Thread

There's a saying in Fintech:

You either die a consumer goods company, or live long enough to see yourself enter financial services.

One company has managed to do both.

Let me tell you why Starbucks is one of the most successful banks in the U.S.:

You either die a consumer goods company, or live long enough to see yourself enter financial services.

One company has managed to do both.

Let me tell you why Starbucks is one of the most successful banks in the U.S.:

It all started with the gift card.

Starbuck set out with a simple mission: Build a loyalty program to incentivize customers to buy more coffee.

In 2008, their loyalty program was first introduced and paired with their physical gift cards.

Starbuck set out with a simple mission: Build a loyalty program to incentivize customers to buy more coffee.

In 2008, their loyalty program was first introduced and paired with their physical gift cards.

For those who don't remember (or weren't around to see it), here's how it worked:

You buy a gift card for yourself and load it with any amount of money.

You purchase your daily coffee using that gift card and you reload it when necessary.

You buy a gift card for yourself and load it with any amount of money.

You purchase your daily coffee using that gift card and you reload it when necessary.

Eventually, you accrue enough points to redeem for rewards like free refills or free WiFi access.

With the loyalty program, Starbucks was attempting to change the way their cards were used - from a gift card to something resembling a charge card.

With the loyalty program, Starbucks was attempting to change the way their cards were used - from a gift card to something resembling a charge card.

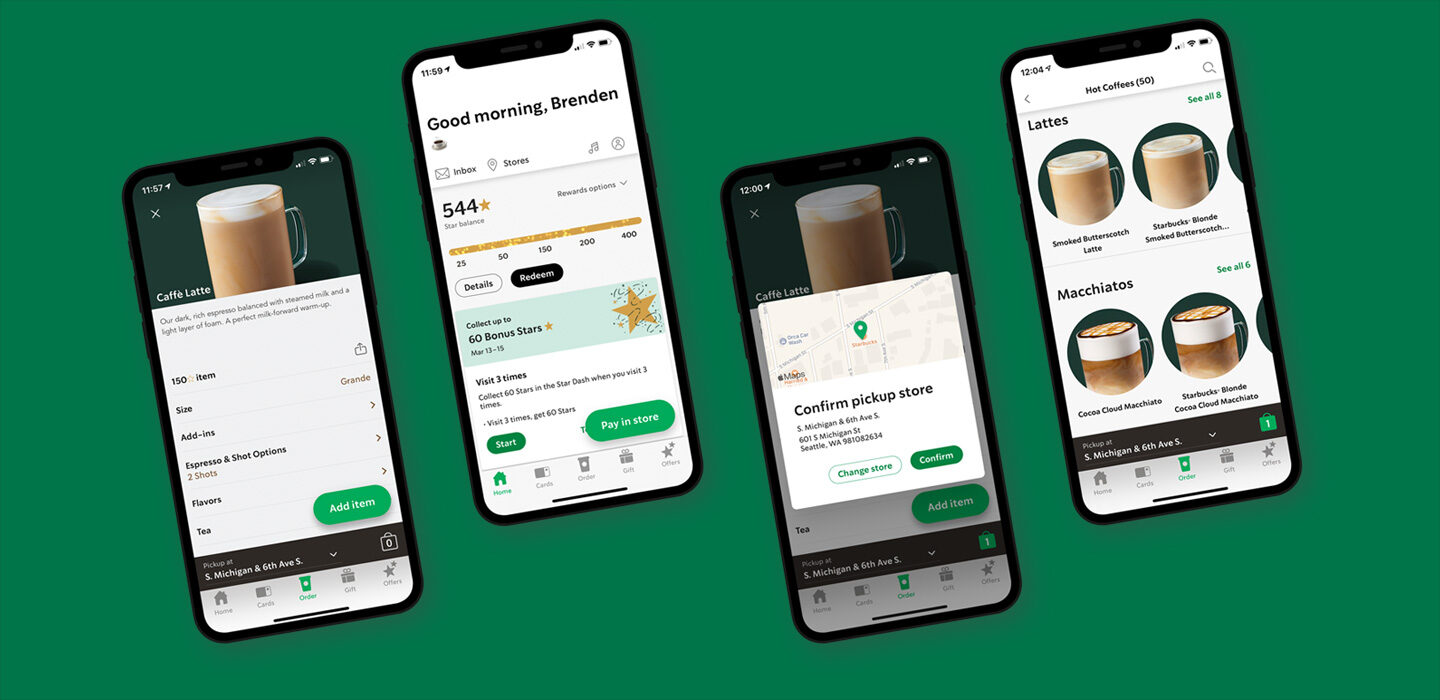

Then, everything changed with the release of the Starbucks mobile app in 2010.

Now, customers could upload a digital gift card to the app, load/reload the card, and make purchases all from their phones.

Their loyalty program became the Starbucks Rewards Program.

Now, customers could upload a digital gift card to the app, load/reload the card, and make purchases all from their phones.

Their loyalty program became the Starbucks Rewards Program.

Adoption of the mobile app exploded.

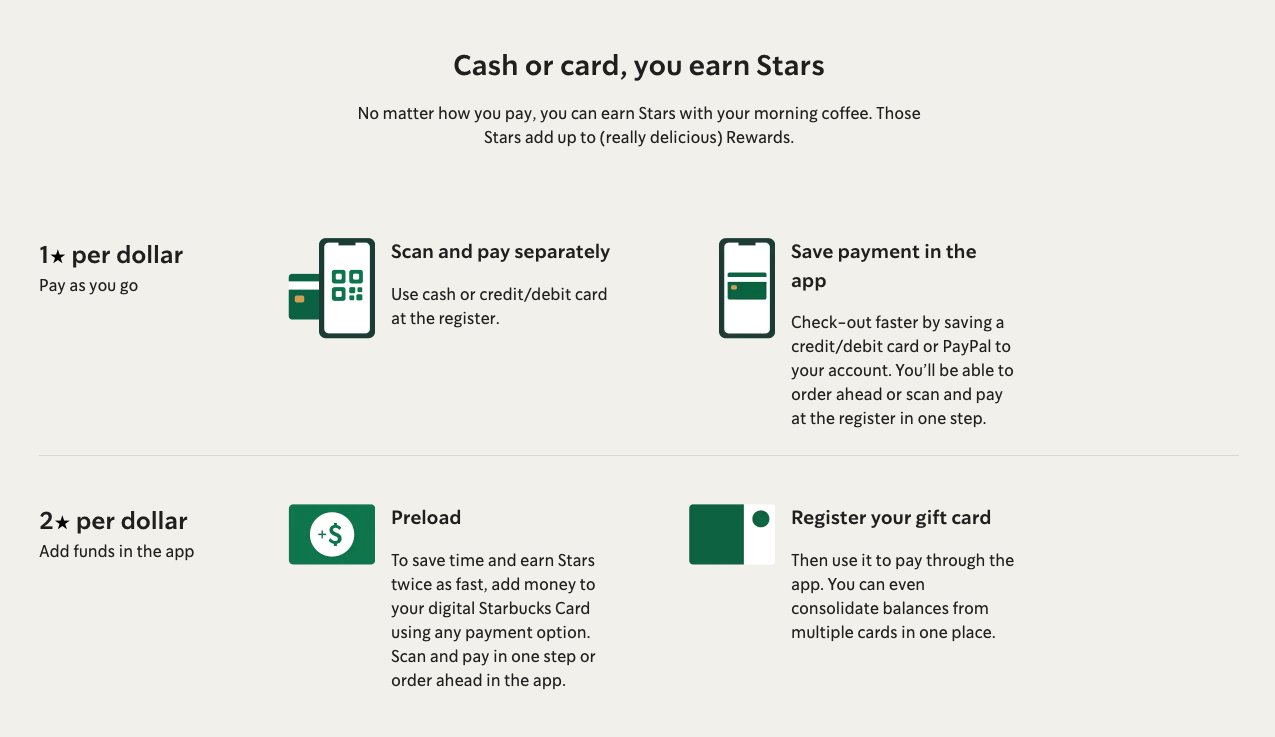

With the rewards program, each purchase would award you 1 star for every dollar spent.

BUT, each purchase made with the reloadable gift card would earn you 2 stars for every dollar spent.

With the rewards program, each purchase would award you 1 star for every dollar spent.

BUT, each purchase made with the reloadable gift card would earn you 2 stars for every dollar spent.

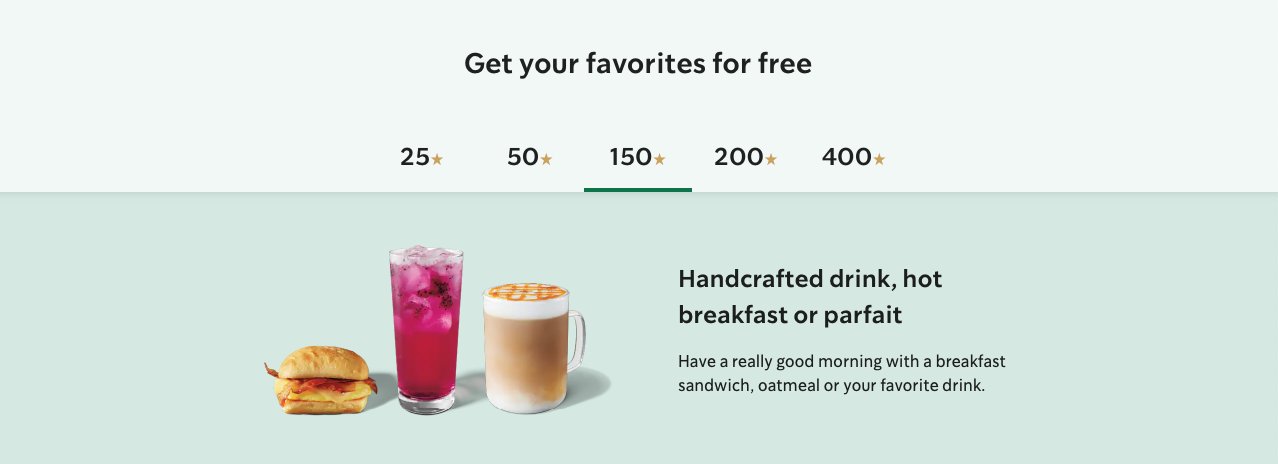

These stars can be redeemed for free customizations, items from the bakery, free drinks, etc.

Once they added mobile ordering and pickup in 2014, about 25% of ALL Starbucks orders in the U.S. were being paid for on mobile.

Once they added mobile ordering and pickup in 2014, about 25% of ALL Starbucks orders in the U.S. were being paid for on mobile.

Here's the magic of the Starbucks Rewards Program.

Each time you load your rewards card, Starbucks holds onto that money until you're ready to spend it.

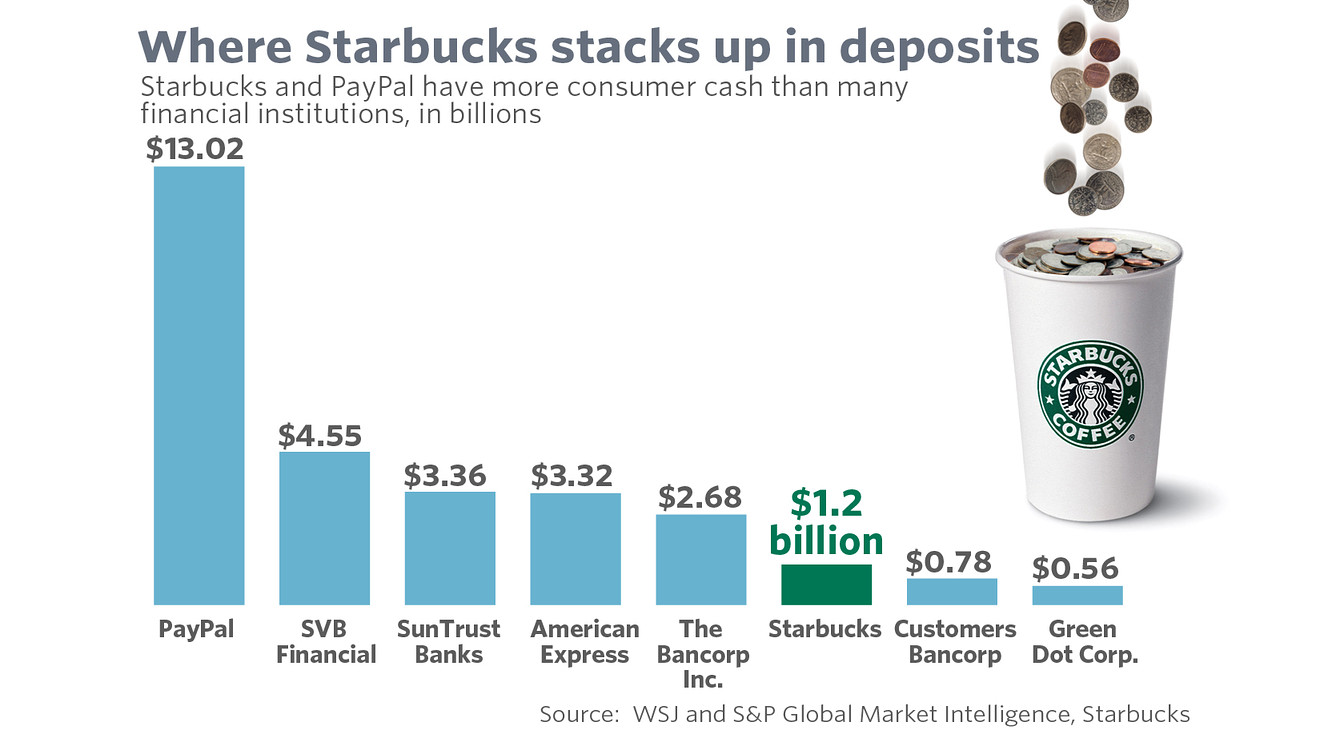

Multiply this by 25 million active rewards members, and you have a company that reported $1.6 BILLION in deposits last year.

Each time you load your rewards card, Starbucks holds onto that money until you're ready to spend it.

Multiply this by 25 million active rewards members, and you have a company that reported $1.6 BILLION in deposits last year.

For reference: Discover, the 4th largest credit card provider in the country, only holds $470M in deposits (photo from 2016).

Every year, rewards members load about $10B onto their Starbucks cards!

So what does Starbucks do with all that extra cash lying around?

Every year, rewards members load about $10B onto their Starbucks cards!

So what does Starbucks do with all that extra cash lying around?

Think of it as a zero-interest line of credit.

Need cash to build a few dozen new locations? Really big ad campaign in the works? Upgrading equipment?

No need to borrow from a bank at 2-4%. Just dip into your cash reserves and replenish it later.

Need cash to build a few dozen new locations? Really big ad campaign in the works? Upgrading equipment?

No need to borrow from a bank at 2-4%. Just dip into your cash reserves and replenish it later.

The reason that Starbucks can do this is that it doesn't have to keep an adequate reserve on hand to facilitate redemptions.

The only way to cash out of Starbucks' balances is to buy something from Starbucks!

So that money can be put to work in higher-yield opportunities.

The only way to cash out of Starbucks' balances is to buy something from Starbucks!

So that money can be put to work in higher-yield opportunities.

This credit line equates to roughly 4% of the company’s total liabilities.

It also improves the health of the balance sheet by increasing FCF and decreasing working capital needs.

With the current liability balance, Starbucks actually earns ~10% in interest on these "deposits".

It also improves the health of the balance sheet by increasing FCF and decreasing working capital needs.

With the current liability balance, Starbucks actually earns ~10% in interest on these "deposits".

Since money loaded onto the app/physical gift card never expires, a significant amount of the money is NEVER spent.

Starbucks is even able to use historical data to quantify "Breakage" - How much money will never be redeemed.

How much?

$141 MILLION of free money in 2019 alone.

Starbucks is even able to use historical data to quantify "Breakage" - How much money will never be redeemed.

How much?

$141 MILLION of free money in 2019 alone.

The Starbucks Rewards Program is responsible for ~53% of spend in their stores, making it one of the most successful rewards programs ever...

While also making the company one of the most successful banks in the country.

While also making the company one of the most successful banks in the country.

If you found this thread interesting and if you would like to see more such analysis:

Subscribe to my 2x/week newsletter:

workweek.com/discover-newsletters/fintech-takes/?utm_source=twitter&utm_medium=social&utm_campaign=fi...

Subscribe to my 2x/week newsletter:

workweek.com/discover-newsletters/fintech-takes/?utm_source=twitter&utm_medium=social&utm_campaign=fi...

Want to learn more about the genius behind Starbucks?

Take a look at @arihappywick's thread about how Starbucks has mastered the subtle art of controversy!

Take a look at @arihappywick's thread about how Starbucks has mastered the subtle art of controversy!