Thread

What will NFT utility look like in the next 6 months??

As an IRL silicon valley tech product manager, I have been evaluating the data and trends. Here's what I have found.

🧵👇

As an IRL silicon valley tech product manager, I have been evaluating the data and trends. Here's what I have found.

🧵👇

1/27

In the past year, the focus for NFTs/Defi has largely been on:

1. Price speculation based on fomo, fud, attention, and influencers

2. Memes + CC0

3. Technology infrastructure + shortcomings

4. Products that didn't need to leverage web3 technology

In the past year, the focus for NFTs/Defi has largely been on:

1. Price speculation based on fomo, fud, attention, and influencers

2. Memes + CC0

3. Technology infrastructure + shortcomings

4. Products that didn't need to leverage web3 technology

2/27

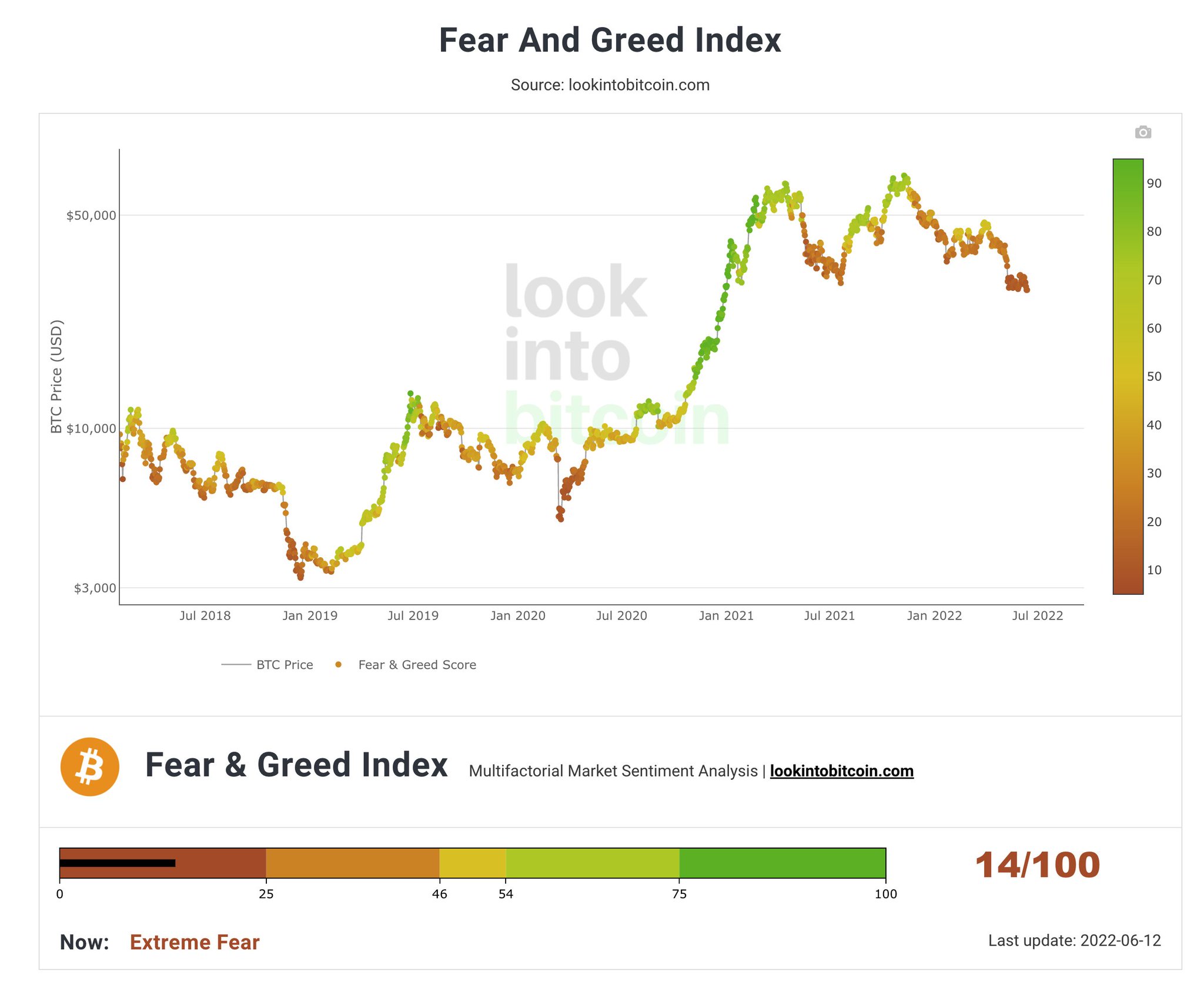

1. PRICE SPECULATION

In contrast to fiat which is backed by a governmental entity or stocks backed by some business fundamentals, crypto/NFTs are completely dependent on market sentiment.

That's why crypto is one of the most volatile assets in the world.

1. PRICE SPECULATION

In contrast to fiat which is backed by a governmental entity or stocks backed by some business fundamentals, crypto/NFTs are completely dependent on market sentiment.

That's why crypto is one of the most volatile assets in the world.

3/27

Particularly in the NFT space, OpenSea and LooksRare have become digital casinos selling us on the idea that we too can make a life changing 10x or 100x trade within a week.

Speculative tweets (whether or not they are true) have the power to 2-3x the value of NFTs.

Particularly in the NFT space, OpenSea and LooksRare have become digital casinos selling us on the idea that we too can make a life changing 10x or 100x trade within a week.

Speculative tweets (whether or not they are true) have the power to 2-3x the value of NFTs.

4/27

NFTs are very much an attention economy where a select few "influencers" wield incredible power because their every tweet will have tens of thousands of impressions.

Some will responsibly use their power. Others, not so much.

NFTs are very much an attention economy where a select few "influencers" wield incredible power because their every tweet will have tens of thousands of impressions.

Some will responsibly use their power. Others, not so much.

5/27

DeFi teams tried novel tokenomics to keep healthy price action — but in the end, tokens were either backed up a much smaller treasury or were only inflated in the short term with "high APY".

Ex. $OHM encouraged its community to 💎 🙌 with "(3,3)" on Twitter but still 📉

DeFi teams tried novel tokenomics to keep healthy price action — but in the end, tokens were either backed up a much smaller treasury or were only inflated in the short term with "high APY".

Ex. $OHM encouraged its community to 💎 🙌 with "(3,3)" on Twitter but still 📉

6/27

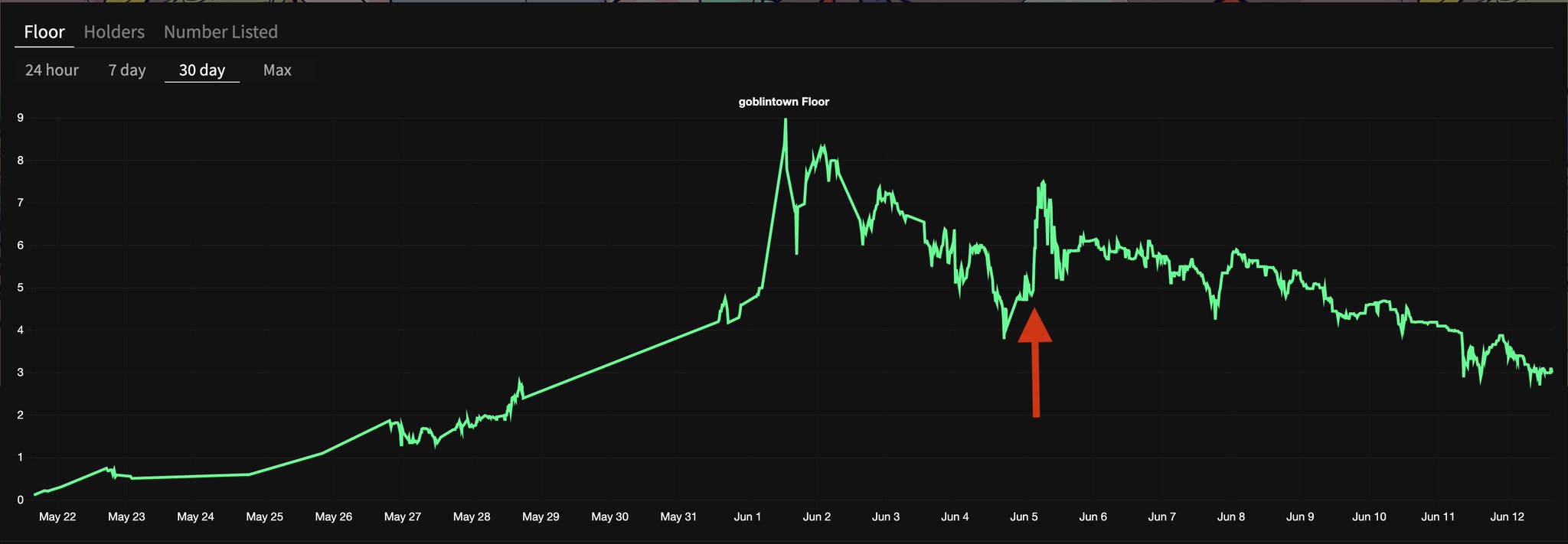

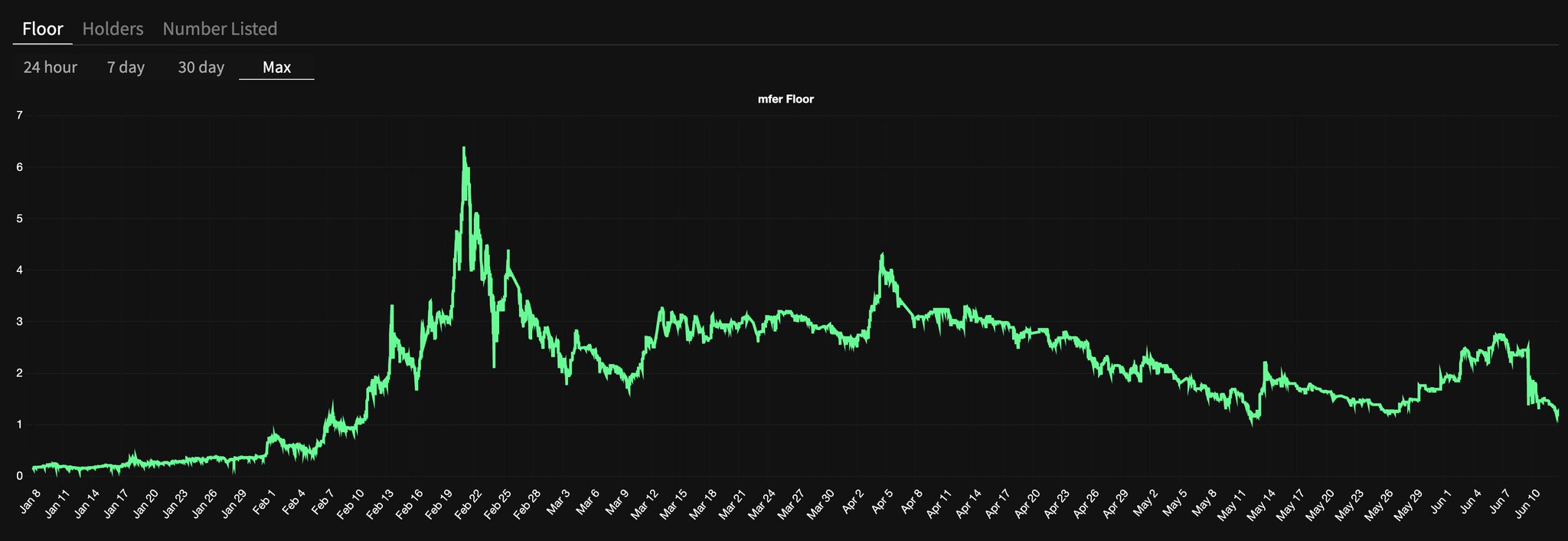

2. MEMES + CC0

Memes are an embodiment of culture. Something intangible, yet everyone understands — and perfect for NFTs.

At the peak of the Kevin meme, this ugly mf was bought for 8.8ETH or $26.4K.

Memes will continue to stay but individual memes may not last forever.

2. MEMES + CC0

Memes are an embodiment of culture. Something intangible, yet everyone understands — and perfect for NFTs.

At the peak of the Kevin meme, this ugly mf was bought for 8.8ETH or $26.4K.

Memes will continue to stay but individual memes may not last forever.

7/27

Most meme projects are CC0, from cryptoadz and mfers to goblins. The value is in the meme or the !vibes. You don't even own the artwork.

Pessimistically, founders can walk away with a quick buck + ongoing royalties.

Unfortunately attention often moves elsewhere + price 📉

Most meme projects are CC0, from cryptoadz and mfers to goblins. The value is in the meme or the !vibes. You don't even own the artwork.

Pessimistically, founders can walk away with a quick buck + ongoing royalties.

Unfortunately attention often moves elsewhere + price 📉

8/27

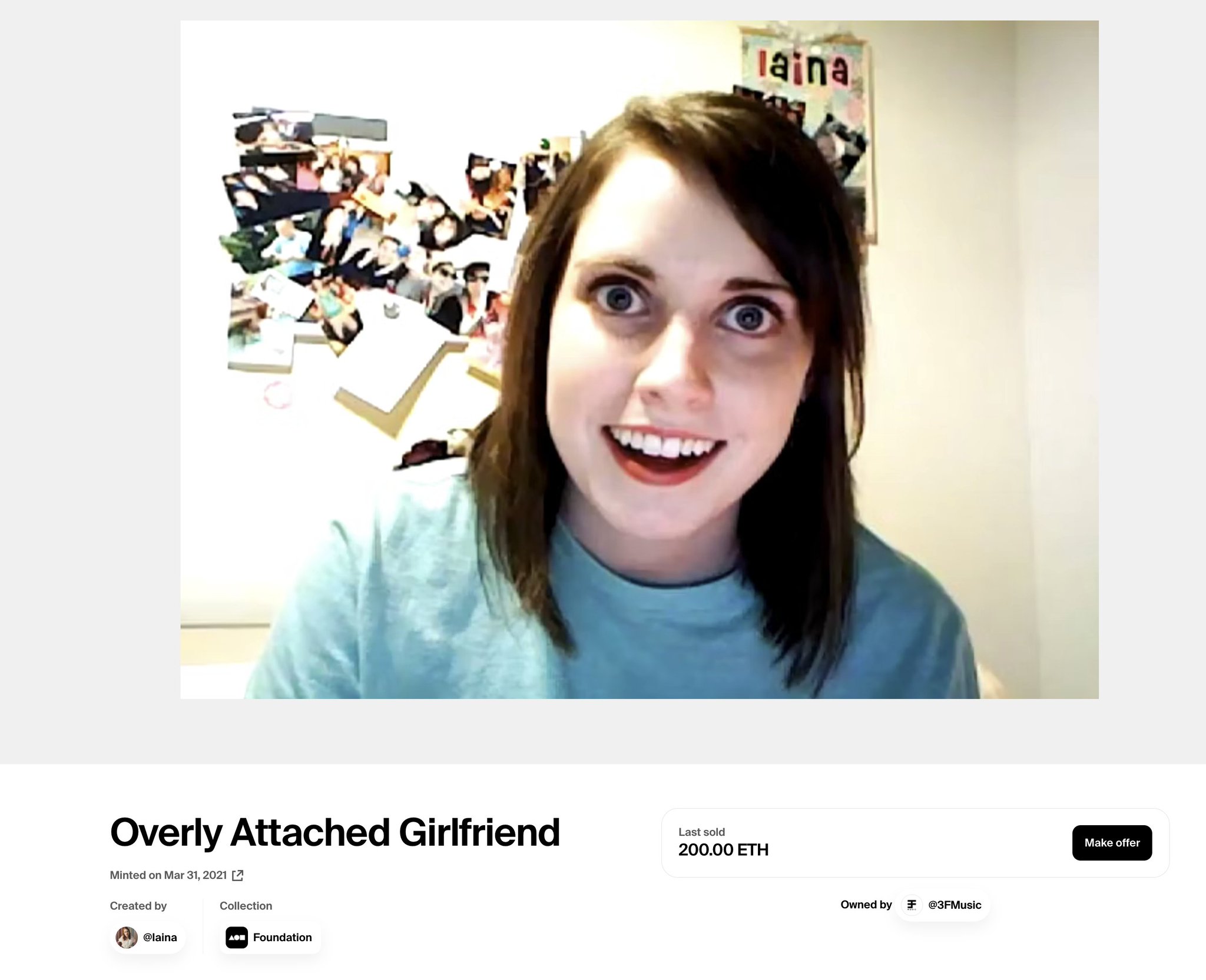

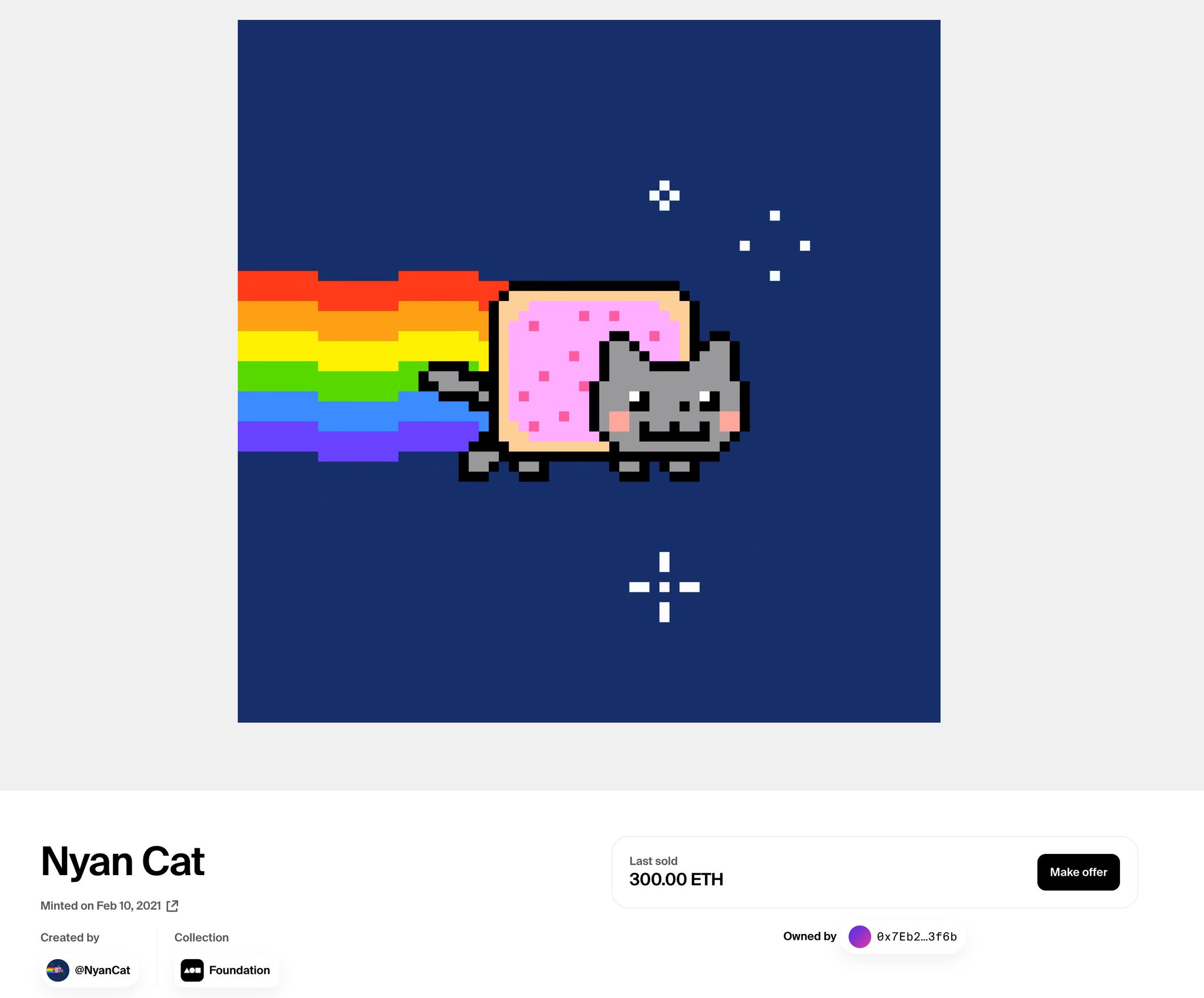

Memes as NFTs will not go away —> for the first time, you can profit off of understanding meme culture.

Even before 10K collections were popular, memes were being monetized. This goes deep into the collectability of NFTs —> you're the owner of a major cultural moment.

Memes as NFTs will not go away —> for the first time, you can profit off of understanding meme culture.

Even before 10K collections were popular, memes were being monetized. This goes deep into the collectability of NFTs —> you're the owner of a major cultural moment.

9/27

3. TECHNOLOGY INFRASTRUCTURE

In the past 6 months:

- a "stablecoin" de-pegged from $1 (Terra)

- a major blockchain shut down 7x (Solana)

- a major blockchain burned > $100M in a day (Ethereum)

- many discussions around L1/L2 vs multi-chain

- $$$ of NFTs stolen

3. TECHNOLOGY INFRASTRUCTURE

In the past 6 months:

- a "stablecoin" de-pegged from $1 (Terra)

- a major blockchain shut down 7x (Solana)

- a major blockchain burned > $100M in a day (Ethereum)

- many discussions around L1/L2 vs multi-chain

- $$$ of NFTs stolen

10/27

These events show us how much focus is on technology vs actual use cases.

This is akin to debating UDP vs TCP. Or asking about SQL vs no-SQL databases.

In web2, the focus is on actual products built on top of the internet that happen to require data storage.

These events show us how much focus is on technology vs actual use cases.

This is akin to debating UDP vs TCP. Or asking about SQL vs no-SQL databases.

In web2, the focus is on actual products built on top of the internet that happen to require data storage.

11/27

Just like how we have evolved from 56k modems to 5G in our pockets today, the technology will get better.

Blockchains will scale. Gas prices will 📉. Scams will be harder to pull off. We will talk about

✅ products

❌ technologies

More on use cases 👇 in a few tweets

Just like how we have evolved from 56k modems to 5G in our pockets today, the technology will get better.

Blockchains will scale. Gas prices will 📉. Scams will be harder to pull off. We will talk about

✅ products

❌ technologies

More on use cases 👇 in a few tweets

11/27

4. PRODUCTS THAT DIDN'T NEED WEB3

This might be the most controversial point.

Many NFT projects would have been better off as an email list or paid subscription service for "alpha". Most P2E games should have just been games first, NFTs second.

4. PRODUCTS THAT DIDN'T NEED WEB3

This might be the most controversial point.

Many NFT projects would have been better off as an email list or paid subscription service for "alpha". Most P2E games should have just been games first, NFTs second.

12/27

By putting technology first, these projects became highly dependent on royalties and hype to become a successful business.

Most that have only raised 5 figures or low 6 figures are in a tricky situation for how to navigate their roadmap promises with very little capital.

By putting technology first, these projects became highly dependent on royalties and hype to become a successful business.

Most that have only raised 5 figures or low 6 figures are in a tricky situation for how to navigate their roadmap promises with very little capital.

13/27

Lots of NFT projects claim they will "build the next Disney" but don't understand that took many decades and >200K employees.

Vision is necessary but there must be clear planning and execution to get from A to Z. The intermediate milestones have to be realistic.

Lots of NFT projects claim they will "build the next Disney" but don't understand that took many decades and >200K employees.

Vision is necessary but there must be clear planning and execution to get from A to Z. The intermediate milestones have to be realistic.

14/27

NFT projects == Startups. You have a target customer demographic. You have a marketing channel. You have a product to sell. You have to make money.

NFTs should only accelerate your growth. Not be your sole business model.

NFT projects == Startups. You have a target customer demographic. You have a marketing channel. You have a product to sell. You have to make money.

NFTs should only accelerate your growth. Not be your sole business model.

15/27

Now that you understand the current state of NFTs...

what does NFT utility look like in the next 6 months?

1. IP licensing

2. Community/memberships

3. Hyperspeed growth for real products

Now that you understand the current state of NFTs...

what does NFT utility look like in the next 6 months?

1. IP licensing

2. Community/memberships

3. Hyperspeed growth for real products

16/27

1. IP LICENSING

When you buy an NFT that gives you full commercial rights, especially one within a 10K collection, you are buying IP to create all kinds of merchandise (coffee beans, wine, hats, board games, etc.) with an existing community who is excited about your IP.

1. IP LICENSING

When you buy an NFT that gives you full commercial rights, especially one within a 10K collection, you are buying IP to create all kinds of merchandise (coffee beans, wine, hats, board games, etc.) with an existing community who is excited about your IP.

17/27

Here, you are no longer betting on the price of the NFT but rather leveraging the NFT as if you would leverage a piece of commercial real estate to grow your business.

It's the opportunity to "invest in yourself" and control the financial outcomes of your NFT investment.

Here, you are no longer betting on the price of the NFT but rather leveraging the NFT as if you would leverage a piece of commercial real estate to grow your business.

It's the opportunity to "invest in yourself" and control the financial outcomes of your NFT investment.

18/27

A new niche of branding agencies will also pop up.

Agencies have the skills and network to create the necessary branding assets and stories around the NFT IP.

Holders aka investors holding $$$ assets simply need to sign the dotted line to make passive income on their IP.

A new niche of branding agencies will also pop up.

Agencies have the skills and network to create the necessary branding assets and stories around the NFT IP.

Holders aka investors holding $$$ assets simply need to sign the dotted line to make passive income on their IP.

19/27

2. COMMUNITY/MEMBERSHIPS

"Community is the one thing that cannot be forked." (I stole that quote from @GiancarloChaux and @midnightlabshq)

We already see pre-NFT examples of exclusive communities in many different industries.

2. COMMUNITY/MEMBERSHIPS

"Community is the one thing that cannot be forked." (I stole that quote from @GiancarloChaux and @midnightlabshq)

We already see pre-NFT examples of exclusive communities in many different industries.

@GiancarloChaux @midnightlabshq 20/27

Ferrari only allows current Ferrari owners to buy their next line of models. What if that turned into an NFT that could be transferable?

Disney Club 33 gets members into exclusive restaurants and many free park tickets. Could that membership be rented out as an NFT?

Ferrari only allows current Ferrari owners to buy their next line of models. What if that turned into an NFT that could be transferable?

Disney Club 33 gets members into exclusive restaurants and many free park tickets. Could that membership be rented out as an NFT?

@GiancarloChaux @midnightlabshq 21/27

I'm personally bullish on communities and strong community leaders (@The333Club @proof_xyz @QuantumNFT @BoredApeYC).

The membership aka mint fee allows the team to bring a variety of utility to members. And with a well curated community, the network is priceless.

I'm personally bullish on communities and strong community leaders (@The333Club @proof_xyz @QuantumNFT @BoredApeYC).

The membership aka mint fee allows the team to bring a variety of utility to members. And with a well curated community, the network is priceless.

@GiancarloChaux @midnightlabshq @The333Club @proof_xyz @QuantumNFT @BoredApeYC 22/27

This goes beyond "business networks" too.

Charity fundraisers via NFT mints create a community of donors who all support the cause.

HS club memberships as NFTs help authenticate participation for college admissions.

Lots of interesting use cases 👀

This goes beyond "business networks" too.

Charity fundraisers via NFT mints create a community of donors who all support the cause.

HS club memberships as NFTs help authenticate participation for college admissions.

Lots of interesting use cases 👀

@GiancarloChaux @midnightlabshq @The333Club @proof_xyz @QuantumNFT @BoredApeYC 23/27

3. HYPERSPEED GROWTH

Today, lots of NFTs are being launched alongside the actual software or merchandise product.

But NFTs can be (and should be) used for existing products too. By launching NFTs to access premium features, you find your power users and raise capital.

3. HYPERSPEED GROWTH

Today, lots of NFTs are being launched alongside the actual software or merchandise product.

But NFTs can be (and should be) used for existing products too. By launching NFTs to access premium features, you find your power users and raise capital.

@GiancarloChaux @midnightlabshq @The333Club @proof_xyz @QuantumNFT @BoredApeYC 24/27

NFTs are hacks to getting user feedback, capital and marketing all in one.

Ex. Netflix could sell 100 lifetime passes to raise some additional capital, generate marketing excitement and figure out what power users want.

NFTs are hacks to getting user feedback, capital and marketing all in one.

Ex. Netflix could sell 100 lifetime passes to raise some additional capital, generate marketing excitement and figure out what power users want.

@GiancarloChaux @midnightlabshq @The333Club @proof_xyz @QuantumNFT @BoredApeYC 25/27

IMO if used in this way, the NFTs would sacrifice long term profit for a short term marketing catalyst and capital raise. People paying $X for your NFT should receive more than $X of value.

Otherwise, they wouldn't have bought the NFT in the first place.

IMO if used in this way, the NFTs would sacrifice long term profit for a short term marketing catalyst and capital raise. People paying $X for your NFT should receive more than $X of value.

Otherwise, they wouldn't have bought the NFT in the first place.

@GiancarloChaux @midnightlabshq @The333Club @proof_xyz @QuantumNFT @BoredApeYC 26/27

In summary, we are finally asking "what am I actually selling and buying with this NFT?".

Sellers create NFTs to generate buzz, raise capital and curate a community who cares about their product.

Buyers buy NFTs to access exclusive networks + premium product utilities.

In summary, we are finally asking "what am I actually selling and buying with this NFT?".

Sellers create NFTs to generate buzz, raise capital and curate a community who cares about their product.

Buyers buy NFTs to access exclusive networks + premium product utilities.

@GiancarloChaux @midnightlabshq @The333Club @proof_xyz @QuantumNFT @BoredApeYC 27/27

What do you think about the short term and medium term utility of NFTs?

I know people have mentioned real estate NFTs and soulbound tokens but IMO that's going to be in the distant future.

What do you think about the short term and medium term utility of NFTs?

I know people have mentioned real estate NFTs and soulbound tokens but IMO that's going to be in the distant future.

Mentions

See All

Ashley Smith @iamboredbecky

·

Jun 13, 2022

Really enjoyed this thread.