Thread by Chris Giles

- Tweet

- Jul 21, 2022

- #EconomicGrowth #Inflation #UnitedKingdom

Thread

TRUSSONOMICS: a thread

In her interview on @BBCr4today, Liz Truss made 3 economic propositions

1) Her tax cuts will decrease inflation

2) Tax cuts boost growth and prevent recession

3) Tax cuts increase government revenues

It would be great if these were true

1/

In her interview on @BBCr4today, Liz Truss made 3 economic propositions

1) Her tax cuts will decrease inflation

2) Tax cuts boost growth and prevent recession

3) Tax cuts increase government revenues

It would be great if these were true

1/

@BBCr4today "My tax cuts will decrease inflation", Truss said, because "reducing NI and reducing corporation tax increases the supply side of the economy".

Problem is that these might improve the supply side, but they also increase demand.

2/

Problem is that these might improve the supply side, but they also increase demand.

2/

@BBCr4today To argue that corporation tax cuts improve supply requires a large business investment response - and business investment is demand

The demand comes first, the supply later - so this must be inflationary

3/

The demand comes first, the supply later - so this must be inflationary

3/

@BBCr4today The NI cuts could incraese labour supply, but the loss of workers we have is linked most strongly to long-term sickness (so this is difficult to argue)

Reducing employer NI increases labour demand not supply

4/

Reducing employer NI increases labour demand not supply

4/

@BBCr4today If the Bank of England thinks there is no spare capacity (it does), then this increase in demand will lead to higher interest rates, which raise the price of business investment, offsetting the effect of lower corporation tax

5/

5/

Generally, economists think the demand effects would be many times larger than the supply effects - it is a reason Joe Biden's plans have run into so much trouble...

...Here is a former Obama adviser making the same points for the US

6/

...Here is a former Obama adviser making the same points for the US

6/

Proposition 2: Truss said she did not want to "choke off growth by raising taxes", and called instead for tax cuts to boost growth.

You might say proposition2 contradicts proposition1....

It does generally UNLESS the supply side boost is extraordinarily large

7/

You might say proposition2 contradicts proposition1....

It does generally UNLESS the supply side boost is extraordinarily large

7/

But Truss here runs into the roadblock of independent economic institions

BoE thinks spare capacity is small, so it will raise interest rates to offset the demand side tax cut effect.

eg Saunders

8/

www.resolutionfoundation.org/events/monetary-policy-in-troubled-times-and-beyond/

8/

BoE thinks spare capacity is small, so it will raise interest rates to offset the demand side tax cut effect.

eg Saunders

8/

www.resolutionfoundation.org/events/monetary-policy-in-troubled-times-and-beyond/

8/

So Truss would have to do something about the BoE to change its view on what is and what isn't inflationary

9/

9/

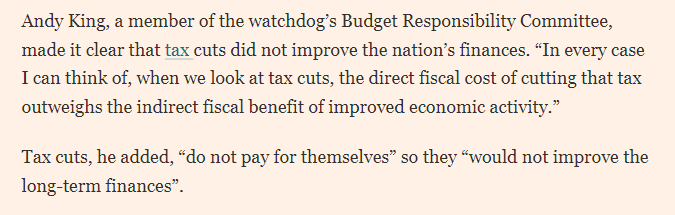

Proposition3: "What I want to do is increase revenues by growing the economy". This again depends on the assessment that there is spare capacity available.

BoE rejects this.

OBR says tax cuts do not pay for themselves

www.ft.com/content/ae63f4fb-184e-42b0-8d46-7a8a9be89cf4

10/

BoE rejects this.

OBR says tax cuts do not pay for themselves

www.ft.com/content/ae63f4fb-184e-42b0-8d46-7a8a9be89cf4

10/

To sum up.

For Trussonomics to work, there needs to be lots of spare capacity at a time of low unemployment and record job vacancies....and for the supply effects of tax changes to outweigh the demand effects

Highly unlikely (but anything is possible)

11/

For Trussonomics to work, there needs to be lots of spare capacity at a time of low unemployment and record job vacancies....and for the supply effects of tax changes to outweigh the demand effects

Highly unlikely (but anything is possible)

11/

What is definite is that the UK's economic institutions do not believe the conditions exist for these three propositions to be true

So Trussonomics is radical. It would involve changing the economic institutions for the experiment to be tried

12/

So Trussonomics is radical. It would involve changing the economic institutions for the experiment to be tried

12/

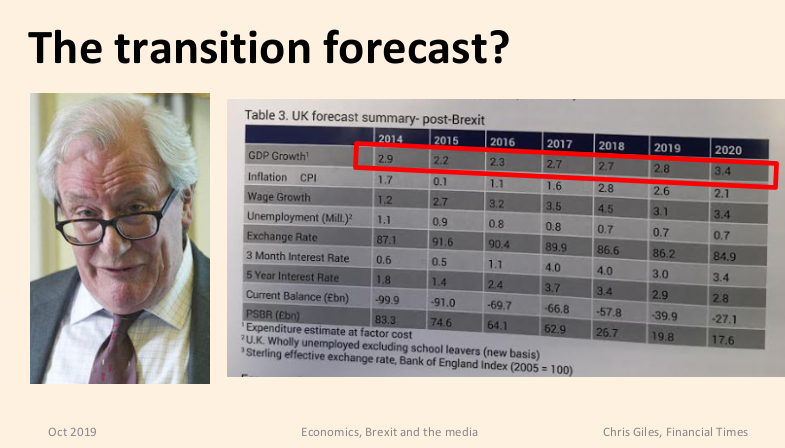

She is right that Patrick Minford is supportive

But his record in forecasting the effects of Brexit were not something to boast about

ENDS

www.telegraph.co.uk/news/2022/07/16/no-rishi-mrs-thatcher-would-not-have-raised-taxes-70-year-high/

But his record in forecasting the effects of Brexit were not something to boast about

ENDS

www.telegraph.co.uk/news/2022/07/16/no-rishi-mrs-thatcher-would-not-have-raised-taxes-70-year-high/