Thread

stETH is depegged, trading at .95

Liq is drying up & smart money is pulling capital. Coupled w/ the rumoured risk of Celsius' functional insolvency, there could be significant selling

Me & @Crypto_Joe10 & have been researching this for the past week

Here is what we found

Liq is drying up & smart money is pulling capital. Coupled w/ the rumoured risk of Celsius' functional insolvency, there could be significant selling

Me & @Crypto_Joe10 & have been researching this for the past week

Here is what we found

@Crypto_Joe10 First, what is Lido & stETH?

LIDO provides a "liquid staking" service, whereby users are able to lock any amount of ETH for validating purposes and then receive the stETH token, which can be rehypotheticated in DeFi to earn yield.

Each stETH is redeemable for 1 ETH after merge

LIDO provides a "liquid staking" service, whereby users are able to lock any amount of ETH for validating purposes and then receive the stETH token, which can be rehypotheticated in DeFi to earn yield.

Each stETH is redeemable for 1 ETH after merge

@Crypto_Joe10 Each stETH is only redeemable through the launch of the beaocn chain. Until that point, the 12.8 mil ETH in the ETH2 staking contract is illiquid.

Lido stakes 32% (4.1 mil) of this 12.8 mil

Lido stakes 32% (4.1 mil) of this 12.8 mil

@Crypto_Joe10 Before we dive into Celsius' balance sheet & smart money tracking, let's first look at how stETH should be priced:

@Crypto_Joe10

As quoted by Lido, stETH is backed by ETH (on the beacon chain), and the market is now starting to realise the fair price for stETH.

But how much of a discount is fair given the liquidity dynamics of this investment?

As quoted by Lido, stETH is backed by ETH (on the beacon chain), and the market is now starting to realise the fair price for stETH.

But how much of a discount is fair given the liquidity dynamics of this investment?

@Crypto_Joe10 stETH pricing should be a function of 4 things

1. The current desire for Liquidity in the market (Demand/Supply)

2. Volume and Liquidity of the current market (How well can the market handle sell pressure)

3. Likelihood of successful/delayed merge

4. Smart Contract risk

1. The current desire for Liquidity in the market (Demand/Supply)

2. Volume and Liquidity of the current market (How well can the market handle sell pressure)

3. Likelihood of successful/delayed merge

4. Smart Contract risk

@Crypto_Joe10 Let's dig in a little..

@Crypto_Joe10 1) The desire for liquidity in the market.

At different stages during the market cycle, demand for liquidity ebbs and flows. When prices are rising, and liquidity is high, liquidating positions is easy, and of low cost and vice versa..

At different stages during the market cycle, demand for liquidity ebbs and flows. When prices are rising, and liquidity is high, liquidating positions is easy, and of low cost and vice versa..

@Crypto_Joe10 We've already seen significant withdrawals of stETH, for example Amber, with over $140m in their wallet withdrawn from the curve pool.

This is a growing trend over the last few days, and indicative of potential larger sell pressure brewing.

This is a growing trend over the last few days, and indicative of potential larger sell pressure brewing.

@Crypto_Joe10 The most crucial supply/demand aspect in this case is Celsius. If one is to believe Celsius may become a forced seller, this drastically alters the supply/demand as highlighted above.

The key question is how much of that can the market absorb, and at what cost?

The key question is how much of that can the market absorb, and at what cost?

@Crypto_Joe10 So how liquid is stETH?

@Crypto_Joe10 2) Volume and liquidity of the current market

The total liquidity in the pool has dropped by over 20% in the early hours this morning, with significant selling from wallets associated with Alameda, and Celsius highlighted earlier in this thread.

etherscan.io/tx/0xf7713ee0fa8a90ce507ee78ecc35733937c97f9801950fb383fad1caeed7288c

The total liquidity in the pool has dropped by over 20% in the early hours this morning, with significant selling from wallets associated with Alameda, and Celsius highlighted earlier in this thread.

etherscan.io/tx/0xf7713ee0fa8a90ce507ee78ecc35733937c97f9801950fb383fad1caeed7288c

@Crypto_Joe10 This withdrawal of liquidity of over $150m of stETH from Amber is significant, and is likely indicative of a fore-warning to sell.

That’s $150m that could hit the market over the next few days.

That’s $150m that could hit the market over the next few days.

@Crypto_Joe10 A second point is the pool imbalance, which is more eloquently explained by @tetranode here:

The key point to stem from this, highlighted by @smallcapscience is this pool imbalance is dangerous and contributes heavily to a higher risk of de-pegging.

The key point to stem from this, highlighted by @smallcapscience is this pool imbalance is dangerous and contributes heavily to a higher risk of de-pegging.

@Crypto_Joe10 @Tetranode @SmallCapScience Withdrawal of liquidity from the 3 pool, was the first start to the avalanche attack on UST. Less liquidity = More risk.

@Crypto_Joe10 @Tetranode @SmallCapScience The point is, a number of institutions and normal participants have exposure to stETH at the incorrect risk level given it’s close-ended liquidity structure.

Those tokens hitting the market, could cause significant damage.

Those tokens hitting the market, could cause significant damage.

@Crypto_Joe10 @Tetranode @SmallCapScience 3) The Likelihood of successful/delayed merge

The penultimate risk is the possibility of a delay, or even failure of the beacon chain, which would have consequences for stETH. As pointed out by forecastoor stETH is similar to an ETH future.

The penultimate risk is the possibility of a delay, or even failure of the beacon chain, which would have consequences for stETH. As pointed out by forecastoor stETH is similar to an ETH future.

@Crypto_Joe10 @Tetranode @SmallCapScience In this sense, if merge is delayed, and retrieval of ETH takes 6-12 months after the merge, there is an added cost of liquidity in having your tokens locked, one which is far greater than the yield earned during that period.

@Crypto_Joe10 @Tetranode @SmallCapScience 4. Smart contract risk

Regardless of any demand/liquidity/merge risks, there is also a smart contract risk.

This is pretty simple to price based off the insurance costs of Lido deposit contracts on Nexus mutual which stands at 2.6%.

Regardless of any demand/liquidity/merge risks, there is also a smart contract risk.

This is pretty simple to price based off the insurance costs of Lido deposit contracts on Nexus mutual which stands at 2.6%.

@Crypto_Joe10 @Tetranode @SmallCapScience Therefore at the very least, the smart contract risk ALONE (the most minor risk) in stETH is sitting at 2.6%, which is roughly the current discount of stETH/ETH.

This is telling that stETH risk is hugely underpriced.

This is telling that stETH risk is hugely underpriced.

@Crypto_Joe10 @Tetranode @SmallCapScience A similar case to how stETH could be priced is GBTC in that they are investments into closed-end protocols/funds.

@Crypto_Joe10 @Tetranode @SmallCapScience If you want to sell your GBTC position, you have to sell it on the secondary market as it's a closed-end fund. Until it converts to an ETF, secondary markets are the only option for liquidity.

If you want to sell your stETH you have to sell it on the secondary market until merge

If you want to sell your stETH you have to sell it on the secondary market until merge

@Crypto_Joe10 @Tetranode @SmallCapScience In both cases, this liquidity, open-end risk, and supply/demand dynamics underlie the fair value market price of the asset.

But in this case, why does one trade at a 3% discount, and the other at 30% when the former has added smart contract risk with Lido.

But in this case, why does one trade at a 3% discount, and the other at 30% when the former has added smart contract risk with Lido.

@Crypto_Joe10 @Tetranode @SmallCapScience here are a number of companies that have taken stakes in stETH at these prices:

Similarly, one of the largest bidders of GBTC is blockfi. Let’s have a look to see how they’re doing:

Similarly, one of the largest bidders of GBTC is blockfi. Let’s have a look to see how they’re doing:

@Crypto_Joe10 @Tetranode @SmallCapScience Sitting on $300m of unrealised losses at sub 20% discount, now much closer to $500m+ including management fees.

This is reflected in their recent raise at $1b valuation, having raised at almost 3x the price in May last year.

This is reflected in their recent raise at $1b valuation, having raised at almost 3x the price in May last year.

@Crypto_Joe10 @Tetranode @SmallCapScience The point? Plenty of the biggest players in the game are often wrong, and in this case, a number of entities have completely mispriced the cost of liquidity in both GBTC and stETH, which is a liquidity blackhole in both cases.

@Crypto_Joe10 @Tetranode @SmallCapScience So ultimately, in reply to Lido, and others. We would argue one year staking yield for this liquidity trap is just too low.

Maybe that figure is similar to GBTC at 30%, maybe it’s higher than that given market participants being forced sellers. But it's not 3%.

Maybe that figure is similar to GBTC at 30%, maybe it’s higher than that given market participants being forced sellers. But it's not 3%.

@Crypto_Joe10 @Tetranode @SmallCapScience Now, lets look at what's going on right now in the market:

Liquidity has been depleted & Whales & smart money are selling.

The amount of stETH held by Smart money wallets has dropped from 160,000 stETH to 27,800 stETH in 1 month.

Liquidity has been depleted & Whales & smart money are selling.

The amount of stETH held by Smart money wallets has dropped from 160,000 stETH to 27,800 stETH in 1 month.

@Crypto_Joe10 @Tetranode @SmallCapScience In fact, Alameda dumped 50,615 stETH onto the market in a 2 hr period on Wednesday

@Crypto_Joe10 @Tetranode @SmallCapScience It is very possible someone might be purposefully pulling the peg toward the liquidation prices of stETH.

Leveraged stETH holders will get liquidated at certain prices of stETH:ETH if they do not have sufficient collateral to post.

Pulling stETH to

Leveraged stETH holders will get liquidated at certain prices of stETH:ETH if they do not have sufficient collateral to post.

Pulling stETH to

@Crypto_Joe10 @Tetranode @SmallCapScience Pulling stETH toward these liq. prices would cause a forced selling event & likely result in a liquidation cascade.

For example, at 0.8 stETH:ETH, $299 million will get liquidated.

This type of selling into the low liquidity pools would be cataphoric for short term price

For example, at 0.8 stETH:ETH, $299 million will get liquidated.

This type of selling into the low liquidity pools would be cataphoric for short term price

@Crypto_Joe10 @Tetranode @SmallCapScience Emphasis on short term here.

I do ultimately believe people would happily scoop up stETH at a discount.

However, when you factor in an indiscriminate, forced seller the dynamics change slightly.

The forced seller comes from liquidations & possibly Celsius.

Let's dig in...

I do ultimately believe people would happily scoop up stETH at a discount.

However, when you factor in an indiscriminate, forced seller the dynamics change slightly.

The forced seller comes from liquidations & possibly Celsius.

Let's dig in...

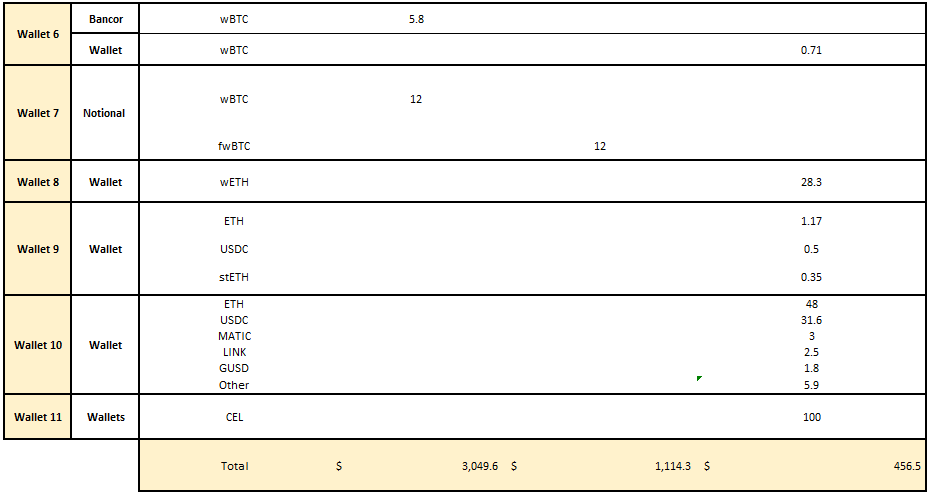

@Crypto_Joe10 @Tetranode @SmallCapScience Performing on-chain analysis, I was able to calculate Celsius' assets & liabilities.

Here is the breakdown:

$3.48 bn in total assets and $1.11 bn in loans, leaving us with $2.374 bn in equity

(this assumes Celsius own 45% of the circ. supply of their CEL token or $100 mil).

Here is the breakdown:

$3.48 bn in total assets and $1.11 bn in loans, leaving us with $2.374 bn in equity

(this assumes Celsius own 45% of the circ. supply of their CEL token or $100 mil).

@Crypto_Joe10 @Tetranode @SmallCapScience The full breakdown of the assets held is here:

*note* this is just assets they have in DeFi, no one can know where else they hold crypto assets (E.g. CEX).

They claim to have around $10 bn TVL, but I was only able to find these.

*note* this is just assets they have in DeFi, no one can know where else they hold crypto assets (E.g. CEX).

They claim to have around $10 bn TVL, but I was only able to find these.

@Crypto_Joe10 @Tetranode @SmallCapScience The important part here is, Celsius is a HUGE holder of stETH.

In fact, they are the largest holder of interest bearing stETH (stETH on Aave)

In fact, they are the largest holder of interest bearing stETH (stETH on Aave)

@Crypto_Joe10 @Tetranode @SmallCapScience If we specifically analyse Celsius' ETH holdings, we find that 71% is held in illiquid / low liquidity types...

$510 mn of ETH is locked in the ETH2 staking contract, unable to be accessed until after merge

& $702 mn is in stETH, unable to exit through liq pools easily

$510 mn of ETH is locked in the ETH2 staking contract, unable to be accessed until after merge

& $702 mn is in stETH, unable to exit through liq pools easily

@Crypto_Joe10 @Tetranode @SmallCapScience So...

what happens if Celsius depositors want to redeem their money?

Have they been redeeming ?

Why do they have 'HODL Mode' activated on accounts?

@kube2_kube looked into it:

what happens if Celsius depositors want to redeem their money?

Have they been redeeming ?

Why do they have 'HODL Mode' activated on accounts?

@kube2_kube looked into it:

@Crypto_Joe10 @Tetranode @SmallCapScience @kube2_kube On Oc 8, 2021, Celsius reported their AUM crossed $25 bn. Celsius is a private company and only reported their financial figure for the operating year of 19' & 20'

No such numbers were released for 22' despite multiple calls by investors on various social platforms...

No such numbers were released for 22' despite multiple calls by investors on various social platforms...

@Crypto_Joe10 @Tetranode @SmallCapScience @kube2_kube including calls from investors from crowdfunding website asking about firm’s liquidity/valuation etc).

The firm has also not released an audit report. They did for 19' & 20' but not in 21'

The firm has also not released an audit report. They did for 19' & 20' but not in 21'

@Crypto_Joe10 @Tetranode @SmallCapScience @kube2_kube In Dec 20', they released a report done in collab with @Chainanalysis. This confirmed that that over $7,609M in deposits and 4,290M in withdrawals since launch in 18'

Based on the report, Celsius claimed that the firm had $3,31 bn worth of assets on chain in in Dec 20'.

Based on the report, Celsius claimed that the firm had $3,31 bn worth of assets on chain in in Dec 20'.

@Crypto_Joe10 @Tetranode @SmallCapScience @kube2_kube @chainanalysis Dec of 2020, there has never been any audit or confirming reported AUMs.

Aside from the not being transparent with their investors about financials figures of 21', the number in old look odd.

Aside from the not being transparent with their investors about financials figures of 21', the number in old look odd.

@Crypto_Joe10 @Tetranode @SmallCapScience @kube2_kube @chainanalysis The firm reported $35M in administrative expenses which is 40% higher than the Cost of Goods Sold.

Lack of transparency have left investors worried about possibility of a bank run on Celsius.

Lack of transparency have left investors worried about possibility of a bank run on Celsius.

@Crypto_Joe10 @Tetranode @SmallCapScience @kube2_kube @chainanalysis The firm is currently holding debt in stable coins versus a position in ETH, BTC and LINK, which exposes them to the market risk of crypto prices.

If the market was to experience a crash (kek), negative crypto prices will decrease the Loan -to- Value ratio.

If the market was to experience a crash (kek), negative crypto prices will decrease the Loan -to- Value ratio.

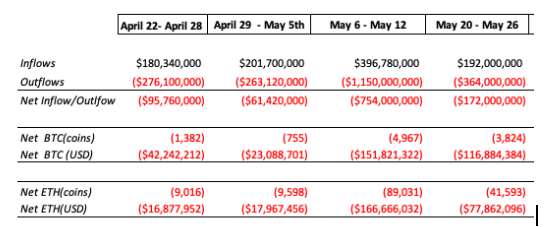

@Crypto_Joe10 @Tetranode @SmallCapScience @kube2_kube @chainanalysis After Terra meltdown (May 6th-12th), there was outflows of $750M of funds (150M ETH & $150M BTC).

Last 2 weeks of May, the firm experienced $450m of net outflows.

Even if we ignore the week, where the outflows were not reported, Celsius experienced $1.2B of outflows.

Last 2 weeks of May, the firm experienced $450m of net outflows.

Even if we ignore the week, where the outflows were not reported, Celsius experienced $1.2B of outflows.

@Crypto_Joe10 @Tetranode @SmallCapScience @kube2_kube @chainanalysis Such outflows are increasing the risk of bank run on Celsius Network.

The following chart shows outflows for the last 5 weeks. Total withdraws for last 5 weeks amounted to 190k of ETH.

Versus the 5-week period before, when Celsius saw 50k of inflows.

The following chart shows outflows for the last 5 weeks. Total withdraws for last 5 weeks amounted to 190k of ETH.

Versus the 5-week period before, when Celsius saw 50k of inflows.

@Crypto_Joe10 @Tetranode @SmallCapScience @kube2_kube @chainanalysis Celsius has been experiencing massive withdrawal for their ETH and assets in general.

Currently, they have enabled “HODL mode,” which prevents users from withdrawing their funds from Celsius network.

Another issue with Celsius is that only 29% of Celsius’ ETH is liquid:

Currently, they have enabled “HODL mode,” which prevents users from withdrawing their funds from Celsius network.

Another issue with Celsius is that only 29% of Celsius’ ETH is liquid:

@Crypto_Joe10 @Tetranode @SmallCapScience @kube2_kube @chainanalysis 1. Liquid ETH:

Most of liq. ETH is deposited into (150k ETH) AAVE & (45k) COMP, both positions have a loan against the assets with ~ 45% LTV

Given the loan against the deposited position, they will have to pay off the loans before being able to withdraw their liquid ETH

Most of liq. ETH is deposited into (150k ETH) AAVE & (45k) COMP, both positions have a loan against the assets with ~ 45% LTV

Given the loan against the deposited position, they will have to pay off the loans before being able to withdraw their liquid ETH

@Crypto_Joe10 @Tetranode @SmallCapScience @kube2_kube @chainanalysis 2. 458k of ETH is in StETH tokens, which means it is in liquid staked format.

The liquidity pool on Curve, st-ETH vs ETH is highly imbalanced and there is only 250k of ETH available for 642k of stETH. If Celsius was to exchange all of the St ETH, they only get 250k...

The liquidity pool on Curve, st-ETH vs ETH is highly imbalanced and there is only 250k of ETH available for 642k of stETH. If Celsius was to exchange all of the St ETH, they only get 250k...

@Crypto_Joe10 @Tetranode @SmallCapScience @kube2_kube @chainanalysis 3. 324K of ETH has been deposited into ETH 2.0 contracts and Celsius will not have access to this position for at least 1-2 years.

- 158K through Figment

- And 166,400 through Ethereum Foundation ETH 2.0 Contract

- 158K through Figment

- And 166,400 through Ethereum Foundation ETH 2.0 Contract

@Crypto_Joe10 @Tetranode @SmallCapScience @kube2_kube @chainanalysis How would you express a trade here?

We’ve thought hard about how to trade this, having contacted market makers, & scoured DeFi

You need to borrow stETH to be able to sell it. There are no futures/perps, which makes it harder to express this view.

*Note* We looked a week ago

We’ve thought hard about how to trade this, having contacted market makers, & scoured DeFi

You need to borrow stETH to be able to sell it. There are no futures/perps, which makes it harder to express this view.

*Note* We looked a week ago

@Crypto_Joe10 @Tetranode @SmallCapScience @kube2_kube @chainanalysis There are two main ways you can do this.

1) OTC market.

If you’re a large institutional player, you’ll have access to market makers and brokers who can lend you stETH against your collateral of ETH.

This isn’t possible for 99% of market participants.

1) OTC market.

If you’re a large institutional player, you’ll have access to market makers and brokers who can lend you stETH against your collateral of ETH.

This isn’t possible for 99% of market participants.

@Crypto_Joe10 @Tetranode @SmallCapScience @kube2_kube @chainanalysis 2) Euler finance. At a 4% cost of carry you can deposit ETH and borrow wstETH against that which you can sell on either Curve, Uniswap or 1inch.

app.euler.finance/market/0x7f39c581f595b53c5cb19bd0b3f8da6c935e2ca0

app.euler.finance/market/0x7f39c581f595b53c5cb19bd0b3f8da6c935e2ca0

@Crypto_Joe10 @Tetranode @SmallCapScience @kube2_kube @chainanalysis The convexity on the trade is good given the largest cost is return to peg, and you have to repay the loan; this is a 5-6% risk.

In a similar way to UST, it is a cheap way to bet on the market given limited upside risk of stETH being worth more than 1:1 with ETH.

In a similar way to UST, it is a cheap way to bet on the market given limited upside risk of stETH being worth more than 1:1 with ETH.

@Crypto_Joe10 @Tetranode @SmallCapScience @kube2_kube @chainanalysis The other way to profit from this trade is by buying stETH at a discount.

If stETH trades at a larger discount than GBTC (30%), and there are forced sellers in the market in Celsius and others.

That, to us, feels like a good opportunity to convert any ETH holdings into stETH.

If stETH trades at a larger discount than GBTC (30%), and there are forced sellers in the market in Celsius and others.

That, to us, feels like a good opportunity to convert any ETH holdings into stETH.

@Crypto_Joe10 @Tetranode @SmallCapScience @kube2_kube @chainanalysis This took a lot of work from myself, @Crypto_Joe10 & @kube2_kube.

Please follow both Joe & Kube, true chad analysts & traders.

Like/Retweet the first tweet below if you can:

Please follow both Joe & Kube, true chad analysts & traders.

Like/Retweet the first tweet below if you can:

@Crypto_Joe10 @Tetranode @SmallCapScience @kube2_kube @chainanalysis Tagging for visibility

.@cobie .@0xHamz .@Galois_Capital .@InternDAO .@AviFelman .@Tetranode .@Darrenlautf .@DeFifrog1 .@dcfgod .@DeFi_Made_Here .@rektdiomedes .@GCRClassic .@GiganticRebirth .@AlgodTrading .@Route2FI .@thedefiedge .@tztokchad .@jimtalbot .@cmsholdings

.@cobie .@0xHamz .@Galois_Capital .@InternDAO .@AviFelman .@Tetranode .@Darrenlautf .@DeFifrog1 .@dcfgod .@DeFi_Made_Here .@rektdiomedes .@GCRClassic .@GiganticRebirth .@AlgodTrading .@Route2FI .@thedefiedge .@tztokchad .@jimtalbot .@cmsholdings

Mentions

See All

Amy Wu @amytongwu

·

Jun 11, 2022

Excellent thread ser thank u