Thread

The world is in a sovereign debt bubble mixed with an inflation crisis. The Fed, ECB, and BoJ are completely trapped.

#Bitcoin is a scarce bearer asset built for this exact moment.

And yet most investors still see Bitcoin as a risk-on play thing. But that will soon change. ⏳

#Bitcoin is a scarce bearer asset built for this exact moment.

And yet most investors still see Bitcoin as a risk-on play thing. But that will soon change. ⏳

Most wealth is held in equities, bonds, cash, and real estate - all fiat derivatives facing inflation and counter-party risk.

Bitcoin's lack of counter-party risk is not widely understood. But as systemic risk increases, I expect investors to begin to place a premium on Bitcoin.

Bitcoin's lack of counter-party risk is not widely understood. But as systemic risk increases, I expect investors to begin to place a premium on Bitcoin.

Entities like Celcius and 3AC are demonstrating how a build up of systemic leverage leads to cascading defaults when liquidity is withdrawn.

Assets you thought were safe can go *poof* overnight.

As the Fed withdraws liquidity, these risks are multiplying across all markets.

Assets you thought were safe can go *poof* overnight.

As the Fed withdraws liquidity, these risks are multiplying across all markets.

Systemic risks are difficult to anticipate because financial entities are intertwined in complex ways.

A default in one entity can spill over in unpredictable ways, leading to a massive deleveraging.

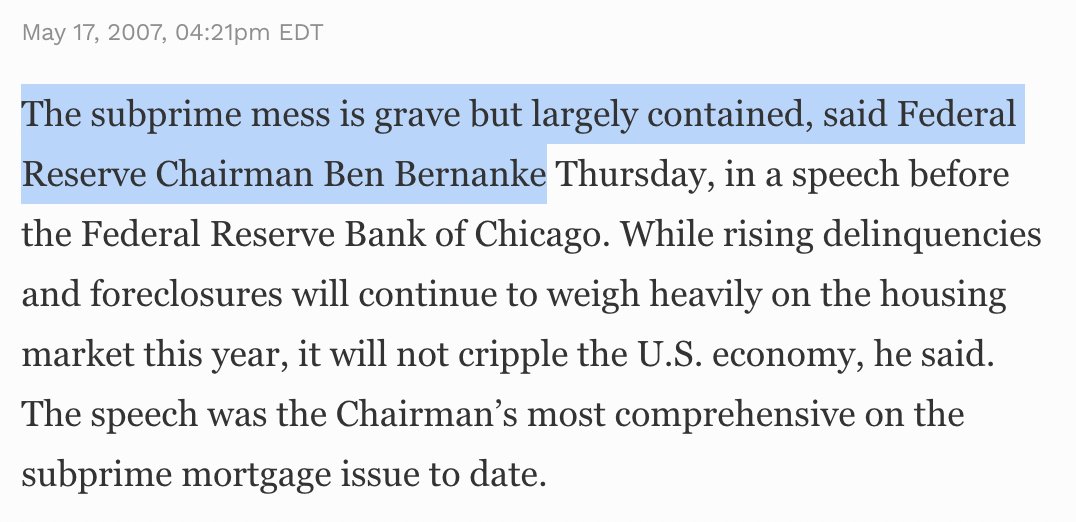

That's what we saw happen in 2008 when they thought subprimes were contained.

A default in one entity can spill over in unpredictable ways, leading to a massive deleveraging.

That's what we saw happen in 2008 when they thought subprimes were contained.

Some investors try to hedge risk with insurance like credit default swaps.

Investors bought billions worth of insurance before '08. And it would have been worth ZERO if not for the government bailout of entities like AIG.

🗝️: Your hedge is only as good as your counter-party.

Investors bought billions worth of insurance before '08. And it would have been worth ZERO if not for the government bailout of entities like AIG.

🗝️: Your hedge is only as good as your counter-party.

Fast forward to today: Liquidity is being withdrawn and interest rates are skyrocketing. The odds of leveraged entities going bust is increasing by the day.

The world needs a hedge without counter-party risk. And #Bitcoin fits the bill because it stands outside of the system.

The world needs a hedge without counter-party risk. And #Bitcoin fits the bill because it stands outside of the system.

But the most likely scenario is that Central banks will pivot hard at the first sign of systemic risk.

Rates will plunge back to zero or negative, and the money printer will once again flood us with liquidity.

And investors will scramble back into scarce assets like #Bitcoin

Rates will plunge back to zero or negative, and the money printer will once again flood us with liquidity.

And investors will scramble back into scarce assets like #Bitcoin

Prediction: The Central Bank pivot will come far before inflation is under control.

And we will soon find ourselves in a situation of continued high inflation with record levels of QE used to prop up debt markets.

Investor confidence in Central Banks will reach a new low.

And we will soon find ourselves in a situation of continued high inflation with record levels of QE used to prop up debt markets.

Investor confidence in Central Banks will reach a new low.

The sudden realization that Central Banks have no choice but to devalue currencies to bring down debt-to-GDP will hit investors like a ton of bricks.

It will destroy the passive investing mindset that has dominated for the past couple decades: The 60/40 portfolio is cooked.

It will destroy the passive investing mindset that has dominated for the past couple decades: The 60/40 portfolio is cooked.

Much like the 1970's, when investors are faced with the prospect of sustained inflation over the long-run, they are going to significantly increase their exposure to scarce assets like #Bitcoin

Bonds will be crushed and equities will underperform.

Bonds will be crushed and equities will underperform.

"But Bitcoin failed as an inflation hedge"

Look, smart investors moved into Bitcoin in early '20 before inflation took hold. And Bitcoin responded perfectly to the money printing, going from $4K to $69K.

Now some of those investors expect the Fed reign in inflation...

Look, smart investors moved into Bitcoin in early '20 before inflation took hold. And Bitcoin responded perfectly to the money printing, going from $4K to $69K.

Now some of those investors expect the Fed reign in inflation...

Investors that moved out of Bitcoin because they believe the Fed can lower inflation are in for a shock.

When that hope is shattered (soon IMO) we will see a return not to "risk" assets like in 2020... But specifically to scarce assets.

When that hope is shattered (soon IMO) we will see a return not to "risk" assets like in 2020... But specifically to scarce assets.

As the Fed inevitably destroys the value of bonds via yield curve control, and businesses struggle in a high-inflation environment, investors will be forced to recognize the difference between #Bitcoin and equities.

Bitcoin's fixed supply and predictable monetary policy will stand in stark contrast to the spastic policy moves of Central Bankers.

Faith in human-driven monetary policy will reach an all time low while #Bitcoin sets an ATH that makes $20K look like the bargain of a lifetime.

Faith in human-driven monetary policy will reach an all time low while #Bitcoin sets an ATH that makes $20K look like the bargain of a lifetime.

Mentions

See All

Greg Foss @FossGregfoss

·

Sep 26, 2022

Excellent thread. #btc