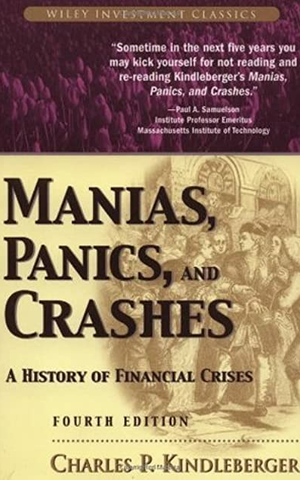

Manias, Panics, and Crashes: A History of Financial Crises

- Book

- 1978

- #Finance

The best known and most highly regarded book on financial crises<br /><br /> Financial crises and speculative excess can be traced back to the very beginning of trade and commerce....

Show More

Number of Pages: 304

ISBN: 0471389455

ISBN-13: 9780471389453

Mentions

See All

Jason Zweig @JasonZweig

·

Nov 25, 2014

- Curated in Best Books For Investors: A Short Shelf

In this classic, first published in 1978, the late financial economist Charles Kindleberger looks back at the South Sea Bubble, Ponzi schemes, banking crises and other mass disturbances of purportedly efficient markets. He explores the common features of market disruptions as they build and burst. If you remember nothing from the book other than Kindleberger’s quip, “There is nothing so disturbing to one’s well-being and judgment as to see a friend get rich,” you are ahead of the game.

Alex Tabarrok @ATabarrok

·

Nov 20, 2022

- Answered to What are some of the best new books to read?

- From Twitter

Jason Zweig @JasonZweig

·

Nov 25, 2022

Tevfik Can Kerimler @TevfikCanKerimler

·

May 28, 2023

- Curated in Financial Crises