Thread

There is quite an outrage in this, so let me break this down for you a little bit to see whether this is worth it or not. This is very common in Forex/CFD world nowadays, and I will assume this is not a scam and all the payout will be legit etc. /cont.

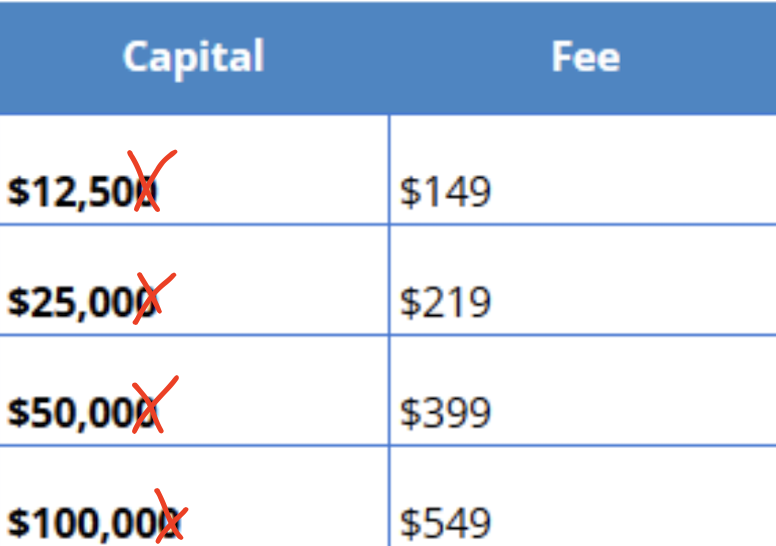

The model is following, you will pay a certain amount of money based on account size and if you pass the evaluation (10% profit twice) you will be able to trade the account with an 80/20 profit split.

Here are the stats from Myforexfund, which is basically the same company; as you can see, your chances of passing this are quite small, especially since she is very likely doing whitelabel of some of those companies.

By whitelabel I mean in trading platforms, you see MT4, MT5 and Tradingview, so there is a high chance that you won't be actually trading crypto as you know it (perps) but contract for difference for crypto

The problem with that is that on CFDs the spreads get a little bigger ($10 for BTC, $2 for ETH and so on), this is basically deal breaker for anyone who wants to actively daytrade, also you only have 1:10 leverage so if you want to open more swings at once, you cant really.

This is the capital provided, but considering the fact you are allowed to lose only 10% of your account before you fail, this is a more realistic view of how much you are actually getting. Also, since your daily DD is 5%, you can split that by half for each day.

There is no scam in this (assuming all the payouts and everything will be legit), it's a popular model in legacy markets, and it is a pretty smart one assuming 90% of people lose money in trading (in crypto probably 99%)

Are you better of saving money and slowly building your capital at a comfortable pace? Yes

Are you profitable in trading, and do you know you can pass the rules and get more money for trading? also yes

Are you profitable in trading, and do you know you can pass the rules and get more money for trading? also yes

Also what is worth to mention is that there are way worse firm running on monthly subscription models and way worse rules in terms of max daily and overall drawdown rules so this is not that bad. By biggest issue is the fact that you are likely to be trading on CFD broker

recently @paracurve published this article about the firms so if you are not familiar with the model go have a read paracurve.com/2022/07/funded-trader-platforms-a-seriously-objective-dive-into-how-they-work-no-affili...

also obviously if you are wondering the testing phase is never done with any real money as all platforms have sophisticated demo trading mode and even if you pass you never see "real" money, its all done via copytrading from demo to real funds (dont be so sure about that)

yeah and 2.5% daily win rule is straight up stupid, there are better ways to prevent people making it in one trade (minimum amount of trading days on account for example). If you risk 1% on account you cant make more than 2.5times of day on a day? not good

Mentions

See All

Cobie @CryptoCobain

·

Sep 5, 2022

Great thread sir thank you