Thread

1/ I said "Vitalik never understood PoW deeply"

I don't know if I'm right or wrong, but here are some examples of @VitalikButerin misunderstanding PoW

🧵👇

I don't know if I'm right or wrong, but here are some examples of @VitalikButerin misunderstanding PoW

🧵👇

2/ Seems like V made up his mind on PoS in 2014 & has been tunnel vision ever since.

“difficult to get a man to understand something when his salary depends upon his not understanding it.”

He also doesn't grasp the energy industry (explains the naive "PoW wastes energy" takes)

“difficult to get a man to understand something when his salary depends upon his not understanding it.”

He also doesn't grasp the energy industry (explains the naive "PoW wastes energy" takes)

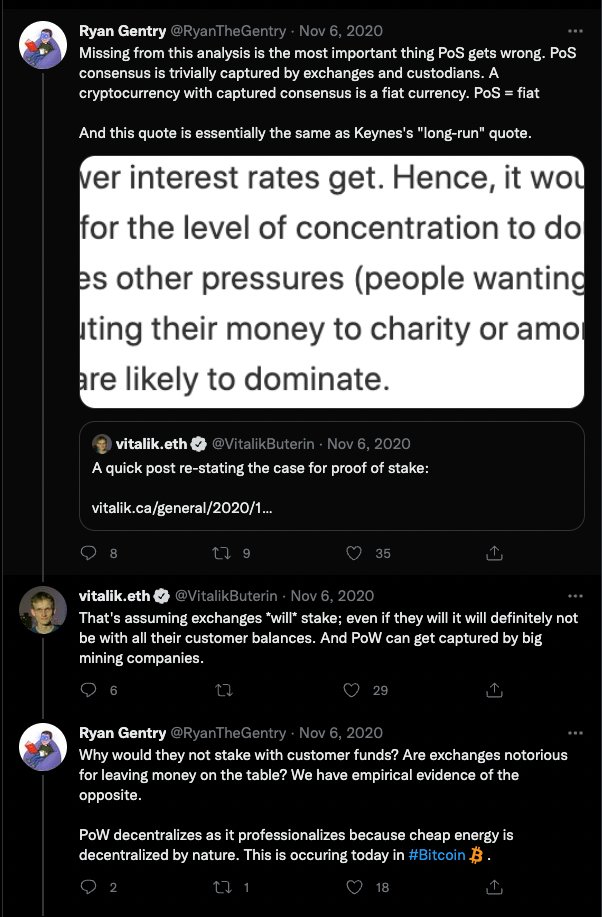

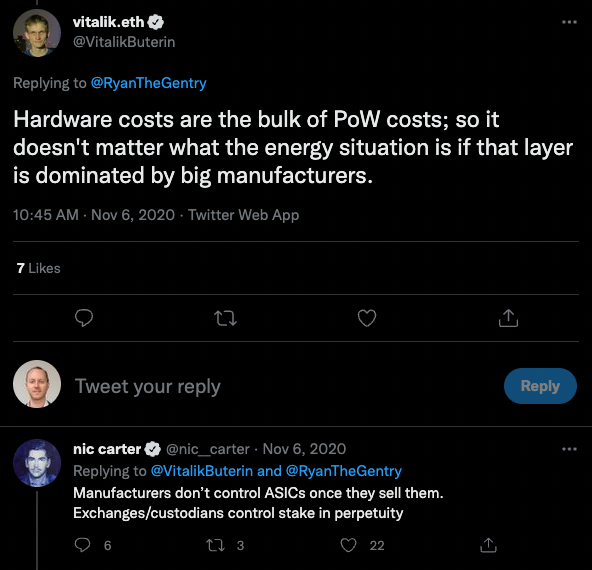

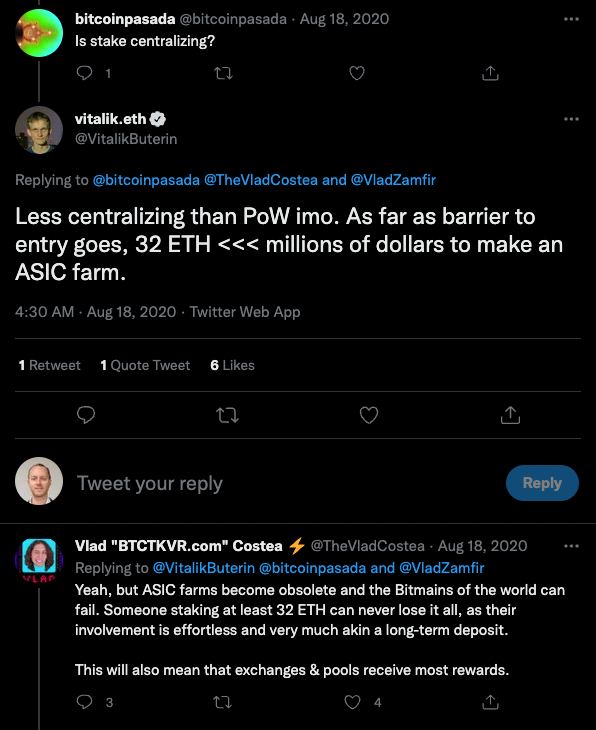

3/ V gets a lot wrong with this one...

A) V doesn't think exchanges will stake customer deposits. (lol how could he possibly miss this?)

B) "PoW can get captured by big mining cos"

Cheap energy is geo-distributed, often in small packages. Favors a fat tail of smaller miners.

A) V doesn't think exchanges will stake customer deposits. (lol how could he possibly miss this?)

B) "PoW can get captured by big mining cos"

Cheap energy is geo-distributed, often in small packages. Favors a fat tail of smaller miners.

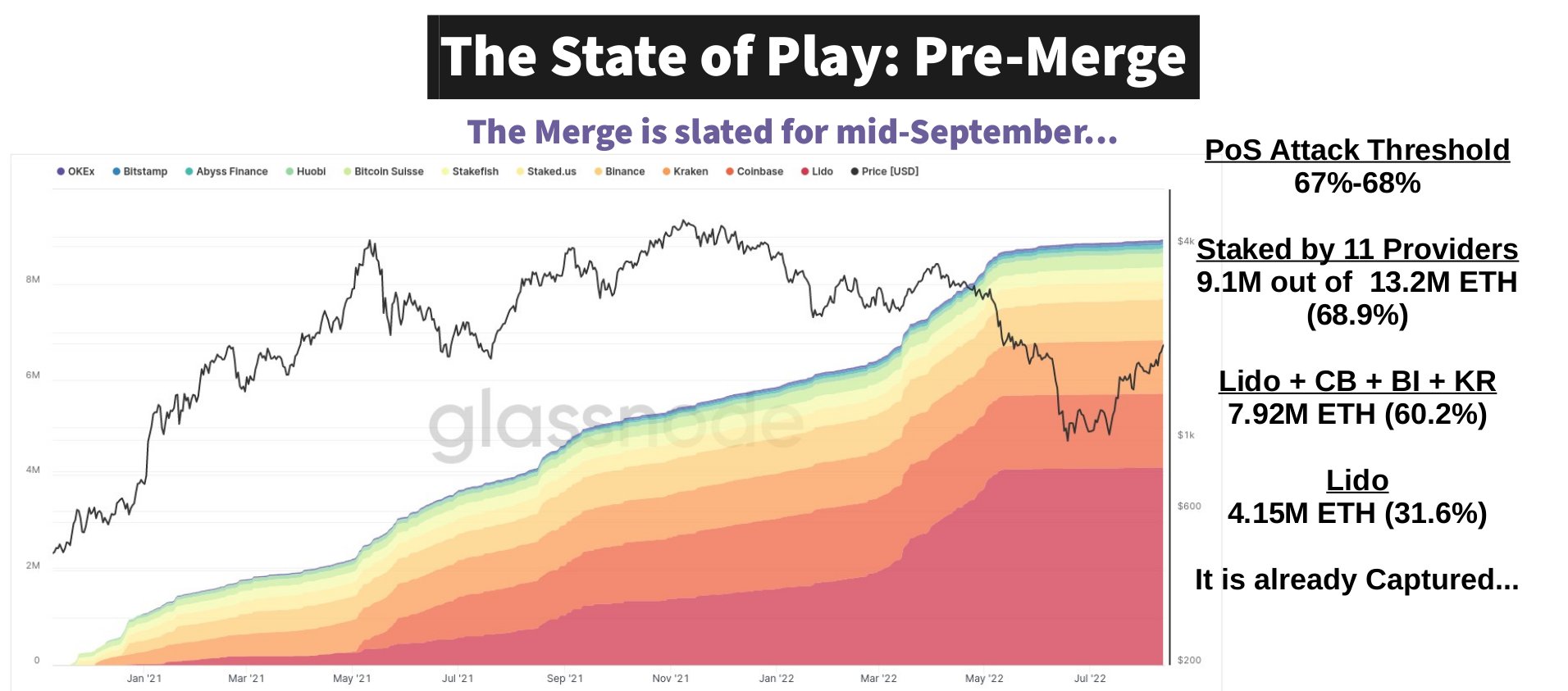

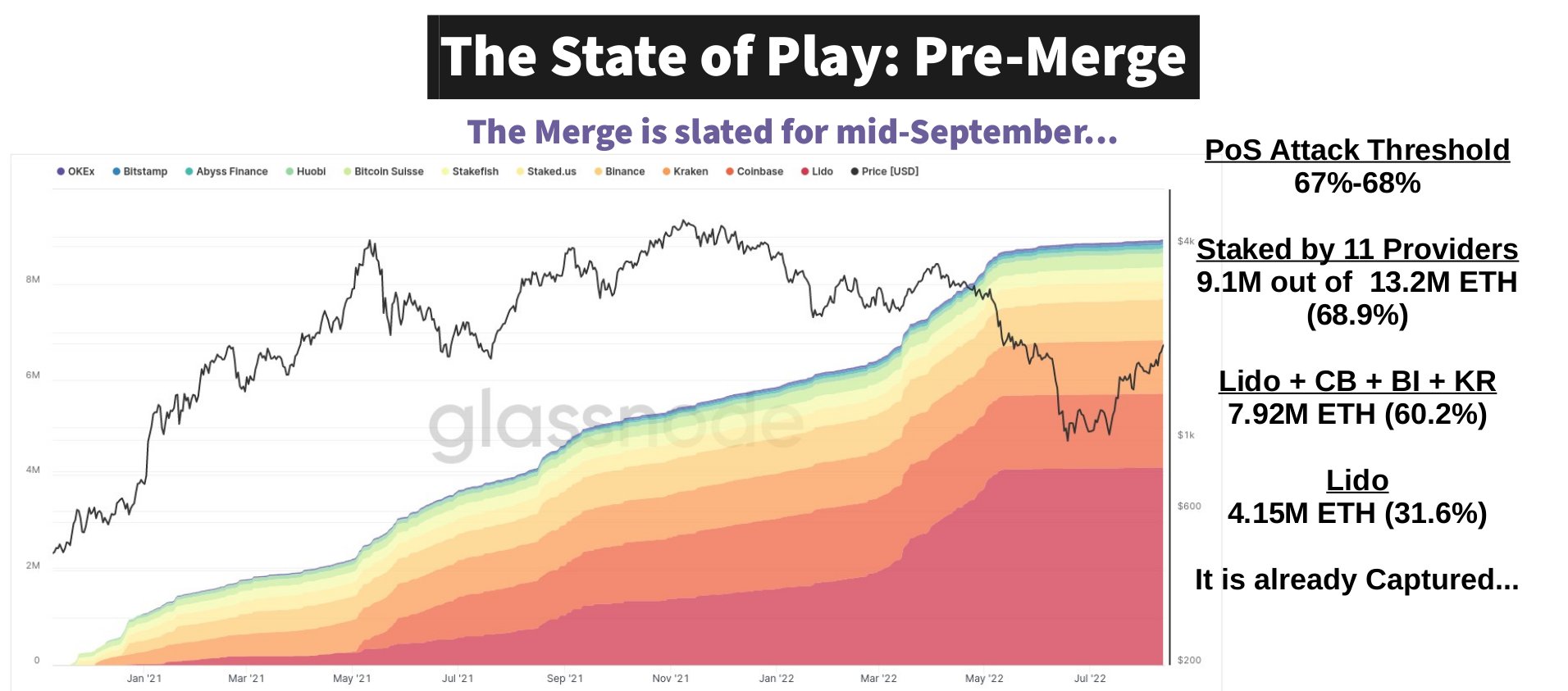

3.1/ Quick chart showing how 67%+ of Ethereum stake is sitting on 11 regulated providers.

Hopefully, the USG doesn't sanction these entities (or coerce them to implement KYC, etc)

good luck slashing the government-compliant chain

h/t @_Checkmatey_

Hopefully, the USG doesn't sanction these entities (or coerce them to implement KYC, etc)

good luck slashing the government-compliant chain

h/t @_Checkmatey_

4/ V argues “ASIC manufacturers are a monopoly"

This risk is real for Bitcoin, but less so each day as ASICs are becoming commoditized, reducing manufacturer bottleneck.

(~stock to flow of ASICS is increasing over time)

Larger issue here in PoS as @nic__carter point out.

This risk is real for Bitcoin, but less so each day as ASICs are becoming commoditized, reducing manufacturer bottleneck.

(~stock to flow of ASICS is increasing over time)

Larger issue here in PoS as @nic__carter point out.

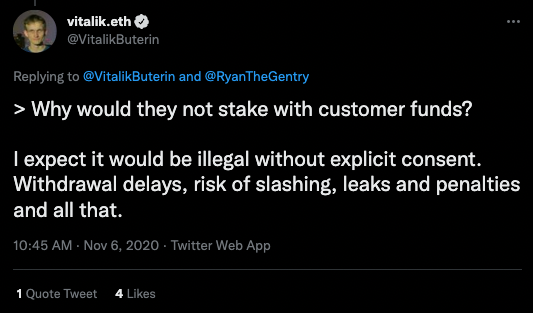

5/ Vitalik doubles down on bad logic (already proven wrong)

"exchanges WON’T stake with customer funds due to risk of slashing"

Come on... Risk of slashing is a major reason to outsource staking. Incentivizes exchanges/providers to gobble up supply. Convenience wins

"exchanges WON’T stake with customer funds due to risk of slashing"

Come on... Risk of slashing is a major reason to outsource staking. Incentivizes exchanges/providers to gobble up supply. Convenience wins

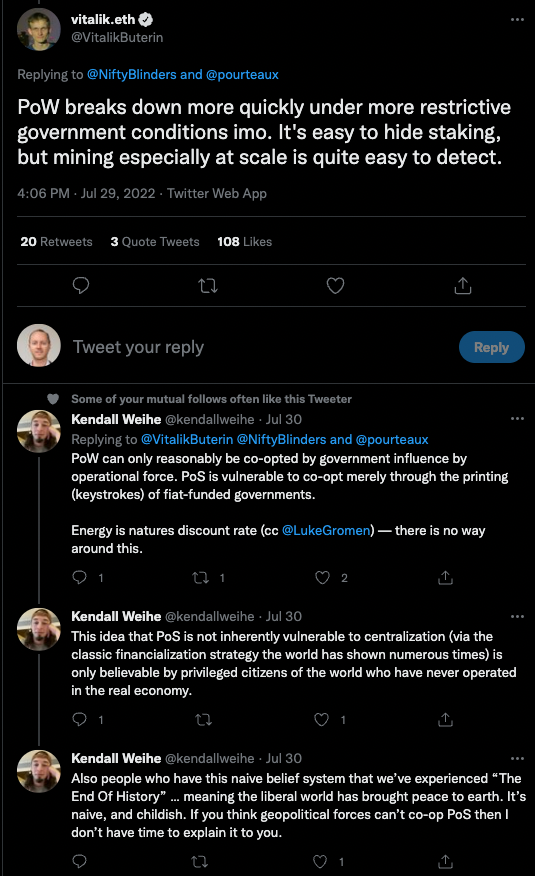

6/ "Physical PoW easier to attack than digital PoS"

PoW: Attack requires global coordination in a multi-polar world. Expensive attack, easy to fail.

PoS: Eth stake is walking into the financialization trap just like gold. Cheap attack, hard to stop.

h/t @kendallweihe

PoW: Attack requires global coordination in a multi-polar world. Expensive attack, easy to fail.

PoS: Eth stake is walking into the financialization trap just like gold. Cheap attack, hard to stop.

h/t @kendallweihe

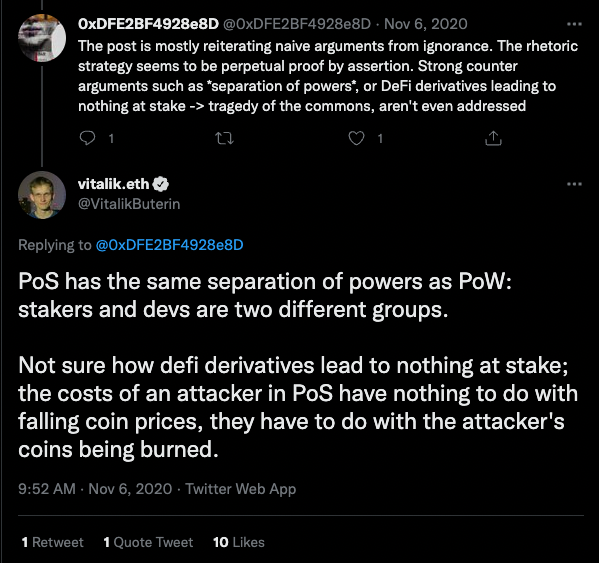

7/ Vitalik says separation of powers are the same in PoW and PoS

Major issue here...

PoS: economic power = political power. No longer neutral, it's political money. new boss 🤝 old boss.

PoW: separates economic power from political power. Enables neutral commodity money

Major issue here...

PoS: economic power = political power. No longer neutral, it's political money. new boss 🤝 old boss.

PoW: separates economic power from political power. Enables neutral commodity money

8.1/ @VitalikButerin argues barriers to entry...

PoS: 32 ETH costs $60k today, most cannot afford that. So they delegate which is a centralization risk.

PoW: Home BTC miners can buy an S9 for $200 and start today. (profitability varies widely)

PoS: 32 ETH costs $60k today, most cannot afford that. So they delegate which is a centralization risk.

PoW: Home BTC miners can buy an S9 for $200 and start today. (profitability varies widely)

8.2/ "does stake centralize?"

Forget barriers to entry, real concern = validator set CHURN

PoW: highly competitive, Miners + Hardware Cos go bust. Ensures high churn in block producers (antifragile)

PoS: No risk if you follow majority. Stake, collect rent. Low churn (fragile)

Forget barriers to entry, real concern = validator set CHURN

PoW: highly competitive, Miners + Hardware Cos go bust. Ensures high churn in block producers (antifragile)

PoS: No risk if you follow majority. Stake, collect rent. Low churn (fragile)

9/ Seriously?

Ruthless competition means miners fail regularly.

Stakers essentially earn risk-free yield indefinitely.

Not to mention the Lubin's of the world premined their stake. (tbf the market doesnt seem to care. But it feels immoral if ETH is supposed to be money)

Ruthless competition means miners fail regularly.

Stakers essentially earn risk-free yield indefinitely.

Not to mention the Lubin's of the world premined their stake. (tbf the market doesnt seem to care. But it feels immoral if ETH is supposed to be money)

10/ “lots of PoS chains have been working successfully” -@VitalikButerin

I guess if you don’t care about censorship resistance… then sure go ahead with PoS.

Otherwise, go look at BSC, Solona, Tron, Stream, and Peercoin. I assume Ethereans don’t want to go that direction?

I guess if you don’t care about censorship resistance… then sure go ahead with PoS.

Otherwise, go look at BSC, Solona, Tron, Stream, and Peercoin. I assume Ethereans don’t want to go that direction?

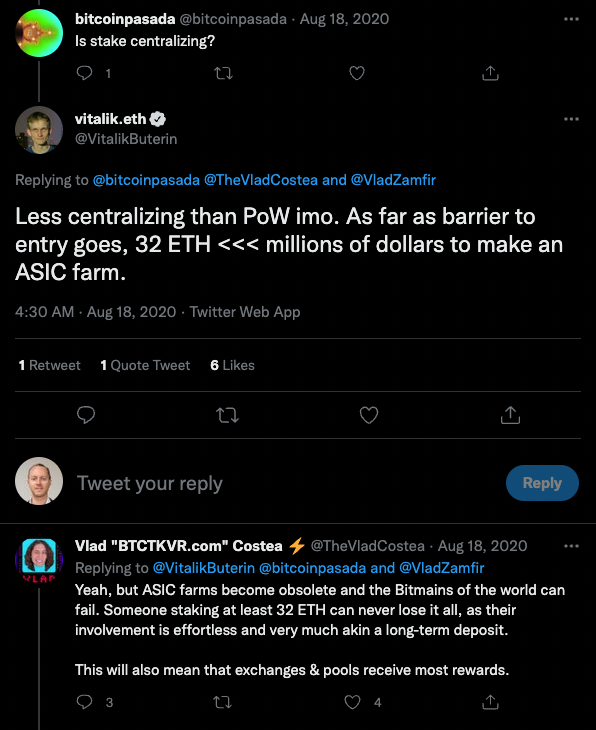

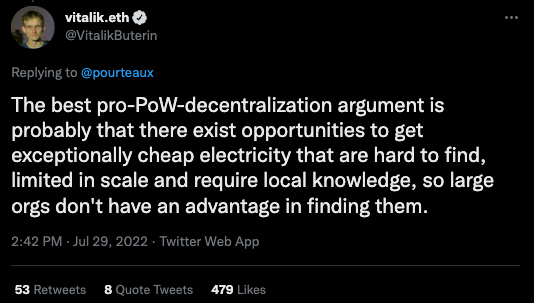

11/ Yay! @VitalikButerin started learning about energy markets.

It also dismantles several of his previous claims that PoW centralizes simply due to economies of scale.

It also dismantles several of his previous claims that PoW centralizes simply due to economies of scale.

12/ Reminder that PoW is the innovation here.

PoW enables a non-political money.

ETH abandoning what works (PoW) seems very risky.

Too late now though. Social consensus in ETH land is PoW is bad.

How many verified this claim? How many trusted Vitalik because he’s smart?

PoW enables a non-political money.

ETH abandoning what works (PoW) seems very risky.

Too late now though. Social consensus in ETH land is PoW is bad.

How many verified this claim? How many trusted Vitalik because he’s smart?

13/ P.S. Why would a Bitcoiner care?

PoS is not going to "fail" like many bitcoiners say.

It's worse than that.

I fear PoS will hand the keys of the castle to the state.

Same state that wants to implement a dystopian CBDC system.

Watch this:

www.youtube.com/watch?v=gyP0uxxB6V8

PoS is not going to "fail" like many bitcoiners say.

It's worse than that.

I fear PoS will hand the keys of the castle to the state.

Same state that wants to implement a dystopian CBDC system.

Watch this:

www.youtube.com/watch?v=gyP0uxxB6V8

P.P.S. It’s not too late to change your mind

P.P.P.S Joe Lubin is courting the WEF/Davos crowd to put a CBDC on a "permissioned ethereum"

Ethereum is walking right into a trap. Sad.

Ethereum is walking right into a trap. Sad.

Mentions

See All

Gigi @dergigi

·

Aug 16, 2022

Solid thread.