in-time supply of correctly denominated gold was severely pinched.

5/ If you were short gold on the COMEX, you needed to deliver 100-ounce gold bars to settle. This triggered a classic squeeze as desperate short sellers scoured for both physical supply and refineries authorized to convert between the two sizes.

6/ Free money doesn’t often last long and the arbitrage quickly closed. COMEX and LBMA have since made moves to avoid a reoccurrence of this unusual event, thereby making the gold market even more efficient – the natural result of such market dislocations.

7/ In a perfectly efficient economy, there would be no arbitrage. The same stuff would sell for the same price everywhere. In the real world, opportunities for arbitrage are ubiquitous. In fact, arbitrage is one of the main drivers of incremental efficiencies in the economy.

8/ If a shortage of supply in one area drives prices higher, arbitrageurs with access to lower-cost supply in a different area will simultaneously buy and sell in both and capture the spread, thereby facilitating resupply in the area that needs it.

9/ Incidentally, this is what makes accusations of price gouging during emergencies tragically counterproductive. If a hurricane knocks out power and local hardware stores experience a run on generators, the local price of generators should be allowed to rise substantially.

10/ If the local price of generators were allowed to double or triple, all manner of supply would quickly rush into the area. Instead, our political leaders pass laws to make such price discovery illegal, and in so doing, exacerbate the shortages. But hey, at least it feels fair.

11/ Over the past year, an unprecedented arbitrage has opened up in the market for natural gas. Price disparities across regions have exploded to once-unthinkable levels and look set to persist for at least the next few years.

12/ Natural gas requires intense levels of infrastructure investment to unlock its utility. As such, the market for it is highly regionalized and surprisingly heterogeneous. The speed with which prices normalize will be gated by the West’s inability to build big things quickly.

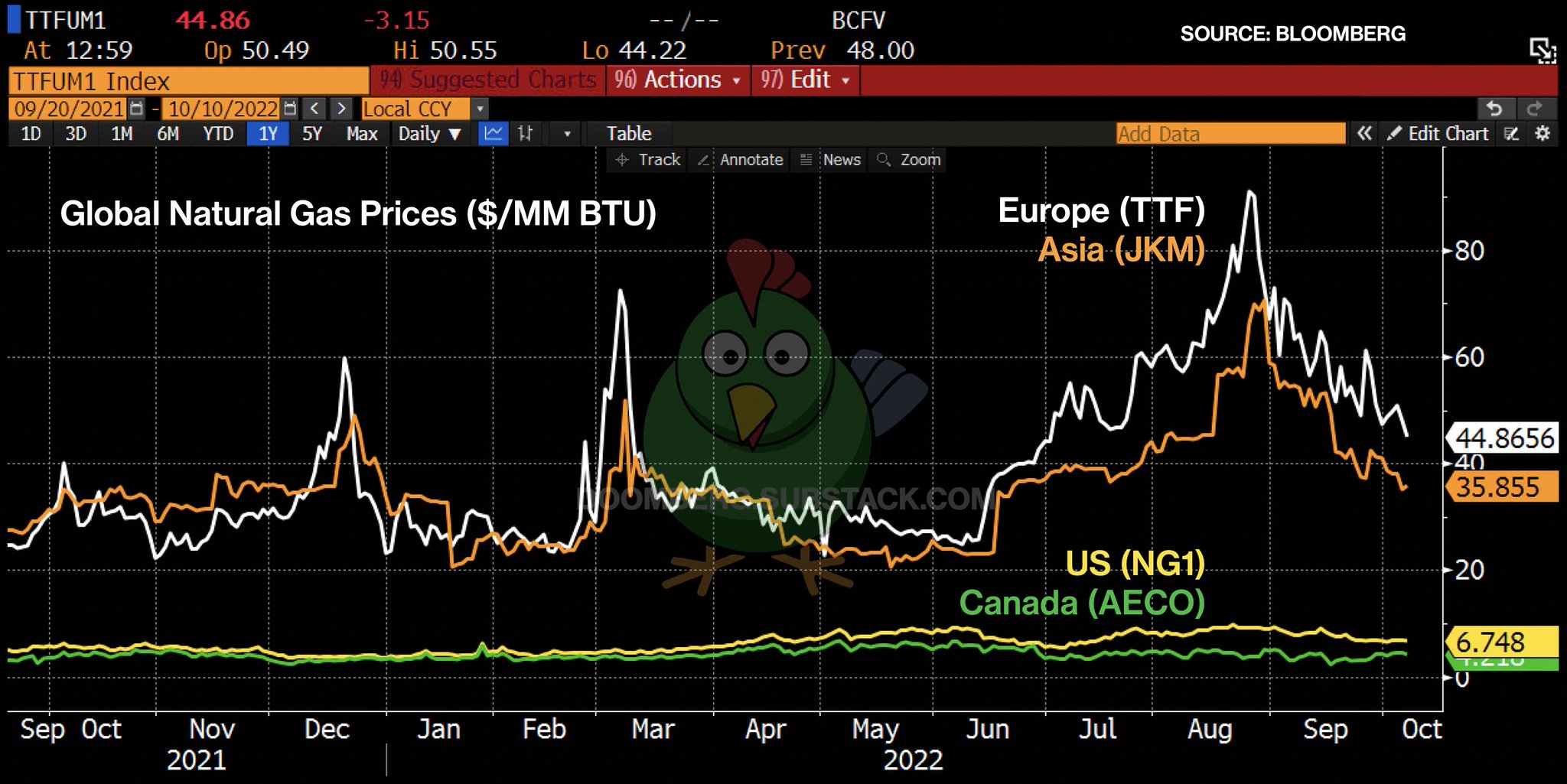

13/ Below is a chart of natural gas front-month contract prices in Europe (Dutch TTF), Asia (JKM), Canada (AECO), and the US (Henry Hub). While a 6% disparity in gold prices shocked the market in 2020, natural gas trades hands for prices that differ by orders of magnitude!

14/ Plotting the price of natural gas in Europe divided by the price in Canada reveals the staggering nature of the arbitrage. At various points in the past few months, natural gas in Europe was selling for more than 20 TIMES the price in Canada!!!

15/ Amazingly, Canadian Prime Minister Justice Trudeau recently claimed there has "never been a strong business case" for LNG exports from Canada to Europe. (It might surprise our followers to learn that you can be a leader of a G7 country with no business acumen whatsoever.)

16/ Eventually, even this arbitrage must close. When enough pipelines, LNG import and export terminals, and LNG carriers are built, the worldwide price of natural gas will trade in a narrow band, the width of which will reflect the fully loaded cost of transportation.

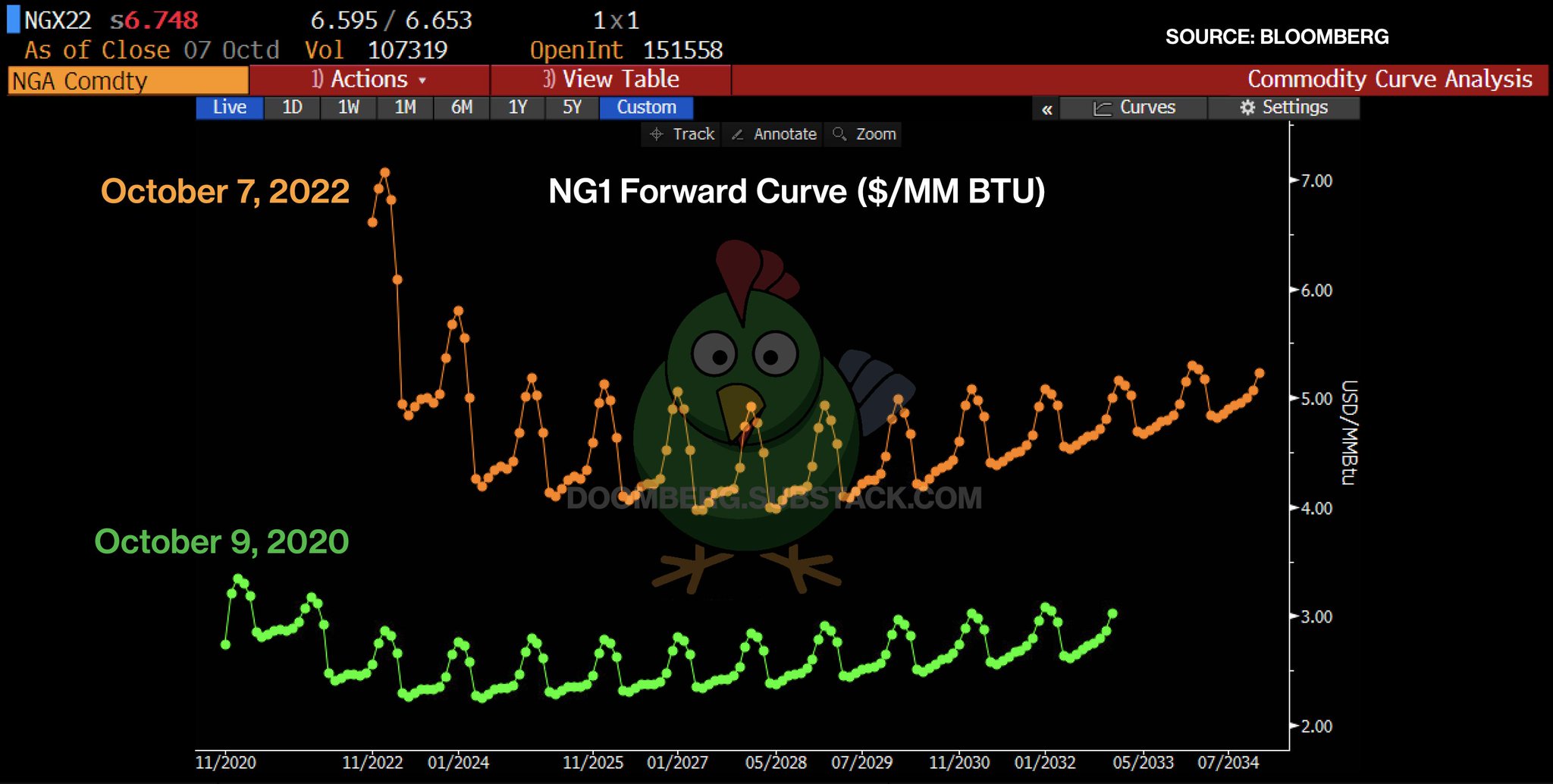

17/ How long will this take? The market is currently pricing in three tough winters for Europe. By 2026, the Dutch TTF futures curves indicate enough logistical infrastructure will be brought online to bring prices down to more reasonable levels.

18/ The historic nature of the current crisis will forever change the energy landscape in ways few are contemplating. We’ve never experienced a world with a truly global market for natural gas, but thanks to the countless billions urgently being invested today, we soon will.

19/ According to Jevon’s Paradox – that demand for a resource increases when technology advances (or government policy increases) the efficiency with which a resource is used – we can expect a worldwide boom in natural gas consumption.

20/ Gas producers in North America stand to gain the most. As the bottom jaw of arbitrage closes up, low-cost producers in the shale patch can lock in healthy profits for years to come. Comparing US natural gas futures from two years ago to today shows a striking shift:

21/ Among the companies benefitting now are those that can access North American natural gas to produce goods sold in a global market. Think fertilizers, chemicals, etc. These companies are printing cash by capturing today’s wide spreads directly.

22/ There are countless other first- and second-order effects to contemplate. Oil with associated gas will become more lucrative to drill for, fracking may finally spread beyond North America at scale, and newly-discovered fields will become more economic to develop.

23/ When the current slate of crises eventually ends, the world that emerges will be forever altered. The natural gas arteries being built now will persist for decades. All thanks to the amazing “nudging” power of arbitrage. <fin>