Thread

Been hearing more and more about how the “next shoe to drop” is BTC miner capitulation. We’ll see some of that, sure, and hash rate is already heading down (30dMA chart @coinmetrics). But I don’t think this will mean miners dumping a ton of BTC on the market. Why? 🧵: /1

@coinmetrics 1) Credit for ASIC purchases may be harder to get, but it won’t totally dry up. Lenders will still lend to good credit risks, many miners ARE good credit risks, and terms will be tougher/more expensive but lenders+ borrowers will find a point that works.

www.coindesk.com/business/2022/06/17/bitfarms-looks-to-boost-liquidity-with-sale-of-1500-bitcoin-new-...

www.coindesk.com/business/2022/06/17/bitfarms-looks-to-boost-liquidity-with-sale-of-1500-bitcoin-new-...

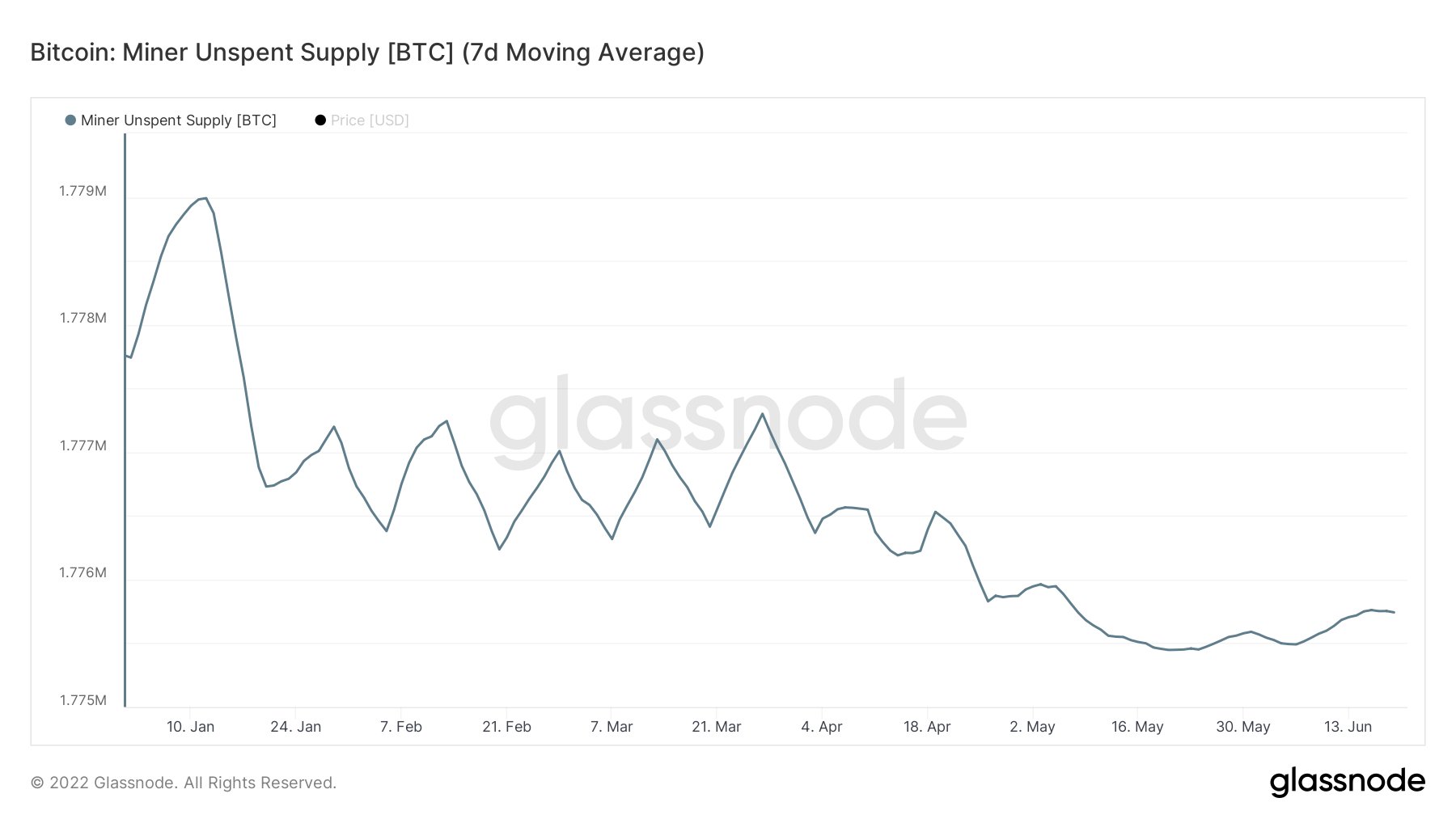

@coinmetrics 2) As Bitfarms showed us last week, some BTC is being sold. Knowing how much is held by miners is tricky because of labelling heuristics. One “sure” data point is where new BTC ends up. The supply of unmoved new BTC has been dropping, but that doesn’t mean it’s sold. (@glassnode)

Speaking of heuristics, the receiving address of new BTC is easy, but most mining is done by pools so new BTC gets distributed. How then to measure? 0 hops? 1 hop? 2? Look at that 0- and 1-hop jump, just when we thought miners would be selling. (Doesn’t mean they’re not.) /4

3) This uncertainty may make it look like BTC is being dumped on the market, but it could just be moving to new addresses, lenders or sales to other miners. We are likely to see some take advantage of the market stress to acquire the operations of others.

www.coindesk.com/business/2022/06/01/bear-market-could-see-some-crypto-miners-turning-to-ma-for-survi...

www.coindesk.com/business/2022/06/01/bear-market-could-see-some-crypto-miners-turning-to-ma-for-survi...

4) The BTC mining industry today is so different from 2018 – more professional, more financialized, a range of options when it comes to funding (yes, even in this market). That does include BTC sales, but distressed miners don't necessarily HAVE to dump.

www.coindesk.com/business/2022/06/06/crypto-miner-hut-8-bucks-trend-by-hodling-its-mined-bitcoins/

www.coindesk.com/business/2022/06/06/crypto-miner-hut-8-bucks-trend-by-hodling-its-mined-bitcoins/