Thread

Jobs numbers have remained strong as other parts of the economy are signaling a recession.

Here’s why jobs numbers matter and what they mean for the future:

Here’s why jobs numbers matter and what they mean for the future:

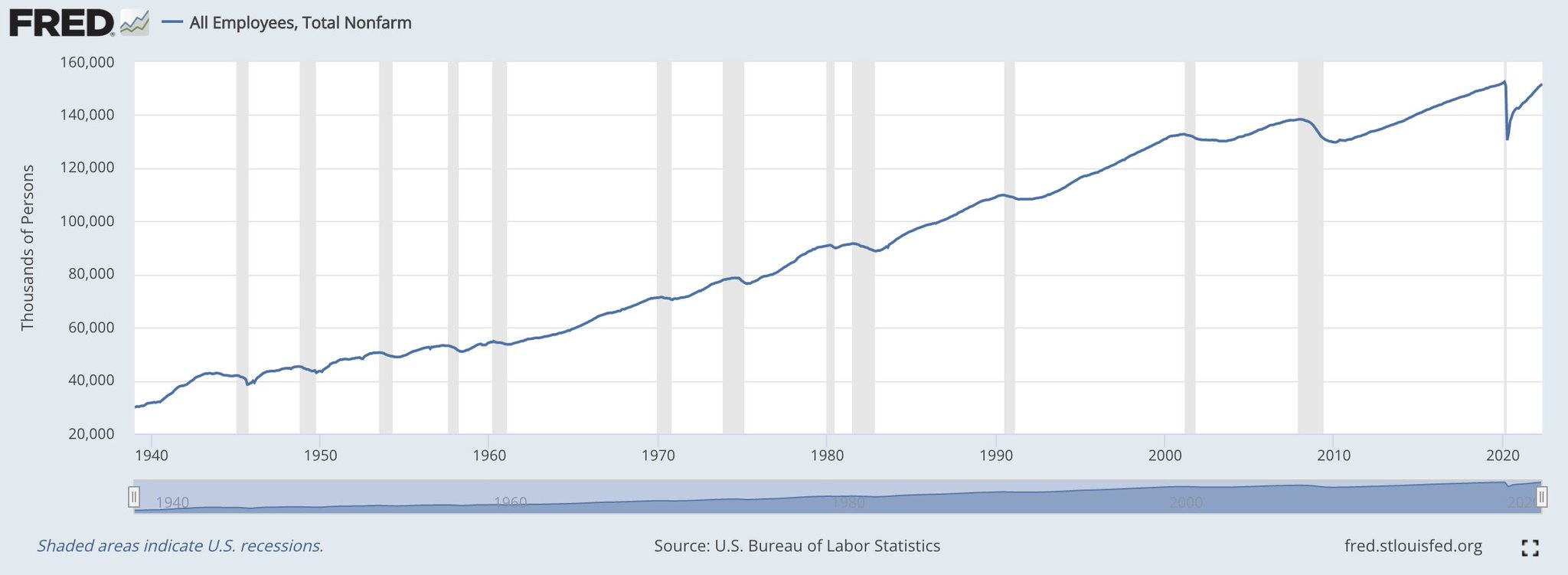

Each month, nonfarm payroll employment is calculated by the Bureau of Labor Statistics to measure the total number of U.S. workers excluding farmers and a few other classifications.

The monthly increase or decrease in nonfarm payroll employment is a strong indicator of how well the job market and overall economy are doing.

Let us take a look at recent job market data, as measured by nonfarm payroll employment.

Let us take a look at recent job market data, as measured by nonfarm payroll employment.

Last month, nonfarm payroll employment increased by 390,000, significantly slowing from a 436,000 increase in April.

The WSJ reports that these job gains were the slowest pace of growth since April 2021, as the job market is no longer “boiling” hot.

www.wsj.com/articles/may-jobs-report-unemployment-rate-2022-11654195243?st=vwzkg2qsohqfjyp&reflink=de...

The WSJ reports that these job gains were the slowest pace of growth since April 2021, as the job market is no longer “boiling” hot.

www.wsj.com/articles/may-jobs-report-unemployment-rate-2022-11654195243?st=vwzkg2qsohqfjyp&reflink=de...

While unemployment approached the pre-pandemic record lows, wage growth has also begun to slow.

Wages grew 5.2% in May, decreasing from the 5.5% increase in April. The decrease in wage growth is a sign that the supply of workers may be increasing.

Wages grew 5.2% in May, decreasing from the 5.5% increase in April. The decrease in wage growth is a sign that the supply of workers may be increasing.

Kalshi markets are predicting the increase in nonfarm payroll employment to be between 200,000-300,000 for the month of June.

kalshi.com/events/PROLLS-22JUN/markets/PROLLS-22JUN-T300?utm_source=twitter-6-27&utm_medium=thread&ut...

kalshi.com/events/PROLLS-22JUN/markets/PROLLS-22JUN-T300?utm_source=twitter-6-27&utm_medium=thread&ut...

An increase in nonfarm payroll employment of less than 300,000 would signal that the job market has cooled, making the likelihood of a recession is even higher.

In fact, Jerome Powell has been using the strong labor market to explain why using high interest rates to curb inflation may not tip us into a recession.

Typically, recessions follow slowing nonfarm payroll employment numbers and increasing unemployment rates.

Typically, recessions follow slowing nonfarm payroll employment numbers and increasing unemployment rates.

In line with our markets, Wells Fargo said that the labor market seems to be cooling to Feb 2021 levels in a statement last week.

Analysts found that wage increases have slowed and are now below inflation, which leaves the economy vulnerable to recession.

www.tradingview.com/news/mtnewswires.com:20220623:A2688577:0-labor-market-is-showing-signs-of-cooling...

Analysts found that wage increases have slowed and are now below inflation, which leaves the economy vulnerable to recession.

www.tradingview.com/news/mtnewswires.com:20220623:A2688577:0-labor-market-is-showing-signs-of-cooling...

Considering the slowing labor market, our markets are predicting a ~75% chance that we will have another quarter of negative GDP this year.

kalshi.com/events/GDPUSMIN-Q2Q42022/markets/GDPUSMIN-Q2Q42022-T0?utm_source=twitter-6-27&utm_medium=t...

kalshi.com/events/GDPUSMIN-Q2Q42022/markets/GDPUSMIN-Q2Q42022-T0?utm_source=twitter-6-27&utm_medium=t...

The jobs numbers for June will be a critical indicator of whether our economy is strong enough to avoid a recession.

Have an opinion on where the job market is headed? Let us know:

kalshi.com/events/PROLLS-22JUN/markets/PROLLS-22JUN-T300?utm_source=twitter-6-27&utm_medium=thread&ut...

Have an opinion on where the job market is headed? Let us know:

kalshi.com/events/PROLLS-22JUN/markets/PROLLS-22JUN-T300?utm_source=twitter-6-27&utm_medium=thread&ut...

Mentions

See All

Sahil Bloom @SahilBloom

·

Jun 27, 2022

great thread