Thread

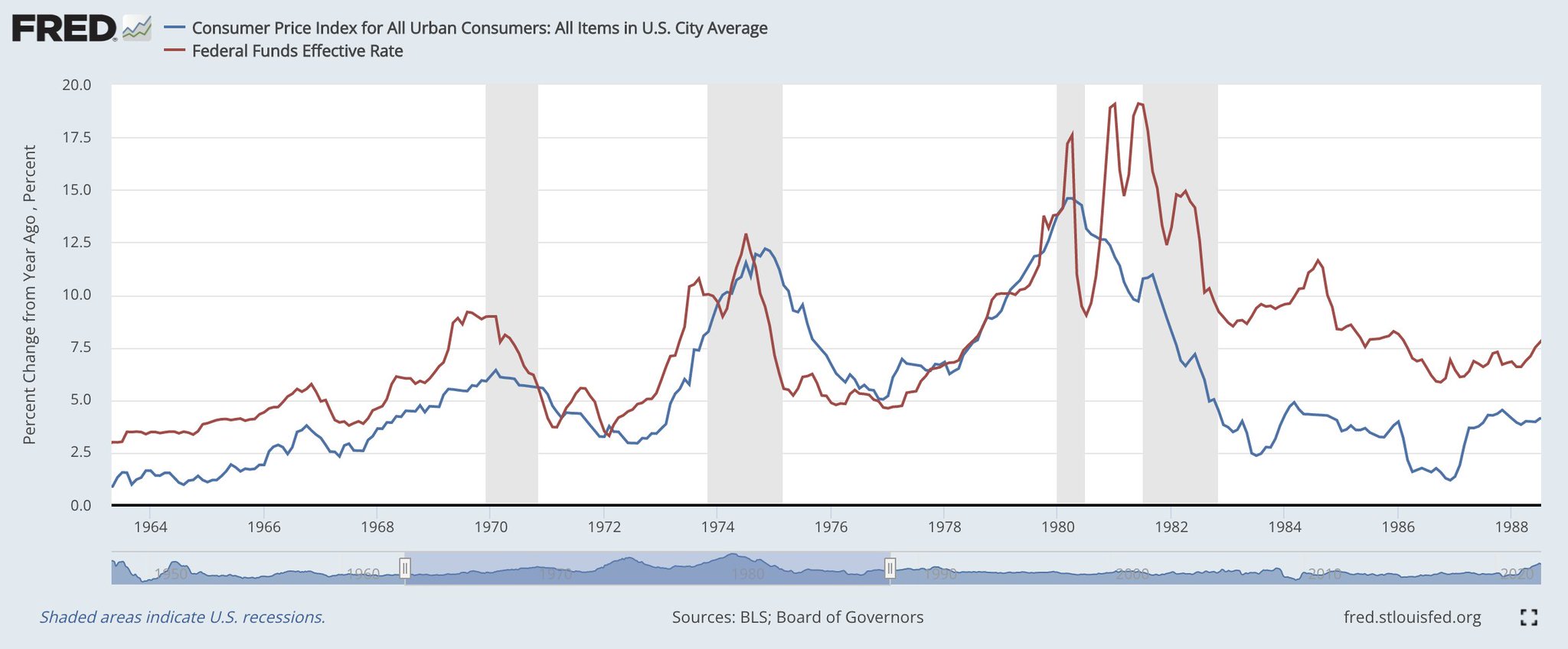

i'm not a fedwatcher by any means but my assessment is they're so humiliated by being historically wrong on inflation that they're going to plunge the economy into a depression just to quell it until everyone panics and it becomes politically impossible to stay the course

i believe we're in the equivalent of 1969/70 - inflation picks up, fed hikes, we get a recession, it tamps down temporarily, then comes roaring back due to unresolved underlying issues (energy crisis)

of course the difference this time is the deficit is 7%, foreigners aren't interested in treasuries any more, and debt to gdp is 120%+. you cannot volcker it. (and I think volcker gets too much credit anyway).

last note on the inflationary 'underlying issues'. 3 big inflationary trends that Fed cannot change;

- energy crisis: underinvestment in O&G

- deglobalization: transition to wartime, mercantile, hoarding-based economy

- green transition: move to lower EROI generation

- energy crisis: underinvestment in O&G

- deglobalization: transition to wartime, mercantile, hoarding-based economy

- green transition: move to lower EROI generation

yes the Fed can drop economic nuke by raising rates. but they cannot get shale wells firing, turn nuclear plants back on, and restore pax americana and free trade globally...