Thread

I angel invested in Fast's Series A in May 2020.

Some lessons learned that I hope are helpful for other angel investors.

Some lessons learned that I hope are helpful for other angel investors.

Before that, a preface: I'm not the kind of person to throw shade.

This isn't about specific people or the decision-making that led to Fast's outcome (well-documented elsewhere).

This is a reflection for myself, and I hope other angel investors can benefit from this experience.

This isn't about specific people or the decision-making that led to Fast's outcome (well-documented elsewhere).

This is a reflection for myself, and I hope other angel investors can benefit from this experience.

Lesson 1: Trust your gut.

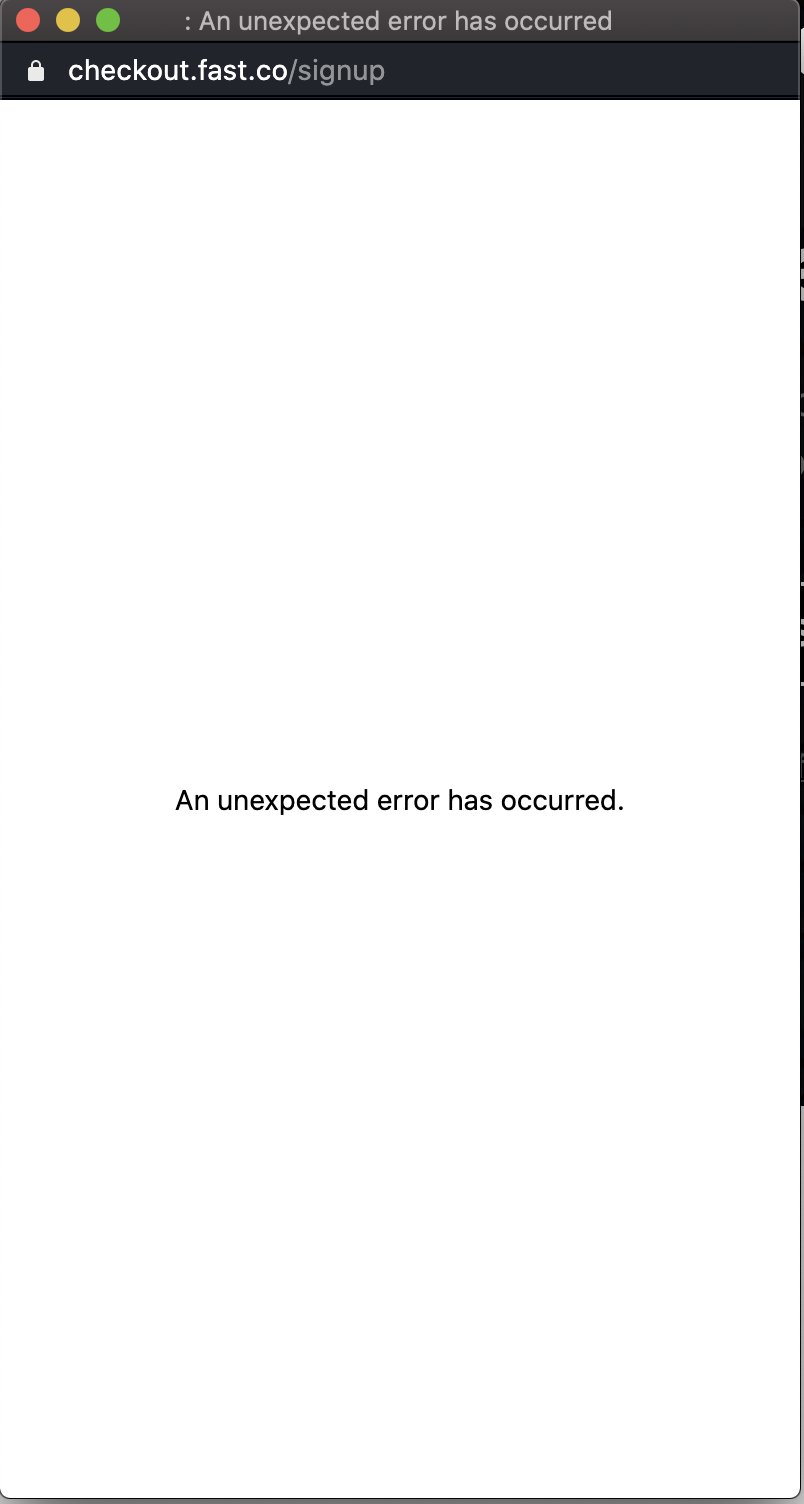

Back in May 2020 as part of diligence, I tried the one-click product on Fast's swag store. It was buggy and broken.

I wrote it off. Early products aren't perfect.

But something felt pretty off and I didn't listen to that voice.

Back in May 2020 as part of diligence, I tried the one-click product on Fast's swag store. It was buggy and broken.

I wrote it off. Early products aren't perfect.

But something felt pretty off and I didn't listen to that voice.

Lesson 2: Don't rely on other investor signals.

Big names were investing (Stripe, Index). A lot of proven angels and prominent tech leaders were in as well.

I figured if they were investing, maybe I should too.

Rookie mistake. Build your own conviction.

Big names were investing (Stripe, Index). A lot of proven angels and prominent tech leaders were in as well.

I figured if they were investing, maybe I should too.

Rookie mistake. Build your own conviction.

Lesson 3: Strategic investors have unique motivations.

Stripe led the Series A. It sounded amazing.

Reality: "Strategics" (aka non-VCs) may care less about ROI, and more about staying close for competitive intel and downstream optionality.

Stripe led the Series A. It sounded amazing.

Reality: "Strategics" (aka non-VCs) may care less about ROI, and more about staying close for competitive intel and downstream optionality.

Lesson 4: Are you looking for ways to say yes, or ways to say no?

You either talk yourself into investing or you talk yourself out of it. I was talking myself into this one, looking past very reasonable concerns.

When you're looking to say yes, be extra judicious w/ diligence.

You either talk yourself into investing or you talk yourself out of it. I was talking myself into this one, looking past very reasonable concerns.

When you're looking to say yes, be extra judicious w/ diligence.

Lesson 5: Ask for investor updates (before investing).

After investing, I received two investor updates over ~2yrs. Both lacked any meaningful numbers/data 😬

Before you invest, ask for the most recent investor updates. Helps you understand how founders think and communicate.

After investing, I received two investor updates over ~2yrs. Both lacked any meaningful numbers/data 😬

Before you invest, ask for the most recent investor updates. Helps you understand how founders think and communicate.

Lesson 6: Markups don't really matter.

When Fast raised a Series B in 2021, it seemed like things were going well. I was happy to hear about their big fundraise.

Of course in hindsight that was moot. All that matters when it comes to ROI is a liquidity event.

When Fast raised a Series B in 2021, it seemed like things were going well. I was happy to hear about their big fundraise.

Of course in hindsight that was moot. All that matters when it comes to ROI is a liquidity event.

Lesson 7: After wiring the money, don't expect to see it again.

Most startups fail. The expected value of the investment is closer to 0 than to the wire amount.

Avoid later disappointment by writing it off immediately (it's only upside from there!).

Most startups fail. The expected value of the investment is closer to 0 than to the wire amount.

Avoid later disappointment by writing it off immediately (it's only upside from there!).

Lesson 8: Investors lose at most 1x their capital. Employees lose much more.

I feel for Fast employees who lost their jobs and equity overnight.

Most startups don't fail this fast after raising $100M+. Remind yourself that the shutdown is more painful for employees than angels.

I feel for Fast employees who lost their jobs and equity overnight.

Most startups don't fail this fast after raising $100M+. Remind yourself that the shutdown is more painful for employees than angels.

Lesson 9: You're not defined by your worst investment.

All angels will have failures in their portfolio. It's part of the process (and important reminder to not invest more than you can lose).

All it takes is one winner to cover the rest. Play the long game.

All angels will have failures in their portfolio. It's part of the process (and important reminder to not invest more than you can lose).

All it takes is one winner to cover the rest. Play the long game.

Lesson 10: It's too easy for some founders to raise capital, and harder than it should be for others.

I've committed that my next angel investment will be in an underrepresented, overlooked founder.

Any fellow angel investors wanna join me? 🙌🏽

I've committed that my next angel investment will be in an underrepresented, overlooked founder.

Any fellow angel investors wanna join me? 🙌🏽

If you're an emerging angel investor, I hope this thread was helpful.

Feel free to like/retweet the first tweet below to help others learn from my experience.

And if you've had angel investments fail, I'd love to hear what you learned as well.

Feel free to like/retweet the first tweet below to help others learn from my experience.

And if you've had angel investments fail, I'd love to hear what you learned as well.