Thread

Just writing Global Macro Investor over the weekend and as ever, I like to share a few insights.

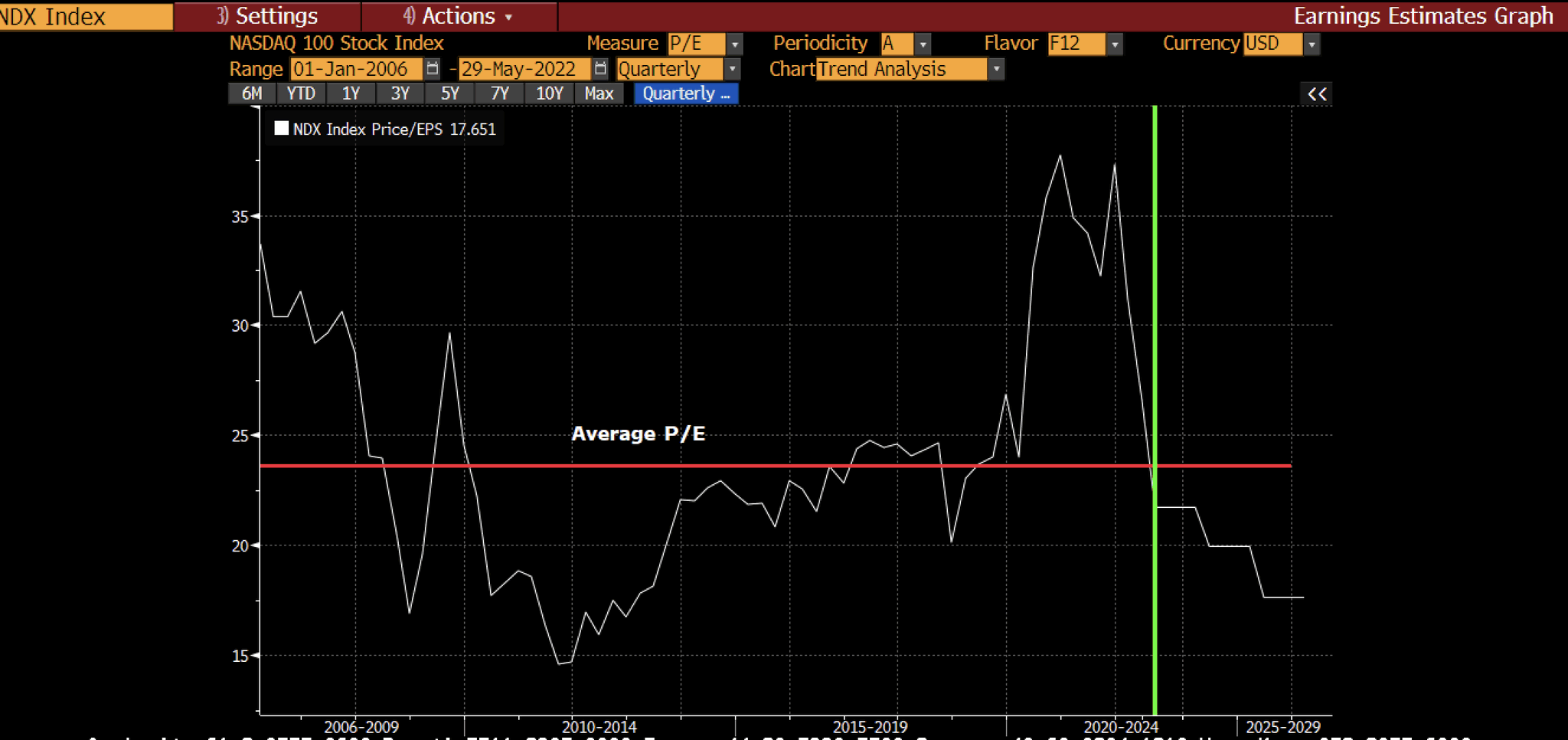

The narrative on Twitter is that tech is dead. The reality is that the Nasdaq has just reverted back to trend - 150 week moving average 1/

The narrative on Twitter is that tech is dead. The reality is that the Nasdaq has just reverted back to trend - 150 week moving average 1/

Put another way, we are at the bottom of the log regression channel, suggesting that the NDX is cheap (but can see more downside in a spike).

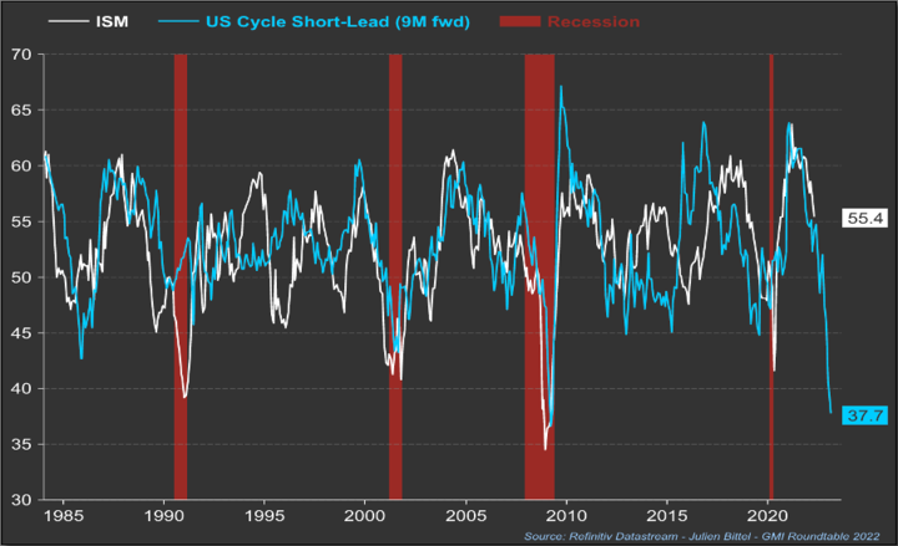

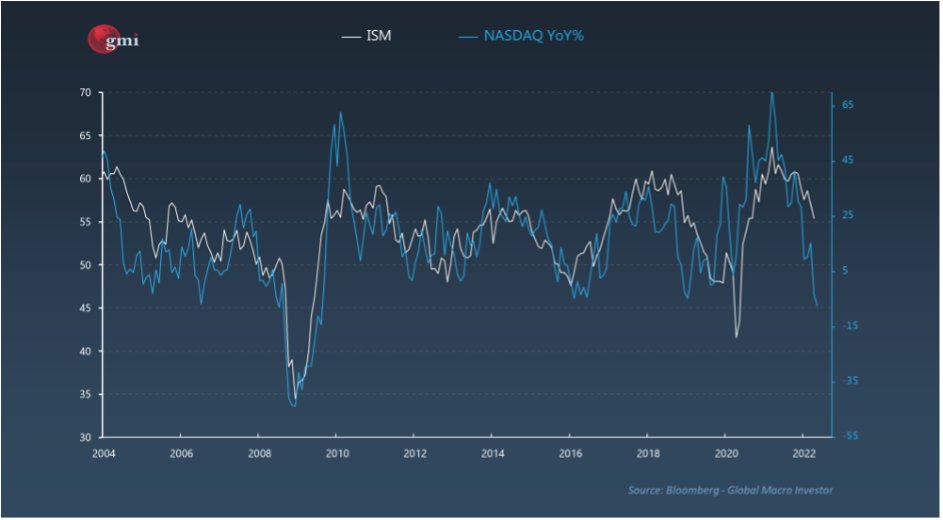

So, question is whether we are going to get a longer recession where earnings get crushed. A recession due to excess monetary tightening seems pretty clear. This chart from @BittelJulien essentially shows rate of change of rates, commodities and the dollar.

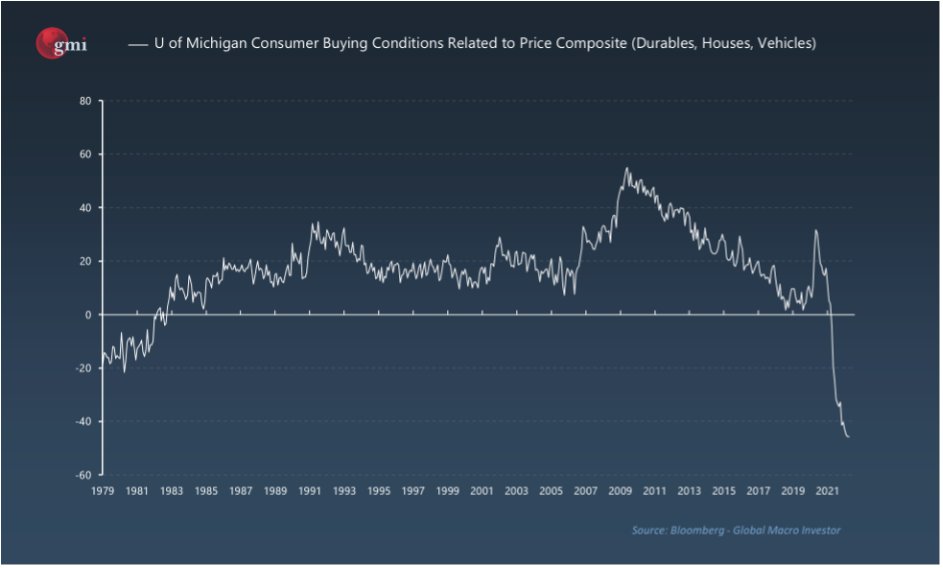

What this chart is saying is that we risk a very sharp growth contraction driven by demand destruction. Higher goods prices and higher borrowing costs kill demand. This chart shows the same...

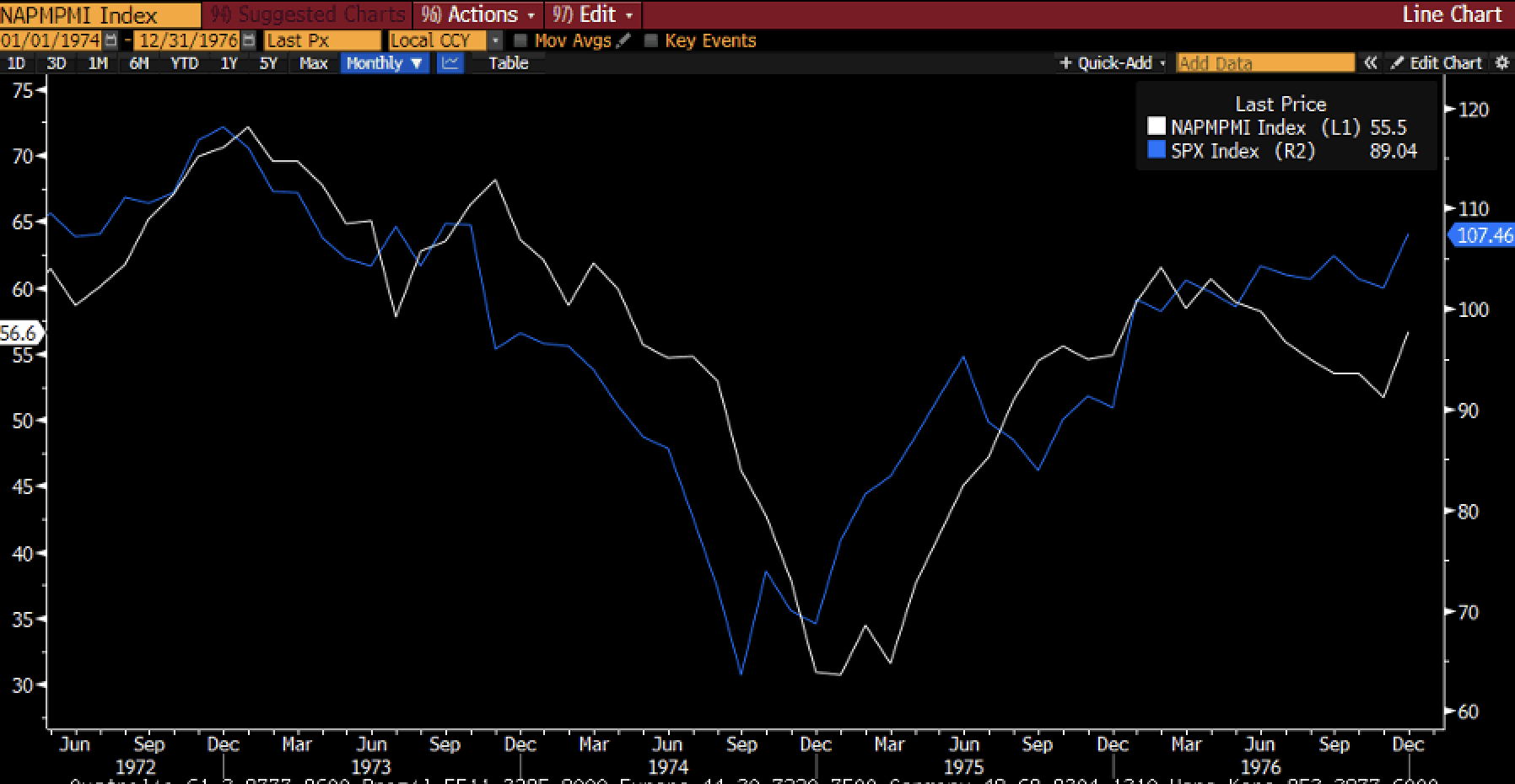

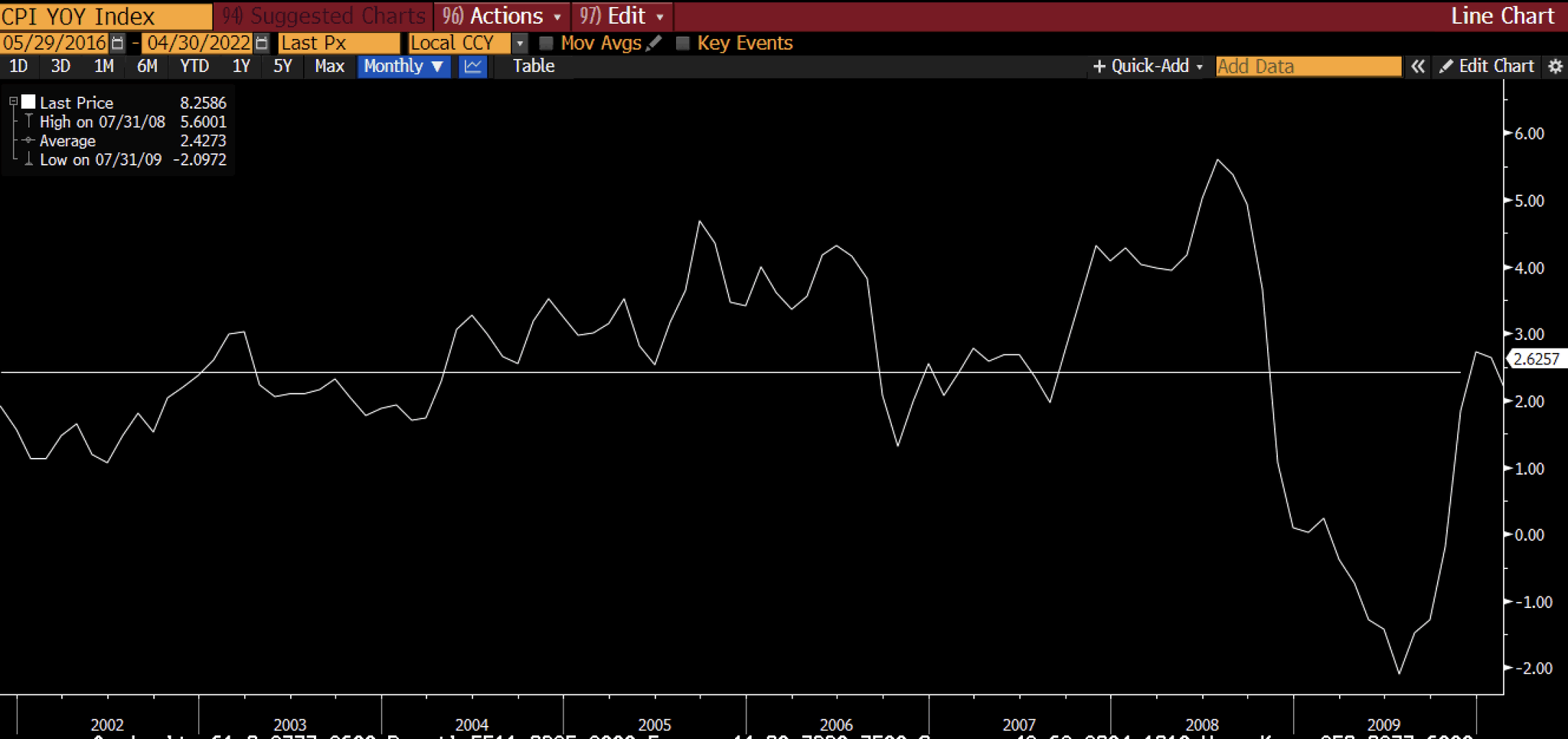

My base case is 1974, where growth collapsed due to high oil and high rates. ISM went from 56 to 30 in 4 months. One of the fastest declines in history... but it was all over quickly as the Fed cut (even with CPI and oil still rising)

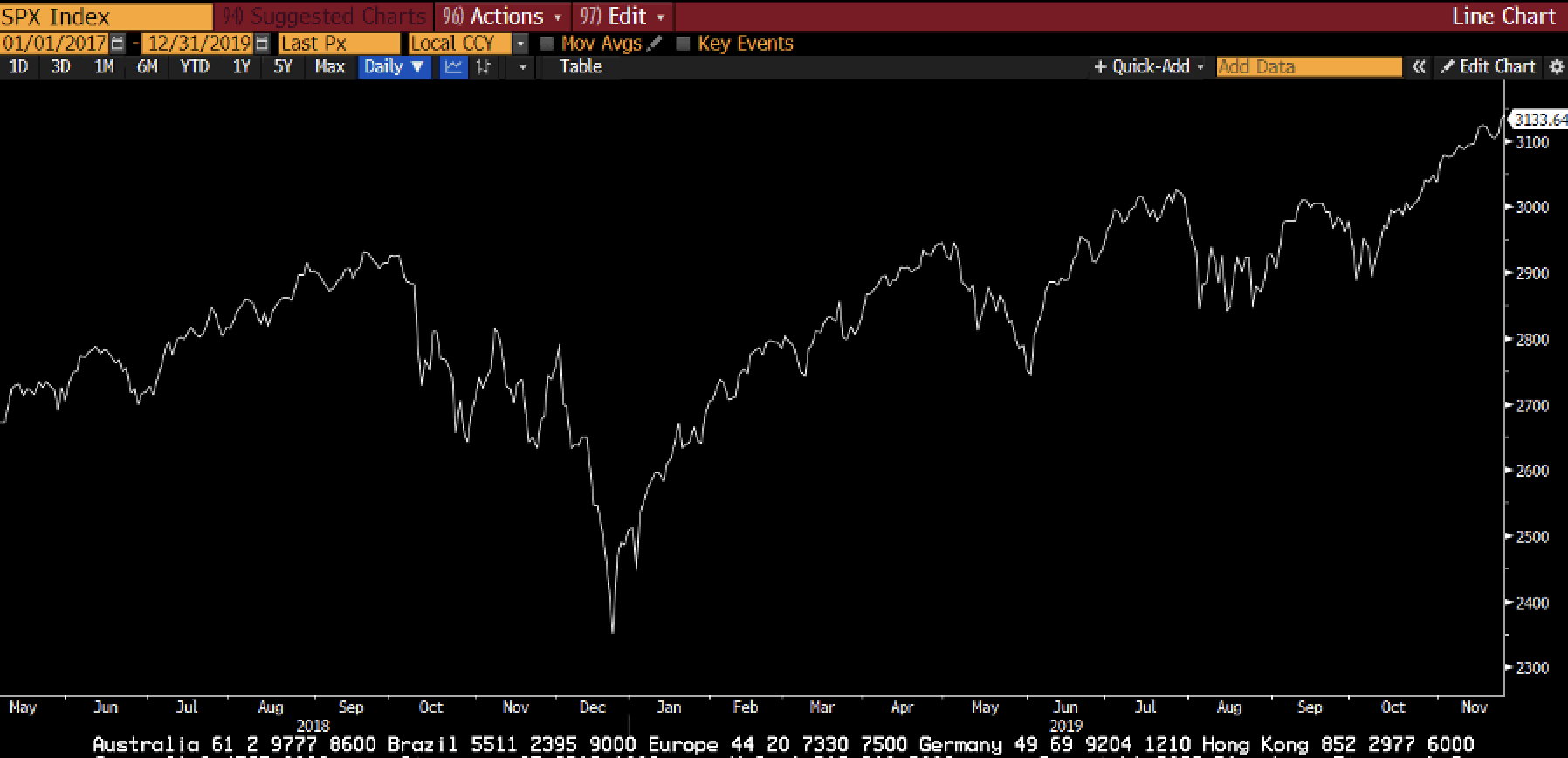

2018 is another decent analogy. Financial conditions were super tight and growth collapsed, leading to the Fed to pivot. Again, there was a final sharp sell off in equities...

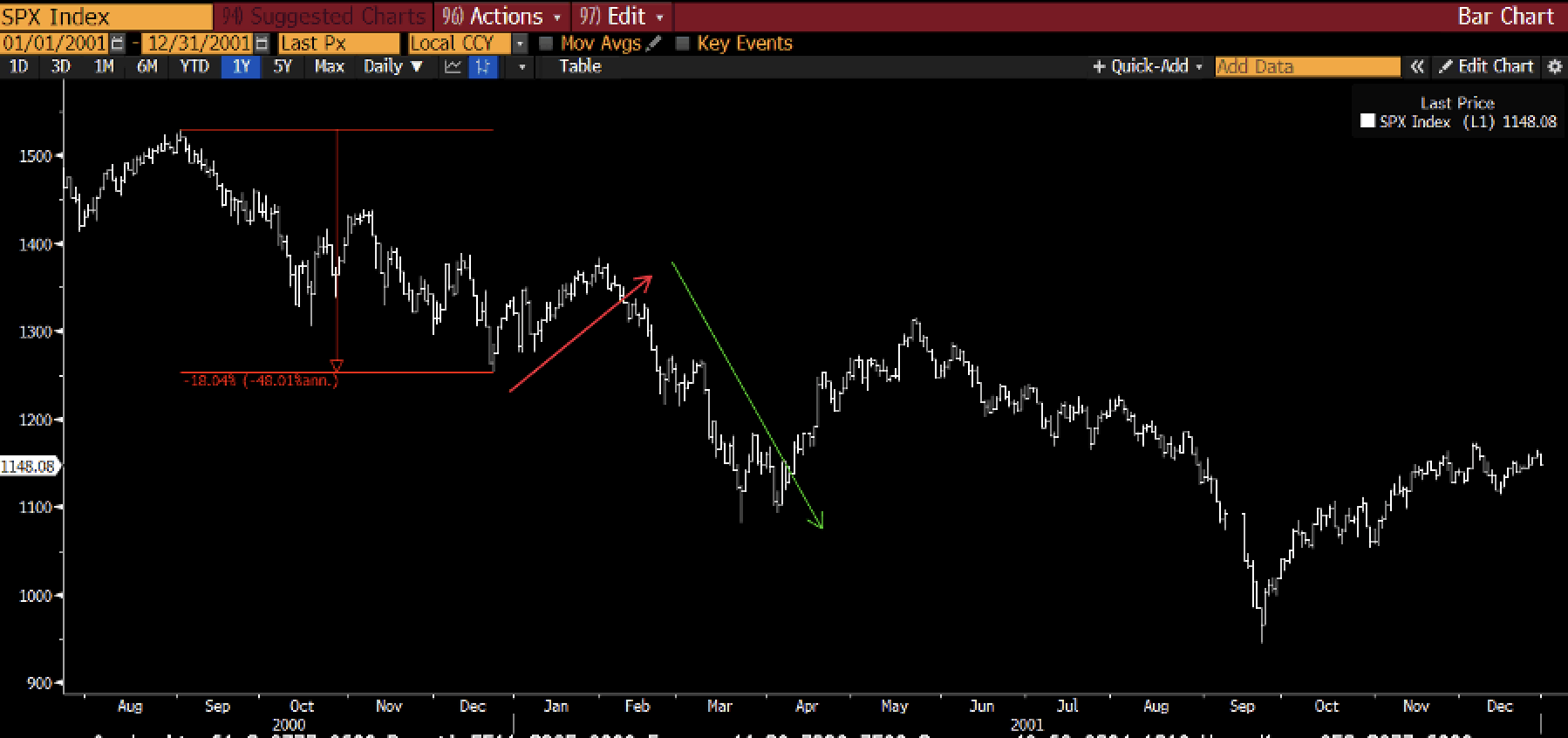

2001 was a different case as earning got killed too as the recession stuck around for longer. It has a probability and would change the outcome and lead to a deeper fall in markets. Maybe is stonks rally from here it forces the Fed to keep hiking and causes this outcome...

But valuations are not extreme now so it is less likely. The potential use of the Fed balance sheet makes it less likely too. But it is possible for sure, but the markets are positioned for it... every VC over the age of 40 is warning about 2001 as it is their mental scar.

I think yields have topped or are topping and that will help clarify the picture. Many good friends suggest that inflation will be sticky and that can lead to a 2001 style outcome as the Fed will be stuck. I have empathy for that view but I don't see it as base case...

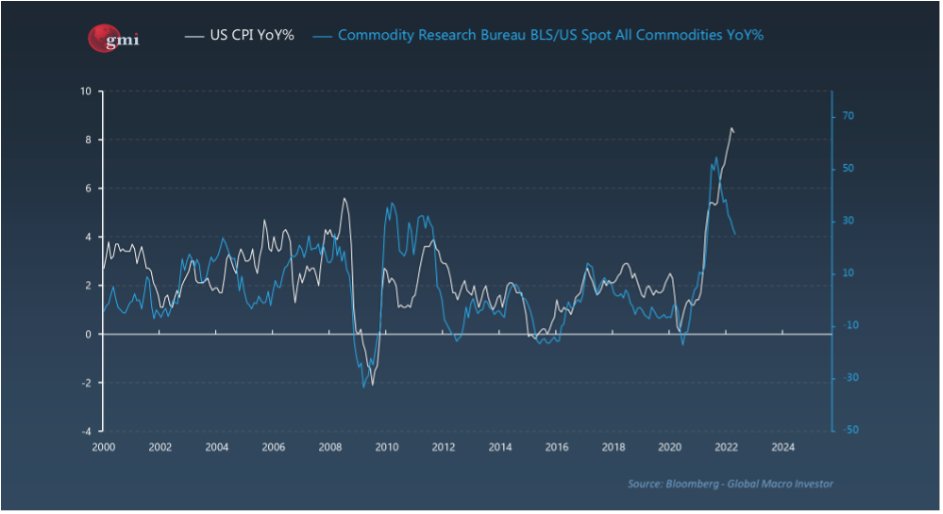

Another good chart to show this is the YoY change in commodity prices. Many make the mistake at look at price levels, which may stay elevated but YoY they still decline. I think we will get commodity price falls too (nothing dramatic) and that will sharply lower CPI.

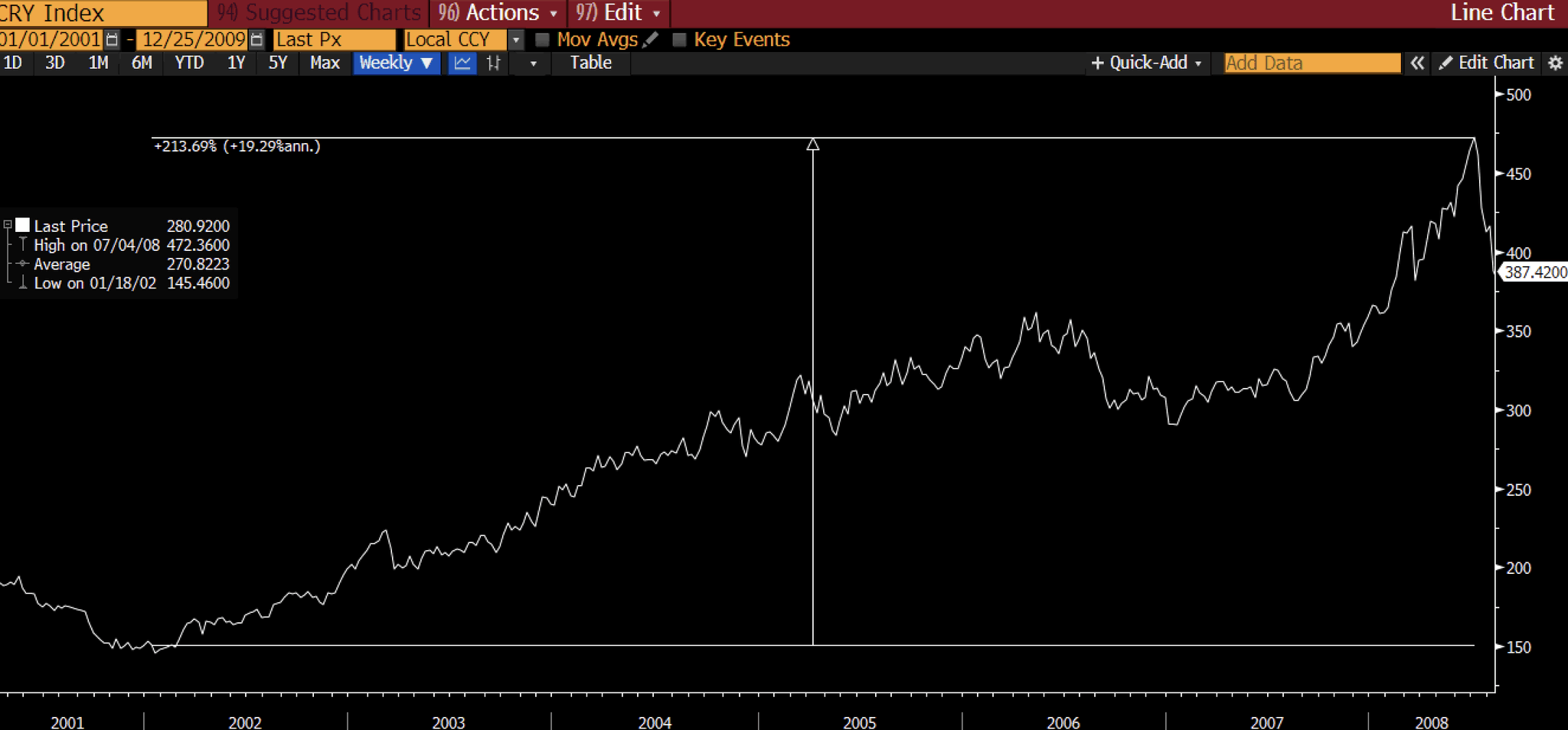

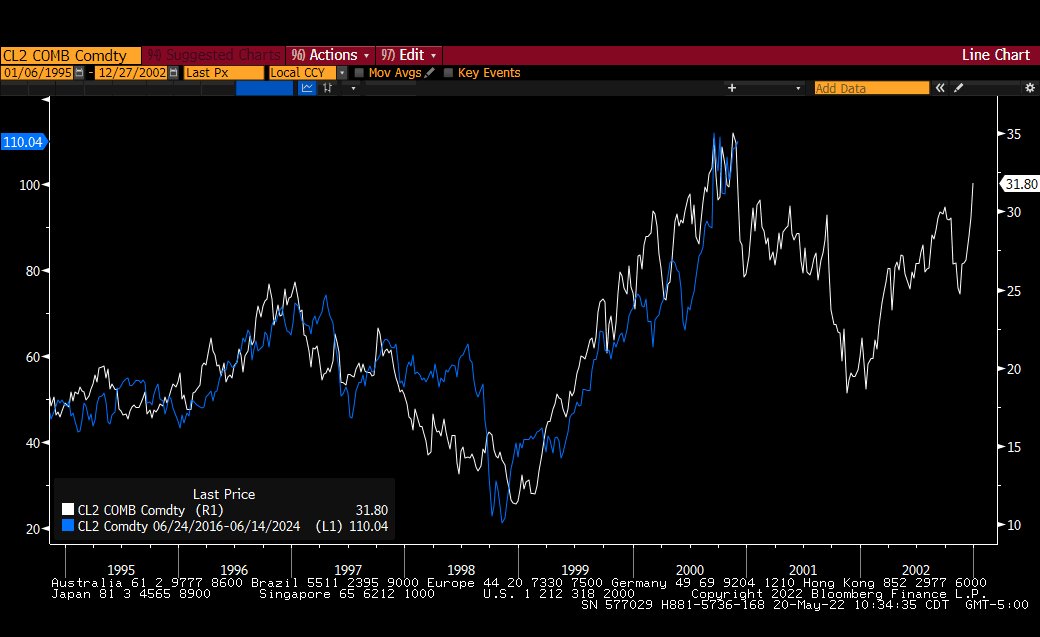

But the commodity supply issue is real and prices will rise when demand comes back, but the odds of high YoY rises are low. We saw similar in 2001 to 2008 when Chinese demand shock caused commodities to explode. Commodities rose 215%

This occurred after years of commodity underinvestment. However, inflation rose only 2.4% on average. Globalization helped but we had a weak dollar. They balanced each other out. Demographics and technology were the swing factors.

Summary:

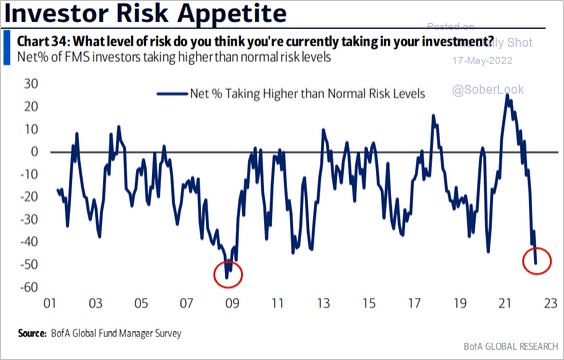

We have a high risk of a sharp recession that is over quickly and another risk off. It is not a certainty. The odds of a bigger recession are lower but could change. Inflation is a past problem.

Probability suggests to buy tech over next month or so. I am a buyer.

We have a high risk of a sharp recession that is over quickly and another risk off. It is not a certainty. The odds of a bigger recession are lower but could change. Inflation is a past problem.

Probability suggests to buy tech over next month or so. I am a buyer.

But you'll have to assess framework in real time if equities dont fall further (quite possible) as that kicks the can down the road and we could see a false hope rally and more Fed.

It's a close call but I think the low is close (now or next few weeks)

It's a close call but I think the low is close (now or next few weeks)

It is near impossible to create YoY commodity price increase vs the comps from last year, even if commodities rise. I think they fall for a while much like 2001.

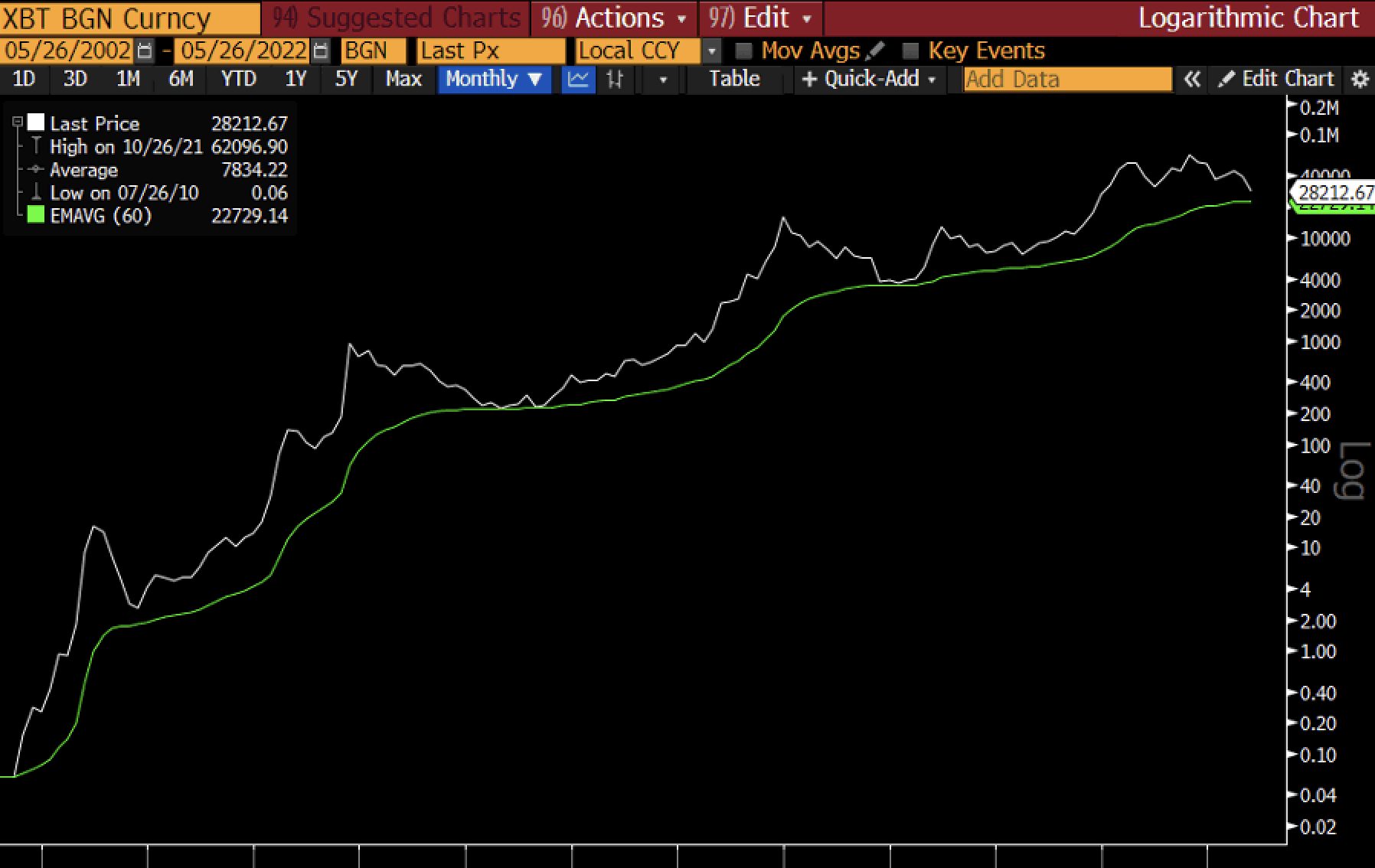

Same applies to crypto which has been constrained by the macro.

I am a significant buyer (for me) into any further weakness...these chances dont come often and they are life changing. The 60 month Exponential Moving Average comes in at $22,500. This is the add zone.

I am a significant buyer (for me) into any further weakness...these chances dont come often and they are life changing. The 60 month Exponential Moving Average comes in at $22,500. This is the add zone.

The only thing that could change all of this is extended inflation at elevated levels. I have tried really hard to assess the odds and even with elevated, rising prices, I just cant get there.

The other easy trade with less risk and less volatility is to buy bonds.

Good luck!

The other easy trade with less risk and less volatility is to buy bonds.

Good luck!