Thread

Several metrics for the Avalanche network that I closely follow to understand its future growth and $AVAX value accrual:

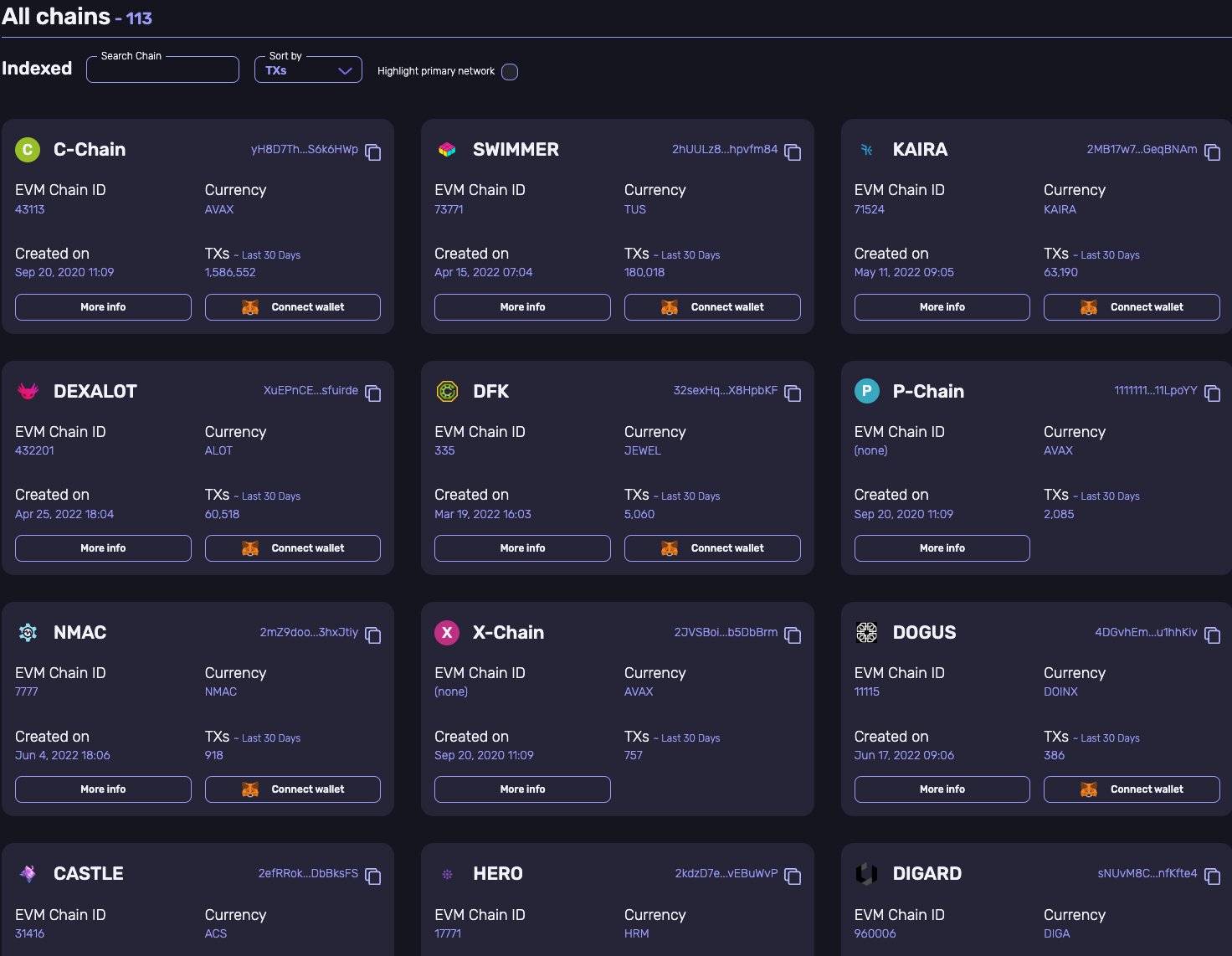

0) # subnets on Fuji: Builders test their VMs on the testnet. This indicator gives a good outlook on upcoming projects.

testnet.avascan.info/blockchains

> 113

0) # subnets on Fuji: Builders test their VMs on the testnet. This indicator gives a good outlook on upcoming projects.

testnet.avascan.info/blockchains

> 113

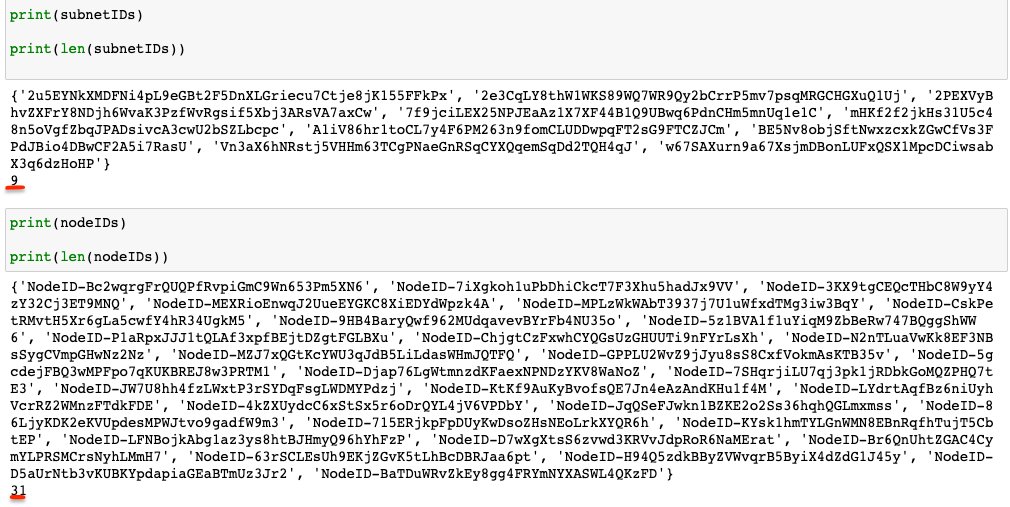

1) # subnets w/ non-zero validators: Have builders taken the next step in their dev cycle and are ready to deploy soon? Subnet validators need to first lock up $AVAX.

subnets.avax.network/subnets & avascan.info/blockchains give an excellent overview.

> 9 (according to Metrics API)

subnets.avax.network/subnets & avascan.info/blockchains give an excellent overview.

> 9 (according to Metrics API)

2) # nodes validating these subnets: Serious projects care about decentralization and grow in their validator sets by staking more $AVAX.

> 31 (according to Metrics API)

metrics.avax.network/

> 31 (according to Metrics API)

metrics.avax.network/

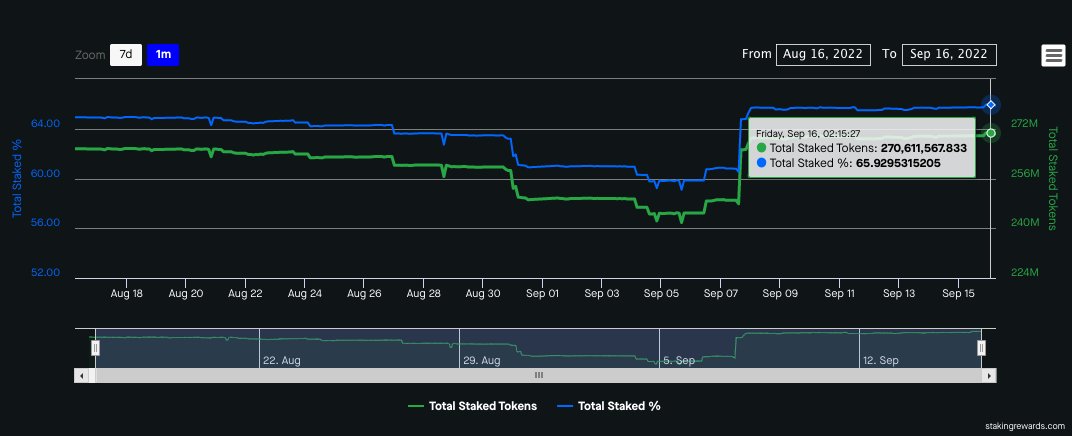

3) Staking ratio: The metric to understand the mindset of mid & long-term investors, subnet builders, and liquid staking enjoyers.

www.stakingrewards.com/earn/avalanche/metrics/

> 65.8%

www.stakingrewards.com/earn/avalanche/metrics/

> 65.8%

4) Subnet staking ratio: What % of the staked $AVAX participates in subnet validation. This is a stickier stake due to subnet validation responsibilities.

> ~0.04%, just getting started with the subnet season

> ~0.04%, just getting started with the subnet season

5) Subnet validator ratio: What % of mainnet validators are actively validating subnets. Smart validators will want to validate successful subnets in the future.

> ~2.37%

> ~2.37%

I'll try to post weekly updates on these numbers to understand the future subnet adoption rate.