Thread by Brian Feroldi

- Tweet

- Jul 3, 2022

- #Investment #Stockmarket

Thread

I’ve bought dozens of bad stocks that lost me money

Here are 8 unforgettable failures (and the painful lesson that I learned the hard way):🤦♂️

Here are 8 unforgettable failures (and the painful lesson that I learned the hard way):🤦♂️

IBM - $IBM

Remember when Warren Buffett bet big on IBM?

I did too

I set up a bullish options position on $IBM at $200 because it was:

✅An iconic brand

✅Had Buffett’s approval

✅Cheap!

Remember when Warren Buffett bet big on IBM?

I did too

I set up a bullish options position on $IBM at $200 because it was:

✅An iconic brand

✅Had Buffett’s approval

✅Cheap!

Yet, $IBM did nothing but go down, down, down….

Why? Its core business was being disrupted by the cloud!

I ended up losing a bundle WITH LEVERAGE

Lesson: 1) Avoid leverage and 2) "Cheap” stocks can get cheaper if the company’s moat is disappearing

Why? Its core business was being disrupted by the cloud!

I ended up losing a bundle WITH LEVERAGE

Lesson: 1) Avoid leverage and 2) "Cheap” stocks can get cheaper if the company’s moat is disappearing

3D System - $DDD

In the early 2010s, 3D printing was all the rage

3D Systems was a top dog & first mover and its business & stock were doing incredibly well

I bought into the hype

In the early 2010s, 3D printing was all the rage

3D Systems was a top dog & first mover and its business & stock were doing incredibly well

I bought into the hype

The bubble soon burst...

3D System’s growth started to slow and the stock went down, down, down...

I didn't fully understand the hype cycle, which ended up costing me a bundle

Lesson: The hype cycle is real. Study it!

3D System’s growth started to slow and the stock went down, down, down...

I didn't fully understand the hype cycle, which ended up costing me a bundle

Lesson: The hype cycle is real. Study it!

Portfolio Recovery - $PRAA

PRAA is a debt collector. It buys distressed debt for pennies and then collects.

At the time, it checked a lot of boxes:

✅Founder-run

✅Profitable

✅High growth

Lots to like and I thought the growth was sustainable…

PRAA is a debt collector. It buys distressed debt for pennies and then collects.

At the time, it checked a lot of boxes:

✅Founder-run

✅Profitable

✅High growth

Lots to like and I thought the growth was sustainable…

It wasn't

PRAA depended on the continual supply of new, cheap debt to buy. That was a factor beyond management’s control

Debt markets dried up. Growth slowed. The stock fell hard. I sold at a loss

Lesson: Be wary of companies who rely heavily on outside forces

PRAA depended on the continual supply of new, cheap debt to buy. That was a factor beyond management’s control

Debt markets dried up. Growth slowed. The stock fell hard. I sold at a loss

Lesson: Be wary of companies who rely heavily on outside forces

CorEnergy - $CORR

CORR is an energy finance company

It buys mission-critical assets from energy companies and then leased them back.

Profits were sent to shareholders as big dividends.

✅No operating risk

✅Huge dividend

✅Good valuation

"How can I lose?" I thought

CORR is an energy finance company

It buys mission-critical assets from energy companies and then leased them back.

Profits were sent to shareholders as big dividends.

✅No operating risk

✅Huge dividend

✅Good valuation

"How can I lose?" I thought

Well, I lost

The business model fell apart when energy prices collapsed

CorEnergy’s CUSTOMERS got crushed by the falling energy prices and couldn't pay

Profits collapsed. The dividend & stock got crushed.

Lesson: A company’s financials are only as healthy as its customers

The business model fell apart when energy prices collapsed

CorEnergy’s CUSTOMERS got crushed by the falling energy prices and couldn't pay

Profits collapsed. The dividend & stock got crushed.

Lesson: A company’s financials are only as healthy as its customers

GrubHub - $GRUB

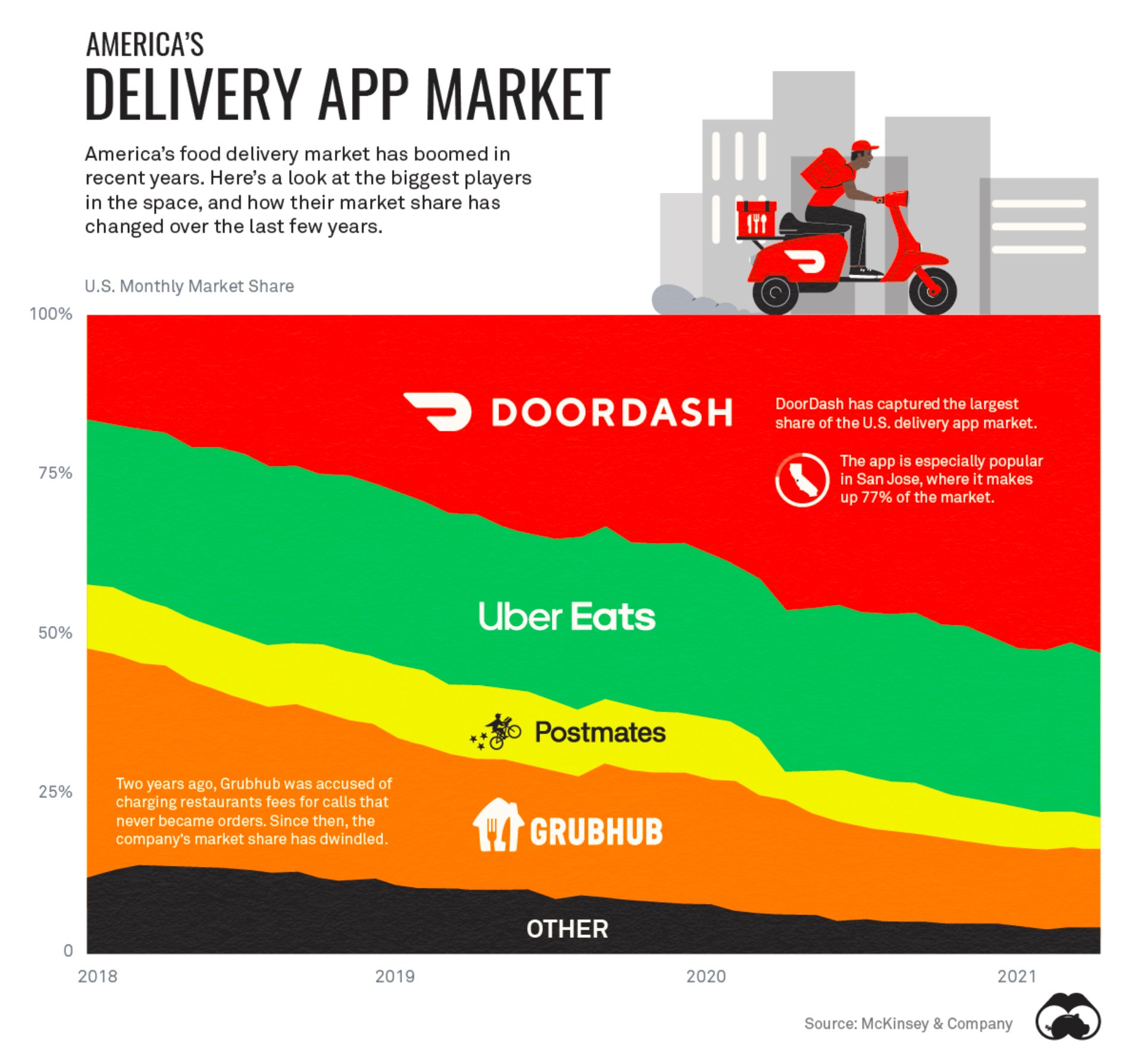

Food delivery is in a bull market. GrubHub was the early market leader.

✅Founder-led

✅Profitable

✅High growth

✅Network effect moat! (or so I thought)

Lots to like, so I paid a premium to become a shareholder

Food delivery is in a bull market. GrubHub was the early market leader.

✅Founder-led

✅Profitable

✅High growth

✅Network effect moat! (or so I thought)

Lots to like, so I paid a premium to become a shareholder

It turns out that GrubHub’s moat wasn’t wide at all

UberEats and DoorDash stole TONS of market share

GrubHub started spending heavily on marketing. Profits evaporated. The stock got crushed.

I sold at a big loss

Lesson: Not all network effects are created equally

UberEats and DoorDash stole TONS of market share

GrubHub started spending heavily on marketing. Profits evaporated. The stock got crushed.

I sold at a big loss

Lesson: Not all network effects are created equally

Under Armour - $UA

UA checked ALL of the boxes…

✅ High growth

✅ Profits

✅ Great brand

✅ Huge TAM

✅ Founder led

I really thought it was the next Nike

UA checked ALL of the boxes…

✅ High growth

✅ Profits

✅ Great brand

✅ Huge TAM

✅ Founder led

I really thought it was the next Nike

It wasn’t

Kevin Plank (CEO/Founder) became hugely distracted by side projects

The culture went downhill and problems appeared

UA chased growth by selling in discount stores. That killed the brand allure

Lesson: If the moat is brand, and management starts to dilute it, exit

Kevin Plank (CEO/Founder) became hugely distracted by side projects

The culture went downhill and problems appeared

UA chased growth by selling in discount stores. That killed the brand allure

Lesson: If the moat is brand, and management starts to dilute it, exit

Gilead Sciences - $GILD

Gilead's growth SKYROCKETED in 2012 after it launched a cure for Hepatitis C

Revenue + profits were exploding, yet it was only trading for ~11x earnings

High growth + profits + very cheap stock!

I bought a bunch

Gilead's growth SKYROCKETED in 2012 after it launched a cure for Hepatitis C

Revenue + profits were exploding, yet it was only trading for ~11x earnings

High growth + profits + very cheap stock!

I bought a bunch

The stock stagnated and then went down, down, down...

Why? Revenue from its Hepatitis C business WASN'T SUSTAINABLE

Competition soon entered and quickly drove down prices

Revenue + profits stagnated. The stock fell.

The market understood this. I didn’t.

Why? Revenue from its Hepatitis C business WASN'T SUSTAINABLE

Competition soon entered and quickly drove down prices

Revenue + profits stagnated. The stock fell.

The market understood this. I didn’t.

This is why the P/E ratio can be SO deceiving

If the "E" isn't sustainable -- or is artificially inflated -- then the P/E ratio is a mirage

(This is why $COIN's P/E ratio is useless)

Lesson: If the P/E ratio looks "ridiculously cheap", there's probably a good reason

If the "E" isn't sustainable -- or is artificially inflated -- then the P/E ratio is a mirage

(This is why $COIN's P/E ratio is useless)

Lesson: If the P/E ratio looks "ridiculously cheap", there's probably a good reason

RPX Corp - $RPXC

RPX bought patents and then sold them as a subscription service

It was an innovative business model and had lots of big tech companies as customers

It was growing fast and a new way to invest in intellectual property.

I bought it soon after the IPO

RPX bought patents and then sold them as a subscription service

It was an innovative business model and had lots of big tech companies as customers

It was growing fast and a new way to invest in intellectual property.

I bought it soon after the IPO

Growth slowed right after I bought

Why? The company had already captured the lions’ share of its market opportunity BEFORE it came public

Growth rates slowed. The stock fell hard

Lesson: Companies choose WHEN they IPO. Be wary & don’t assume that high growth is here to stay

Why? The company had already captured the lions’ share of its market opportunity BEFORE it came public

Growth rates slowed. The stock fell hard

Lesson: Companies choose WHEN they IPO. Be wary & don’t assume that high growth is here to stay

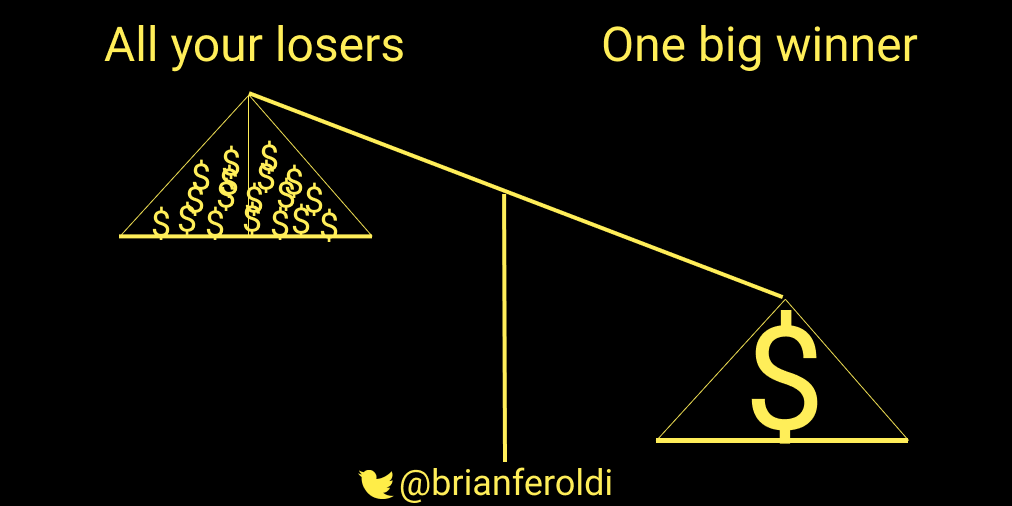

Here's the good news:

My #1 biggest winner of all time — $TSLA — has made me more than ALL of these losers lost COMBINED

That’s how investing in stocks works!

You just need a few big winners to do very, very well

My #1 biggest winner of all time — $TSLA — has made me more than ALL of these losers lost COMBINED

That’s how investing in stocks works!

You just need a few big winners to do very, very well

I have a free newsletter that teaches readers how to think long-term

Each Wednesday I share:

▪️One simple financial graphic

▪️One piece of timeless content

▪️One Twitter thread

▪️One resource

▪️One quote

Interested? Sign up here: mindset.brianferoldi.com

Each Wednesday I share:

▪️One simple financial graphic

▪️One piece of timeless content

▪️One Twitter thread

▪️One resource

▪️One quote

Interested? Sign up here: mindset.brianferoldi.com

I can all but guarantee that some stocks that I own today are going to lose me a bunch of money

I'm OK with that because I'm ready, willing, and able to accept those losses and learn as I go

Investing is a never-ending journey of learning & discovery

I'm OK with that because I'm ready, willing, and able to accept those losses and learn as I go

Investing is a never-ending journey of learning & discovery

Summary:

1: “Cheap” stocks can get cheaper

2: Study the hype cycle

3: Watch for outside forces

4: Think about customer health

5: Not all network effects are created equally

6: Watch for brand dilution

7: The P/E ratio doesn't always work

8: Companies choose when they IPO

1: “Cheap” stocks can get cheaper

2: Study the hype cycle

3: Watch for outside forces

4: Think about customer health

5: Not all network effects are created equally

6: Watch for brand dilution

7: The P/E ratio doesn't always work

8: Companies choose when they IPO