Thread

COVID set off a supply chain phenomenon known as the bullwhip effect.

For the past 2 years, it has battered US businesses that import products from overseas.

But now, companies that were the biggest victims are going to win big in the months ahead.

Here's why:

For the past 2 years, it has battered US businesses that import products from overseas.

But now, companies that were the biggest victims are going to win big in the months ahead.

Here's why:

First, what is the "bullwhip effect"?

When the supply chain experiences a small disturbance in demand, it often triggers a series of overcorrections that keep growing in magnitude.

When the supply chain experiences a small disturbance in demand, it often triggers a series of overcorrections that keep growing in magnitude.

COVID and the ensuing demand disruption lit the fuse.

For a breakdown of how the process played out, check out this popular thread I wrote a couple of months ago about how the bullwhip was hitting retailers like Target and Walmart.

For a breakdown of how the process played out, check out this popular thread I wrote a couple of months ago about how the bullwhip was hitting retailers like Target and Walmart.

The TLDR is that the demand disruption eventually caused brands and retailers to buy too much inventory. This glut led to deep discounting over the past few months.

As a result, everyone wants to reduce their inventory exposure. This led to less ordering from overseas factories.

As a result, everyone wants to reduce their inventory exposure. This led to less ordering from overseas factories.

This decline in manufacturing demand is a big headwind to the Chinese economy. China is also dealing with major financial disruptions from declines in real estate prices and the zero-COVID policy.

So China is cutting interest rates. They're increasing the money supply of RMB.

So China is cutting interest rates. They're increasing the money supply of RMB.

At the exact same time, the US Federal Reserve is raising interest rates. Today the Fed raised rates by .75%. Most experts predict they will continue to raise rates the rest of this year.

So the United States is reducing the money supply of USD.

Money printer no longer go brrrr

So the United States is reducing the money supply of USD.

Money printer no longer go brrrr

As the supply of dollars is decreasing, it is strengthening compared to every other currency.

What does this mean? For example, if you want to trade your dollars for Euros, you get a lot more than you did a year ago.

Today, the dollar is the strongest it has been in 20 years!

What does this mean? For example, if you want to trade your dollars for Euros, you get a lot more than you did a year ago.

Today, the dollar is the strongest it has been in 20 years!

All of the other currencies in the world look like Dogecoin's price chart when compared to the dollar. Down and to the right.

Check out the price chart of the dollar vs China's rmb.

The exchange rate hasn't been this favorable for the US since 2009.

Check out the price chart of the dollar vs China's rmb.

The exchange rate hasn't been this favorable for the US since 2009.

Why does this matter? Because this is a massive tail wind for companies who import products.

Let me explain how the process of importing goods works:

Let me explain how the process of importing goods works:

First, a US company orders a product from a Chinese factory.

The factory places orders with its suppliers for the necessary materials. It pays for these orders in RMB.

The factory then ships the order to the US customer and invoices them in dollars.

The factory places orders with its suppliers for the necessary materials. It pays for these orders in RMB.

The factory then ships the order to the US customer and invoices them in dollars.

When the exchange rate changes dramatically, the factory still pays the same rates to its suppliers, but if it can charge the same price in dollars to the US company, it will reap a much bigger profit because it can exchange those dollars for more RMB than before.

Importers recognize this dynamic. When the exchange rate changes they are able to negotiate prices downward by approximately the same amount.

If the dollar becomes 10% stronger vs the RMB then importers are now likely to pay 10% lower prices from the factory when buying products

If the dollar becomes 10% stronger vs the RMB then importers are now likely to pay 10% lower prices from the factory when buying products

There's a second important dynamic playing out at the exact same time.

The cost to ship products globally is plummeting.

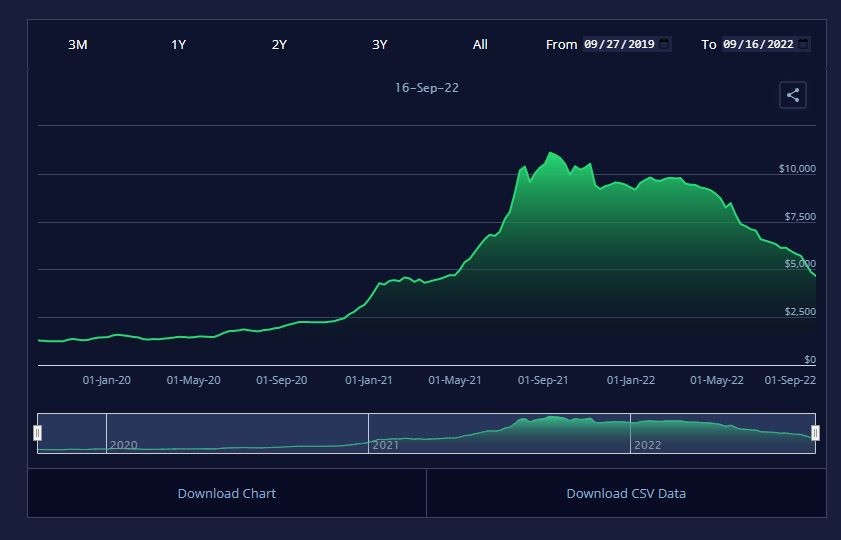

This is a chart of the Global Container Freight Index

The cost to ship products globally is plummeting.

This is a chart of the Global Container Freight Index

Check out what a difference a year makes. It's almost a perfect inversion of the exploding costs last year.

In 2021, shipping containers were renting for as much as 12x the rate they had gone for just 2 years earlier.

Some shipping companies made more money in a year than they had made cumulatively over decades!

Some shipping companies made more money in a year than they had made cumulatively over decades!

How did this impact importers?

The combination of a weakened dollar and crazy shipping costs destroyed margins.

At our company, we saw our costs on some products rise by 40% over a 12-month period.

The combination of a weakened dollar and crazy shipping costs destroyed margins.

At our company, we saw our costs on some products rise by 40% over a 12-month period.

Brands responded in the only way they could - they raised prices. This is one of the many causes of the inflation we are dealing with in the US today.

So now every brand that raised prices is seeing their costs drop significantly. That's going to mean much better profit.

So now every brand that raised prices is seeing their costs drop significantly. That's going to mean much better profit.

My predictions:

The new cost dynamics are going to fuel an increase in ordering from foreign manufacturers, especially China.

Inflation in retail goods is going to slow significantly over the coming months. Retailers are going to fight against further price increases.

The new cost dynamics are going to fuel an increase in ordering from foreign manufacturers, especially China.

Inflation in retail goods is going to slow significantly over the coming months. Retailers are going to fight against further price increases.

Finally, some US consumer brands that have been negatively impacted by the bullwhip are going to put up great numbers over the next few quarters.

Thanks for reading! You can follow me for more first-hand perspectives I've gained from leading a consumer brand.

If you liked this thread, you can read more about the company I co-founded and how we have bootstrapped to 100mm in revenue:

If you liked this thread, you can read more about the company I co-founded and how we have bootstrapped to 100mm in revenue: