Thread

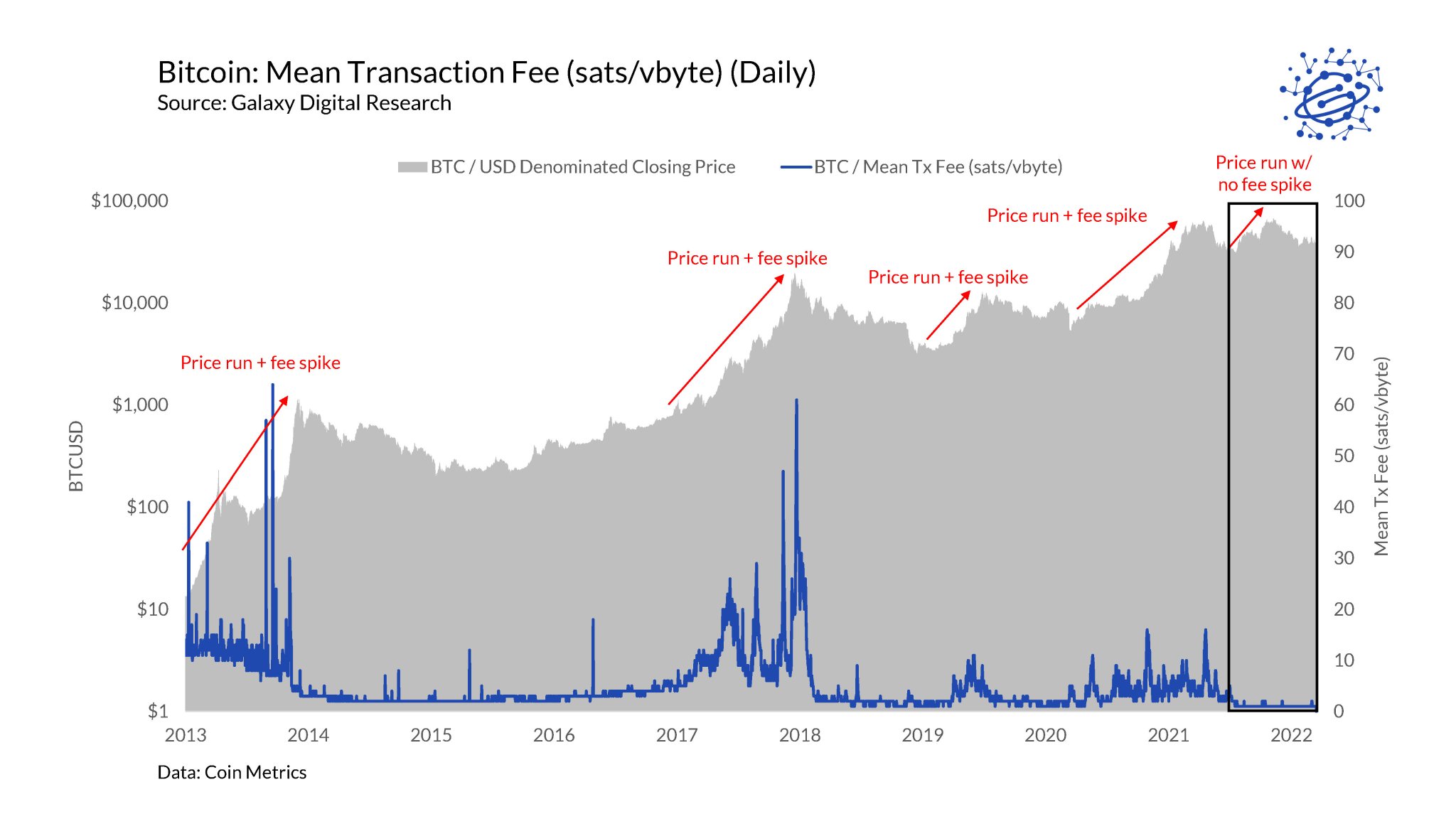

#bitcoin fees are at all-time lows. the craziest thing? fall 2021 was the first bull run not accompanied by a major spike in fees.

how is that possible? what does it mean? here's a thread explaining the most confounding (and awesome) chart in bitcoin. (remember june 2021)

how is that possible? what does it mean? here's a thread explaining the most confounding (and awesome) chart in bitcoin. (remember june 2021)

i explain the low-fee environment in 5 key trends:

1 - Segwit adoption

2 - increased use of Tx batching

3 - reduced OP_RETURN usage

4 - growth of the Lightning Network

5 - reduced miner selling

i summarize each here, in detail in this report for clients: docsend.com/view/jsgnh3vnssip3uvt

1 - Segwit adoption

2 - increased use of Tx batching

3 - reduced OP_RETURN usage

4 - growth of the Lightning Network

5 - reduced miner selling

i summarize each here, in detail in this report for clients: docsend.com/view/jsgnh3vnssip3uvt

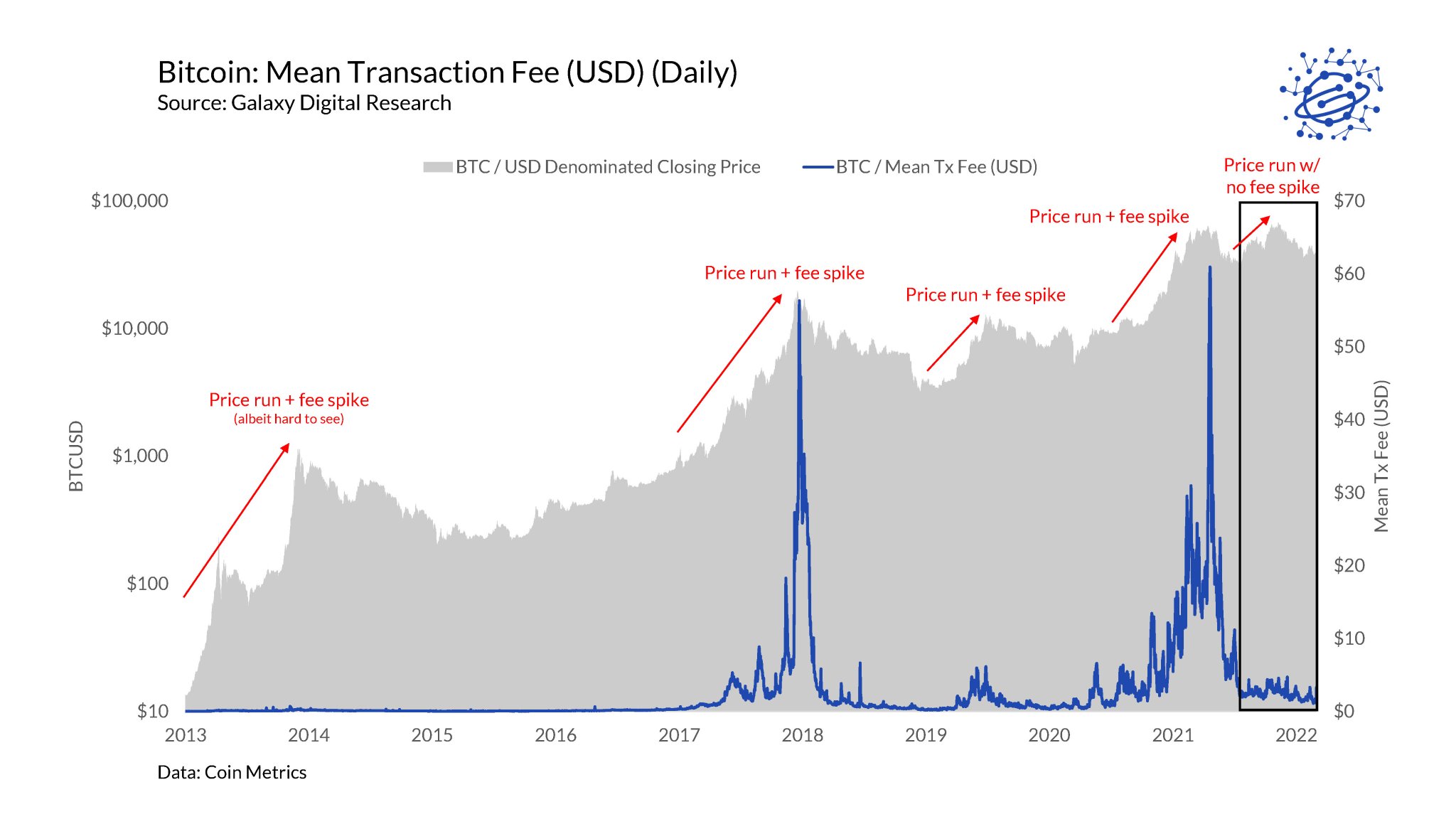

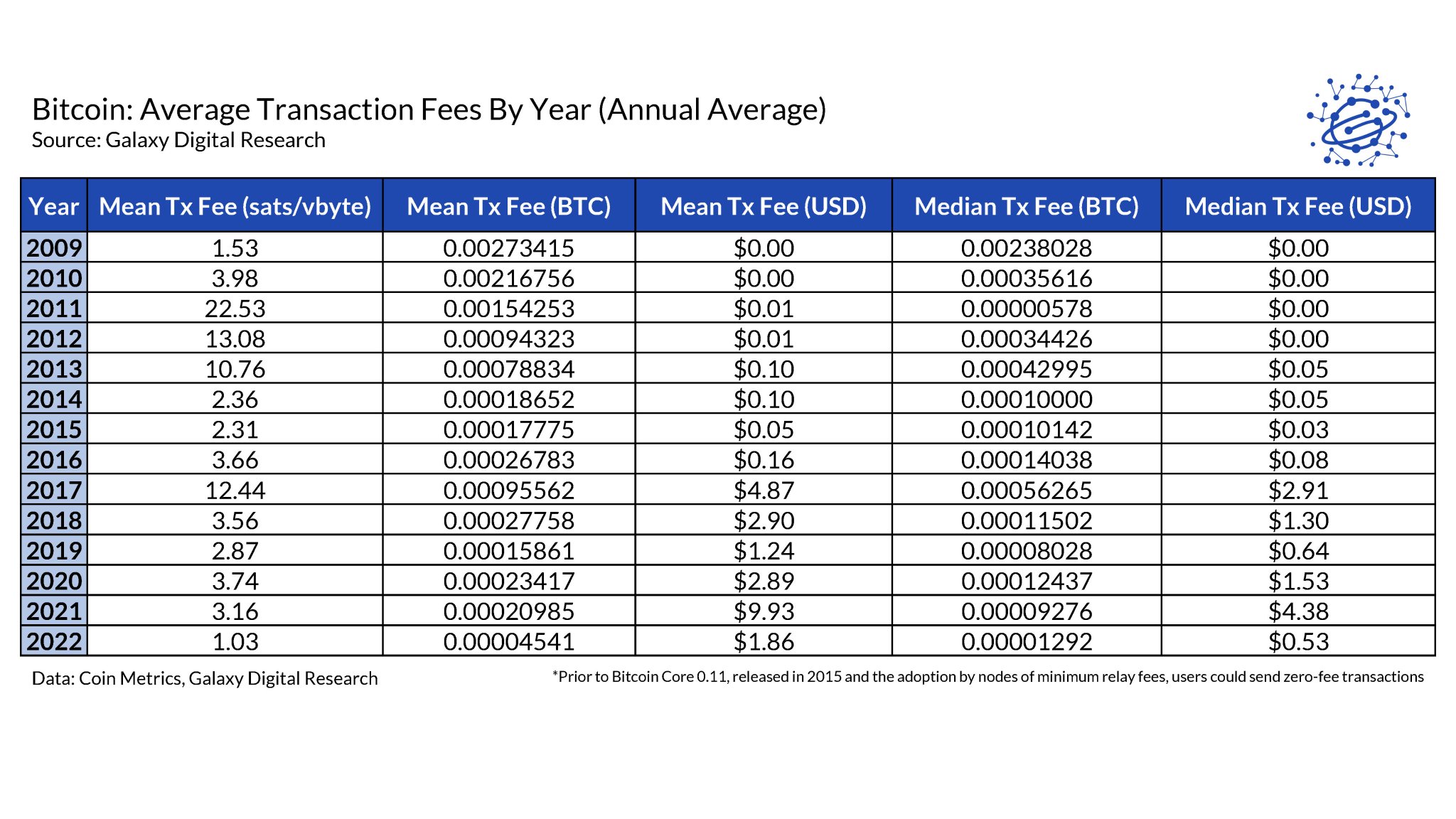

in native (btc) terms, when measured by total per-tx fee or by sats/byte, bitcoin tx fees rae at all-time lows. in dollar terms, tx fees haven't been this low since spring 2020. (BTCUSD price rose 10x since then).

the table below summarizes bitcoin tx fees by year on both a mean and median basis. annualized, fees in btc terms are the lowest ever. in usd terms, fees are the lowest since 2019 (mean) and 2016 (median).

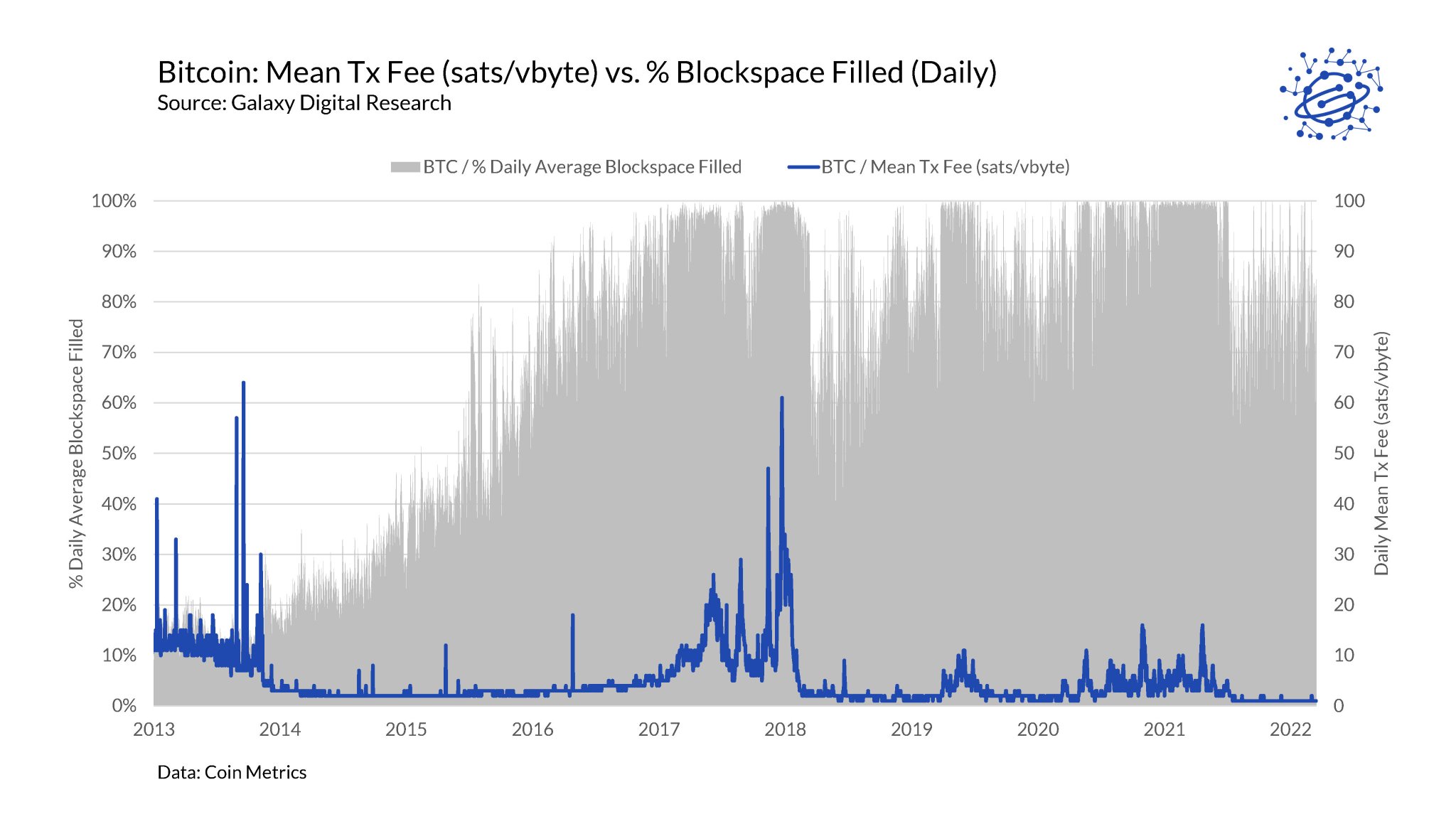

so why is this happening? given that competition for tx confirmation is the key driver for user behavior on fees, the level of block space usage is a key indicator for fee markets. blocks filled on bull runs in 2017, 2019, and 2021, but blocks haven't been full since june 2021

even when BTCUSD ran to new ATHs in fall 2021, blocks did not fill and fees did not rise. in the modern bitcoin era, the last 9 months are the only time that a BTCUSD all-time high was not accompanied by full blocks.

why aren't blocks full? 2 reasons: scaling and user behavior

why aren't blocks full? 2 reasons: scaling and user behavior

1 - Segwit

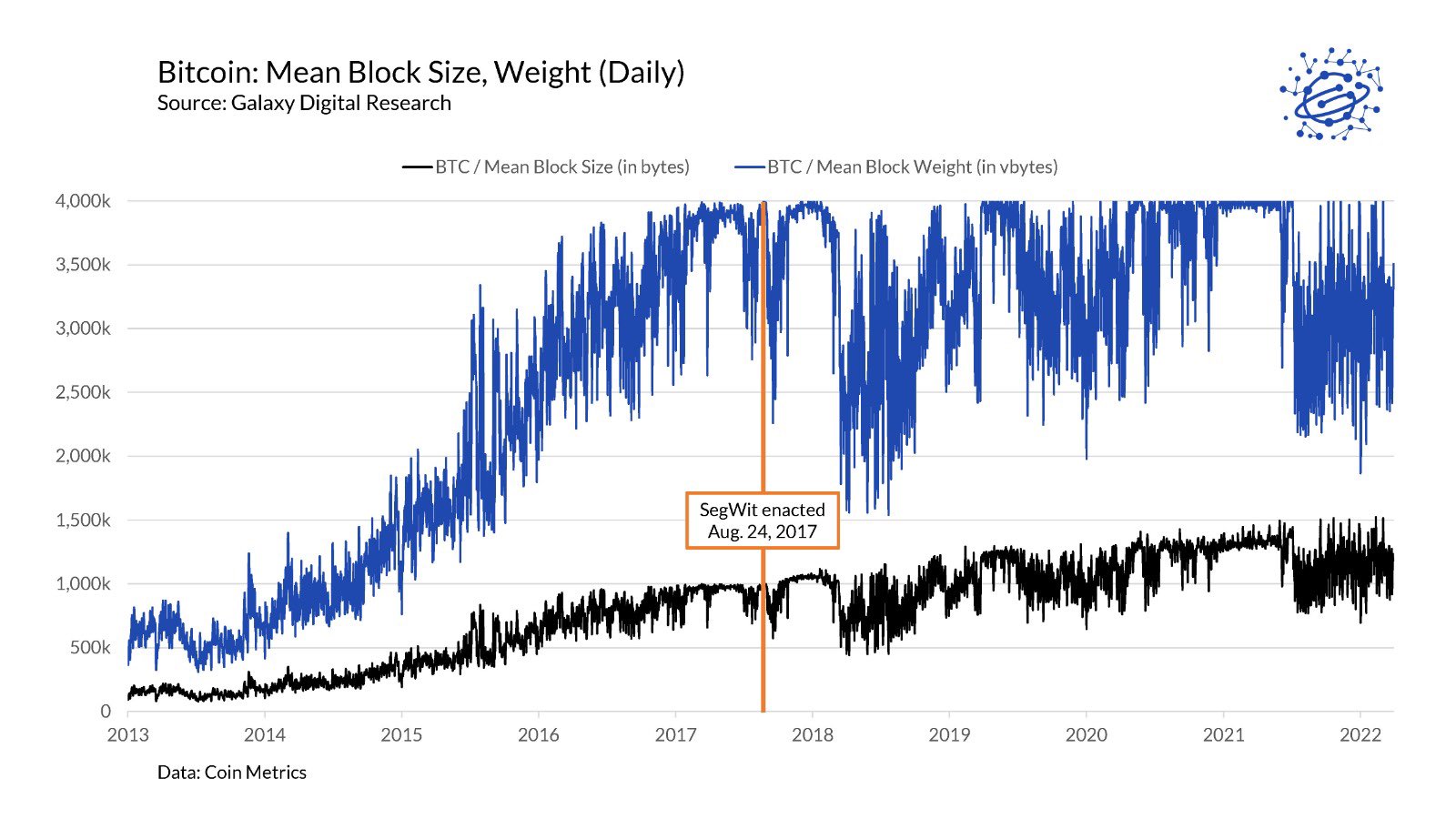

segwit compresses txs by moving witness data to the end of the tx, replace bytes with weight ("virtual bytes"), then recalculates the weight of sig data such that each byte only counts 1/4 of a weight unit. this allows blocks to rise above 1mb.

segwit compresses txs by moving witness data to the end of the tx, replace bytes with weight ("virtual bytes"), then recalculates the weight of sig data such that each byte only counts 1/4 of a weight unit. this allows blocks to rise above 1mb.

1 - Segwit

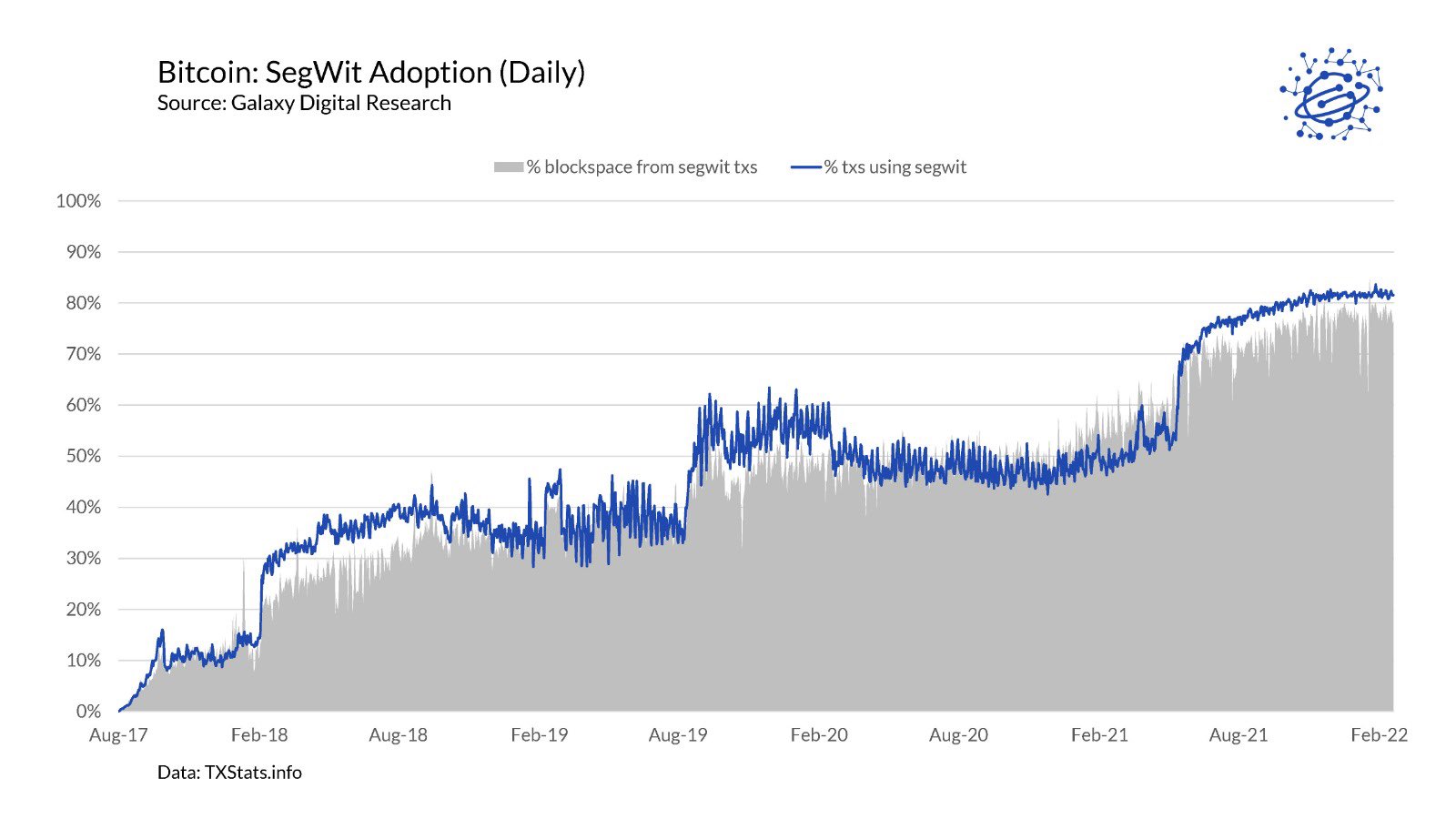

after segwit activation in august 2017, blocks start to creep above 1mb due to the recalculation of bytes as weight units. the more txs use segwit, the more txs can fit in a block. a massive jump in segwit usage occurred in june 2021, up from 53% june 1 to 70% july 1

after segwit activation in august 2017, blocks start to creep above 1mb due to the recalculation of bytes as weight units. the more txs use segwit, the more txs can fit in a block. a massive jump in segwit usage occurred in june 2021, up from 53% june 1 to 70% july 1

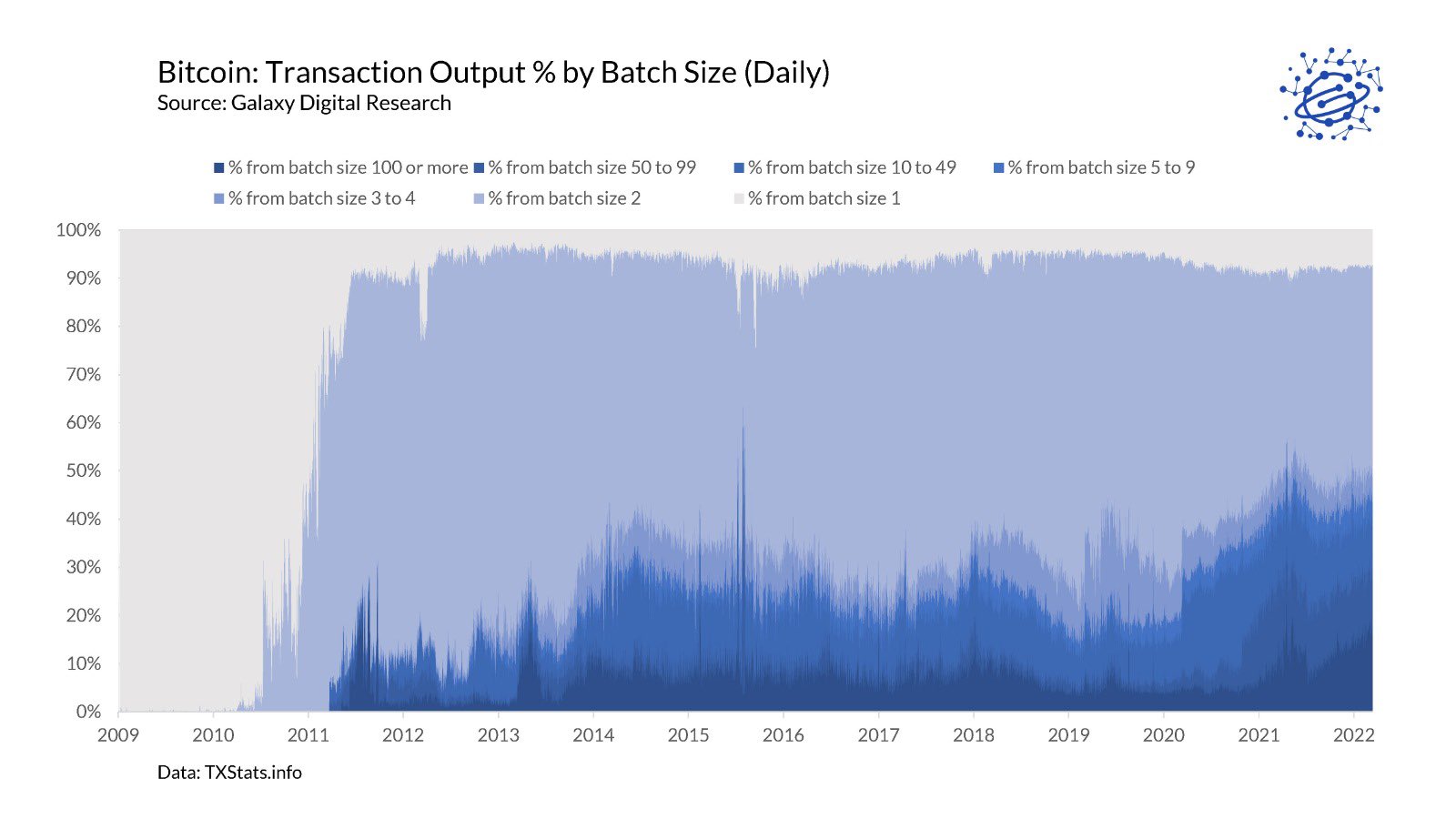

2 - Tx batching

bitcoin users can realize significant gains by batching multiple spends into one tx. for example, an exchange can process many client withdrawals in one on-chain tx. a large increase in batching occurred in june 2021, when fees dropped.

bitcoin users can realize significant gains by batching multiple spends into one tx. for example, an exchange can process many client withdrawals in one on-chain tx. a large increase in batching occurred in june 2021, when fees dropped.

2 - Tx batching

the portion of outputs that were included in batch txs of more than 100 outputs rose to more than 23% in may/june 2021, and the portion of outputs in batch txs of more than 3 outputs reached an all-time high at 53% (and has remained elevated around 50%).

the portion of outputs that were included in batch txs of more than 100 outputs rose to more than 23% in may/june 2021, and the portion of outputs in batch txs of more than 3 outputs reached an all-time high at 53% (and has remained elevated around 50%).

2 - Tx batching

the elevated use of tx batching significantly reduces the per-payment block space required and reduces fee pressure across the network. according to @bitcoinoptech, adding 4 more outputs to a typical tx can save the spender 60% in fees. bitcoinops.org/en/payment-batching/

the elevated use of tx batching significantly reduces the per-payment block space required and reduces fee pressure across the network. according to @bitcoinoptech, adding 4 more outputs to a typical tx can save the spender 60% in fees. bitcoinops.org/en/payment-batching/

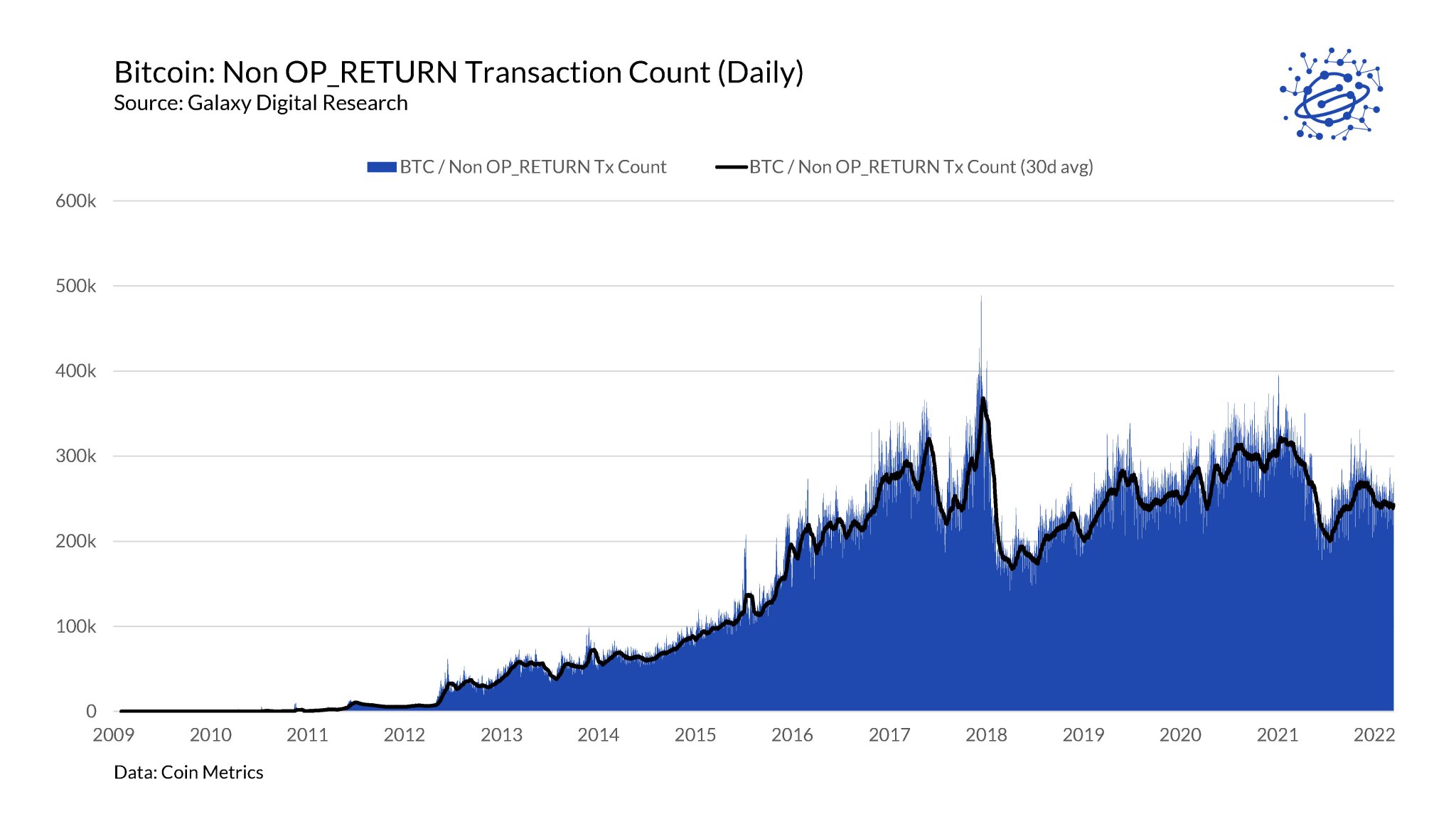

3 - Tx count

daily tx counts have declined consistently since 2019, when bitcoin briefly processed as many as 500k txs per day. the chart below shows the % of block space filled as well as tx count stacked by OP_RETURN and non-OP_RETURN txs.

daily tx counts have declined consistently since 2019, when bitcoin briefly processed as many as 500k txs per day. the chart below shows the % of block space filled as well as tx count stacked by OP_RETURN and non-OP_RETURN txs.

3 - Tx count

the decline in tx counts since 2019 should be taken with a grain of salt. OP_RETURN txs, those that use Bitcoin to store arbitrary data, spiked in 2018 following the launch of veriblock. when OP_RETURNs are removed, we see a more consistent tx count over time.

the decline in tx counts since 2019 should be taken with a grain of salt. OP_RETURN txs, those that use Bitcoin to store arbitrary data, spiked in 2018 following the launch of veriblock. when OP_RETURNs are removed, we see a more consistent tx count over time.

3 - Tx count

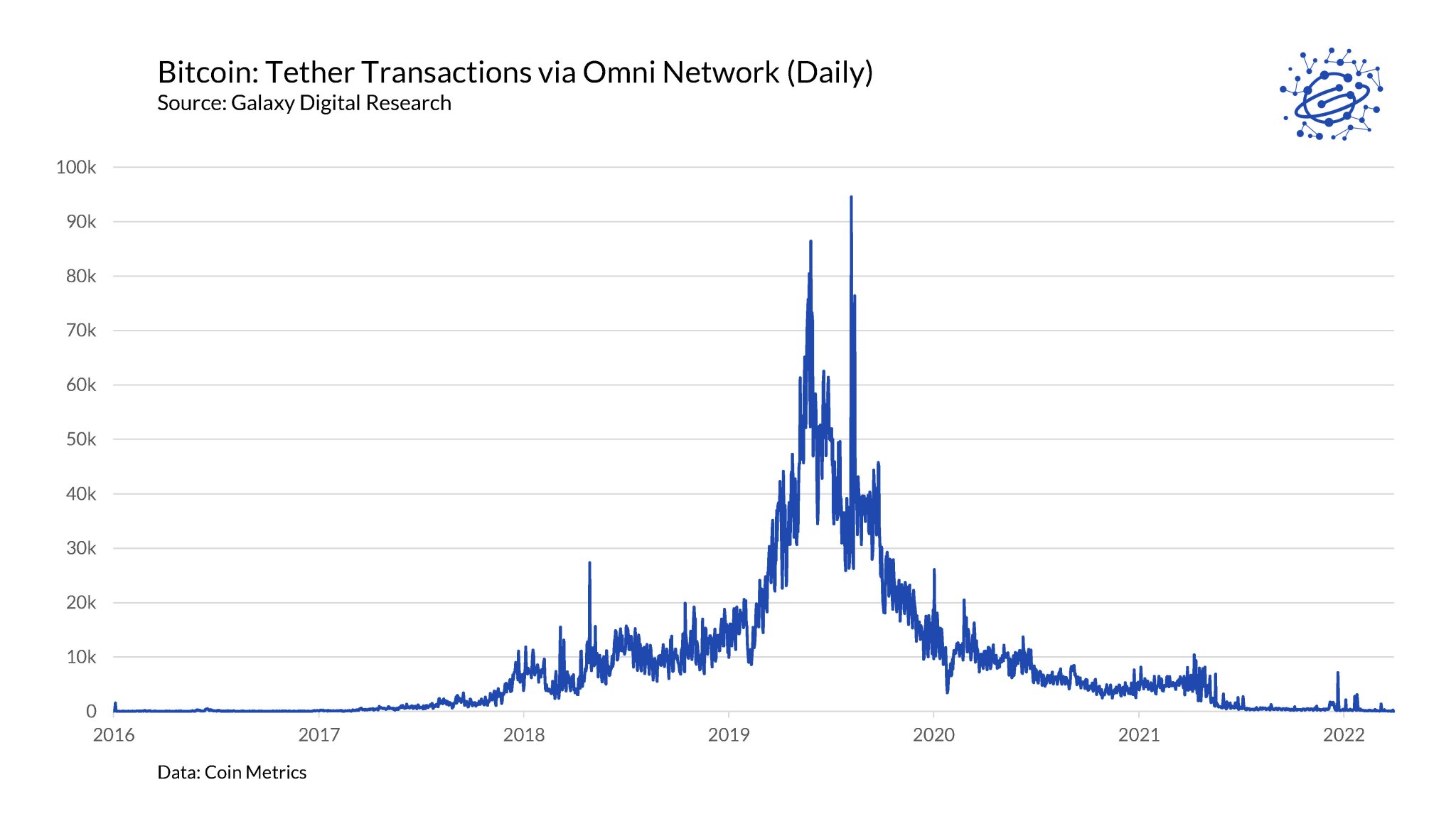

veriblock txs have gone away, but so have @Tether_to txs, which used the Omni Network and OP_RETURN txs to move $usdt. the last vestiges of USDT txs on bitcoin ended in june 2021.

veriblock txs have gone away, but so have @Tether_to txs, which used the Omni Network and OP_RETURN txs to move $usdt. the last vestiges of USDT txs on bitcoin ended in june 2021.

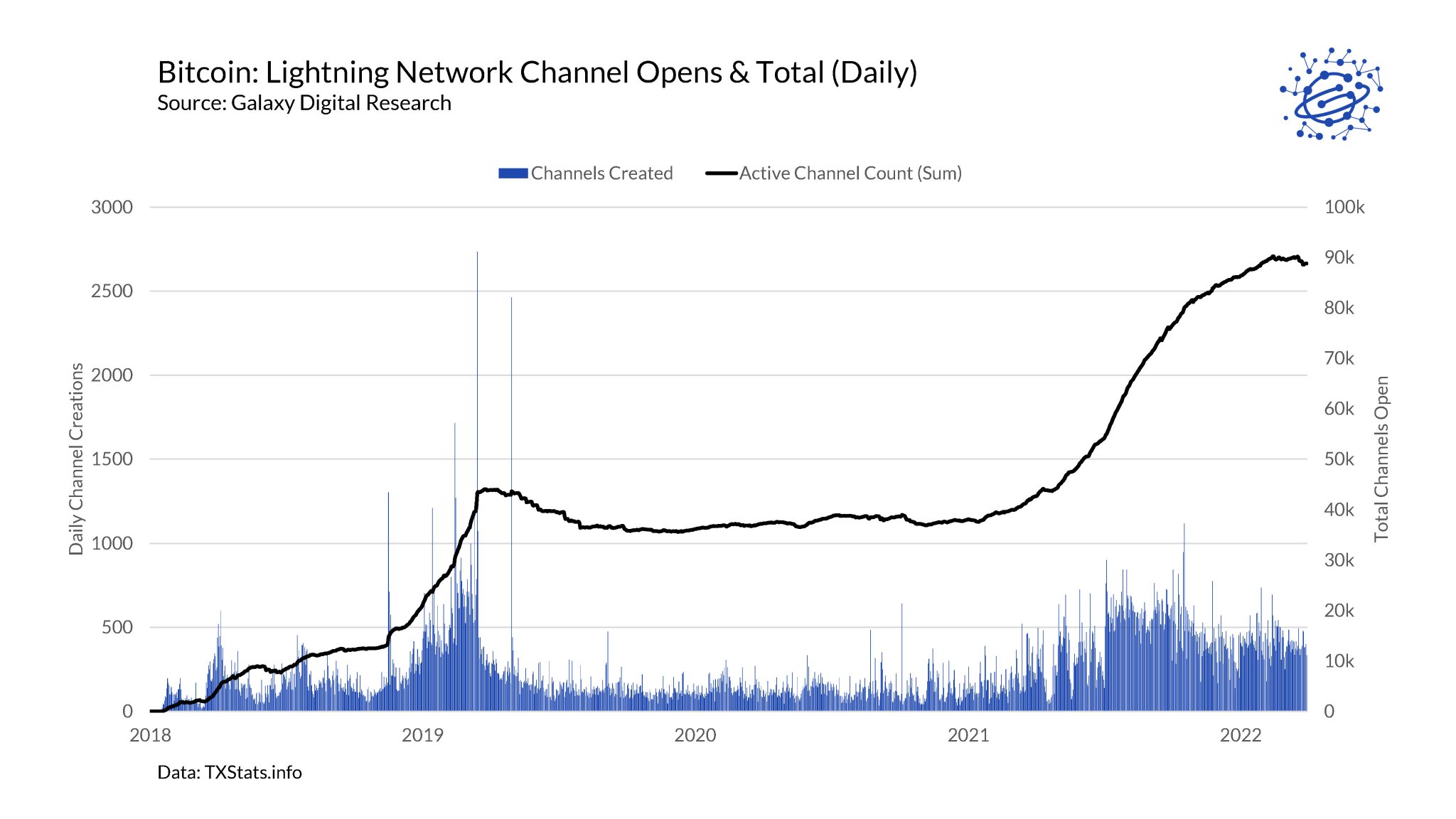

4 - Lightning Network

usage of bitcoin's layer 2 payment channel network also grew notably in june 2021. specifically, there was a large increase in the number of channels created and active channels.

usage of bitcoin's layer 2 payment channel network also grew notably in june 2021. specifically, there was a large increase in the number of channels created and active channels.

4 - Lightning Network

channel creates require on-chain txs but LN channels can host many off-chain economic txs for each single on-chain tx. it's impossible to know the total number of payments by LN users, but the growth of channels is indicative of demand for efficient BTC txs

channel creates require on-chain txs but LN channels can host many off-chain economic txs for each single on-chain tx. it's impossible to know the total number of payments by LN users, but the growth of channels is indicative of demand for efficient BTC txs

5 - Miner selling

when china enacted a ban on bitcoin mining, miners moved to the US, and new public miners finance with debt and equity rather than selling BTC. a result is that miners in aggregate have not been selling BTC at the same levels as before.

when china enacted a ban on bitcoin mining, miners moved to the US, and new public miners finance with debt and equity rather than selling BTC. a result is that miners in aggregate have not been selling BTC at the same levels as before.

these 5 things combined and accelerated in june 2021 to result in unprecedented low fees. the current near-zero-fee environment won't last forever, but for now fees are at the lowest levels ever.

the success of segwit, batching, and LN in reducing fees for bitcoin users is a testament to the vision of the small blockers: scaling via compression rather than block expansion. if u don't know abt the block size wars, read @bitmexresearch's awesome book www.amazon.com/dp/B08Z18GWD6/

this thread was a summary. read the full report i sent to clients this morning here: docsend.com/view/jsgnh3vnssip3uvt