Thread

Financial cabin pressure is rising as quickly as price.

In the span of human history, debt based systems have known a single destiny.

When gazing across the present landscape of money, labor, and credit- the spectrum of outcomes has only one hue: debase until bust.🧵

In the span of human history, debt based systems have known a single destiny.

When gazing across the present landscape of money, labor, and credit- the spectrum of outcomes has only one hue: debase until bust.🧵

The Fed, limited by a lens of tradition, is driven on by an unemployment rate warped from secular demographic shifts.

They will likely march forward until the labor market, largely bereft of its willing supply, capitulates from consumer weakness.

They will likely march forward until the labor market, largely bereft of its willing supply, capitulates from consumer weakness.

A tandem deterioration of corporate debt is possible. Businesses may find their solvency torched by illiquid lending markets and generationally high costs in non-discretionary goods, which limit consumers' ability to spend freely & drive expansion.

In the midst of this, rising rates put upward pressure on the cost of public debt, pushing interest expense higher in a period of economic weakness and wider deficits.

The US spends more than 50% of its annual defense budget solely to maintain its debt.

The US spends more than 50% of its annual defense budget solely to maintain its debt.

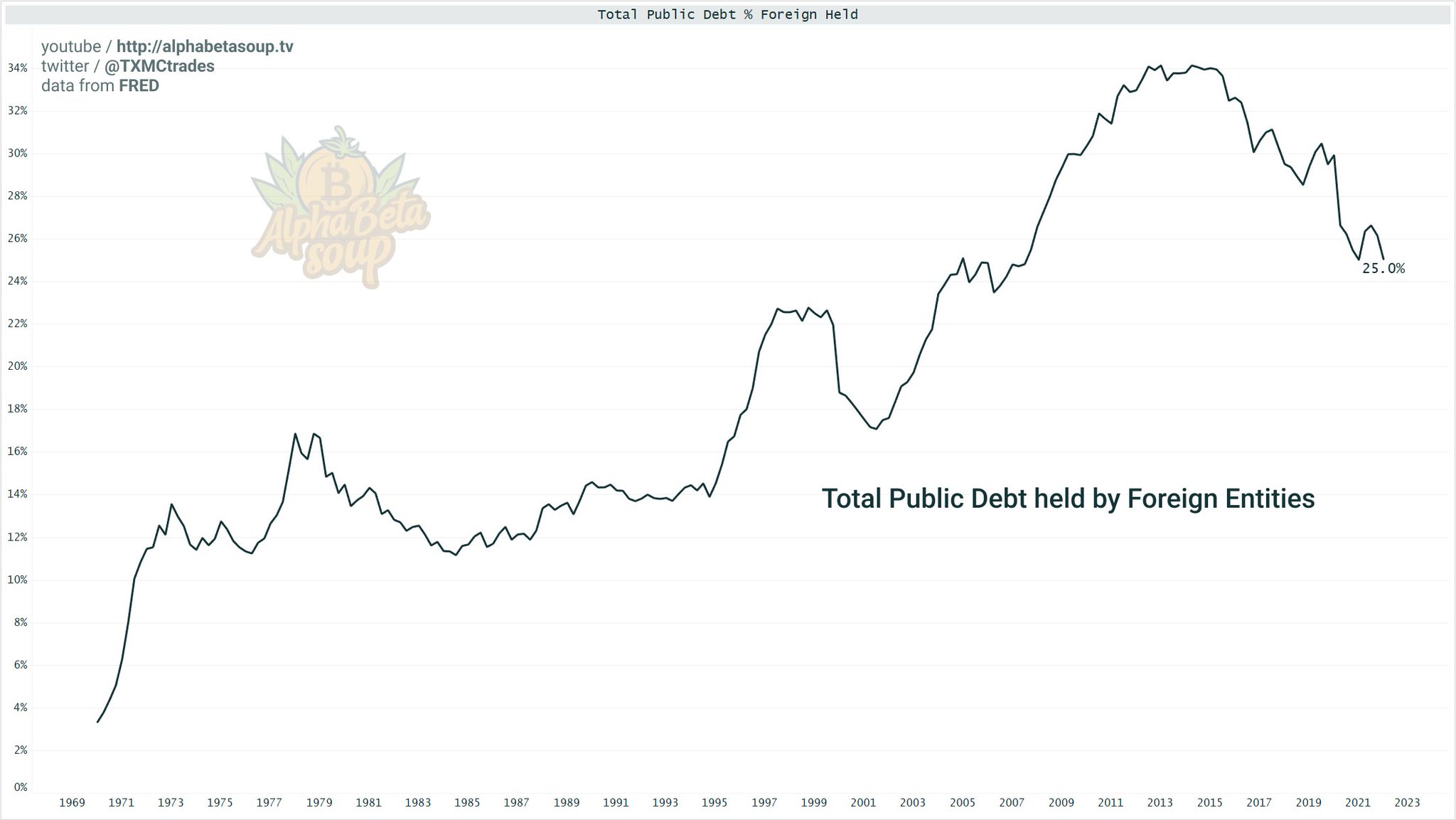

As the dollar shows resilience and rates rise, foreign appetite for treasuries diminishes. Chances increase that foreign entities sell USTs in the race for dollars.

Unless the private sector can fill the void in this environment, Uncle Sam becomes the buyer of last resort.

Unless the private sector can fill the void in this environment, Uncle Sam becomes the buyer of last resort.

My base case is that the Fed won't reach their 3.5% terminal rate target.

Debt levels are historically high, and if the 2yr Treasury is any indication, getting beyond 3% will be a struggle.

All prior times Fed Funds met the 2yr (since 1988), hikes in that cycle were ended.

Debt levels are historically high, and if the 2yr Treasury is any indication, getting beyond 3% will be a struggle.

All prior times Fed Funds met the 2yr (since 1988), hikes in that cycle were ended.

From my perspective, the left tail risk is extremely wide, and I hesitate to describe outcomes in much detail.

I suspect the final innings may catch many off guard with the pace at which they unfold, particularly those who discount the macro picture.

I suspect the final innings may catch many off guard with the pace at which they unfold, particularly those who discount the macro picture.

The US, faced with withering demographics and generational debt, will see their tightening plans ultimately (and soon) meet the cold reality of math.

They will borrow from themselves in order to spend, and in ever higher sums.

They will, as the only alternative will be default.

They will borrow from themselves in order to spend, and in ever higher sums.

They will, as the only alternative will be default.

When they're forced to ease into stubbornly elevated costs, inflation (and inflation expectations) become entrenched.

As debasement begins anew, the opportunity cost of holding cash explodes, and markets become a race for yield ahead of accelerating prices.

As debasement begins anew, the opportunity cost of holding cash explodes, and markets become a race for yield ahead of accelerating prices.

QE may come in various forms. In 2020 they threw the kitchen sink at the economy.

The next time, they may attempt targeted stimulus. Think gas and food stipends for lower income brackets, rent subsidies, etc.

All of these are inflationary and driven by political expediency.

The next time, they may attempt targeted stimulus. Think gas and food stipends for lower income brackets, rent subsidies, etc.

All of these are inflationary and driven by political expediency.

Perhaps we will be "lucky" and the engineered recession will slay the inflation dragon, allowing them to loosen without stagflationary risk.

But in the face of fertilizer shortages, reduced harvests, and diminished long-term energy capex, inflation is bound to remain stubborn.

But in the face of fertilizer shortages, reduced harvests, and diminished long-term energy capex, inflation is bound to remain stubborn.

The duration & sequence of events is impossible to predict, but the outcome is a dance humans have repeated for a millenium.

Credit based fiat systems must constantly expand lest they buckle under the weight of their own carrion.

Credit based fiat systems must constantly expand lest they buckle under the weight of their own carrion.

This cyclical boom and bust of credit may continue on for years, despite the predictions of sovereign collapse by some.

But make no mistake, we are firmly in the transformational phase of the saeculum, and the next decade will be a defining era for all living through it.

But make no mistake, we are firmly in the transformational phase of the saeculum, and the next decade will be a defining era for all living through it.

The dissolution of monetary systems plays out over generations.

In the wake of change, as far back as Ancient China, civilizations ultimately reject the fragility of fiat and return to hard assets. To sound money...for a time.

In the wake of change, as far back as Ancient China, civilizations ultimately reject the fragility of fiat and return to hard assets. To sound money...for a time.

In the past, gold and commodities fit the role of escape valve.

But now, an un-confiscatable digital commodity exists for the first time in humanity's story: #Bitcoin

A tale as old as time, but with a new twist.

Thus is the core of my long term thesis.

But now, an un-confiscatable digital commodity exists for the first time in humanity's story: #Bitcoin

A tale as old as time, but with a new twist.

Thus is the core of my long term thesis.