Thread

OK, gonna do an econ thread most of my followers will find incomprehensible. But I think it needs to be done, bc there seems to be a dispute over the inflation outlook in which people are talking past each other 1/

Ever since Friedman and Phelps wrote their seminal papers on inflation and unemployment in the 60s, most practicing macroeconomists have worked with a model that looks something like this:

Core inflation = f(u) + Expected inflation

where u is the unemployment rate 2/

Core inflation = f(u) + Expected inflation

where u is the unemployment rate 2/

There is some level of u — call it u* — for which f(u)=0. One way or another, u* (which can change over time!) is highly significant. But exactly how it's significant depends on what determines expectations 3/

In the 60s and 70s it seemed reasonable to assume that expected inflation was equal to recent past inflation — in fact, the previous year's inflation looked like a pretty good proxy. So the Phillips curve could be rearranged to

Change in inflation = f(u) 4/

Change in inflation = f(u) 4/

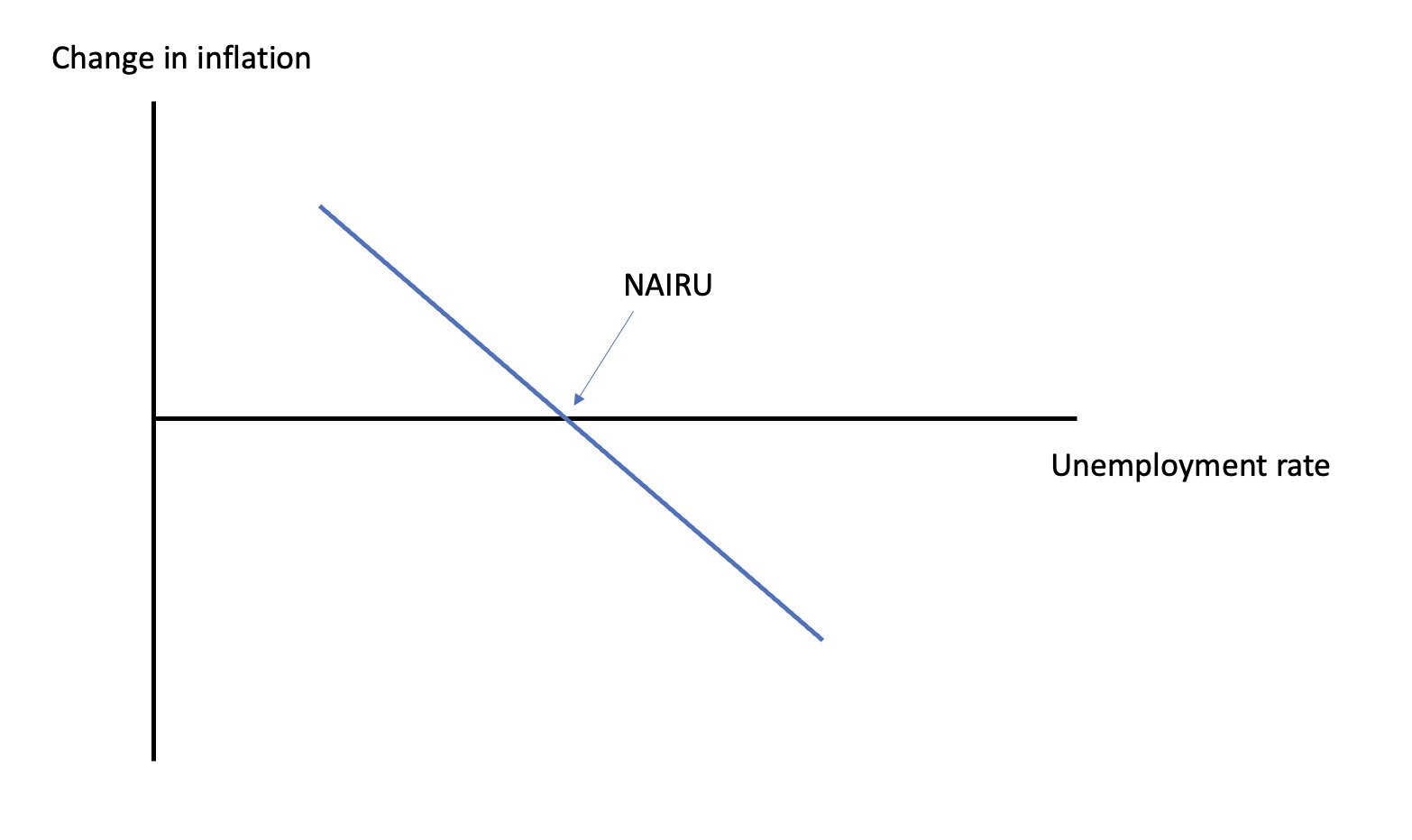

In that case u* became the NAIRU — the rate of unemployment at which inflation neither rose nor fell. The picture looked like this 5/

Given that picture, bringing inflation down would require a period of unemployment higher than u*. How much higher for how much longer? The "sacrifice ratio" was an estimate of how much excess unemployment would be needed to bring inflation down by one point 6/

And if you apply estimates of the sacrifice ratio to the gap between core inflation and the Fed's 2 percent target, it's ugly: it says that we need a lot of excess unemployment in the years ahead 7/

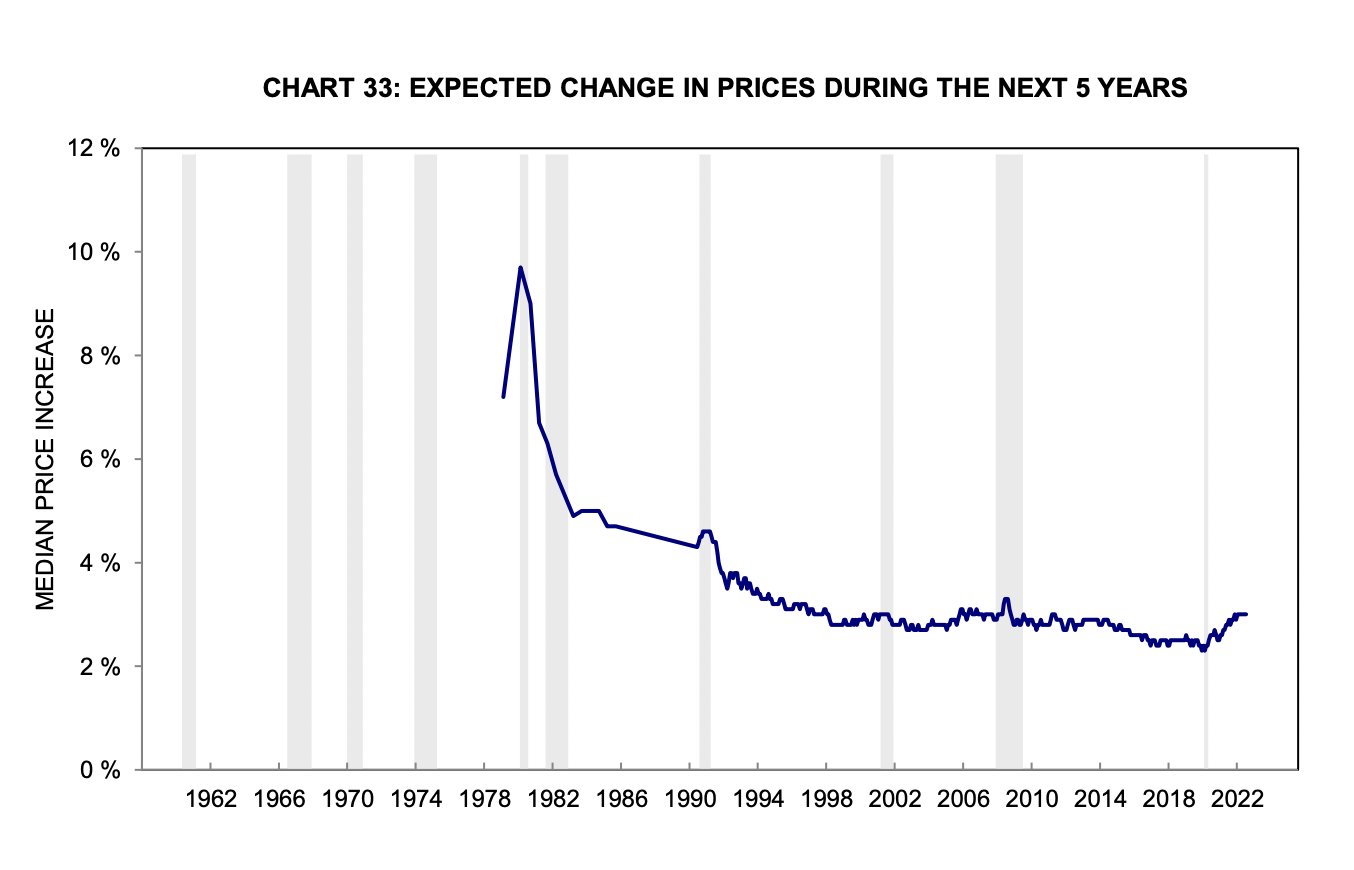

But is this calculation relevant? Both market prices and surveys suggest that medium-term inflation expectations have remained "anchored" despite recent inflation 8/

If those measures are right, getting inflation under control requires getting u up to u*, so f(u) is zero — so some pain — but that's the end of the story. No need for a period of above-normal unemployment 9/

This could, of course, be wrong, and God knows we've learned to be wary of optimistic forecasts. But what seems odd to me is that the pessimists don't even seem to engage with this issue. They're just telling 80s-style stories and ignoring the direct evidence on expectations 10/

Do they think the expectations data are meaningless? Do they have a different model of inflation? Inquiring minds want to know 11/