Thread

Yesterday Nate Chastain, former product manager at Opensea, was indicted for making ~$40,000 insider-trading NFTs.

He's facing up to *40 years in prison.*

DOJ is coming for your ass too.

Here's what you need to know to get smart on this surprising case and not go to jail:

He's facing up to *40 years in prison.*

DOJ is coming for your ass too.

Here's what you need to know to get smart on this surprising case and not go to jail:

The facts:

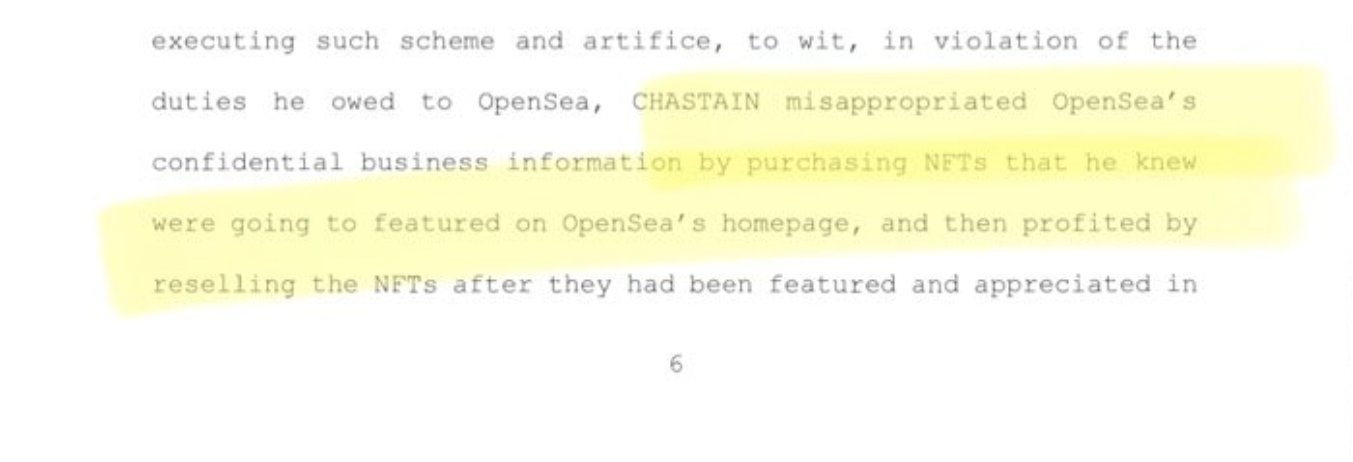

Nate had insider knowledge that Opensea would feature certain NFTs on its homepage.

He bought NFTs within those collections in advance of the feature, and dumped them after for a modest profit.

See here for the full DOJ press release:

www.justice.gov/usao-sdny/pr/former-employee-nft-marketplace-charged-first-ever-digital-asset-insider...

Nate had insider knowledge that Opensea would feature certain NFTs on its homepage.

He bought NFTs within those collections in advance of the feature, and dumped them after for a modest profit.

See here for the full DOJ press release:

www.justice.gov/usao-sdny/pr/former-employee-nft-marketplace-charged-first-ever-digital-asset-insider...

What's surprising is that this isn't "classical" insider trading, in which an insider uses material non-public information to trade securities.

Instead of securities fraud, federal prosecutors are instead pursuing a much broader wire fraud charge.

Instead of securities fraud, federal prosecutors are instead pursuing a much broader wire fraud charge.

Fraud in general is essentially "lying to steal money from someone," that someone being the victim.

Let's put on our law school hats and ask:

Who is the victim in this case?

Let's put on our law school hats and ask:

Who is the victim in this case?

You might think that the victim is "the person he bought the NFTs from."

After all, THAT poor schlub stood to gain a penny or two from Opensea's feature event.

But--using insider information--Nate purchased their NFTs first.

And rather than Poor Schlub gaining 2-5x, Nate did.

After all, THAT poor schlub stood to gain a penny or two from Opensea's feature event.

But--using insider information--Nate purchased their NFTs first.

And rather than Poor Schlub gaining 2-5x, Nate did.

This is the market fairness theory--we want fair markets and Nate made it not-fair.

But the thing is, that's *not* what DOJ is claiming, and *not* who DOJ says the victim was.

The victim in this case was (drumroll) Opensea.

Wait, what?

But the thing is, that's *not* what DOJ is claiming, and *not* who DOJ says the victim was.

The victim in this case was (drumroll) Opensea.

Wait, what?

Here's the logic:

Nate didn't owe a duty to the random schlubs who owned the featured NFTs, or even to maintaining a fair market--but he did owe a duty to his employer.

And what duty was that?

Put broadly, to not misappropriate confidential information.

Nate didn't owe a duty to the random schlubs who owned the featured NFTs, or even to maintaining a fair market--but he did owe a duty to his employer.

And what duty was that?

Put broadly, to not misappropriate confidential information.

Board members of public corporations owe a duty to shareholders to not trade against them using non-public information.

But in this case, there was no established fiduciary duty to NFT holders.

But in this case, there was no established fiduciary duty to NFT holders.

So why is it a crime to violate a duty to your employer?

Shouldn't that be a civil claim you can settle 1:1 with your company without involving, uhm, prison?

Nope, says the DOJ.

Shouldn't that be a civil claim you can settle 1:1 with your company without involving, uhm, prison?

Nope, says the DOJ.

If what you did:

a) is fraud

b) touches interstate wire (aka the internet aka any financial transaction)

Then it's under Federal purview and you will go to prison.

a) is fraud

b) touches interstate wire (aka the internet aka any financial transaction)

Then it's under Federal purview and you will go to prison.

Now here comes the fun part.

If insider trading, read as "misappropriation of confidential information" can be and is enforced outside of the classical securities context, then there's a big open question:

What exactly counts as insider trading?

If insider trading, read as "misappropriation of confidential information" can be and is enforced outside of the classical securities context, then there's a big open question:

What exactly counts as insider trading?

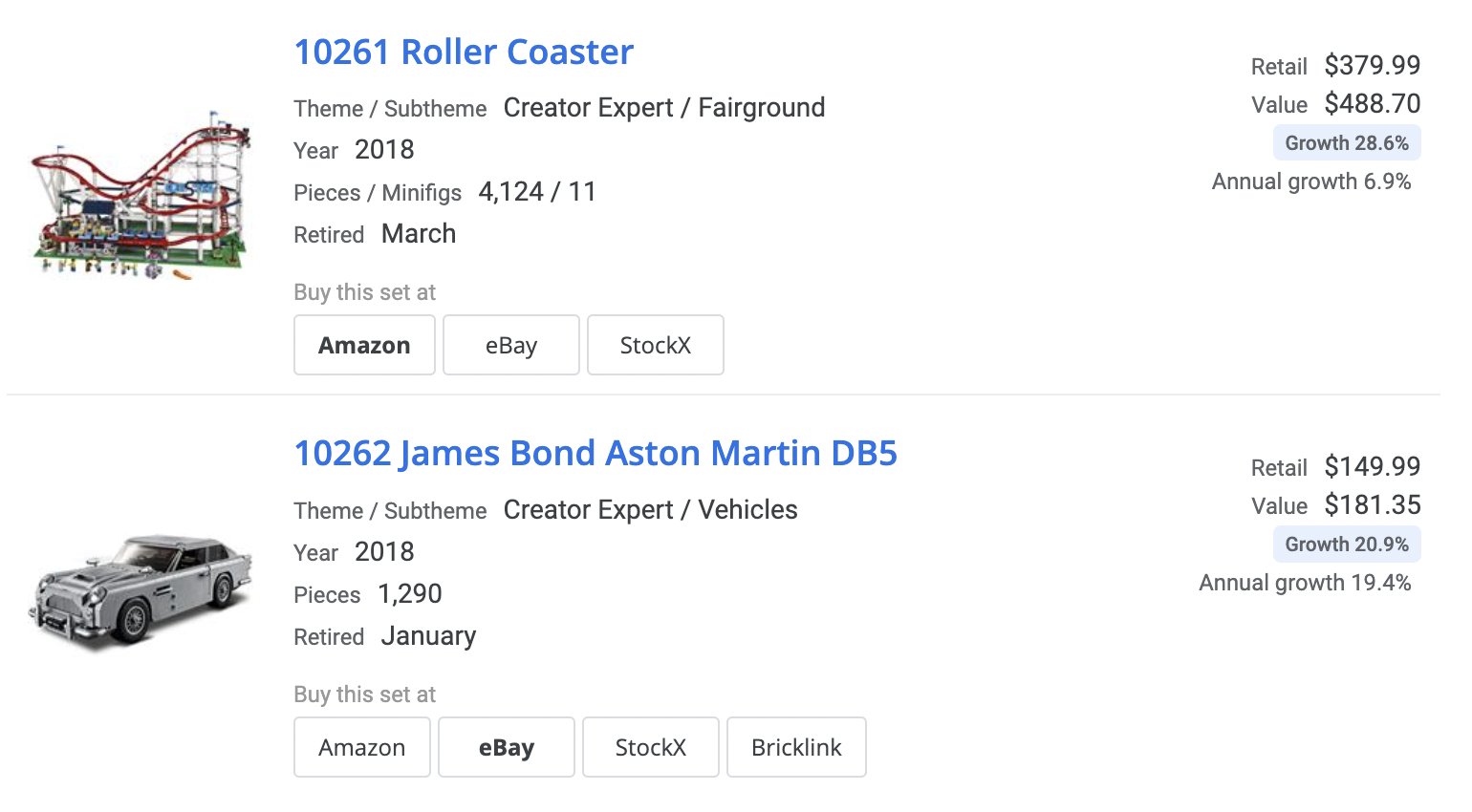

Say you're a Lego employee who knows the 10261 Roller Coaster set is soon to be discontinued.

It's well known that discontinuation typically leads to a pop in secondary market value.

It's well known that discontinuation typically leads to a pop in secondary market value.

So, knowing Lego 10261 Roller Coaster is going to be discontinued, you buy a bunch of 10261 Roller Coaster sets before the announcement and sell them after for a profit.

Is that fraud?

Yes!

Is that fraud?

Yes!

Some other confidential-info hypotheticals:

- Stubhub employee buys Dua Lipa tix in advance of a homepage feature

- Netflix employee buys Stranger Things merch in advance of Season 4

- NFL employee buys #84 memorabilia in advance of Tom Brady's retirement

Fraud! Fraud! Fraud!

- Stubhub employee buys Dua Lipa tix in advance of a homepage feature

- Netflix employee buys Stranger Things merch in advance of Season 4

- NFL employee buys #84 memorabilia in advance of Tom Brady's retirement

Fraud! Fraud! Fraud!

There are many such examples where tech employees can abuse insider information:

- Product announcements

- New market entry

- Listings and features

All of which, if utilized to facilitate a profit-making scheme, can constitute fraud.

- Product announcements

- New market entry

- Listings and features

All of which, if utilized to facilitate a profit-making scheme, can constitute fraud.

tl;dr to tech and crypto employees abusing confidential information:

Do not think for a second because digital assets are not securities that you are not insider trading.

Do not think for a second because digital assets are not securities that you are not insider trading.

Regardless of asset type and profit earned, the DOJ will send you to prison.

"Classical" insider trading is dead.

Long live digital asset insider trading.

"Classical" insider trading is dead.

Long live digital asset insider trading.

I hope this helps clarify what's going on here, and note: I am not a lawyer.

Follow me @jonwu_ for more analysis on privacy, NFTs, and crypto.

And Like/Retweet the first tweet below if you can:

Follow me @jonwu_ for more analysis on privacy, NFTs, and crypto.

And Like/Retweet the first tweet below if you can: