Thread

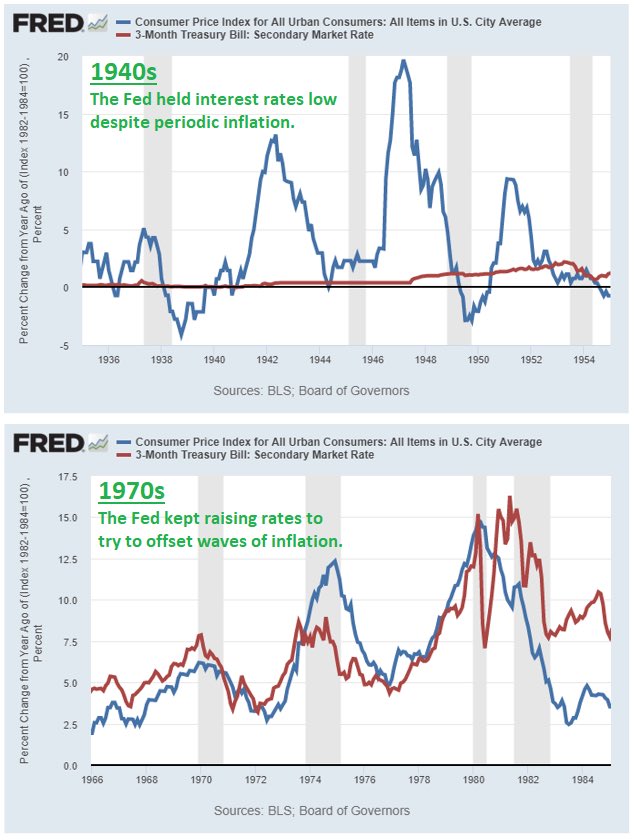

I keep coming back to these charts from @LynAldenContact, thinking about the ways “this time may be different”.

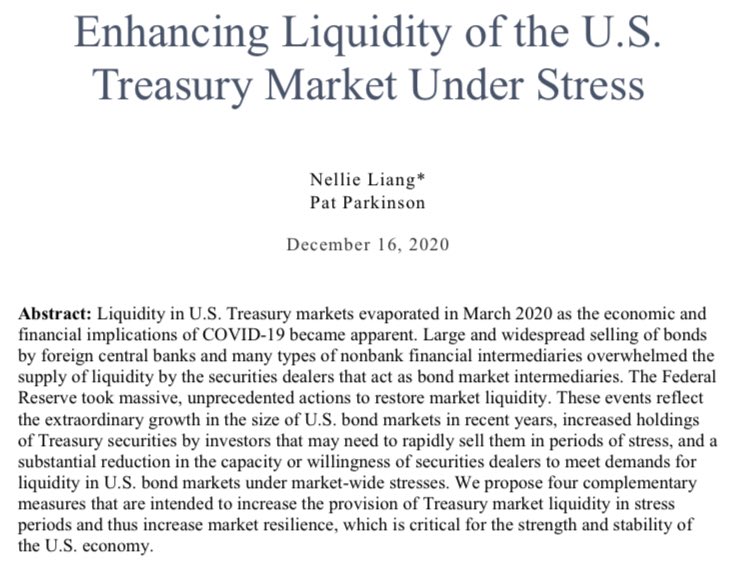

A key difference imo is the nature of the Treasury market itself.

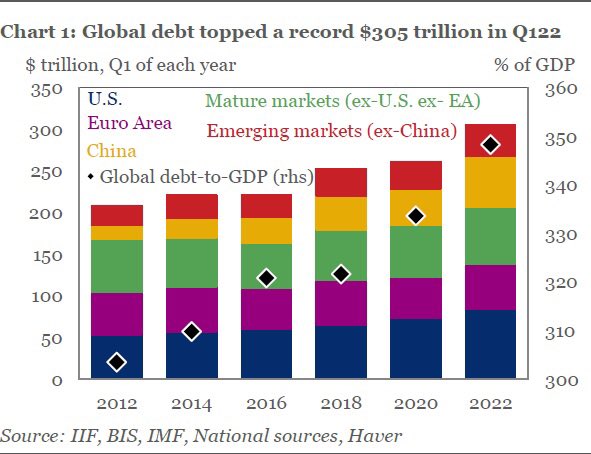

Unlike 40s (or even 70s), USTs are the foundational reserve asset & collateral for global $ system.

A key difference imo is the nature of the Treasury market itself.

Unlike 40s (or even 70s), USTs are the foundational reserve asset & collateral for global $ system.

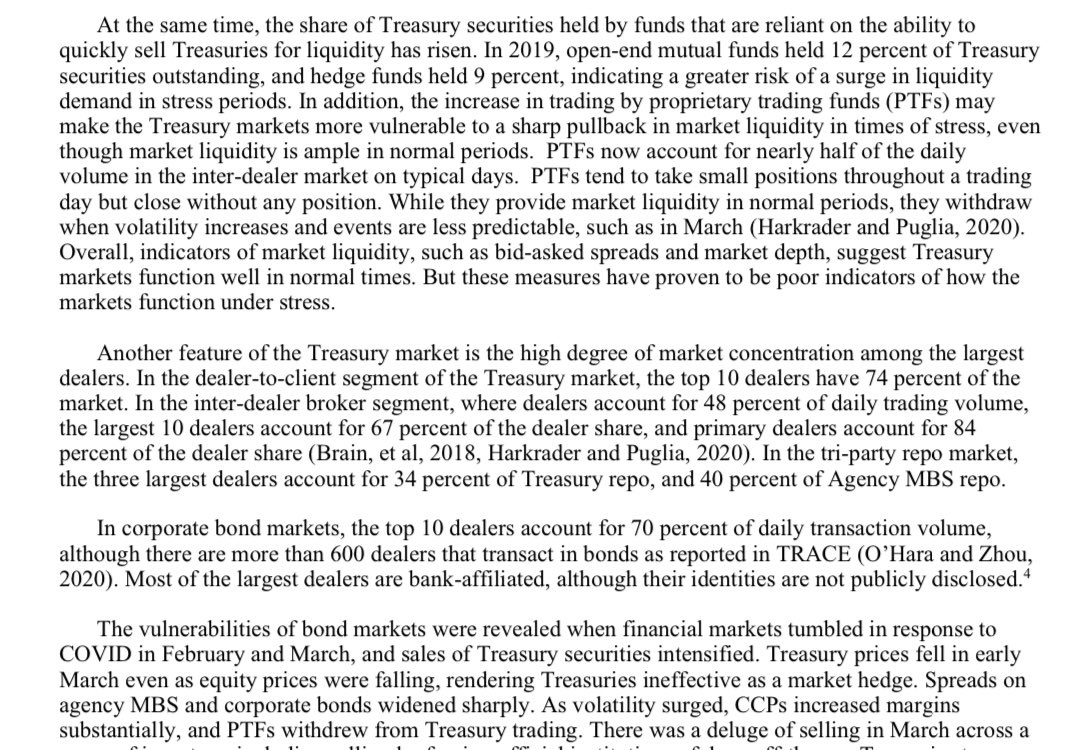

The UST market has grown enormously but also become concentrated, opaque, and increasingly illiquid (in times of stress).

Demand for USTs as “safe and liquid” collateral is thus a very fragile demand—UST “moneyness” is really only secured by functioning repo markets/facilities.

Demand for USTs as “safe and liquid” collateral is thus a very fragile demand—UST “moneyness” is really only secured by functioning repo markets/facilities.

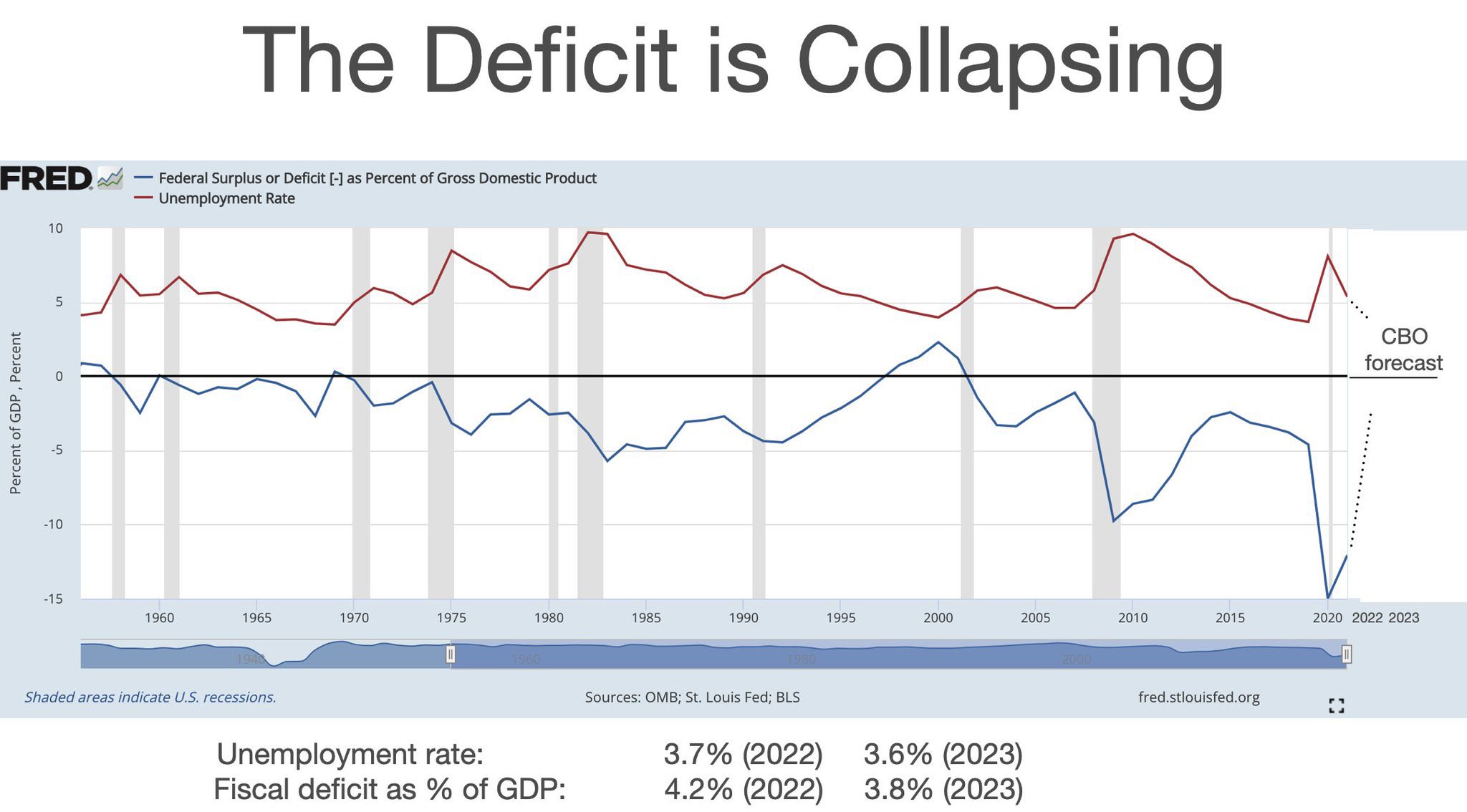

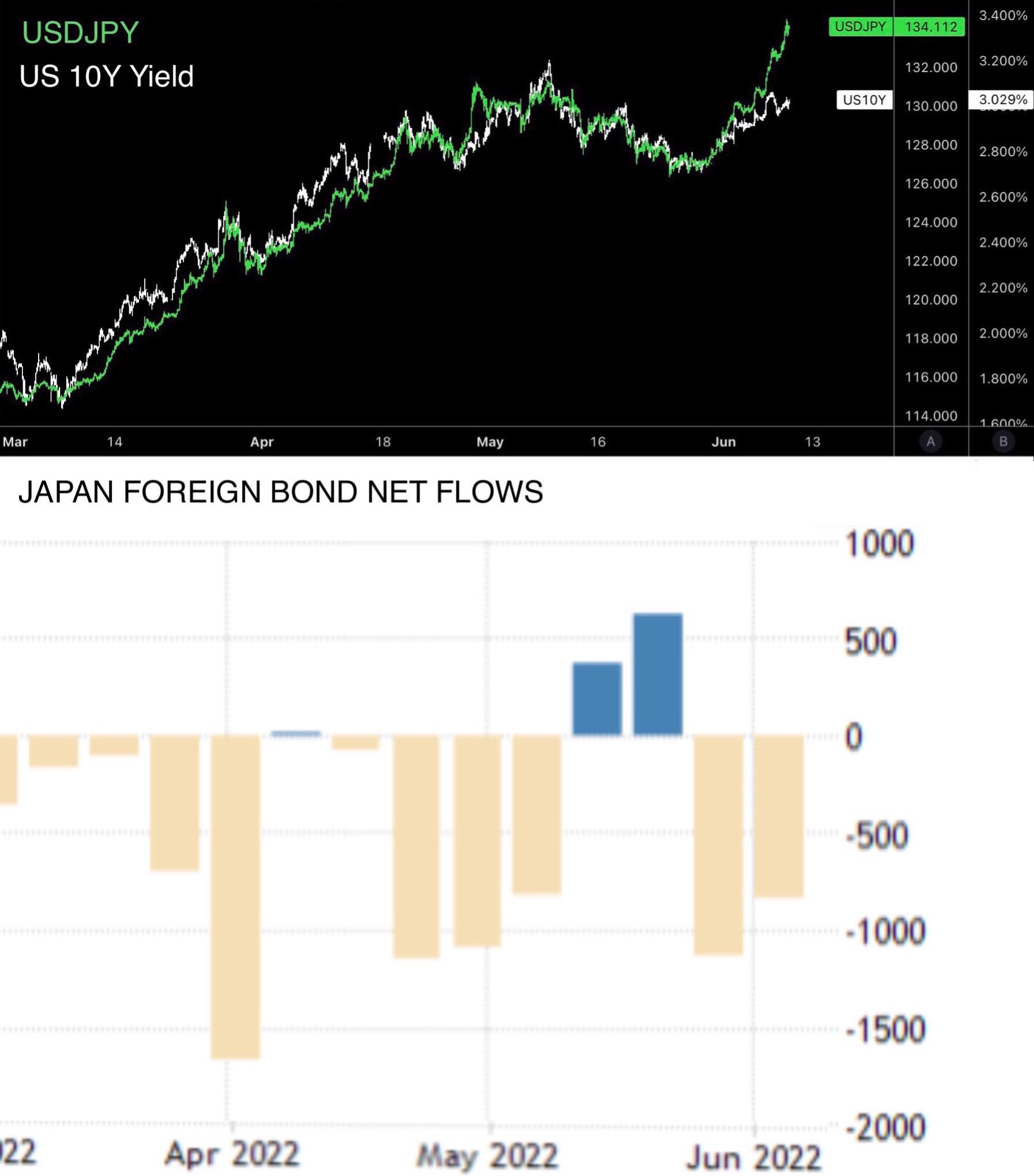

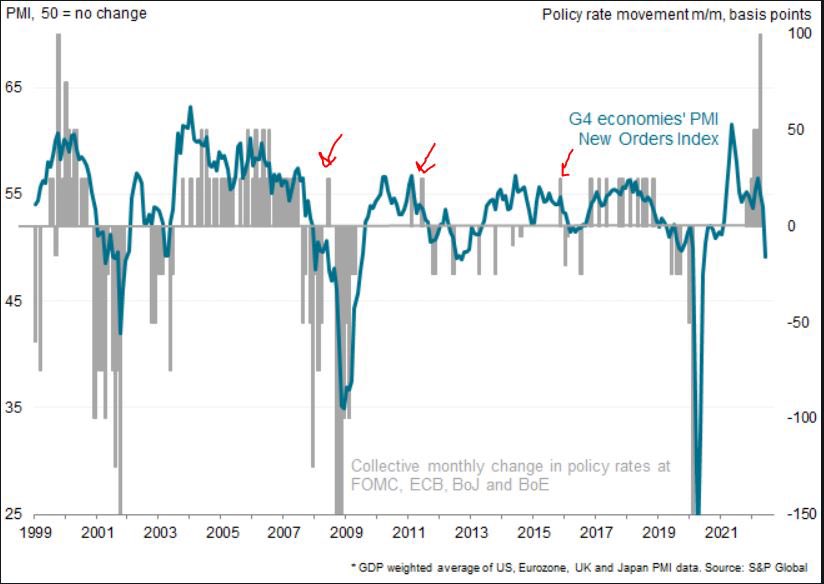

An impending recession will once again blow out the US deficit, requiring more UST issuance just as the Fed is committed to roll USTs off its balance sheet & as the major source of foreign UST demand (Japan YCC) is facing stress.

Normally USTs are bid in recessions. What if not?

Normally USTs are bid in recessions. What if not?

Another major difference is the geopolitics of the UST market.

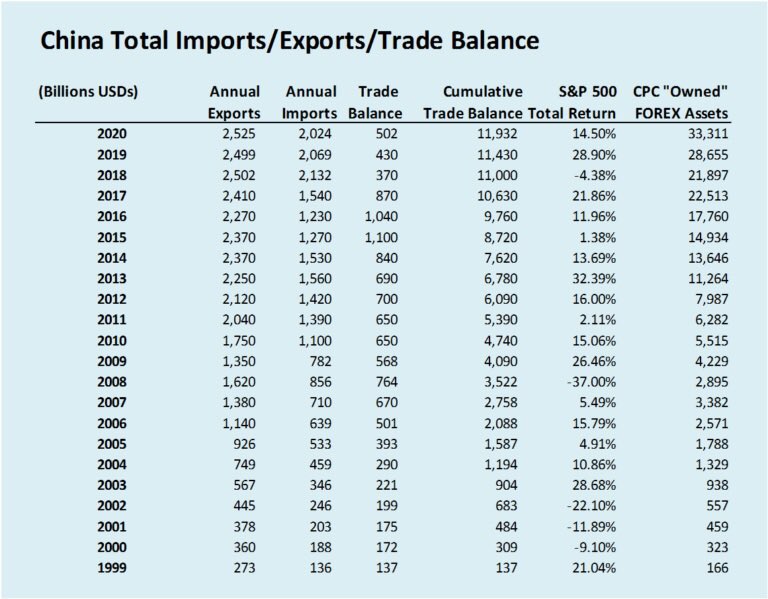

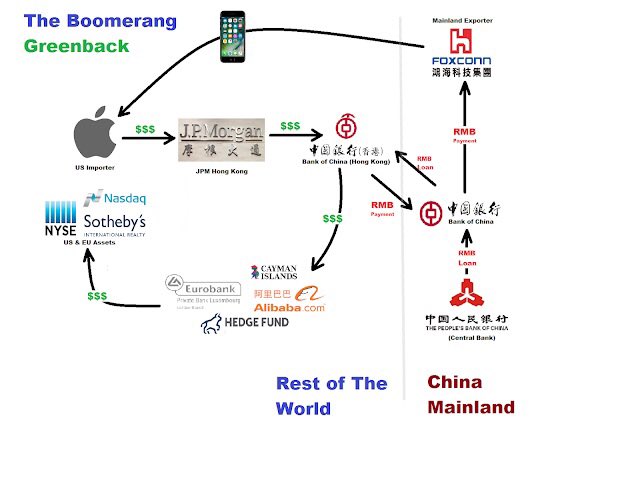

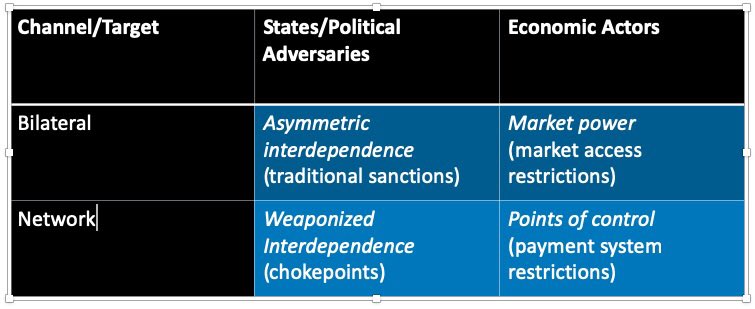

Our principle foreign adversary is drawing down official UST holdings, but more significant are the ~$30T $-denominated assets acquired by recycling U.S. deficits and held via thousands of expertly layered ShellCos.

Our principle foreign adversary is drawing down official UST holdings, but more significant are the ~$30T $-denominated assets acquired by recycling U.S. deficits and held via thousands of expertly layered ShellCos.

As China faces an internal economic slowdown, $-demand from credit stress, political sensitivity to growth (20th Party Congress), & pressure to limit CCP members’ overseas assets in preparation for western sanctions, net selling of U.S. assets (including USTs) could accelerate.

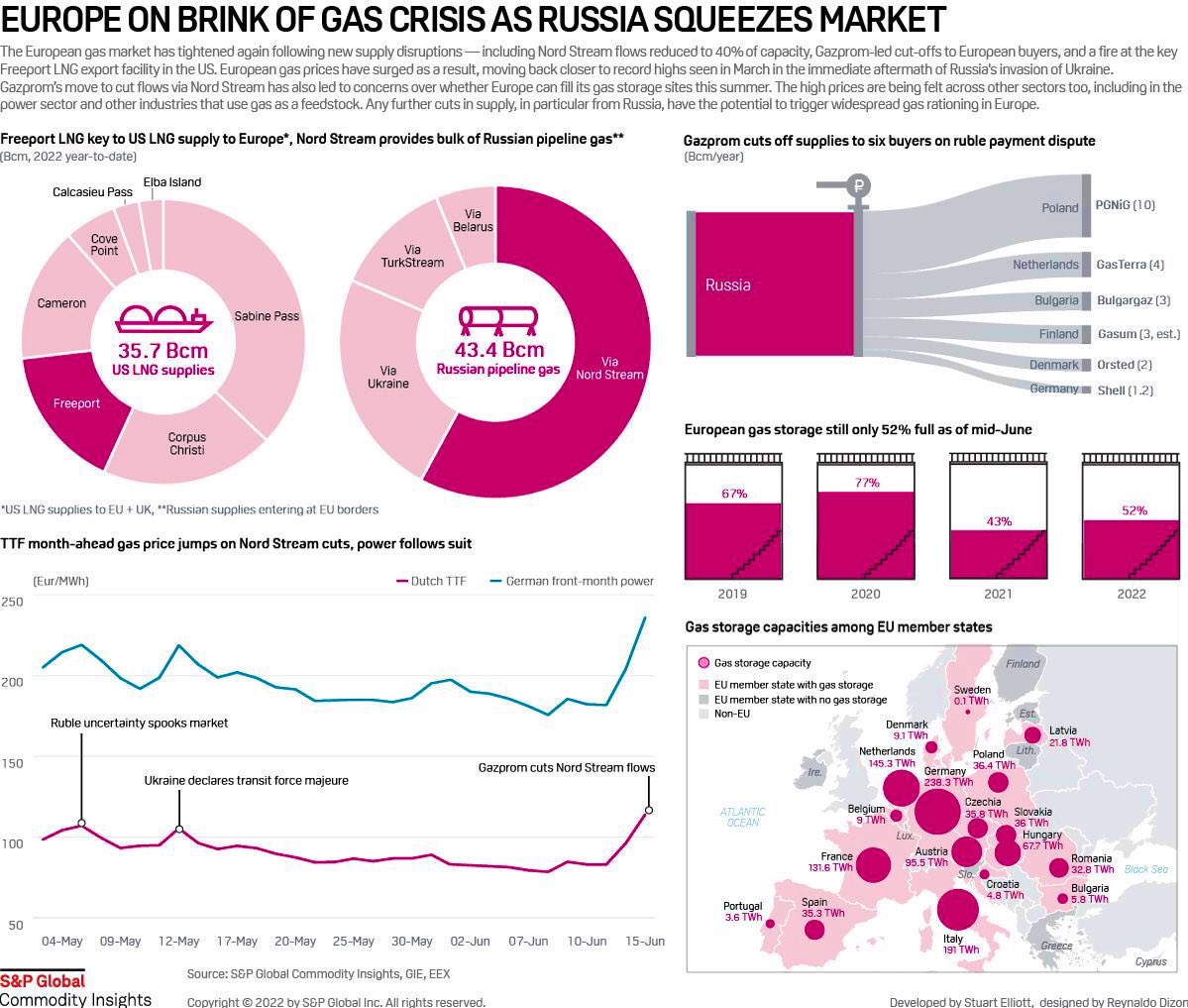

Meanwhile, G7 leaders are pulling out all the stops to limit inflation (RU oil price caps) and seem to see demand destruction from global recession as the only option to “starve the Russian war machine” even as parts of the world literally starve later this year…

Implementing YCC, policymakers in the 40s had the luxury of 1) existing social acceptance of wartime price controls/rationing, 2) information asymmetry to manage inflation expectations (no social media/FinTwit), 3) a war *victory* under their belt, 4) and strong social cohesion.

While things like Basel III and SRF (and stablecoin regs) can help cram down more USTs into private balance sheets, and repo facilities like SRF/FIMA can help keep USTs “money good”, they may not be enough, and certainly seem more like temporary band-aids than enduring solutions.

Any return to a “semi-stable” normal assumes no more shocks or tail risks manifesting.

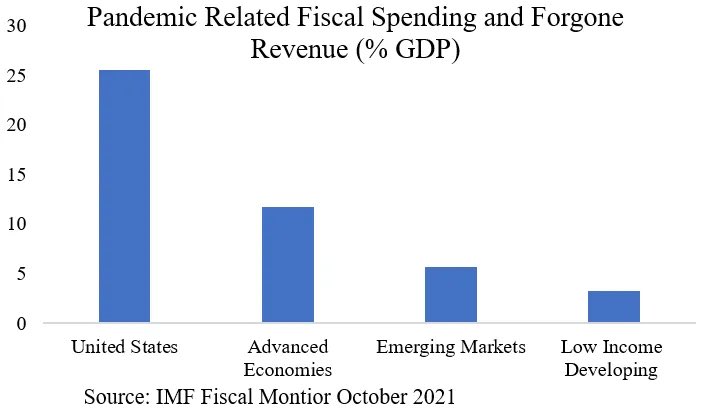

We may not have the fiscal capacity to withstand another pandemic-like event or major conflict, especially as our adversaries seem intent on exploiting & confronting the US-led global system.

We may not have the fiscal capacity to withstand another pandemic-like event or major conflict, especially as our adversaries seem intent on exploiting & confronting the US-led global system.