Thread by The DeFi Edge

- Tweet

- May 12, 2022

- #Investment #Cryptocurrency

Thread

My Lessons From the Terra Luna Collapse:

First, this isn't an "I told you so" thread.

• I had 5% of my portfolio in Luna.

• I had 15% of my portfolio in $UST.

I exited last night at a loss.

I'm sharing how I'm updating my Crypto investment thesis based on the events of the past few days.

• I had 5% of my portfolio in Luna.

• I had 15% of my portfolio in $UST.

I exited last night at a loss.

I'm sharing how I'm updating my Crypto investment thesis based on the events of the past few days.

Avoid the Cult of Personalities

These leaders become popular through charisma, strength, and meme mastery.

Skyrocketing token prices and solid partnerships give them even more authority.

The problem?

When then success leads to narcissism and egomania.

These leaders become popular through charisma, strength, and meme mastery.

Skyrocketing token prices and solid partnerships give them even more authority.

The problem?

When then success leads to narcissism and egomania.

We saw this with Frog Nation, Solidly, Node Projects, and now Luna.

The leaders don't take criticism well.

They and their followers attack anyone critical of what they're trying to build.

The leaders don't take criticism well.

They and their followers attack anyone critical of what they're trying to build.

No Room for Healthy Debates

We saw @banklesshq, @gametheorizing, @JackNiewold, @algodtrading, and others got torn to shreds for critiquing Terra.

This creates an echo chamber.

There are fewer debates because "it's not worth it to deal with the crazy followers"

We saw @banklesshq, @gametheorizing, @JackNiewold, @algodtrading, and others got torn to shreds for critiquing Terra.

This creates an echo chamber.

There are fewer debates because "it's not worth it to deal with the crazy followers"

Risk Management

I'm shocked at how many people went "all in" on Luna and Anchor Protocol.

You NEVER go all-in into anything.

NOTHING is guaranteed in any asset, Crypto or non-crypto.

I'm shocked at how many people went "all in" on Luna and Anchor Protocol.

You NEVER go all-in into anything.

NOTHING is guaranteed in any asset, Crypto or non-crypto.

Creating Systems

I have a rule: No token goes over 15% of my portfolio.

My $UST never went over 15%.

I would've allocated more to UST & Anchor protocol if it wasn't for that rule.

Create rules to protect yourself from your emotions and biases.

I have a rule: No token goes over 15% of my portfolio.

My $UST never went over 15%.

I would've allocated more to UST & Anchor protocol if it wasn't for that rule.

Create rules to protect yourself from your emotions and biases.

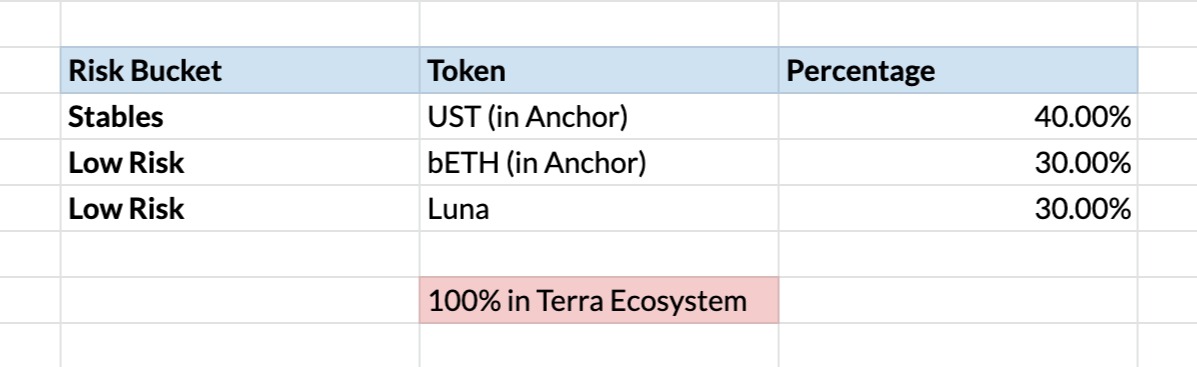

Ecosystem Blindspot

• They held Luna

• They held stables in UST

• They collateralized their ETH and AVAX

They were diversified in their eyes.

They didn't realize they were overexposed to the Terra ecosystem.

When the Terra collapsed, so did their portfolio.

• They held Luna

• They held stables in UST

• They collateralized their ETH and AVAX

They were diversified in their eyes.

They didn't realize they were overexposed to the Terra ecosystem.

When the Terra collapsed, so did their portfolio.

What's a Blue Chip?

I considered Luna and AVAX to be blue chips.

I was wrong.

A coin needs to survive two cycles (and be on the uptrend) to become a blue chip.

The only blue chips are Bitcoin and Ethereum for now.

(Don't get me wrong, I still love AVAX)

I considered Luna and AVAX to be blue chips.

I was wrong.

A coin needs to survive two cycles (and be on the uptrend) to become a blue chip.

The only blue chips are Bitcoin and Ethereum for now.

(Don't get me wrong, I still love AVAX)

Don't Catch a Falling Knife

Luna crashed from $85 to $50.

Then down to $20.

And now it's at $.07.

It was tempting to try to scoop it up for "cheap", but you're anchoring it to its all-time high prices.

When it falls fast, get out of the way.

Luna crashed from $85 to $50.

Then down to $20.

And now it's at $.07.

It was tempting to try to scoop it up for "cheap", but you're anchoring it to its all-time high prices.

When it falls fast, get out of the way.

Never Use Leverage

People got wrecked because they used leverage.

People always assume they can pay back to maintain a healthy ratio.

• We saw how fast Luna's price collapsed

• Bank runs cause network congestion

Don't use leverage - No exceptions.

People got wrecked because they used leverage.

People always assume they can pay back to maintain a healthy ratio.

• We saw how fast Luna's price collapsed

• Bank runs cause network congestion

Don't use leverage - No exceptions.

Stablecoin Risks

I primarily held UST, USDC, & some Dai as my stable coins.

I should've diversified my stable coins more - I didn't because I wanted to keep things simple. 🤦

I'm going to be spreading my stables more to bUSD, Frax, and others.

I primarily held UST, USDC, & some Dai as my stable coins.

I should've diversified my stable coins more - I didn't because I wanted to keep things simple. 🤦

I'm going to be spreading my stables more to bUSD, Frax, and others.

Each Stablecoin Presents its own Risks

• USN is new

• USDC is centralized

• USDD...Justin Sun

The best play is to diversify your stable coins and spread the risk.

I'm going to limit 5% max to each stable coin.

• USN is new

• USDC is centralized

• USDD...Justin Sun

The best play is to diversify your stable coins and spread the risk.

I'm going to limit 5% max to each stable coin.

Stables Will Keep Being Attacked

There's speculation that this was a coordinated attack on $UST.

If that's true, then expect more attacks in the upcoming years.

Centralized powers do not want decentralized money to succeed.

Adjust your risks accordingly.

There's speculation that this was a coordinated attack on $UST.

If that's true, then expect more attacks in the upcoming years.

Centralized powers do not want decentralized money to succeed.

Adjust your risks accordingly.

Doxxed Founder Risks

Everyone knew that anonymous founders have risks.

I underestimated doxxed founder risk 🤦

Someone may be doxxed but could've done something shady anonymously in the past.

Everyone knew that anonymous founders have risks.

I underestimated doxxed founder risk 🤦

Someone may be doxxed but could've done something shady anonymously in the past.

"Too Big to Fail Bias"

• Terra Top 10 coin

• It's backed by so many of the top VCs such as 3AC / Jump

• They had partnerships with AVAX, Lido, & countless others.

I thought Terra became too big to fail, especially after defending the Peg in May 21' & improving it.

• Terra Top 10 coin

• It's backed by so many of the top VCs such as 3AC / Jump

• They had partnerships with AVAX, Lido, & countless others.

I thought Terra became too big to fail, especially after defending the Peg in May 21' & improving it.

"Haha, should've been a BTC / ETH Maxi"

Maxis want to take this opportunity to kick the Alt L1s while they're down.

Solunavax and other L1s had incredible runs in the past year.

If you invested in them early and took profits, you would've been up.

Maxis want to take this opportunity to kick the Alt L1s while they're down.

Solunavax and other L1s had incredible runs in the past year.

If you invested in them early and took profits, you would've been up.

There's some survivorship bias there.

And it depends WHEN you bought, WHAT you took profits in, and which coins you invested in.

I love BTC / ETH as a store of value, but not for maximizing profits.

And it depends WHEN you bought, WHAT you took profits in, and which coins you invested in.

I love BTC / ETH as a store of value, but not for maximizing profits.

This boils down to your investing style.

• Want simple?

Dollar-cost average into ETH and BTC. Forget about it for a few years.

• Want to Optimize Profits? (with more risks)

Invest in solid L1s / altcoins at cheap prices, and take profits into BTC / ETH / Stables.

• Want simple?

Dollar-cost average into ETH and BTC. Forget about it for a few years.

• Want to Optimize Profits? (with more risks)

Invest in solid L1s / altcoins at cheap prices, and take profits into BTC / ETH / Stables.

The past few days haven't been easy.

I've been through several cycles, and this feeling is familiar.

Crypto always comes back.

It might not be the same coins for the next cycle, but the market always bounces back.

I've been through several cycles, and this feeling is familiar.

Crypto always comes back.

It might not be the same coins for the next cycle, but the market always bounces back.

If you survived this and you're still in the game, then you've earned your stripes.

Engrain the lessons.

Legends plant seeds in the bear market and reap them in the bull cycles.

Engrain the lessons.

Legends plant seeds in the bear market and reap them in the bull cycles.