Thread by Jan Eeckhout

- Tweet

- May 2, 2022

- #Monopoly #PoliticalEconomy

Thread

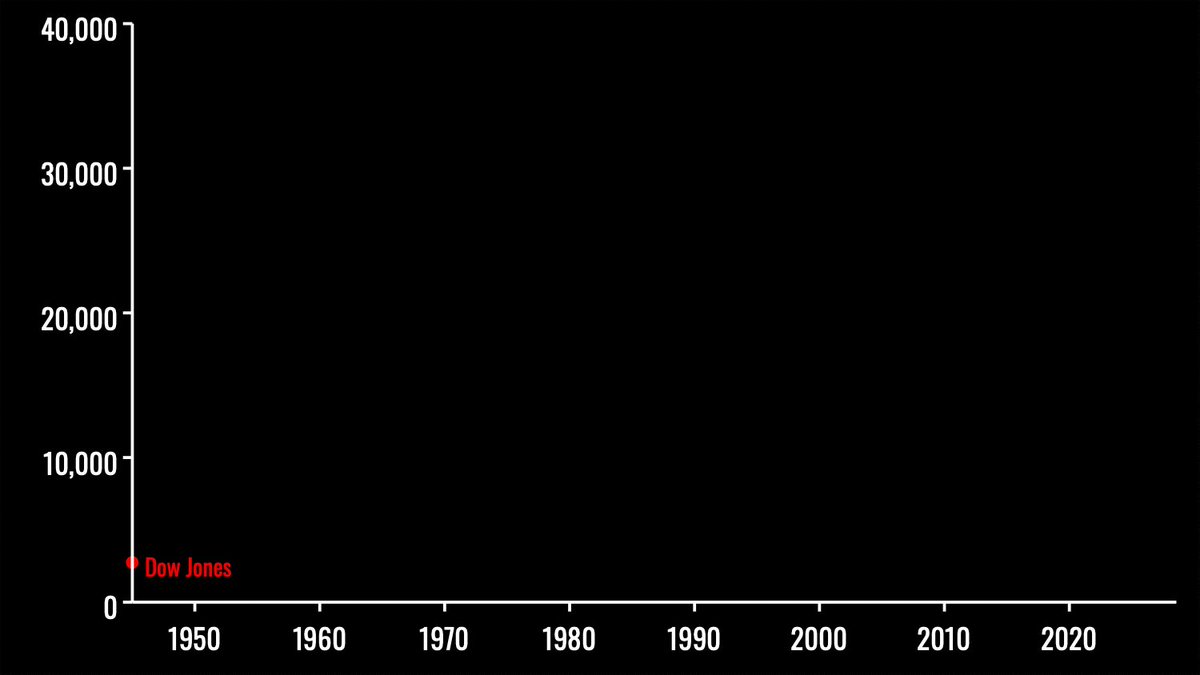

DOW 10,000

If market power of the dominant firms were eliminated, the Dow Jones index would fall below 10,000

If market power didn’t increase, the Dow Jones index would grow at the rate of GDP growth (+/-2%)

1/10

If market power of the dominant firms were eliminated, the Dow Jones index would fall below 10,000

If market power didn’t increase, the Dow Jones index would grow at the rate of GDP growth (+/-2%)

1/10

Some History: If you invested in a Dow Jones portfolio in 1945, it would have had zero (real) growth by 1981. From 1981 onwards, the Dow Jones grew nearly 7% per year in real terms

2/

2/

The stock price of a firm depends:

1. Stream of future profits (dividends)

2. Net value of assets (assets net of debt)

3. Risk

4. Inflation

(and undoubtedly many other factors, such as tax policy or stock buy-backs for example; feel free to add your favorite)

3/

1. Stream of future profits (dividends)

2. Net value of assets (assets net of debt)

3. Risk

4. Inflation

(and undoubtedly many other factors, such as tax policy or stock buy-backs for example; feel free to add your favorite)

3/

Consider a firm in a world with perfect competition, zero net assets, no risk and no inflation, then the stock market value of a firm would be zero

4/

4/

4. Inflation was generally low in the last decades

3. Risk hasn’t grown over time

2. Net assets: firms grow, but the capital share hasn’t grown, so net assets grow no faster than the firm grows

1. The 7% growth of DOW since 1980s is due to growth of profits, market power

5/

3. Risk hasn’t grown over time

2. Net assets: firms grow, but the capital share hasn’t grown, so net assets grow no faster than the firm grows

1. The 7% growth of DOW since 1980s is due to growth of profits, market power

5/

Firm size and firm growth matters for the stock market valuation (publicly traded firms, especially those in DOW, S&P500, are large):

Market power also leads to firm growth

But, in terms of employment (not revenue), young/small firms tend to grow faster than large firms

6/

Market power also leads to firm growth

But, in terms of employment (not revenue), young/small firms tend to grow faster than large firms

6/

The stock market is like a wood of trees. Trees grow fastest when they are young, but they are also most likely to be wiped out by a mudslide. A mature forest has plenty of large trees. But even 400 year-old sequoias fall

7/

7/

If we return to the period 1945-1981, market power didn’t grow much

Until the mid 1960s, net assets grew and stocks reflected this

From the 1970s on, there was massive inflation wiping out value

From 1980 on, stock grew mostly due to market power

8/

Until the mid 1960s, net assets grew and stocks reflected this

From the 1970s on, there was massive inflation wiping out value

From 1980 on, stock grew mostly due to market power

8/

The bottom line:

If market power was magically eliminated, the stock market valuation of those firms would drop massively, hence a DOW below 10,000

If the ascent of market power was stopped at its current levels but not eliminated, the DOW would grow at 2% per year, not 7%

9/

If market power was magically eliminated, the stock market valuation of those firms would drop massively, hence a DOW below 10,000

If the ascent of market power was stopped at its current levels but not eliminated, the DOW would grow at 2% per year, not 7%

9/

For now, I am not selling the stocks in my pension fund yet. I will when Lina Khan (FTC), Jonathan Kantor (DOJ) and Margrethe Vestager (EC competition) sell theirs…

end/

end/