Thread by Jamie Coutts CMT

- Tweet

- May 25, 2022

- #Cryptocurrency

Thread

Understanding #bitcoin and #crypto requires a multidisciplinary approach. 3 lens I use at #Bloomberg Intelligence are; #onchain,#macro & #technicalanalysis. Lets take a look at what is happening on-chain with $btc ;

Thread 🧵

Thread 🧵

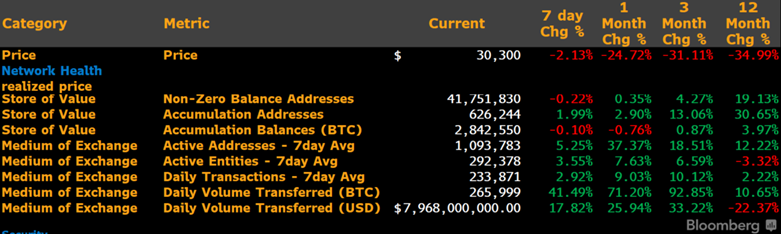

Network Health KPIs for the past 12mths;

1. moderate but consistent adoption-growth curve (addresses)

2. greater resilience in network activity (transactions) vs. the 2017-19 bear market

3. migration of coins from short- to longer-term holders (accumulation)

1. moderate but consistent adoption-growth curve (addresses)

2. greater resilience in network activity (transactions) vs. the 2017-19 bear market

3. migration of coins from short- to longer-term holders (accumulation)

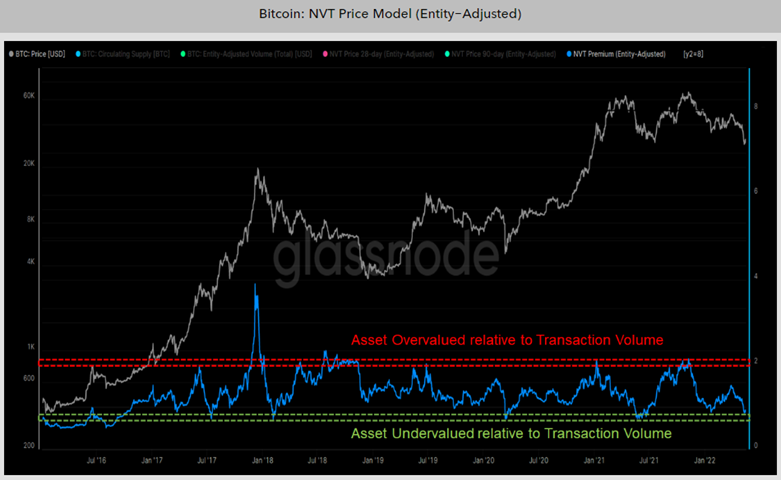

The strong recovery in transactions on the network, coupled with falling prices, has pushed the network-value-to-transactions (NVT) model to levels consistent with prior intermediate lows.

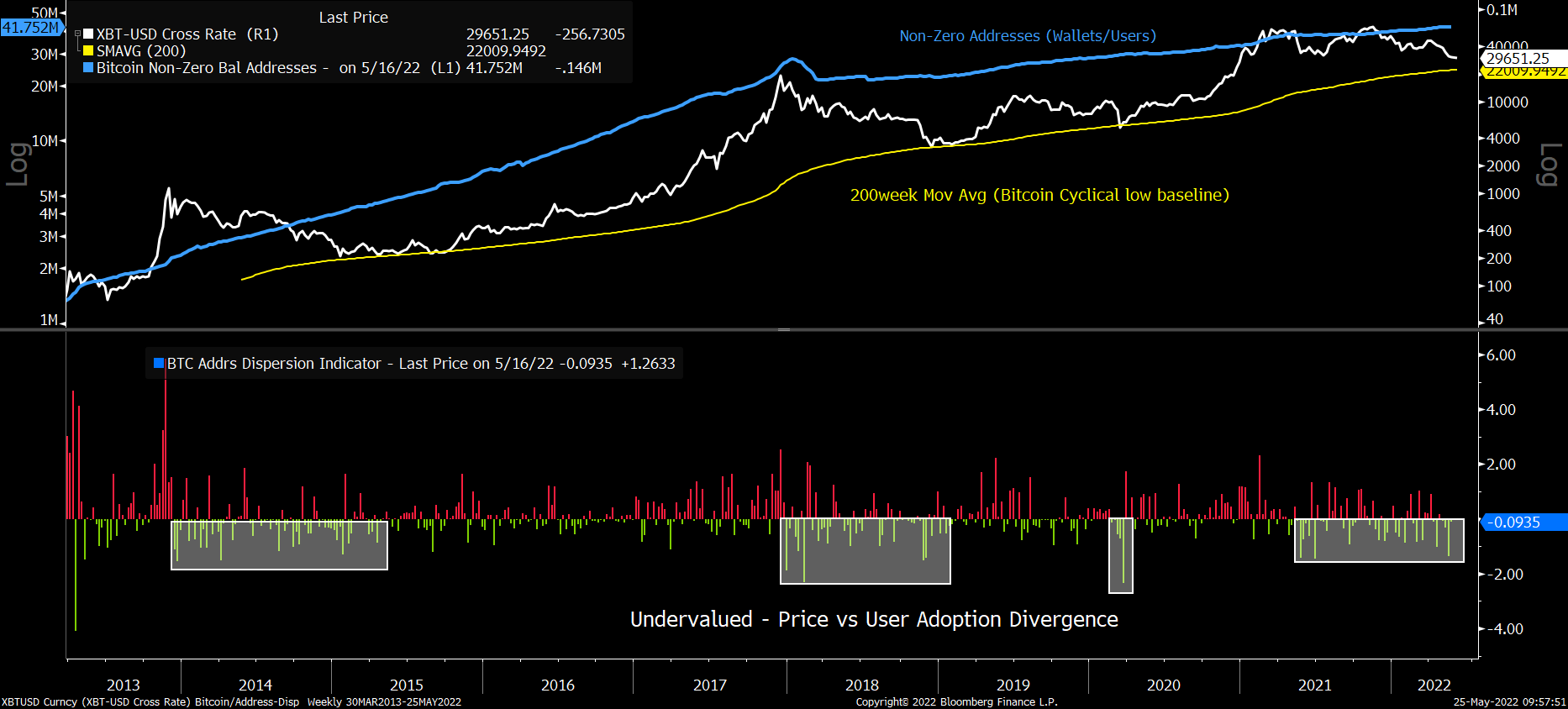

Adoption (addresses holding #BTC), rose 19% in 12mths, flat past month as price fell 30%. Our address-dispersion indicator, plots price and user-growth divergence; its in the undervalued region-only been lower 7% of the time since network inception. Not a timing signal but useful

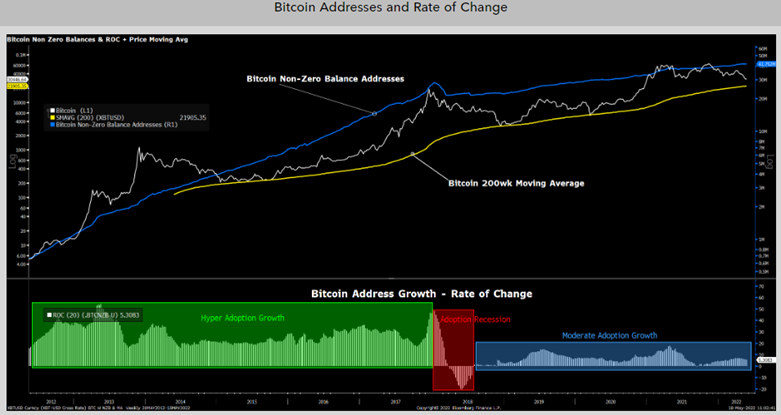

Slowing growth could be a bigger issue for valuation going fwd as 2018-21 cycle experienced moderate user adoption than previous cycles disappointing those who had extrapolated target values based on price trend alone. Can network growth increase or is this more permanent trend?

Bitcoin's May price collapse, led predominately by short-term holders dumping the asset (capitulation), has reached levels seen at major lows in 2015,2019 cycles & 2020 crash. Long-term supply has grown to 65%, the largest ratio since inception

At these levels a capitulation event becomes more likely (2018, 2020) but the MVRV Z-score is approaching where a cyclical lows form

Final word: On-chain data is a great guide into the health of a network, behavior and sentiment. But macro is the primary driver for asset prices (for now) and ultimately only price is TRUTH (technical analysis)