Thread

I've spent the past 3 years building a mortgage lender that aims to create a fairer housing market by redefining how you can buy and own your home.

Truss and Kwarteng's budget is a tragedy for existing and aspiring homeowners across the UK. 1/

Truss and Kwarteng's budget is a tragedy for existing and aspiring homeowners across the UK. 1/

In this post I've explained the mechanism by which the budget hits homeowners and provided what I'm afraid is a very gloomy assessment of what will happen next. 2/

medium.com/@will_genh/the-economic-vandalism-of-liz-truss-will-take-down-the-housing-market-1e0bf877f...

medium.com/@will_genh/the-economic-vandalism-of-liz-truss-will-take-down-the-housing-market-1e0bf877f...

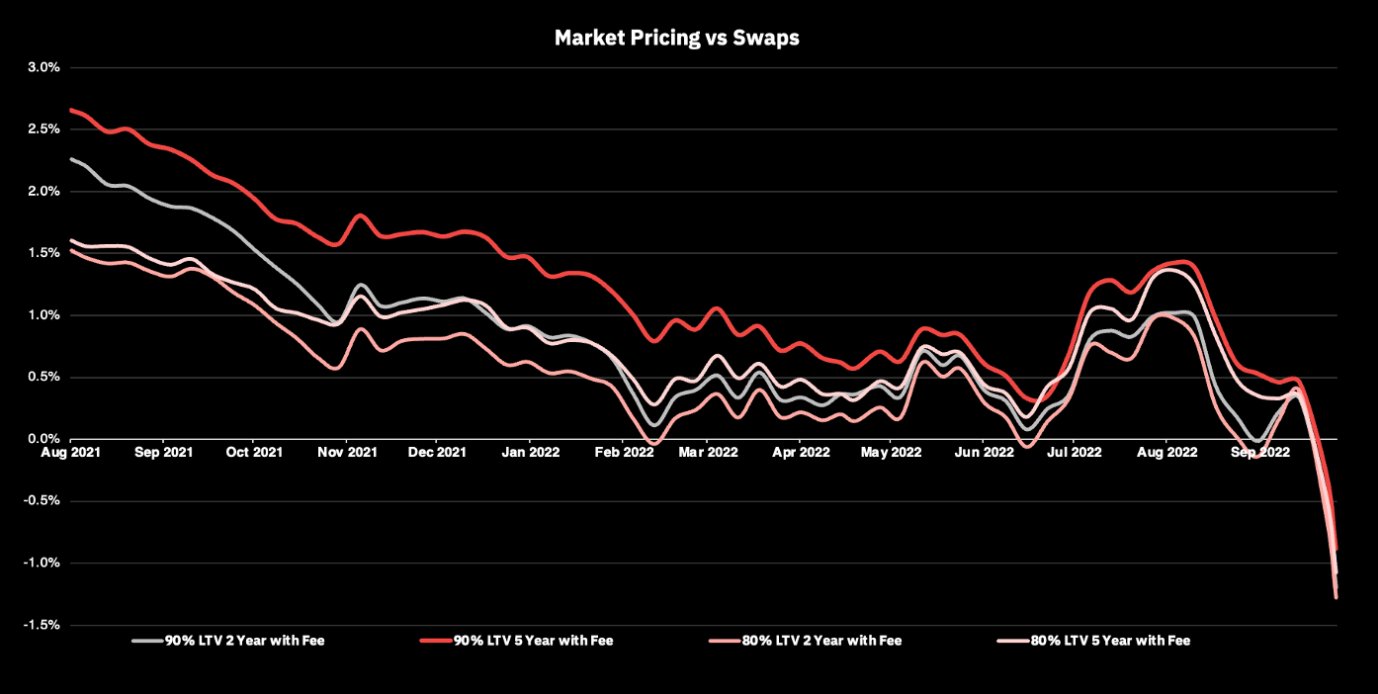

Mortgage rates will rise 1.5-2% in the coming fortnight. This chart shows you mortgage lender spreads — that is the interest rate charged to you on your mortgage, less the cost to the lender to protect themselves from interest rate risk for the duration of that loan 3/

Lender spreads are negative in the region of 1%, meaning you can borrow from a bank at a cheaper rate than they can fund that loan (this can happen in the short run because they bulk hedge a few weeks in advance) 4/

The average mortgage rate at the end of last week was 4.75% on a 2-yr or 5-yr fixed rate, so these will move to a range of approximately 6–6.75%. This is a major problem because mortgage repayments will soon be higher than many homeowners can afford. 5/

We can know this because we’re breaching the “stress test” levels used by banks over the past 2 years to determine how much to lend. Over the past 2 years, lenders were testing a customer’s ability to afford the mortgage using an interest rate of 6.5–6.6%. 6/

So, all else being equal, many homeowners will no longer be able to afford their mortgage at the end of their fixed-rate period if the rate available on their new product is 6.5% or higher — exactly where we’re headed in the coming fortnight. 7/

But all else is not equal. Real incomes are declining, basic living costs soaring, and consumers are turning to debt to fund their spending. This means that affordability will crack before rates reach the 6.5% threshold. 8/

Demand will also get crushed. In the coming months, your typical homebuyer will need to pay 3.8–4.5x more interest on their loan than January’s buyers. In absolute terms, this means a monthly payment that is £546–£695 higher. 9/

Needless to say, the chilling effect on economic activity of this move in rates will be orders of magnitude greater than any stimulus benefit the government hoped for from cutting taxes. Consumers’ disposable income will be gobbled up by their mortgage. 10/

A £1M, 30yr mortgage will cost £833 more each month for every 1% move in rates. As we can safely say that Truss has loaded at least 2% onto rates, she's just cost this household £20,000/yr, dwarfing the savings delivered by cutting the 45% tax rate on higher earners. 11/

I'd love the views of @MartinSLewis @D_Blanchflower @paulkrugman @RachelReevesMP @edconway @Peston and others on what policymakers should be doing today to head off the scenario I've set out and whether my analysis falls short in any significant way. 12/12

@MartinSLewis @D_Blanchflower @paulkrugman @RachelReevesMP @edconway @Peston Also in case of interest @MrJamesPickford @mrjamesob @Samfr @b_judah @campbellclaret @RoryStewartUK