Thread by Compounding Quality

- Tweet

- Sep 4, 2022

- #Investment

Thread

🧵 Terry Smith is one of the greatest Quality Investors in the world. Since his fund launched in 2010, Fundsmith achieved an astonishing CAGR of 15.46% (!) after fees.

In this thread you can find 10 great investment tips from the Quality Maestro himself ⬇️⬇️⬇️⬇️⬇️⬇️

In this thread you can find 10 great investment tips from the Quality Maestro himself ⬇️⬇️⬇️⬇️⬇️⬇️

1. Invest in companies with wide economic moats.

When a company earns a lot of cash, it will attract rivals and reversion to the mean takes place. However, this is not the case for wide moat stocks as they have a superior service or product which rivals can’t replicate.

When a company earns a lot of cash, it will attract rivals and reversion to the mean takes place. However, this is not the case for wide moat stocks as they have a superior service or product which rivals can’t replicate.

2. Strong organic growth is a must.

Organic growth is the most preferred source of growth.

Seek for companies who managed to grow organically over the past years. When these companies are still active in a strongly growing end market today, this is a great sign.

Organic growth is the most preferred source of growth.

Seek for companies who managed to grow organically over the past years. When these companies are still active in a strongly growing end market today, this is a great sign.

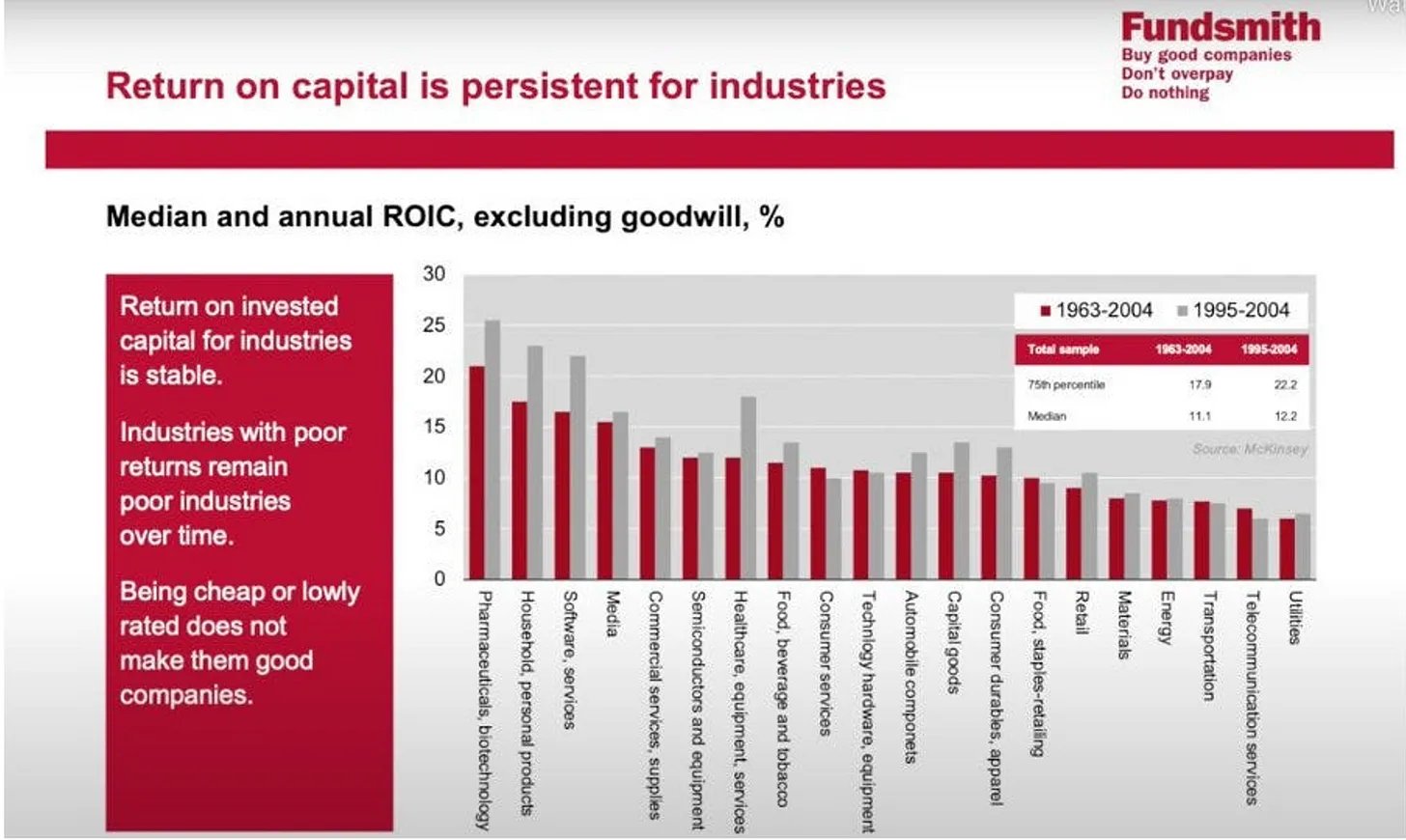

3. Invest in companies with a high Return on Invested Capital (ROIC).

The higher the Return on Invested Capital (ROIC) of a company, the better.

The higher the Return on Invested Capital (ROIC) of a company, the better.

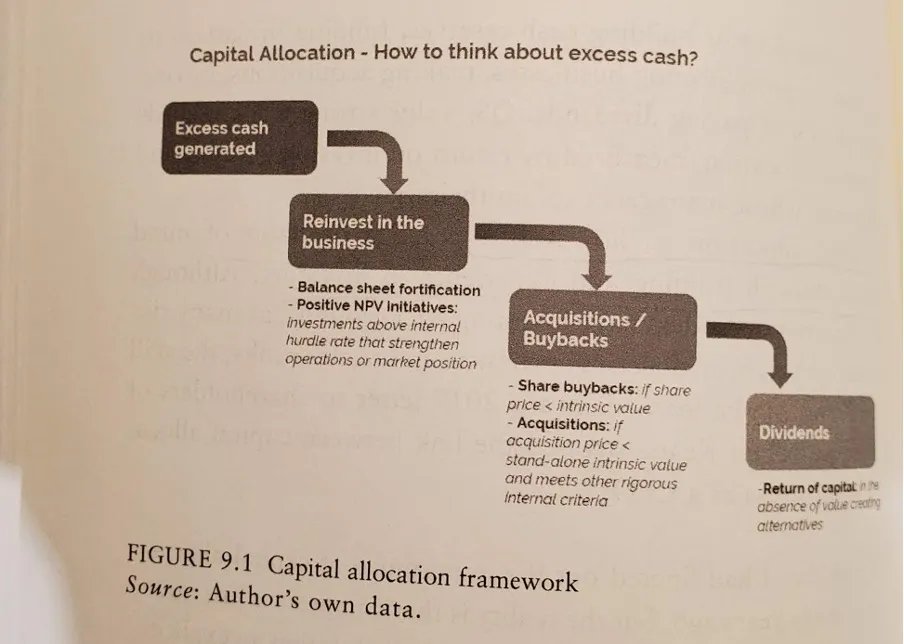

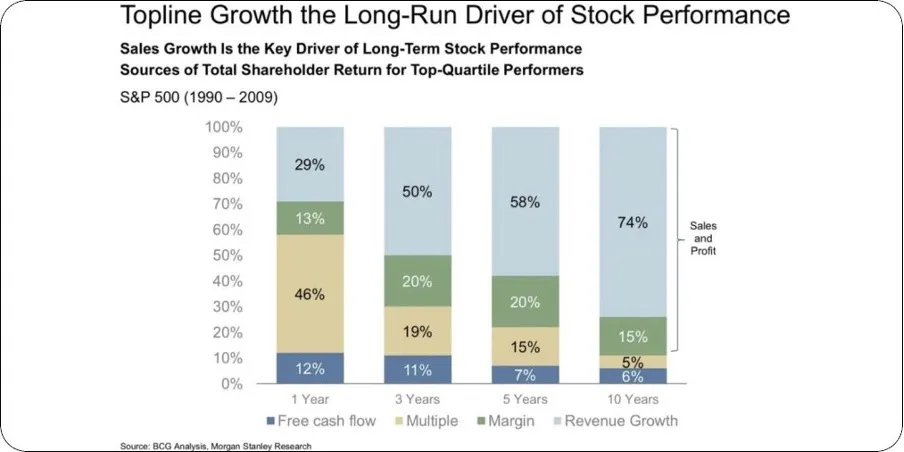

4. Revenue growth is the main driver for value creation.

Eventually, the stock price will follow the revenue and free cash flow growth of a company.

Eventually, the stock price will follow the revenue and free cash flow growth of a company.

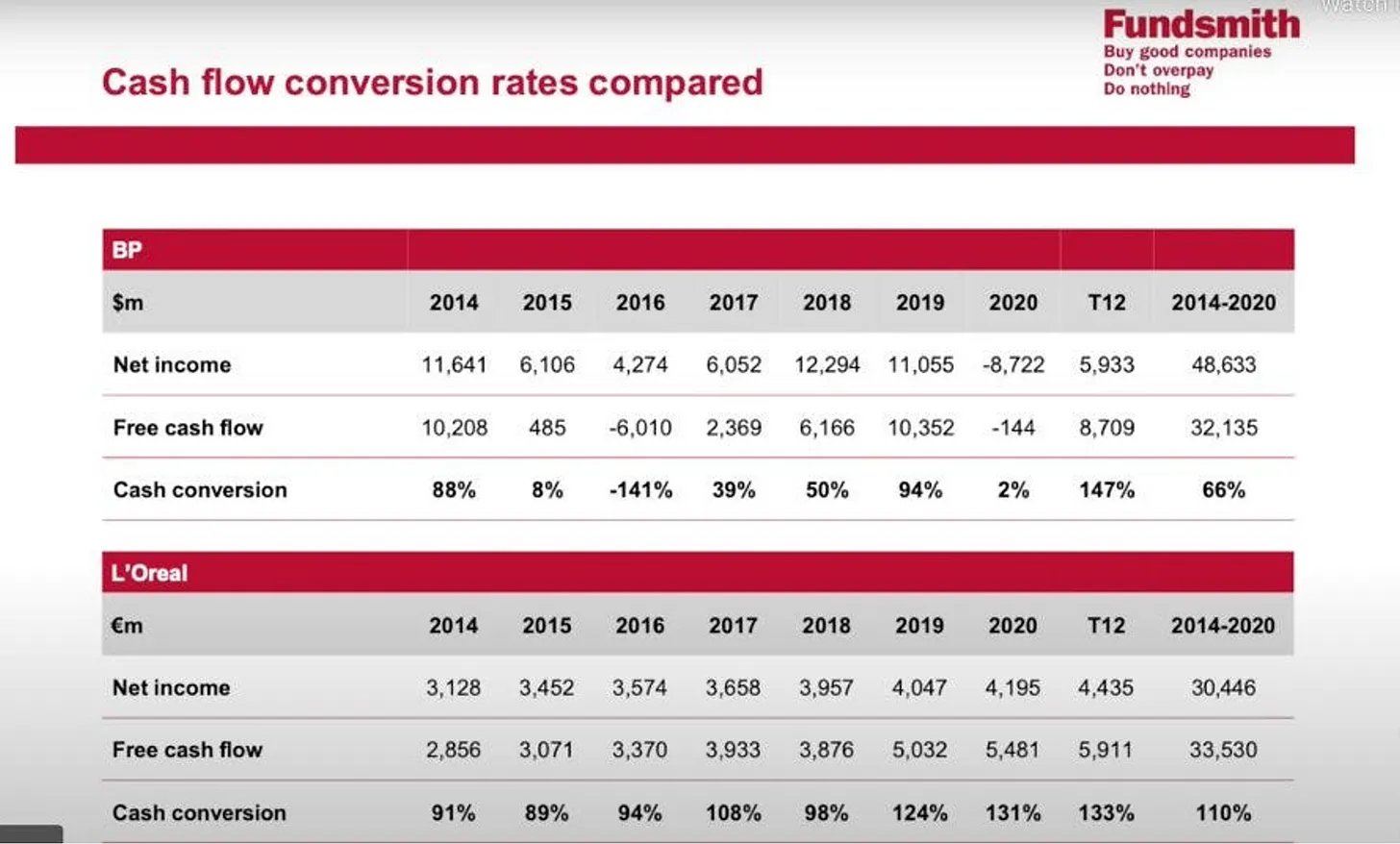

5. Buy companies who translate most earnings into free cash flow.

Earnings are an opinion, cash is a fact.

A study found that companies that translated most earnings into FCF outperformed companies that translated the least earnings into FCF by 18% (!) per year.

Earnings are an opinion, cash is a fact.

A study found that companies that translated most earnings into FCF outperformed companies that translated the least earnings into FCF by 18% (!) per year.

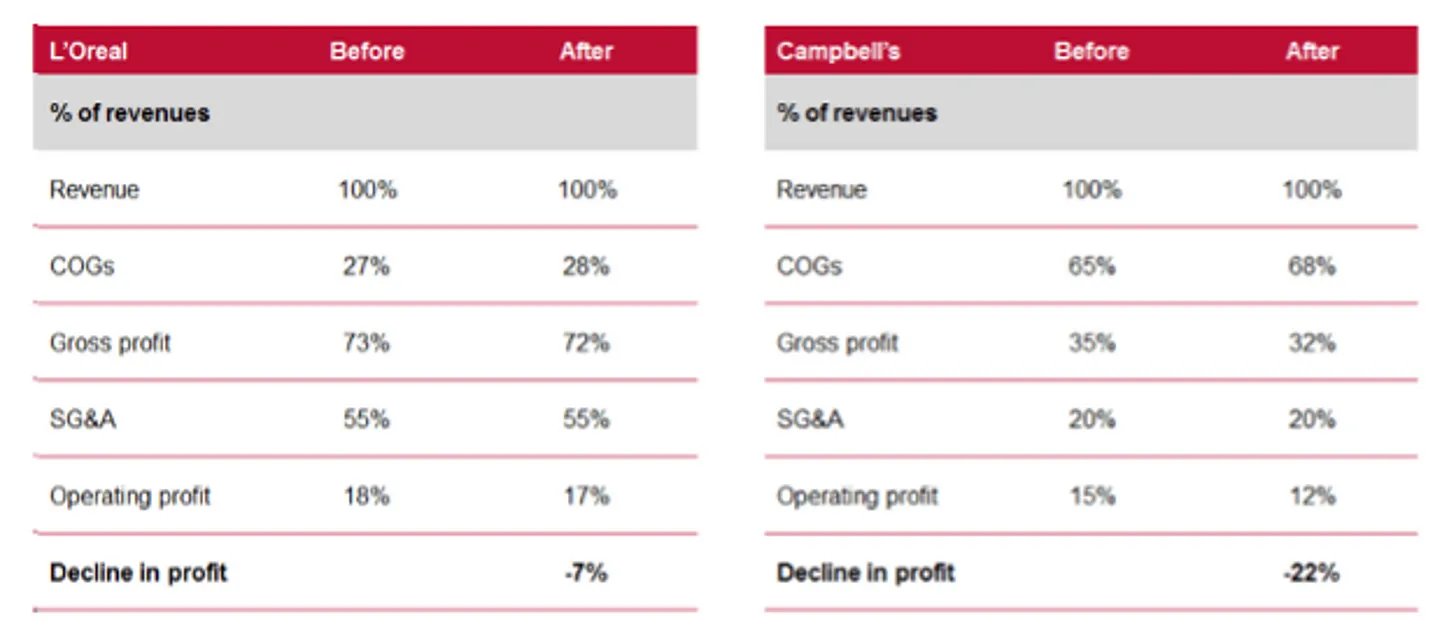

6. A high gross margin is a good protection against inflation.

The higher the gross margin of a company, the better the company is protected against inflation.

When a company has high, consistent gross margins, it is a great indication that the company has a wide moat too.

The higher the gross margin of a company, the better the company is protected against inflation.

When a company has high, consistent gross margins, it is a great indication that the company has a wide moat too.

7. Be disciplined.

When you invest in stocks, one thing is for sure: you will underperform the market from time to time. No rider has ever won all stages of the Tour De France. The same principle is valid on the stock market.

When you invest in stocks, one thing is for sure: you will underperform the market from time to time. No rider has ever won all stages of the Tour De France. The same principle is valid on the stock market.

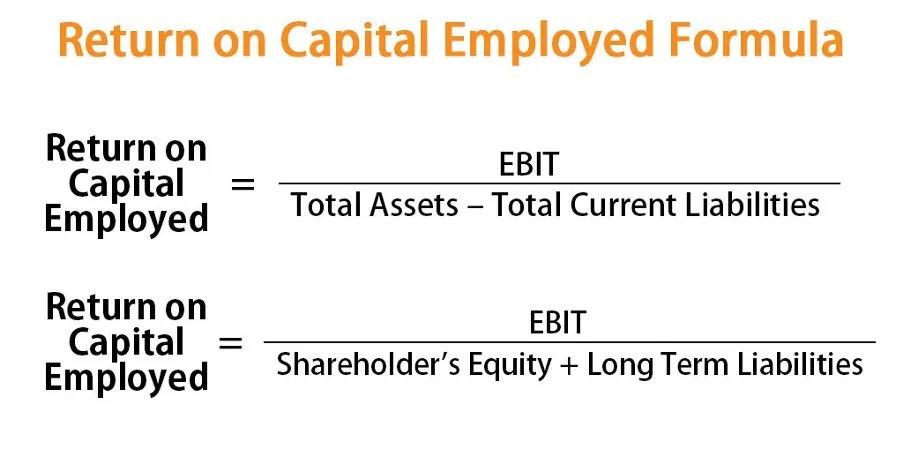

8. Look at ROCE instead of ROE.

The Return on Capital Employed (ROCE) is a better metric than the Return on Equity (ROE) because it considers all capital employed (equity, debt and other liabilities).

The Return on Capital Employed (ROCE) is a better metric than the Return on Equity (ROE) because it considers all capital employed (equity, debt and other liabilities).

9. Don’t overpay.

Even the best companies in the world can sometimes be so overvalued that you will end up with bad investment results. Pay a fair price for a wonderful company, and you’ll end up with wonderful investment returns.

Even the best companies in the world can sometimes be so overvalued that you will end up with bad investment results. Pay a fair price for a wonderful company, and you’ll end up with wonderful investment returns.

10. Do nothing.

The best investor is a dead investor.

Trading too much harms your investment results. Be disciplined and don’t trade too much.

The best investor is a dead investor.

Trading too much harms your investment results. Be disciplined and don’t trade too much.

It's a wrap!

We mapped all shareholder letters of the Quality Maestro himself in one PDF. You can download it for free on our website: qualitycompounding.substack.com/p/how-to-invest-in-quality-companies

We mapped all shareholder letters of the Quality Maestro himself in one PDF. You can download it for free on our website: qualitycompounding.substack.com/p/how-to-invest-in-quality-companies