Thread

If you’ve never heard of a *debt spiral*, it’s time you did,

and ask the question, "is the US already in one?"

Let’s dig in and answer that.

A debt 🧵👇

and ask the question, "is the US already in one?"

Let’s dig in and answer that.

A debt 🧵👇

🏛 The government as a business

Before we get into any debt specifics, let’s first cover the basics of how a government operates financially

And while it’s an absolute beast of an operation, it can be boiled down into some pretty simple parts that mirror a typical company.

Before we get into any debt specifics, let’s first cover the basics of how a government operates financially

And while it’s an absolute beast of an operation, it can be boiled down into some pretty simple parts that mirror a typical company.

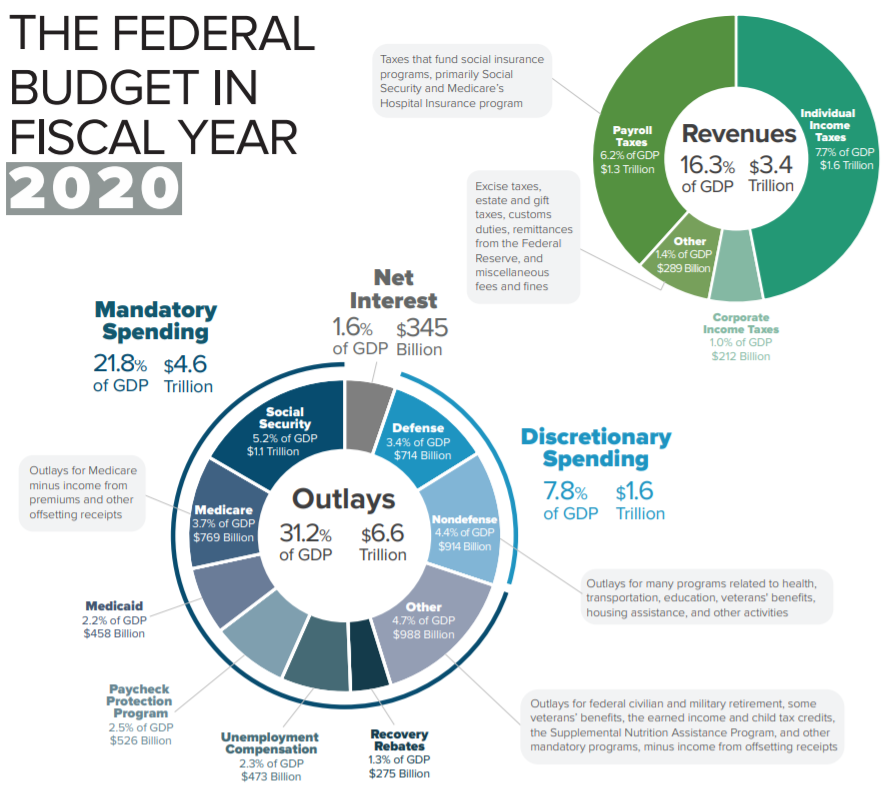

First, like any business, a gov't has revenues and expenses and often borrows money using debt

~95% of US gov't revenues come from taxes: individual and corporate income, payroll, and excise taxes

~5% comes from estate taxes, customs, Fed earnings, penalties, and other fees.

~95% of US gov't revenues come from taxes: individual and corporate income, payroll, and excise taxes

~5% comes from estate taxes, customs, Fed earnings, penalties, and other fees.

Just like a business, there must be enough revenue to cover all expenses for it to keep operating

A budget

And in the business of running a country, taxes should cover all gov't expenses: infrastructure, defense, entitlements, etc., as well as interest payments on its debt.

A budget

And in the business of running a country, taxes should cover all gov't expenses: infrastructure, defense, entitlements, etc., as well as interest payments on its debt.

Of course, they don't

We spend far more than we make, as the US is perpetually operating in a deficit.

Here’s what the US federal budget looked like it 2020:

(www.cbo.gov/publication/57170):

We spend far more than we make, as the US is perpetually operating in a deficit.

Here’s what the US federal budget looked like it 2020:

(www.cbo.gov/publication/57170):

🌀 What’s a debt spiral?

If a government is operating in a deficit, it can either cut expenses (ha!), generate more income by stimulating GDP (think war), or raise taxes.

If a government is operating in a deficit, it can either cut expenses (ha!), generate more income by stimulating GDP (think war), or raise taxes.

Problem is, cutting expenses costs votes; war can lead to future productivity damage, higher taxes can impact companies’ ability to grow and in turn hurt the country’s GDP, leading to lower tax revenues

The easiest thing to do?

Just issue more debt to cover the budget.

The easiest thing to do?

Just issue more debt to cover the budget.

Problem solved, right? Right?

Well, we know what happens to a company that issues too much debt and winds up unable to pay the interest on it

Exactly

It becomes distressed, and if it cannot fix its budget problem, it eventually goes bankrupt.

Well, we know what happens to a company that issues too much debt and winds up unable to pay the interest on it

Exactly

It becomes distressed, and if it cannot fix its budget problem, it eventually goes bankrupt.

The difference is, countries are given far more leeway in the amount of debt they can issue before investors begin to balk

We often look at debt to GDP to measure a country’s financial health

But we can also look at the country’s budget, its actual revenues and expenses.

We often look at debt to GDP to measure a country’s financial health

But we can also look at the country’s budget, its actual revenues and expenses.

Using these, we can calculate an interest coverage ratio:

(Tax Revenues - Entitlements - Defense) / Interest Expense

Note* This calculation is purposefully simplified, as the remaining budgetary items can swing considerably from year to year with legislation

(Tax Revenues - Entitlements - Defense) / Interest Expense

Note* This calculation is purposefully simplified, as the remaining budgetary items can swing considerably from year to year with legislation

Bottom line: if this number is lower than 1 to 1 (i.e., there are more interest expenses than revenues left over to pay them) then a country must borrow even more money by issuing more debt

This only leads to higher interest expense payments, which makes the ratio even worse.

This only leads to higher interest expense payments, which makes the ratio even worse.

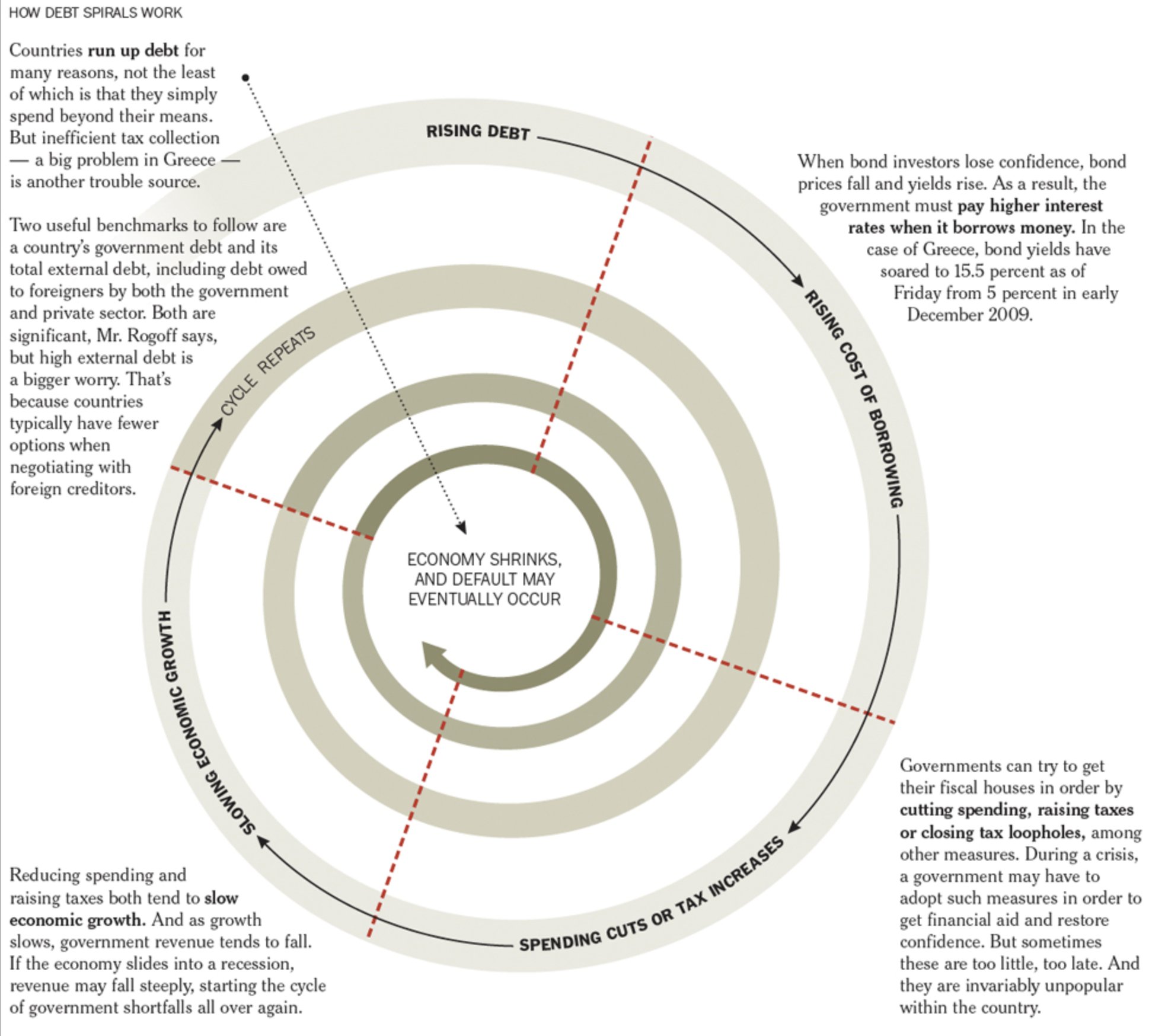

Think of it like this: You run up the balance on a credit card

The monthly payments are then more than you have after mandatory costs like mortgage, car loans, and food

So, you open a new credit card to cover the gap...

The monthly payments are then more than you have after mandatory costs like mortgage, car loans, and food

So, you open a new credit card to cover the gap...

But your credit score is now worse, and the interest rate on the new card is even higher--hence the monthly payments are even higher, plus you’ve borrowed even more

Solution?

Open yet another credit card to cover the raised expenses…and so on…you are trapped

Solution?

Open yet another credit card to cover the raised expenses…and so on…you are trapped

It’s no different for a country perpetually operating in a deficit

more debt → higher interest rates → higher deficits → more debt

As it worsens, investors lose confidence in the country and demand higher rates for the country’s bonds, only worsening the situation

more debt → higher interest rates → higher deficits → more debt

As it worsens, investors lose confidence in the country and demand higher rates for the country’s bonds, only worsening the situation

🇺🇸 What’s the situation in the US?

Well, let’s peek at the US budget situation

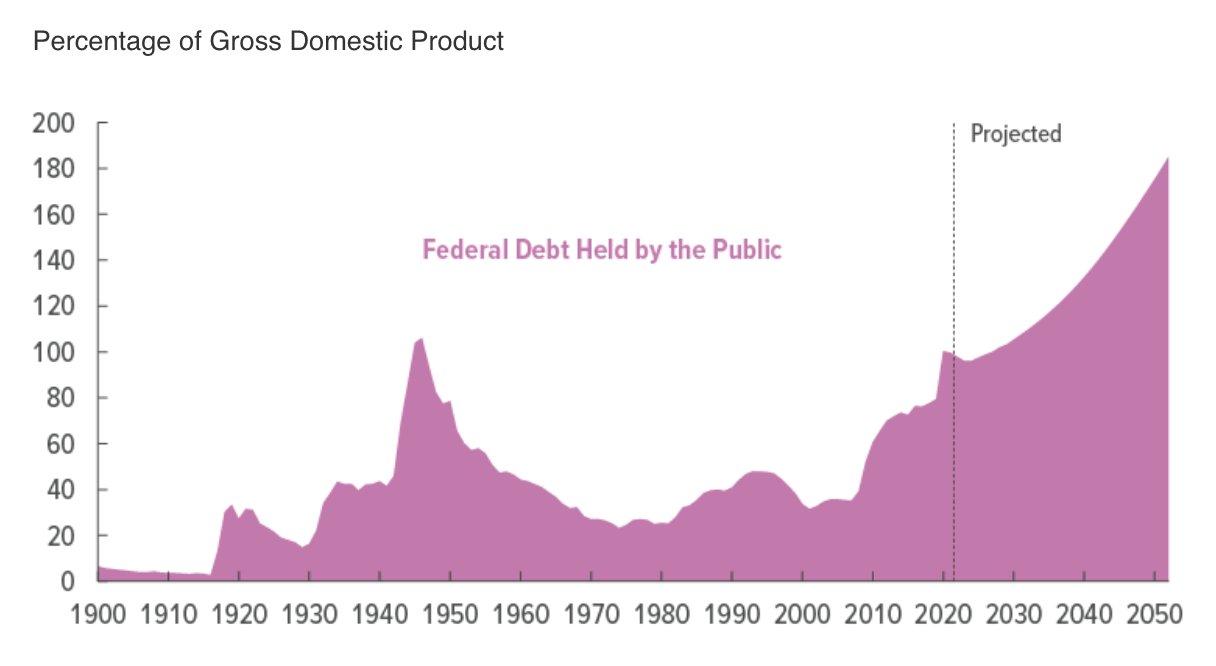

You can see, total US federal debt is now $30.7T, and US GDP is $24.8T

Including all federal, state, and local debt, the current debt to GDP ratio is 1.37 or 137%

Not great, at first glance.

Well, let’s peek at the US budget situation

You can see, total US federal debt is now $30.7T, and US GDP is $24.8T

Including all federal, state, and local debt, the current debt to GDP ratio is 1.37 or 137%

Not great, at first glance.

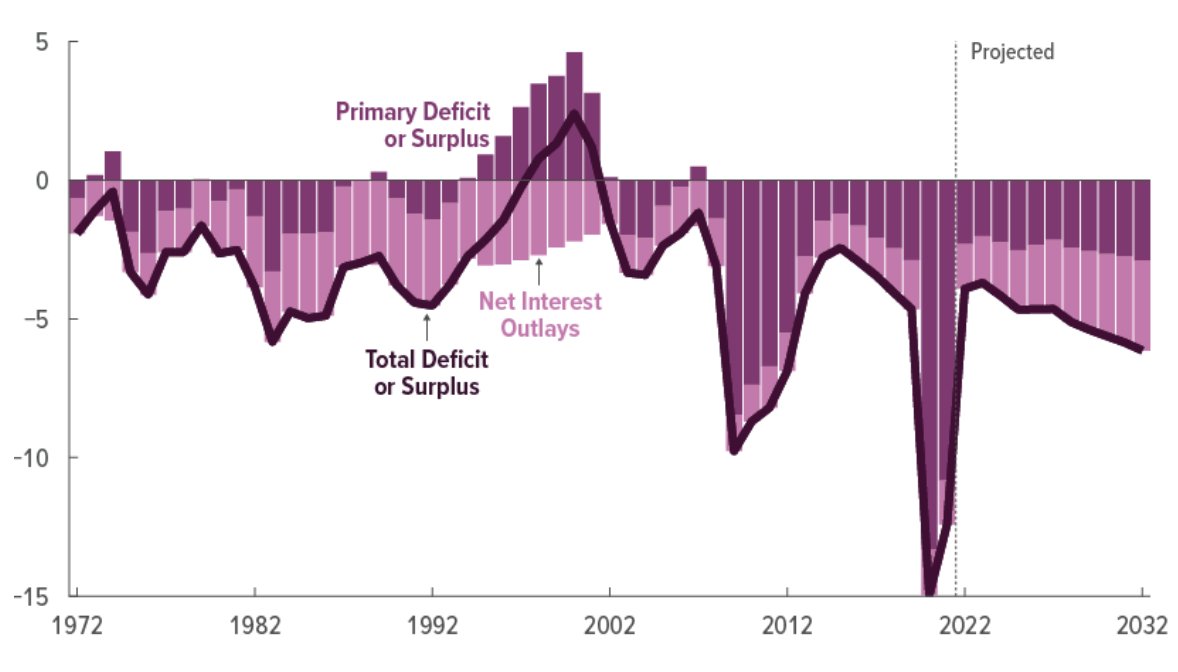

But let’s dig deeper. How’s the interest coverage ratio look?

The debt clock shows $4.4T in tax revenues, but the US Congressional Budget Office counts $400B in “other taxes” to total $4.8T in 2022

Even if we give the CBO the benefit of the doubt, it still doesn’t look so good.

The debt clock shows $4.4T in tax revenues, but the US Congressional Budget Office counts $400B in “other taxes” to total $4.8T in 2022

Even if we give the CBO the benefit of the doubt, it still doesn’t look so good.

Why?

entitlement spending + interest on debt > revenues

Taking the same CBO report, we see mandatory expenses total $3.7T (includes all entitlements signed into legislation, considered absolute obligations)

Adding $800B of defense spending, and our expenses total $4.5T in 2022

entitlement spending + interest on debt > revenues

Taking the same CBO report, we see mandatory expenses total $3.7T (includes all entitlements signed into legislation, considered absolute obligations)

Adding $800B of defense spending, and our expenses total $4.5T in 2022

$4.8T taxes - $3.7T entitlements - $800B defense = $300B budgeted for interest expense

Problem is, the US currently owes $400B on interest annually (you don’t have to be a math genius to see the problem here)

300B - 400B = -100B (oops)

Interest coverage ratio = .75X!

Problem is, the US currently owes $400B on interest annually (you don’t have to be a math genius to see the problem here)

300B - 400B = -100B (oops)

Interest coverage ratio = .75X!

And here’s where the math gets really ugly

See, with rising rates, as current debt matures and needs to be replaced, the additional interest cost adds up rapidly

As @FossGregfoss pointed out recently, if we replace $30T of debt at 3.2%, the annual interest expense becomes $1T!

See, with rising rates, as current debt matures and needs to be replaced, the additional interest cost adds up rapidly

As @FossGregfoss pointed out recently, if we replace $30T of debt at 3.2%, the annual interest expense becomes $1T!

That’s $600B more than currently, pushing the interest coverage ratio down to .3X!

Forget distressed, that’s bankrupt. If the bonds were corporates, they'd trade pennies on the dollar at best and only because there'd be claims on assets to offset the risk

But wait. There’s more

Forget distressed, that’s bankrupt. If the bonds were corporates, they'd trade pennies on the dollar at best and only because there'd be claims on assets to offset the risk

But wait. There’s more

As @FossGregfoss also points out, this is before reduced tax revenues due to lower capital gains as the market sells off in this recession

And I’ll add, fewer individual and corporate taxes with earnings lower than the above estimates

And I’ll add, fewer individual and corporate taxes with earnings lower than the above estimates

To avoid this immediate problem, the Fed likely pivots by lowering rates and resuming quantitative easing

They simply kick the debt can down the road

Inflation resumes, the Fed must raise rates to tame it, and US borrows at higher rates to cover the deficit

A vicious circle

They simply kick the debt can down the road

Inflation resumes, the Fed must raise rates to tame it, and US borrows at higher rates to cover the deficit

A vicious circle

The math remains simple but ominous

Even the CBO agrees in their own estimates

CBO projected debt to GDP:

Even the CBO agrees in their own estimates

CBO projected debt to GDP:

The other choice is to let inflation run higher than the 2% target, in order to raise GDP and monetize the debt

i.e., they use cheaper future dollars to pay for past debts, and stick it on the Fed balance sheet through QE

i.e., they use cheaper future dollars to pay for past debts, and stick it on the Fed balance sheet through QE

Still only a short term solution, investors will eventually demand higher Treasury rates to compensate for being paid back in cheaper dollars and increased default risk

It’s a debt trap that leads to a debt spiral, and though it'll likely last a while, IMO, we're already in it.

It’s a debt trap that leads to a debt spiral, and though it'll likely last a while, IMO, we're already in it.

🛡 How can you protect yourself?

Though each investor requires personal advisor specific advice, you’ve heard me say it before, and I will reiterate it

I think it's prudent to have some % of investments allocated to hard assets: gold, silver, and at least a small amount of $BTC

Though each investor requires personal advisor specific advice, you’ve heard me say it before, and I will reiterate it

I think it's prudent to have some % of investments allocated to hard assets: gold, silver, and at least a small amount of $BTC

As we continue to manipulate the money and kick the debt can down the road, there’s simply no way out for sovereigns

Whether it's in 10 years or 50, every single fiat based sovereign currency will eventually collapse under the weight of their own debts.

Whether it's in 10 years or 50, every single fiat based sovereign currency will eventually collapse under the weight of their own debts.

When this happens, those who own hard money like gold, silver, and #Bitcoin will have protection vs their own currency hyper-inflating and being reset

Some of you have seen this thread before, but if you haven’t, the scenario is all laid out for you here:

Some of you have seen this thread before, but if you haven’t, the scenario is all laid out for you here:

What we have learned that is most important for each of us to understand after the last two years, is that it is absolutely inevitable...

Fiat is backed by nothing

Our global financial system is built on debt and borrowing

Eventually these debts will grow too big, even for the USA

The chickens will someday have to roost.

Our global financial system is built on debt and borrowing

Eventually these debts will grow too big, even for the USA

The chickens will someday have to roost.

This thread was a summary of a recent Informationist Newsletter. If you enjoyed it, make sure to:

1. Follow @jameslavish to see more investment related content

2. Subscribe to The Informationist Newsletter to learn one simplified concept weekly: jameslavish.substack.com

1. Follow @jameslavish to see more investment related content

2. Subscribe to The Informationist Newsletter to learn one simplified concept weekly: jameslavish.substack.com

Mentions

See All

Preston Pysh @PrestonPysh

·

Aug 23, 2022

A must read thread from James.