Thread

Which public #bitcoin miners will be the winners and losers of the bear market?

I analyzed their cash flows and balance sheets to find out.

A thread🧵

I analyzed their cash flows and balance sheets to find out.

A thread🧵

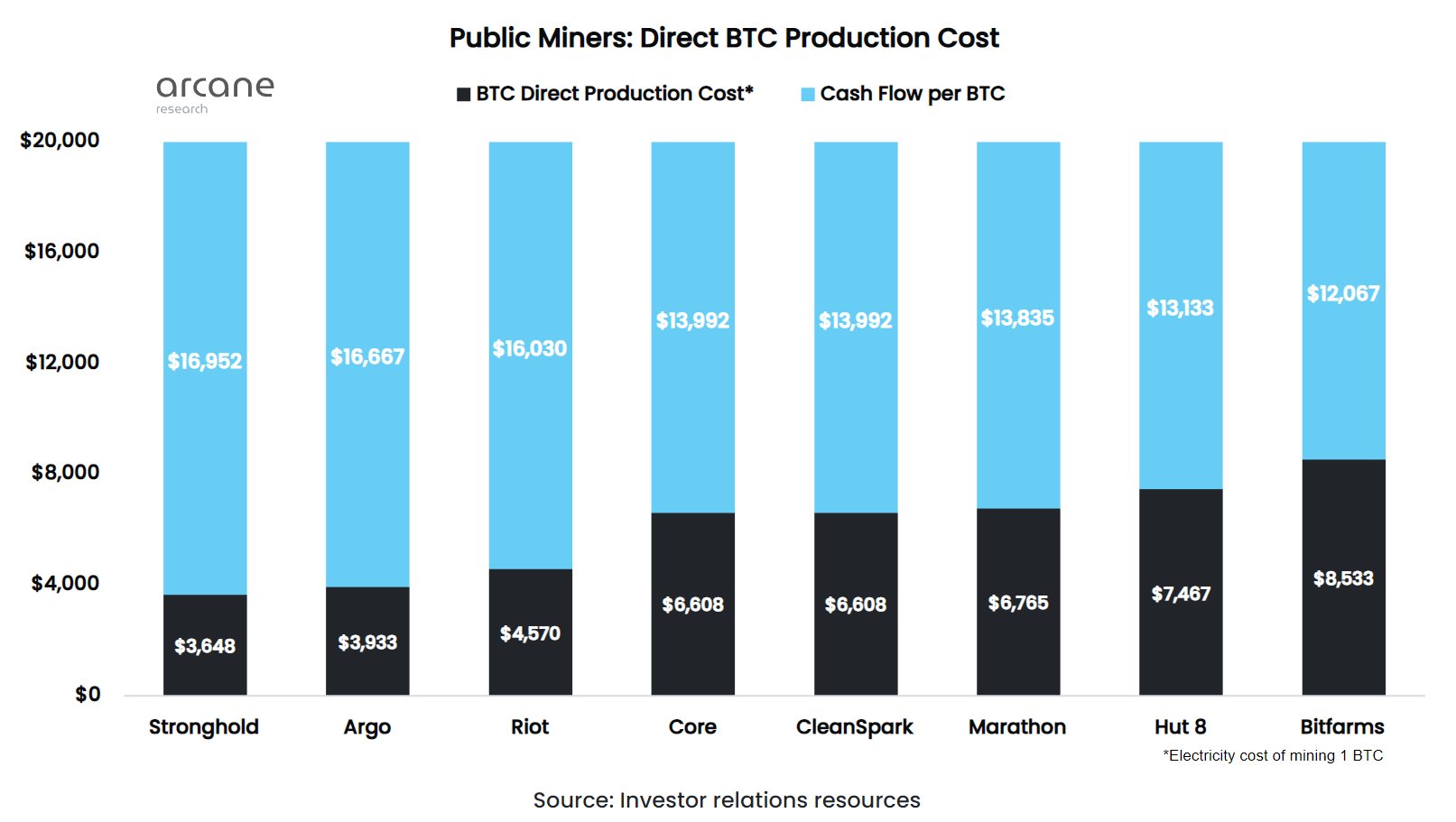

The direct bitcoin production cost impacts a miner's operating cash flow and determines when a miner is forced to turn off machines.

Stronghold and Argo have the lowest direct bitcoin production costs, while Bitfarms and Hut 8 have the highest.

Stronghold and Argo have the lowest direct bitcoin production costs, while Bitfarms and Hut 8 have the highest.

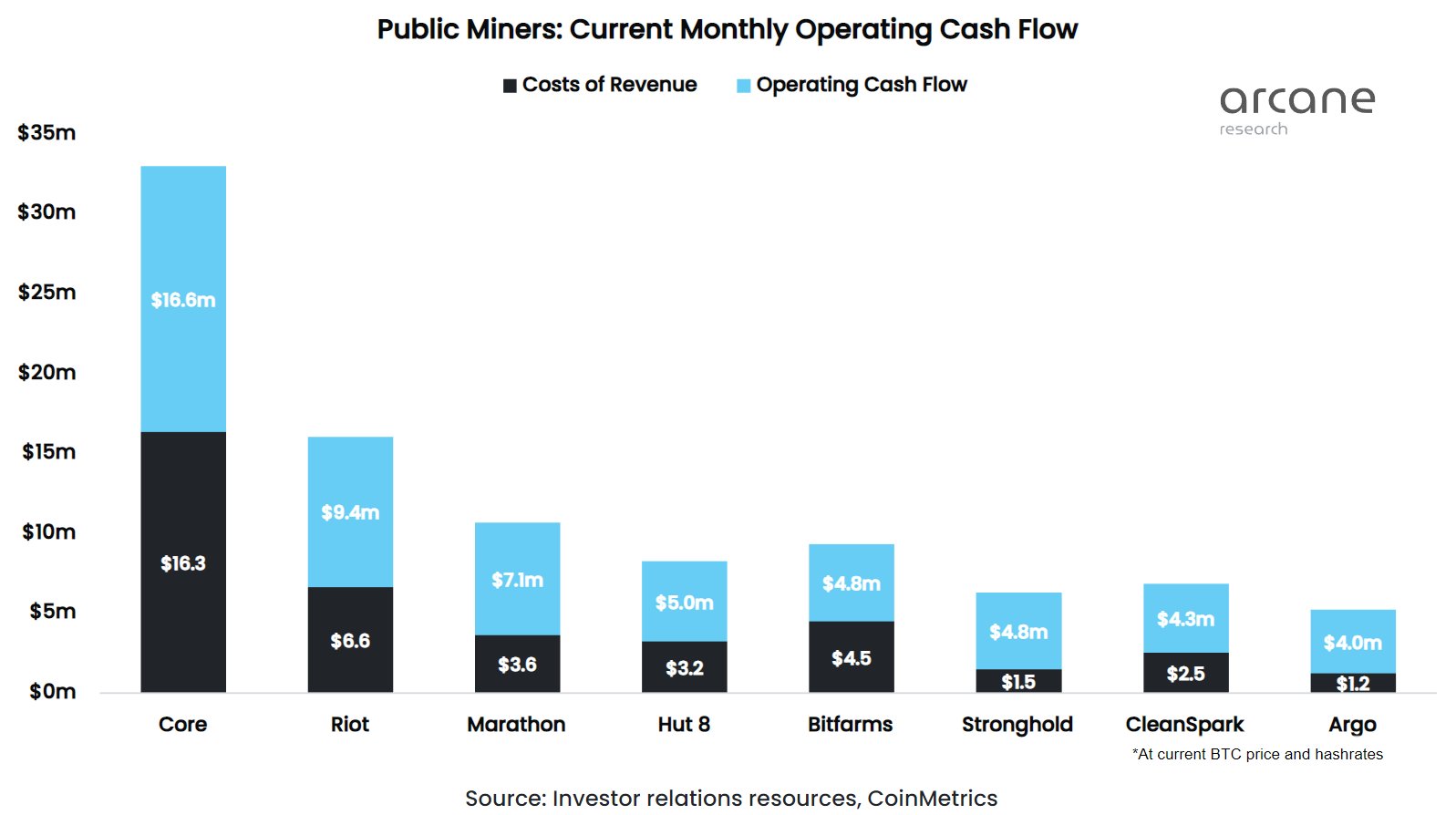

Cash is king in a bear market. The miners with the most substantial operating cash flows are best positioned to pay upcoming expenses, such as machine deliveries or debt payments.

Core Scientific has the highest current operating cash flows.

Core Scientific has the highest current operating cash flows.

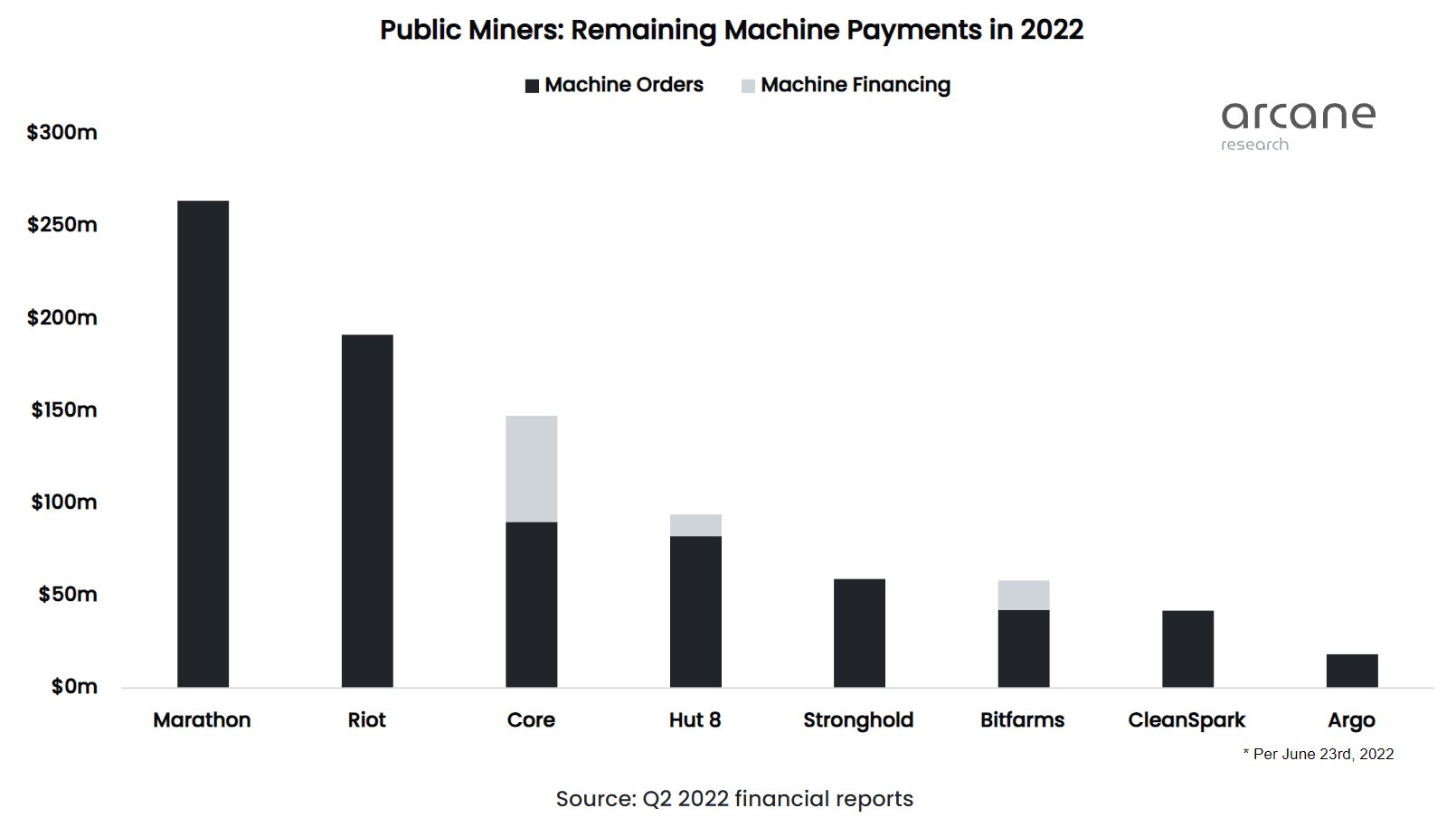

The cash outflows are also important. Some of these companies have hundreds of millions in remaining machine payments in 2022.

Marathon has the most, with $260 million.

Marathon has the most, with $260 million.

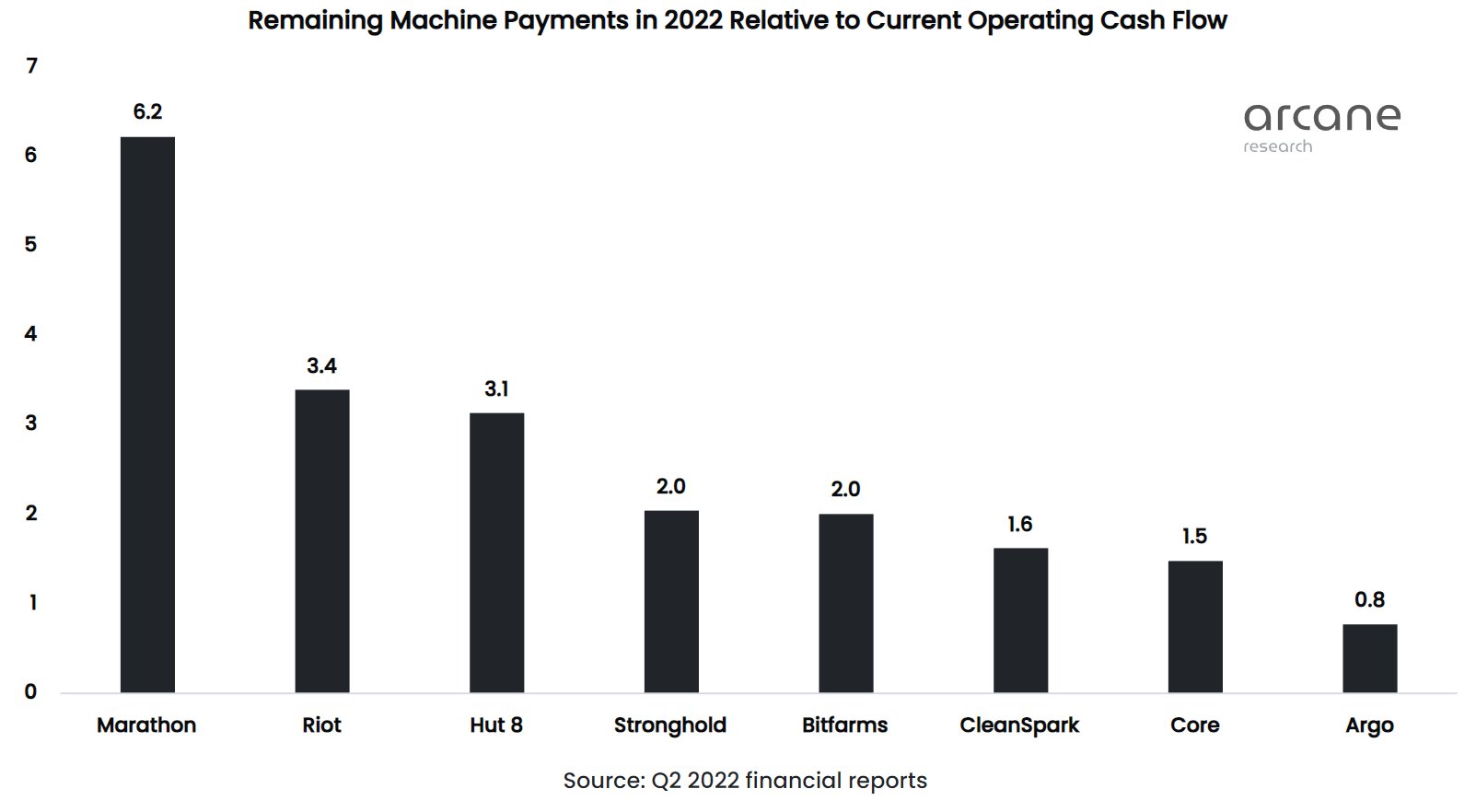

This chart shows the remaining machine payments in 2022 relative to the current operating cash flows.

Marathon has 6.2 times higher remaining machine payments in 2022 than their accumulated current operating cash flow accumulated out the year. This will drain them of liquidity.

Marathon has 6.2 times higher remaining machine payments in 2022 than their accumulated current operating cash flow accumulated out the year. This will drain them of liquidity.

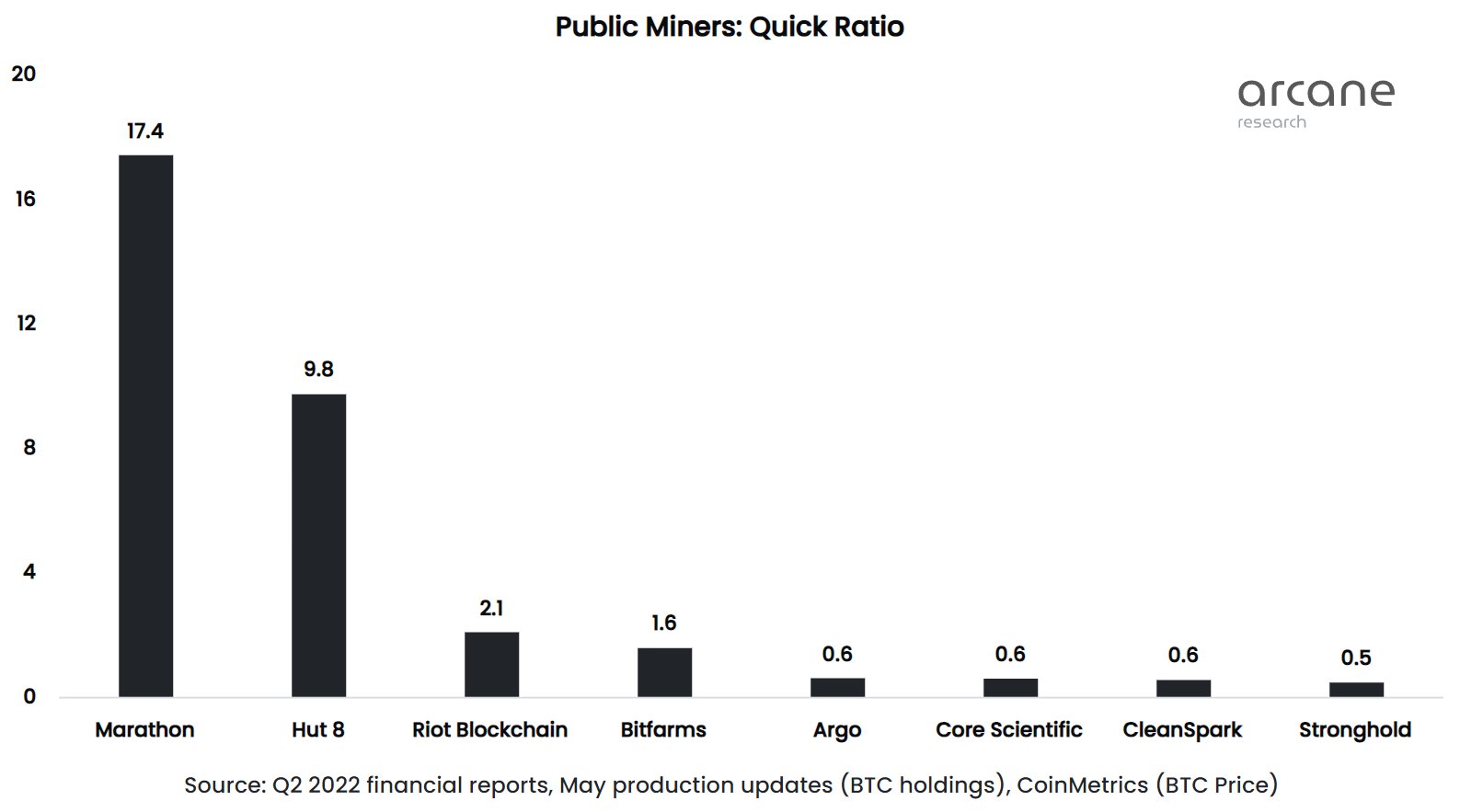

Let's move away from cash flows and look at the balance sheets. Marathon may have horrible cash flows, but at least they have a very strong balance sheet with lots of cash and little short term debt.

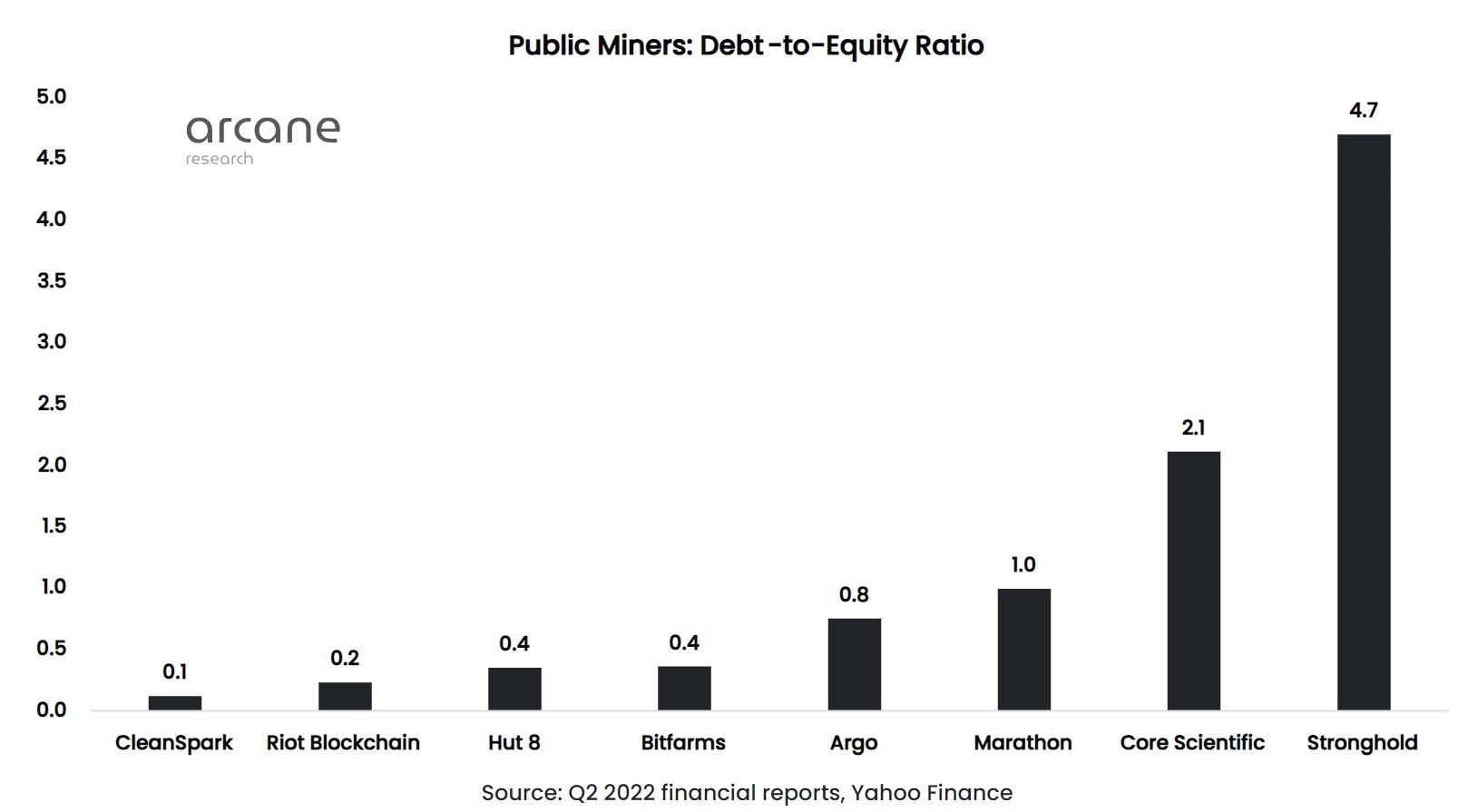

CleanSpark has the least debt relative to equity, with a D/E ratio of only 0.1. Stronghold has the most debt with a D/E ratio of 4.7, which is exceptionally high for a bitcoin mining company.

Most of these companies are struggling, and some will get into a liquidity squeeze that will force them to liquidate parts of their assets. In the midst of every crisis lies great opportunity, as the best-capitalized miners can buy the struggling miners' assets cheaply.

I believe that @ArgoBlockchain is currently the bitcoin miner in the best financial condition. Argo has a strong balance sheet with little debt and strong operating cash flows relative to upcoming machine payments. Argo also has the second-lowest direct bitcoin production cost.

The weakest miner based on this analysis is Marathon. Marathon has a strong balance sheet with loads of cash, but their massive upcoming machine payments will drain their liquidity. I believe they will be forced to liquidate most of their bitcoin or sell their machine orders

Read the full article here:

arcane.no/research/survival-of-the-fittest-which-public-bitcoin-miners-are-the-best-prepared-to

arcane.no/research/survival-of-the-fittest-which-public-bitcoin-miners-are-the-best-prepared-to