Thread

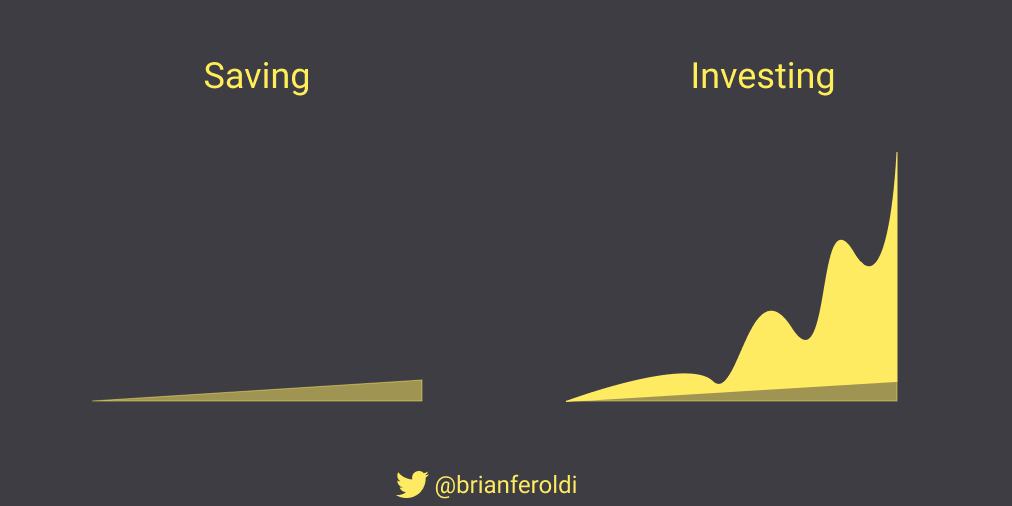

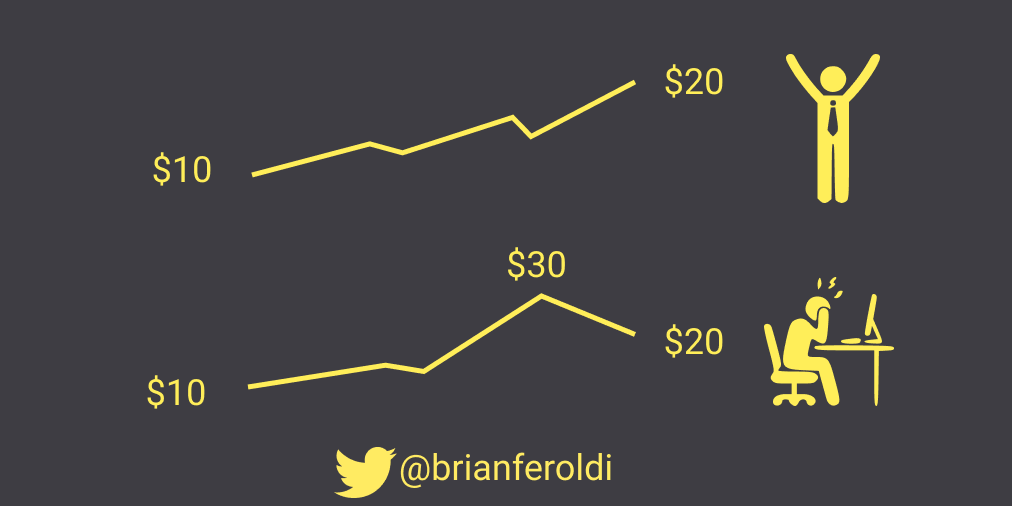

4: In the beginning, your savings rate is all that matters

Over time, your investment returns become all that matter

Over time, your investment returns become all that matter

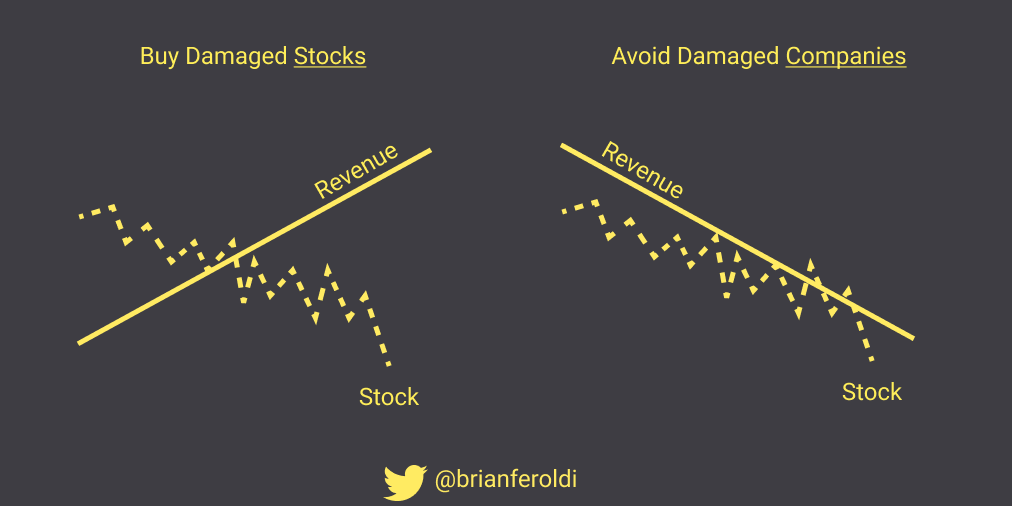

5: What’s risky in the short-term is safe in the long-term

What’s safe in the short-term is risky in the long-term

What’s safe in the short-term is risky in the long-term

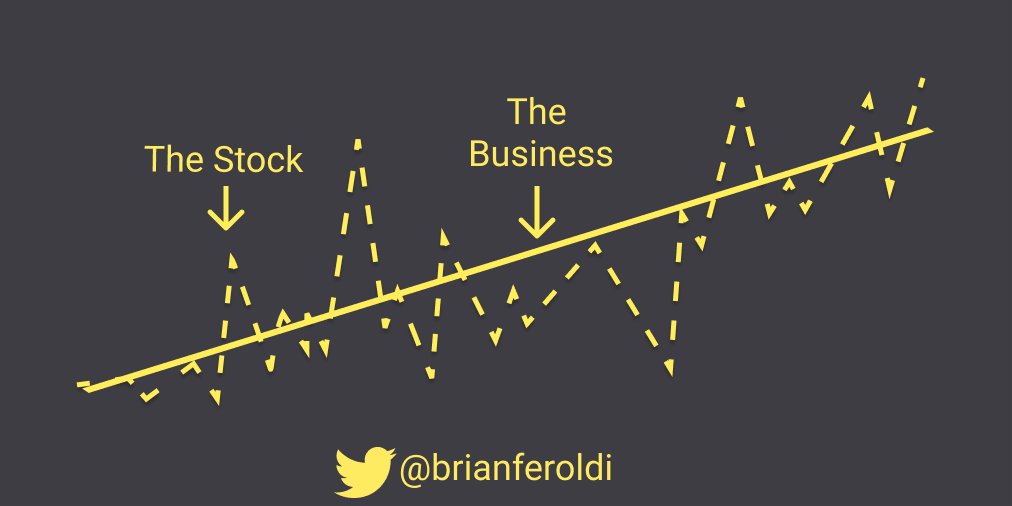

8: The business and the stock are 0% correlated in the short-term, but 100% correlated in the long-term

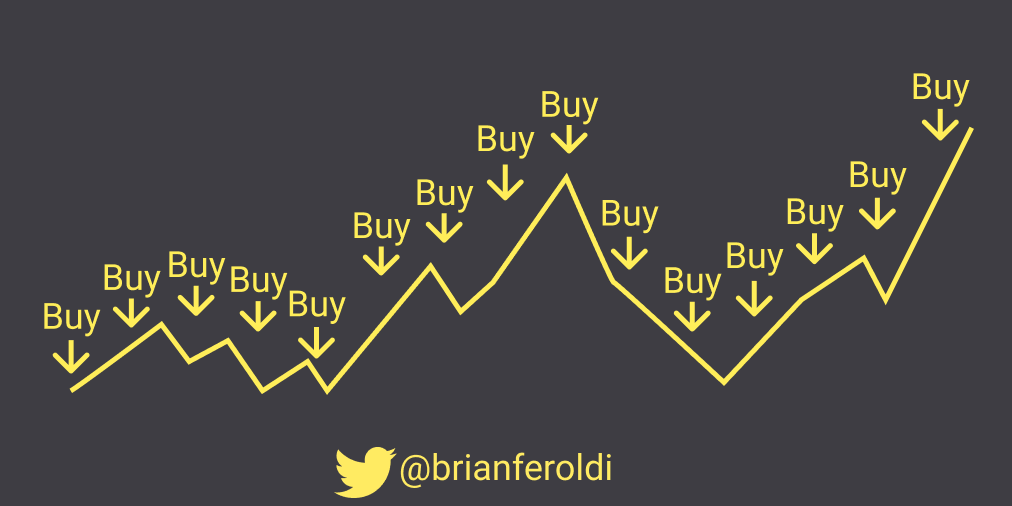

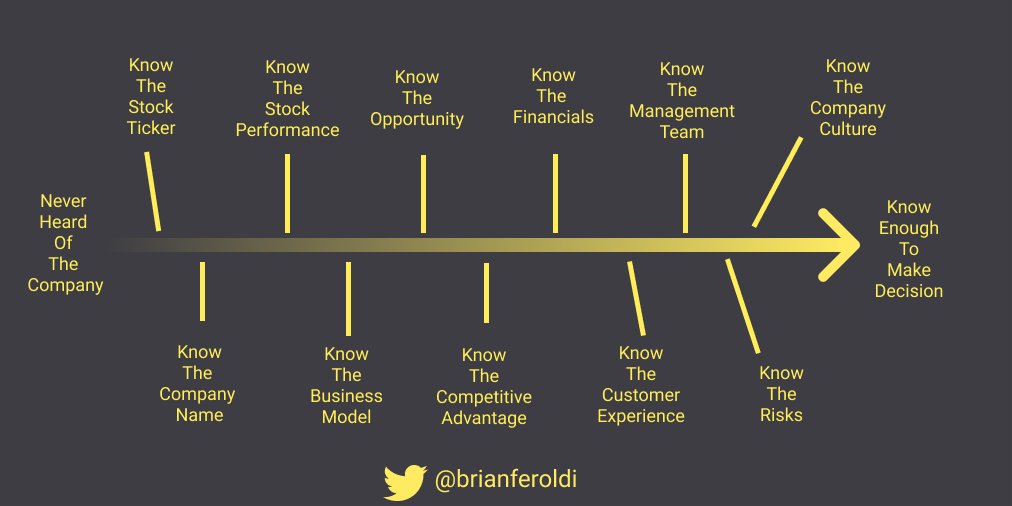

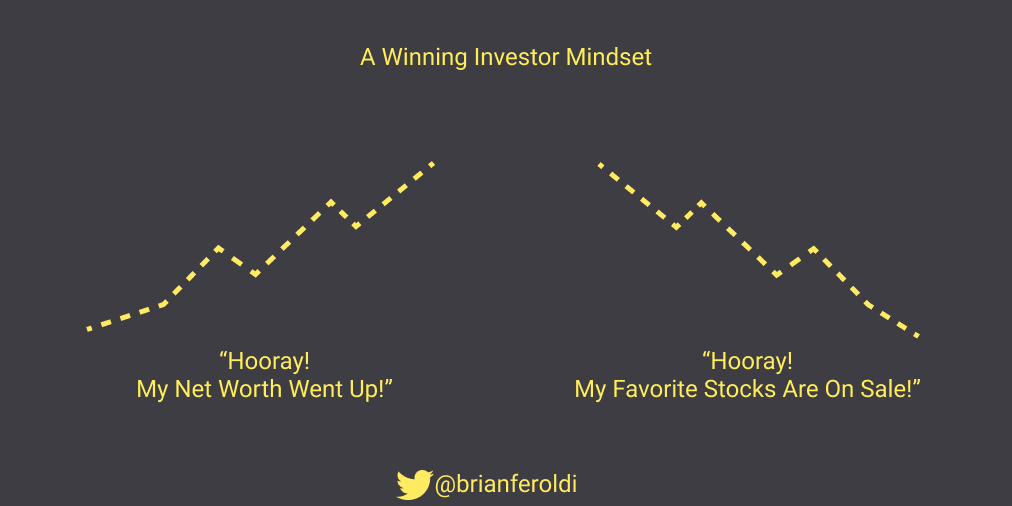

9: Humans are born to be bad at investing

Understand that your emotions are going to play all kinds of tricks on you along the way

Understand that your emotions are going to play all kinds of tricks on you along the way

If you like these images, you'll love my free newsletter

▪️One simple graphic like this

▪️One piece of timeless content

▪️One Twitter thread

▪️One resource

▪️One quote

Join 26,052+ others by signing up here:

mindset.brianferoldi.com

▪️One simple graphic like this

▪️One piece of timeless content

▪️One Twitter thread

▪️One resource

▪️One quote

Join 26,052+ others by signing up here:

mindset.brianferoldi.com