Thread by Luca Prosperi

- Tweet

- Apr 22, 2022

- #DecentralizedFinance

Thread

0/ At @MakerDAO we are exploring the possibility of kicking-off one of the largest fund raising efforts in DeFi in order to boost the System Surplus and turbocharge Maker's growth plans. This would be much more than a plain vanilla raise of cash through VC funding 🧵👇

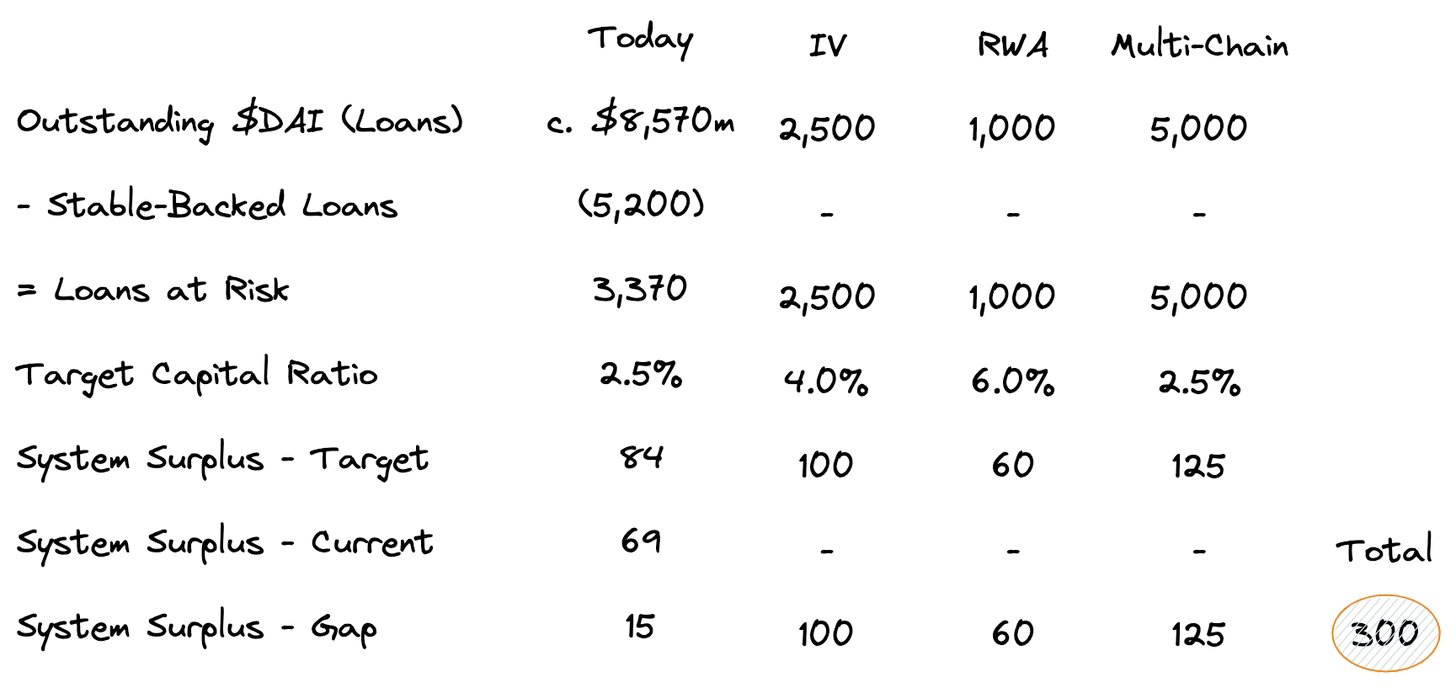

1/ @MakerDAO's System Surplus (SS) is the closest comp to a bank's Core Equity Tier 1 capital, a buffer to protect the protocol against the unknown unknowns that might hit us if the over-collateralisation proves not to be enough. That SS currently sits at 69m

2/ SS 69m is 0.8% of total outstanding $DAI, or 2.0% if we exclude stablecoin-backed $DAI. This compares to 12-15% of traditional banks. Sure, @MakerDAO's over-collateralised model is more transparent and solid, but collateral risk is not the only risk the DAO is exposed to

3/ @MakerDAO relies on markets staying deep enough to execute collateral auctions (liquidity risk), and has the unavoidable smart contract + general business risk of any business endeavours (crypto or not). And that's with business as is. Still, much better than algo-stables...

4/ On March 16th @hexonaut and other @MakerDAO community members highlighted the under-capitalisation issue, especially if we want the protocol to scale across initiatives such as Institutional Vaults, Real-World Assets, and Multi-Chain Efforts

forum.makerdao.com/t/aggressive-growth-strategy/13958

forum.makerdao.com/t/aggressive-growth-strategy/13958

5/ The conclusion is simple: to be able to grow while remaining loyal to its currency protection mandate, @MakerDAO will have to increase the System Surplus by a factor of 5x or more, or by 200-300m. Boom

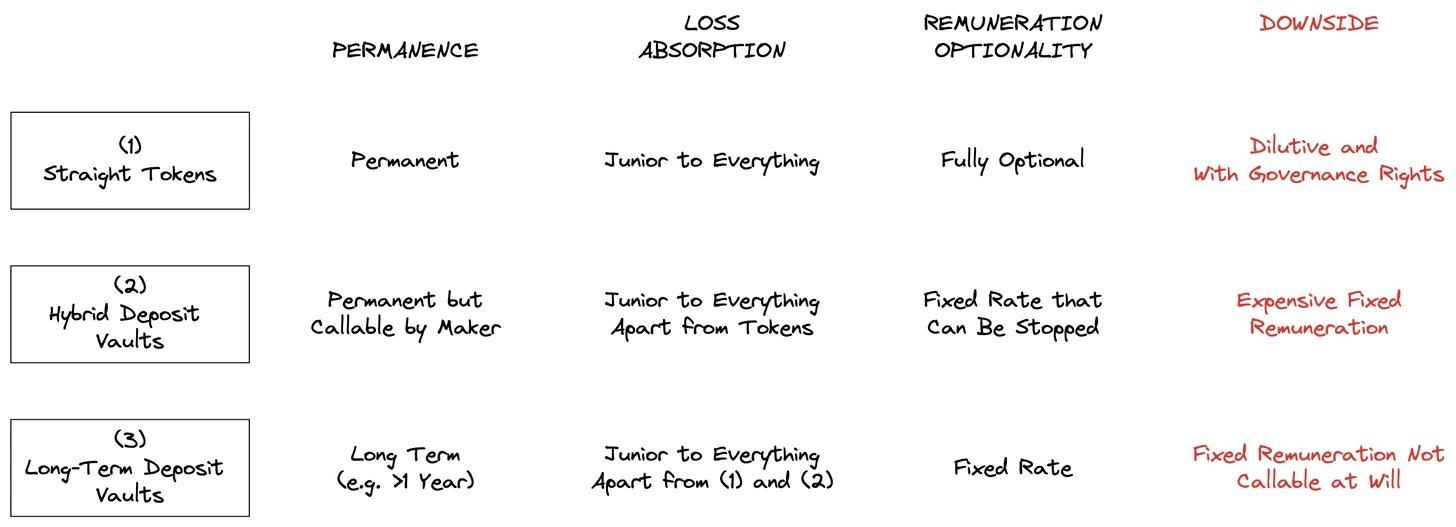

6/ Tokens are not the only possible source of funding, and probably not the best due to high implied cost (read dilution) and governance rights. Learning from TradFi, @MakerDAO (MY view) could spin off Hybrid Debt Vaults (HDVs) that allow investors to deposit in fixed-rates perps

7/ What could HDVs be: think of a permissionless vault where depositors can put $DAI for a fixed rate in perpetuity. Those deposits would be junior to everything but SS in absorbing losses, can be 'called' by the protocol at par, and traded through LP ERC-20 tokens

8/ If you feel @anchor_protocol vibes you're not wrong, but better: i) fixed but more conservative rate, ii) callable by the protocol, iii) variable in debt ceiling, iv) with a liquid LP market to trade rates (this piece is missing now in DeFi)

9/ We could think about another, more senior, lien, with fixed-rate / fixed-maturity 3-6-12-18-month maturity Fixed Rate Vaults. We would then have a spectrum of funding solutions serving investors, boosting $DAI usage, and stimulating other use-cases within @MakerDAO

10/ We could get very geeky very quickly. As usual, for the *NERDS* around you, here's the Dirt Roads piece to put you to sleep. Let's go!

dirtroads.substack.com/p/-37-capital-structures-for-stablecoin?r=k87cd&s=w&utm_campaign=post&utm_medi...

dirtroads.substack.com/p/-37-capital-structures-for-stablecoin?r=k87cd&s=w&utm_campaign=post&utm_medi...