Thread

Ever wanted to leverage trade without the chance of getting liquidated? or 3x long ETH and simply wait until new ATH?

A thread on how @TracerDAO allows users to take lev positions in assets, both crypto & real world assets, w/out any risk of liquidation & with negated vol decay

A thread on how @TracerDAO allows users to take lev positions in assets, both crypto & real world assets, w/out any risk of liquidation & with negated vol decay

@TracerDAO Tracer allows users to buy or sell leveraged tokens in their perpetual pools.

Simply, a leveraged token is a token that tracks the price of an underlying asset (E.g. ETH) & replicates it's returns by some multiple (leverage factor).

3x Leveraged ETH vs ETH for example:

Simply, a leveraged token is a token that tracks the price of an underlying asset (E.g. ETH) & replicates it's returns by some multiple (leverage factor).

3x Leveraged ETH vs ETH for example:

@TracerDAO If you are bullish ETH, you can buy the 3L-ETH token & you will make approx 3 times the returns of holding spot ETH if prices move up

If you are Bearish ETH, you buy the 3S-ETH token & you will make approx 3 times the returns of shorting ETH with 1x lev if prices move down

If you are Bearish ETH, you buy the 3S-ETH token & you will make approx 3 times the returns of shorting ETH with 1x lev if prices move down

@TracerDAO You can buy these tokens on secondary markets via the balancer integration or you can either mint, burn or flip tokens.

Buying a token MINTS a new token

Selling a token BURNS this token & returns your assets

When you switch from L to S, your tokens FLIP

Buying a token MINTS a new token

Selling a token BURNS this token & returns your assets

When you switch from L to S, your tokens FLIP

@TracerDAO The long or short tokens represent your share in the perpetual pool.

Minting adds tokens to this pool, burning removes tokens from this pool & it is akin to opening & closing your perpetual position.

But who pays out traders winnings?

Minting adds tokens to this pool, burning removes tokens from this pool & it is akin to opening & closing your perpetual position.

But who pays out traders winnings?

@TracerDAO The long & short pool are counterparties, with a % of funds being periodically transferred between pools, depending on the underlying assets performance.

E.g. the Long pool will pay some fund to the short pool if ETH prices moves against them (down)

E.g. the Long pool will pay some fund to the short pool if ETH prices moves against them (down)

@TracerDAO But how do the pools stay balanced?

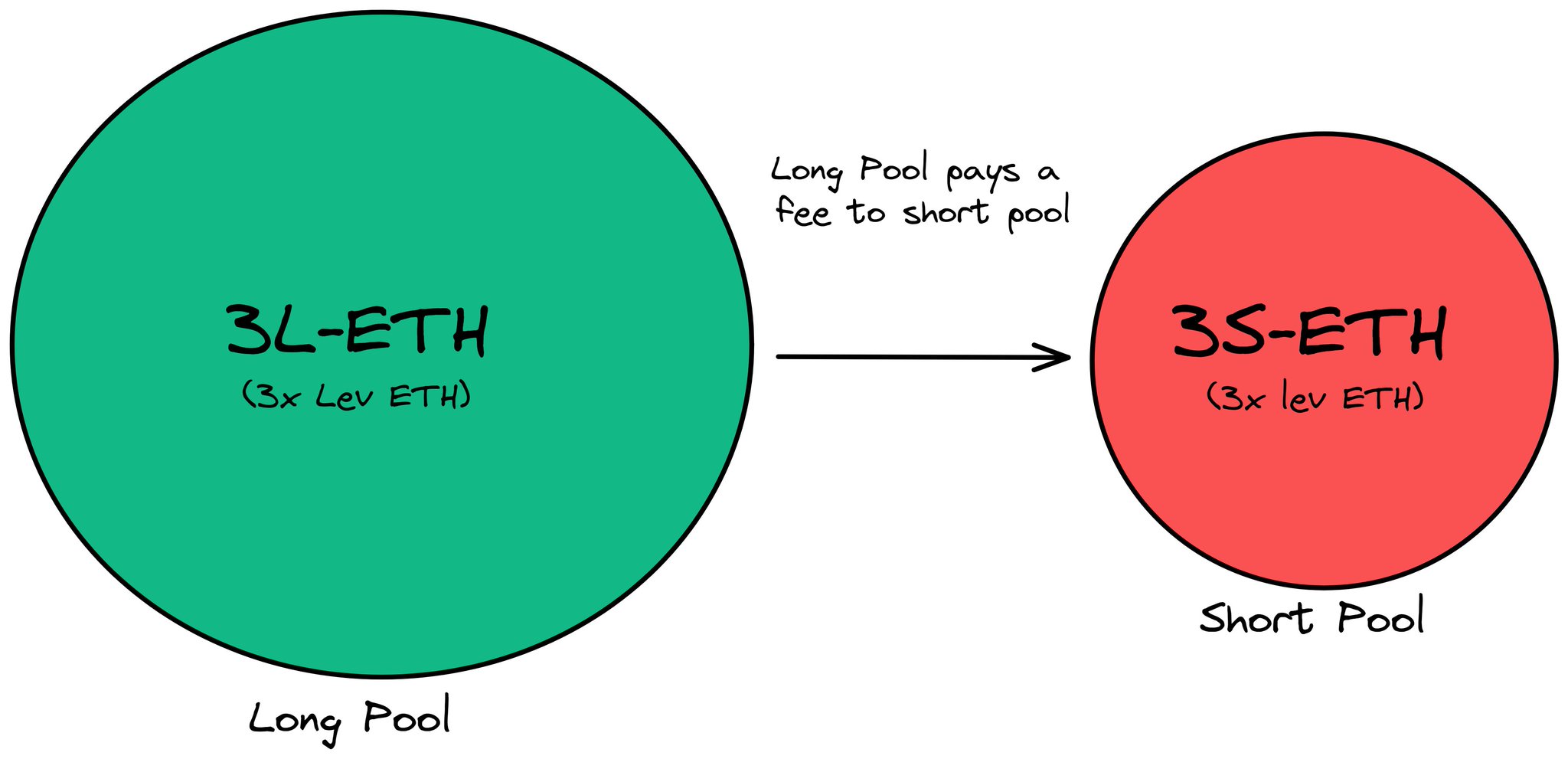

If the funds from one of the pools (L/S) exceed 50% of the entire open interest (Long pool funds + Short pool funds), than the pool which is in high demand will pay a fee to the other pool

Analogous to the funding rate on Perps

If the funds from one of the pools (L/S) exceed 50% of the entire open interest (Long pool funds + Short pool funds), than the pool which is in high demand will pay a fee to the other pool

Analogous to the funding rate on Perps

@TracerDAO If there are more funds in the long pool than short pool, then the long pool will pay the short pool a payment.

& Vice versa

This will effectively reduce the leverage you have on a position if you are in the long pool.

& Vice versa

This will effectively reduce the leverage you have on a position if you are in the long pool.

@TracerDAO Since the perpetual pools are bilateral derivative contracts, you can keep them open for as long as you like, without getting liquidated.

However, this doesn't mean you can *efficiently* keep this trade on due to something called volatility decay.

However, this doesn't mean you can *efficiently* keep this trade on due to something called volatility decay.

@TracerDAO TL;DR of Volatility Decay

If ETH is volatile, you could underperform just holding spot even if ETH price ends higher than it starts and you are 3x leveraged.

E.g. ETH starts the week at $1,800 and ends at $1,820.

With these daily returns, you're worse of being 3x Lev

If ETH is volatile, you could underperform just holding spot even if ETH price ends higher than it starts and you are 3x leveraged.

E.g. ETH starts the week at $1,800 and ends at $1,820.

With these daily returns, you're worse of being 3x Lev

@TracerDAO So it's not as simple as 3x longing ETH and waiting for new ATH

However, @TracerDAO have implemented a few features to severely dampen volatility decay

This would mean you could 3 x long ETH and wait as long as it takes to reach ATH..

However, @TracerDAO have implemented a few features to severely dampen volatility decay

This would mean you could 3 x long ETH and wait as long as it takes to reach ATH..

@TracerDAO The 8 hour mint/burn allows for Tracer to use a simple moving average pricing (SMA) system that dampens volatility in prices & thus reduces volatility decay.

As you can see, the SMA smooths ETH price here.

As you can see, the SMA smooths ETH price here.

@TracerDAO With the SMA pricing included, we get the following results for the 3x leveraged ETH token on Tracer.

As you can see, the volatility decay has been mitigated & we are significantly outperforming the standard 3x Lev ETH long, whilst also beating the spot ETH position.

As you can see, the volatility decay has been mitigated & we are significantly outperforming the standard 3x Lev ETH long, whilst also beating the spot ETH position.

@TracerDAO The fees for minting leveraged tokens are also distributed back to pools to further offset this volatility decay + $TCR rewards!

However, vol decay isn't completely eliminated and so my representative example where 3L-ETH SMA outperformed spot ETH, may not always hold.

However, vol decay isn't completely eliminated and so my representative example where 3L-ETH SMA outperformed spot ETH, may not always hold.

@TracerDAO The team are also actively working on adjusting parameters to help eliminate vol decay.

Imagine a day when you could simply 3x Long ETH & chill...

Imagine a day when you could simply 3x Long ETH & chill...

@TracerDAO Great team at @TracerDAO & really excited to see how they evolve and integrate with other great teams such as @UmamiFinance

One to keep an eye on, especially with the delta neutral vaults ('tis a bear mkt after all) Umami will offer by integrating Tracer as a hedging mechanism

One to keep an eye on, especially with the delta neutral vaults ('tis a bear mkt after all) Umami will offer by integrating Tracer as a hedging mechanism

@TracerDAO @UmamiFinance Hope you enjoyed the thread!

Pls Like/Retweet the first tweet below if you did :)

Pls Like/Retweet the first tweet below if you did :)

@TracerDAO @UmamiFinance Tagging for visibility:

.@tetranode .@crypto_condom .@jackniewold .@eth_aj .@thedefiprincess .@BarryFried1 .@rektdiomedes .@thedefiedge .@Route2FI .@mynt_josh .@phtevenstrong .@PrismaticCap .@Crypto_Joe10 .@InternDAO .@alpha_pls .@Darrenlautf

.@tetranode .@crypto_condom .@jackniewold .@eth_aj .@thedefiprincess .@BarryFried1 .@rektdiomedes .@thedefiedge .@Route2FI .@mynt_josh .@phtevenstrong .@PrismaticCap .@Crypto_Joe10 .@InternDAO .@alpha_pls .@Darrenlautf

Mentions

See All

David Hoffman @TrustlessState

·

Jun 11, 2022

Really good thread