Thread

Payrolls rose a robust +263k in September, a touch above expectations.

Unemployment down a tick to 3.5%, equal to the lowest level in fifty years. Revisions also positive.

This is an economy that's still growing nicely. All that recession talk was empty.

Unemployment down a tick to 3.5%, equal to the lowest level in fifty years. Revisions also positive.

This is an economy that's still growing nicely. All that recession talk was empty.

BLS is very clear that these numbers were unaffected by Hurricane Ian, which may well distort the jobs numbers over the next few months (as businesses both close, and then re-open and rebuild).

Nominal wages grew by +0.3% in September, an annual rate of only 3.8%. Over the past three months, the annualized rate is 4.4%, down from 4.6% over the previous three months.

When you look at recent data, there's no sense of a wage-price spiral in these numbers.

When you look at recent data, there's no sense of a wage-price spiral in these numbers.

If you wanted to write the September script for what a perfect soft landing looked like, you might have drawn up these latest set of jobs numbers with employment growth continuing, but slowing to more sustainable rates, and wage growth running at rates unlikely to spark inflation

(That's not a promise that the next few months will follow that soft landing script. It might; it might not. But right now, Jay Powell and his colleagues have to be feeling pretty happy.)

The household survey tells a roughly similar story: Employment rose by +204k, but the dip in unemployment was somewhat aided by a slight (-57k) decline in the labor force. Over a longer time horizon labor force growth has been healthy so it's good to see those gains locked in.

The past three months of jobs gains are +537k in July, +315k in August and +253k in September.

By one view, data are noisy, so average those for an unsustainably fast +368k average rate.

By another, that's a trend with job growth slowing from unsustainable to sustainable.

By one view, data are noisy, so average those for an unsustainably fast +368k average rate.

By another, that's a trend with job growth slowing from unsustainable to sustainable.

If you really want to know where the Fed's eyes will be in this report, it's all about hourly earnings.

And lemme tell you about an interesting trend:

- Over 2022 Q3, nominal wages grew at an annualized rate of +4.4%

- 2022 Q2: +4.6%

- 2022 Q1: +4.8%

- 2021 Q4: +6.1%

And lemme tell you about an interesting trend:

- Over 2022 Q3, nominal wages grew at an annualized rate of +4.4%

- 2022 Q2: +4.6%

- 2022 Q1: +4.8%

- 2021 Q4: +6.1%

Point is, these data don't point to any inflationary pressures coming from the labor market. That doesn't resolve the question of how much is demand versus supply, as demand pressures can play out directly in the product market. But workers aren't the problem.

I'm not a big fan of reporting on the second derivative. A sophisticated reader might get what's going on, but others might miss the reality that:

- Employment is high (above pre-pandemic levels)

- Employment is growing rapidly (far faster than is typical)

- Employment is high (above pre-pandemic levels)

- Employment is growing rapidly (far faster than is typical)

A reminder that there are still millions of people on the sidelines of the labor market.

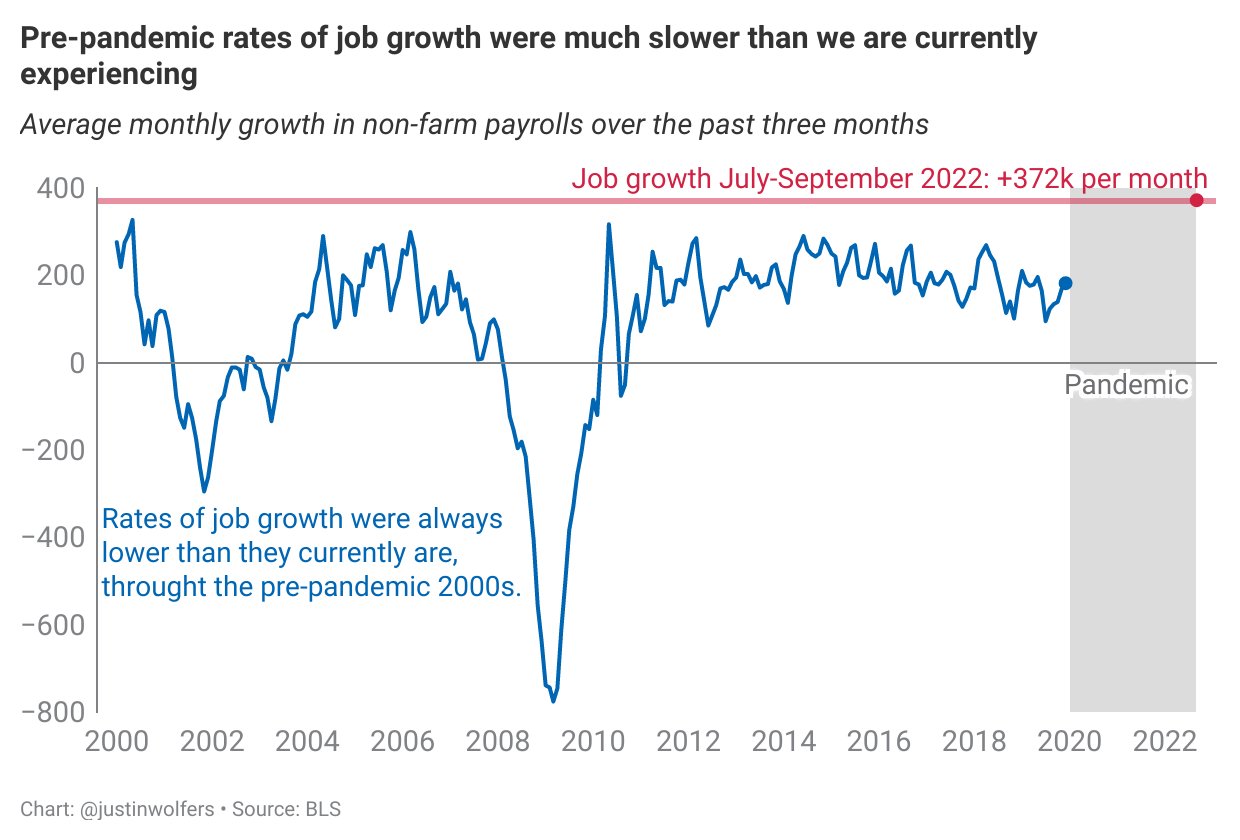

To put today's job growth context, it's worth noting that over the prior 20 years, payrolls growth has averaged only +92k. This is a much stronger than average rate of employment growth!

Over the past three months (a time of peak "recession" talk!), jobs growth has averaged +372k. For some context, realize that the economy *never* registered 3 months of employment growth this fast in the pre-pandemic 2000s.

Folks seem to have forgotten how rapid these rates are.

Folks seem to have forgotten how rapid these rates are.

Point is, for all of our pre-pandemic history, the idea that jobs growth as rapid as it currently is would be coupled with "recession!" talk would have been thought laughable.

It's clear that the economy is slowing a bit. And there's a lot of uncertainty about our economic future. And that uncertainty means a recession is *possible* (but so is an ongoing BOOM).

"Forecasting" the present moment is easier, and the data are clear: We're not in recession.

"Forecasting" the present moment is easier, and the data are clear: We're not in recession.

Mentions

See All

Scott Kupor @ScottKupor

·

Oct 7, 2022

Very good thread